Novus 2020 Annual Report Shows Continual Expansion

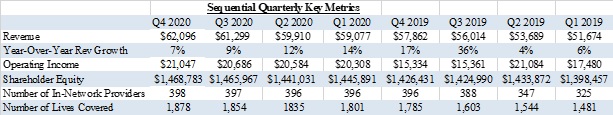

Novus Acquisition and Development Corp. (OTC PINK:NDEV) reported its financial results for the year ending December 31, 2020. Revenue rose by 11% to $242,382, with a 34% profit margin in Q4. Operating income increased by 37% to $21,047 in the fourth quarter. Shareholder equity grew to $1,468,783, and cash reserves improved to $156,422. The company secured contracts with various health carriers, integrating its cannabis health plans into their offerings. No dilution occurred in Q4 2020, highlighting stability amid market challenges.

- Revenue increased by 11% to $242,382 for the year ended December 31, 2020.

- Operating income rose by 37% to $21,047 in Q4 2020.

- Shareholder equity increased to $1,468,783 on December 31, 2020.

- Cash and cash equivalents rose to $156,422 as of December 31, 2020.

- Secured contracts with health carriers for integrating cannabis health plans.

- No dilution in the fourth quarter of 2020.

- The acquisition of new members slowed due to economic impacts from COVID-19.

Agreements with Carriers and InsureTech Platform Continue to Increase Visibility and Traction

MIAMI, FL / ACCESSWIRE / March 30, 2021 / Novus Acquisition and Development, Corp. (OTC PINK:NDEV), through its wholly-owned subsidiary WCIG Insurance Services, Inc., is the nation's first hybrid carrier offering cannabis health plans to recreation and medicinal users, today announced its financial and operational results for twelve months ended December 31, 2020.

Fourth Quarter 2020 Financial Highlights:

- Revenue increased

$4,234 or7% to$62,096 for the three months ended December 31, 2020, as compared to the three months ended December 31, 2019 - Revenue increased

$23,143 or11% to$242,382 for the twelve months ended December 31, 2020, as compared to the twelve months ended December 31, 2019 - Demonstrated a

34% profit margin pricing structure in its business model for the three months ended December 31, 2020 - Operating and Net income increased

$5,713 or37% to$21,047 for the three months ended December 31, 2020, as compared to the three months ended December 31, 2019 - Operating and Net income increased

$13,368 or19% to$82,626 for the twelve months ended December 31, 2020, as compared to the twelve months ended December 31, 2019 - Shareholder equity increased to

$1,468,783 on December 31, 2020, from$1,424,990 on December 31, 2019 - Cash and Cash Equivalents increased to

$156,422 on December 31, 2020, from$142,796 on December 31, 2019 - Secured Life-Health Carrier contracts that integrate Novus Cannabis MedPlan in their fully guaranteed insurance plans

- No dilution in the fourth quarter of 2020

Management Discussion & Analysis Of 2020

Due to the COVID 19 crisis, the second quarter of 2020 saw the U.S. economy come to a standstill, with layoffs of nonessential workers, slowing down the acquisition of new members but the company still maintaining

Highlights of Novus' Infrastructure That Ended The Year With Great Momentum:

a). Carrier Participation: Executed contracts with carriers in Health, Life, Minimal Essential Coverage, and InsureTech Platforms who saw benefits of integrating Novus Cannabis MedPlan with their offerings to allure new and existing customer conversions.

b). Furthering Compliance: Compliant with Health Savings Account (HSA) and Health Reimbursement Accounts (HRA). These are savings/reimbursement accounts used by employees with a high-deductible health insurance policy, allowing individuals to save money tax-free as long as it is amenably applied towards medical expenses and/or premiums.

c). User-Based Insurance UBI: As cannabis moves toward federal legalization, Novus will offer User-Based Insurance (UBI), a tiered pricing plan based on a calculation of a user's behavior in their cannabis consumption.

Notable Fourth Quarter Accomplishments:

Deal Executions:

a). Unique Insurance Concepts UIC: A consortia of health insurance agents that focus on group policies, Medicare supplements, dental and critical illness with over 5,000 corporate clients.

b). Go Enroll / Elevate Wellness: One of the nation's top InsureTech platforms targeted for large groups with over 92,000 clients. This platform allows employees to integrate cannabis with Dental, Vision, GAP, and Medical Plans. The Elevate Wellness Plans cover over 4,500 employers where their employees are allowed to choose alternative treatment options that may not be available through their traditional healthcare providers.

c). Oneshare: A medical cost-sharing provider an ACA-exempt path to healthcare. Its health-based sharing membership plan focuses on Catastrophic Plans and Complete Health.

d). Essential Benefits: Is Minimal Essential Care (MEC) is a plan that meets the Affordable Care Act requirement for getting health coverage. Some of these programs under MEC include marketplace plans, job-based plans, Medicare, and Medicaid. Mainly focused on covering routine preventative illness plans.

e). Wellness 360: This is an employee-based wellness platform that offers plans, program guides, online educational resources, a white label wellness program, and many other customizable options for workplace wellness.

f). Back 9 Insurance: This is an InsureTech platform that sells annuities, life, long-term care, and disability. Their platform makes it easy for agents to display side-by-side comparisons with of over 50 carriers and offers Novus' plans in a cross-sell.

g). National Life: Contracted through Novus provider Compass Health this is one of the oldest life insurance carriers in the country.

h). Medova Healthcare: Medova offers plans under Bridgewell Health®, which are six guaranteed issued plans that offer preventive and wellness plans with robust medical benefits designed for employer-based group health benefits.

Focus On Continual Expansion in 2021

Pooling Cannabis Users With Employer-Sponsored Health Plans

With federal legalization around the corner, keeping the supply chain clean from black market weed is the foremost challenge cannabis stocks have today. We've assessed the cannabis industry and management is confident on how by using our guaranteed health insurance plans as a tool for compliantly pooling med and rec users.

How it works: Forty-nine percent of the 150 million American workers get their health plans from their employer, and more than

The cannabis verticals benefit from increased sales by a loyal customer base that is aligned with Novus'provider network giving them the faculty to compete and separate from the herd undesirable illicit weed purchases in the marketplace.

Will employers accept cannabis as a part of healthcare for their employees?

It's been a challenge up until March 2020, when precedence was set in the New Jersey Supreme Court, that ruled, under the New Jersey Law Against Discrimination ("LAD"), employees who legally use cannabis as permitted by the state's Compassionate Use of Cannabis of Medical Marijuana Act[i] may not be fired. Subsequently, we've seen employers shying away from zero tolerance to the freedom of non-discriminatory workplace rules and standards relating to cannabis use.

In Closing

Trends that the cannabis industry is experiencing in 2021, are that cannabis sales will continue to increase, the prohibition movement will grow stronger towards legalization, an increase of cannabis products in the marketplace, consumers becoming more aware of its medicinal properties, and more doctors will recommend medicinal cannabis.

The market advantage of Novus being an insurance entity is the fluidity in the development of new tactics in acquiring patient/members and their purchasing habits towards cannabis brand(s), we anticipate that 2021 will be one of the cannabis industry's most significant years to date.

Research Novus Now:

- Financial Filings: Click Here

- Quote: Click Here

- Website: Click Here

- Investor's Page: Click Here

- How Insurance Companies are Valued: Click Here

About Novus

Novus Acquisition & Development Corp. (OTC PINK:NDEV), through its subsidiary WCIG Insurance, provides health insurance and related insurance solutions within the wellness and medical marijuana industries in states where legal programs exist. Novus has developed its infrastructure within many lines of the insurance business such as health, property & casualty, life, accident, and fixed annuities.

Novus' medical cannabis benefits package will work as outside developers and will not cultivate, handle, transport grow, extract, dispense, put up for sale, put on the market, vend, deliver, supply, circulate, or trade cannabis or any substances that violate the United States law or the Controlled Substances Act, nor does it intend to do so in the future and will continue to follow state and federal laws. The statements made about specific products have not been evaluated by the United States Food and Drug Administration (FDA) and are not intended to diagnose, treat, cure, or prevent disease. All information provided on these press releases or any information contained on or in any product label or packaging is for informational purposes only and is not intended as a substitute for advice from your physician or other health care professional. Once a push notification is completed the transaction is solely between the state-licensed dispensary and the registered patient.

The state laws conflict with the federal Controlled Substances Act. The current administration has effectively stated that it is not an efficient use of resources to direct federal law enforcement agencies to prosecute those lawfully abiding by state-designated laws, allowing the use and distribution of medical marijuana. However, there is no guarantee that the current administration, nor any future administration, will not change this policy and decide to enforce the federal laws strongly. Any such change in the federal government's enforcement of current federal laws could cause significant financial changes to Novus Medical Group. While we do not intend to harvest, distribute or sell cannabis or cannabis-related products, we may be harmed by a change in enforcement by federal or state governments.

Forward-Looking Statements

This release includes forward-looking statements, which are based on certain assumptions and reflect management's current expectations. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Some of these factors include: general global economic conditions; general industry and market conditions and growth rates; uncertainty as to whether our strategies and business plans will yield the expected benefits; increasing competition; availability and cost of capital; the ability to identify and develop and achieve commercial success; the level of expenditures necessary to maintain and improve the quality of services; changes in the economy; changes in laws and regulations, includes codes and standards, intellectual property rights, and tax matters; or other matters not anticipated; our ability to secure and maintain strategic relationships and distribution agreements. Novus disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Investor Contact Information

855-228-7355

Email: info@getnovusnow.com

SOURCE: Novus Acquisition and Development, Corp.

View source version on accesswire.com:

https://www.accesswire.com/638071/Novus-2020-Annual-Report-Shows-Continual-Expansion

FAQ

What were the financial results of NDEV for 2020?

Did NDEV experience any shareholder dilution in Q4 2020?

How much did NDEV's operating income increase in Q4 2020?

What is the profit margin for NDEV in Q4 2020?