NioCorp to Initiate Drilling Program at Elk Creek Project in Order to Support Updated Feasibility Study

NioCorp (NASDAQ:NB) has announced the launch of a 9-hole drilling campaign at its Elk Creek Critical Minerals Project in Nebraska. The 12-week program, starting later this month, aims to upgrade a portion of indicated resources to measured resources and probable mineral reserves to proven mineral reserves.

The drilling campaign is part of requirements for an updated feasibility study, necessary for the company's application for up to $800 million in potential debt financing from the U.S. Export-Import Bank (EXIM). The project update will include engineering of a new production process incorporating light and heavy magnetic rare earth oxides, titanium tetrachloride production, and potential ferroniobium and niobium oxide products.

The initiative comes amid China's recent threats to restrict exports of heavy rare earths and defense-critical minerals to the U.S. and Western allies. While the company is proceeding with EXIM's due diligence process, NioCorp notes there is no guarantee of securing the debt financing or timeline for the application process.

NioCorp (NASDAQ:NB) ha annunciato l'inizio di una campagna di perforazione di 9 fori presso il suo Elk Creek Critical Minerals Project in Nebraska. Il programma di 12 settimane, che partirà entro la fine del mese, ha l'obiettivo di aggiornare una parte delle risorse indicate in risorse misurate e le riserve minerarie probabili in riserve minerarie certe.

La campagna di perforazione fa parte dei requisiti per uno studio di fattibilità aggiornato, necessario per la domanda dell'azienda di un finanziamento a debito fino a 800 milioni di dollari dalla U.S. Export-Import Bank (EXIM). L'aggiornamento del progetto includerà l'ingegnerizzazione di un nuovo processo produttivo che integra ossidi di terre rare leggere e pesanti, la produzione di tetracloruro di titanio e potenziali prodotti di ferroniobio e ossido di niobio.

L'iniziativa arriva in un momento di recenti minacce da parte della Cina di limitare le esportazioni di terre rare pesanti e minerali critici per la difesa verso gli Stati Uniti e gli alleati occidentali. Pur procedendo con il processo di due diligence di EXIM, NioCorp sottolinea che non vi è alcuna garanzia di ottenere il finanziamento a debito né di tempi certi per la conclusione della domanda.

NioCorp (NASDAQ:NB) ha anunciado el inicio de una campaña de perforación de 9 pozos en su Proyecto de Minerales Críticos Elk Creek en Nebraska. El programa de 12 semanas, que comenzará a finales de este mes, tiene como objetivo actualizar una parte de los recursos indicados a recursos medidos y las reservas minerales probables a reservas minerales probadas.

La campaña de perforación forma parte de los requisitos para un estudio de factibilidad actualizado, necesario para la solicitud de la empresa de hasta 800 millones de dólares en financiamiento mediante deuda del Banco de Exportación e Importación de EE.UU. (EXIM). La actualización del proyecto incluirá la ingeniería de un nuevo proceso de producción que incorpora óxidos de tierras raras ligeras y pesadas, producción de tetracloruro de titanio y posibles productos de ferroniobio y óxido de niobio.

La iniciativa surge en medio de recientes amenazas de China de restringir las exportaciones de tierras raras pesadas y minerales críticos para la defensa a EE.UU. y sus aliados occidentales. Aunque la empresa continúa con el proceso de diligencia debida de EXIM, NioCorp señala que no hay garantía de obtener el financiamiento mediante deuda ni de los plazos para el proceso de solicitud.

NioCorp (NASDAQ:NB)는 네브래스카에 위치한 Elk Creek 핵심 광물 프로젝트에서 9공 구멍 시추 캠페인을 시작한다고 발표했습니다. 이번 12주간의 프로그램은 이달 말 시작되며, 일부 표시 자원을 측정 자원으로, 가능 광물 매장량을 확실한 광물 매장량으로 업그레이드하는 것을 목표로 합니다.

이 시추 캠페인은 미국 수출입은행(EXIM)으로부터 최대 8억 달러의 잠재적 부채 자금 조달 신청을 위한 최신 타당성 조사의 요구사항 중 하나입니다. 프로젝트 업데이트에는 경·중 희토류 산화물, 티타늄 사염화물 생산, 잠재적 페로니오븀 및 니오븀 산화물 제품을 포함한 새로운 생산 공정의 엔지니어링이 포함됩니다.

이번 계획은 중국이 미국 및 서방 동맹국에 대한 중희토류 및 국방 필수 광물 수출 제한을 위협하는 가운데 나왔습니다. 회사는 EXIM의 실사 과정을 진행 중이지만, 부채 자금 조달 확보나 신청 절차의 일정에 대한 보장은 없다고 밝혔습니다.

NioCorp (NASDAQ:NB) a annoncé le lancement d'une campagne de forage de 9 trous sur son projet Elk Creek Critical Minerals au Nebraska. Ce programme de 12 semaines, qui débutera plus tard ce mois-ci, vise à reclasser une partie des ressources indiquées en ressources mesurées et les réserves minérales probables en réserves minérales prouvées.

Cette campagne de forage fait partie des exigences pour une étude de faisabilité mise à jour, nécessaire à la demande de l'entreprise pour un financement par dette pouvant atteindre 800 millions de dollars auprès de la Banque d'Exportation-Importation des États-Unis (EXIM). La mise à jour du projet inclura l'ingénierie d'un nouveau procédé de production intégrant des oxydes de terres rares magnétiques légers et lourds, la production de tétrachlorure de titane, ainsi que des produits potentiels de ferroniobium et d'oxyde de niobium.

Cette initiative intervient alors que la Chine menace récemment de restreindre les exportations de terres rares lourdes et de minéraux critiques pour la défense vers les États-Unis et leurs alliés occidentaux. Bien que l'entreprise poursuive le processus de diligence raisonnable d'EXIM, NioCorp précise qu'il n'y a aucune garantie d'obtenir ce financement par dette ni quant au calendrier du processus de demande.

NioCorp (NASDAQ:NB) hat den Start einer Bohrkampagne mit 9 Bohrlöchern bei seinem Elk Creek Critical Minerals Project in Nebraska angekündigt. Das 12-wöchige Programm, das Ende dieses Monats beginnt, zielt darauf ab, einen Teil der angezeigten Ressourcen in gemessene Ressourcen und wahrscheinliche Mineralreserven in nachgewiesene Mineralreserven umzuwandeln.

Die Bohrkampagne ist Teil der Anforderungen für eine aktualisierte Machbarkeitsstudie, die für den Antrag des Unternehmens auf bis zu 800 Millionen US-Dollar potenzielle Fremdfinanzierung von der US Export-Import Bank (EXIM) erforderlich ist. Das Projekt-Update wird die Entwicklung eines neuen Produktionsprozesses umfassen, der leichte und schwere magnetische Seltene-Erden-Oxide, die Produktion von Titantetrachlorid sowie potenzielle Ferroniob- und Nioboxidprodukte integriert.

Die Initiative erfolgt vor dem Hintergrund der jüngsten Drohungen Chinas, die Exporte von schweren Seltenen Erden und verteidigungskritischen Mineralien in die USA und westliche Verbündete einzuschränken. Während das Unternehmen den Due-Diligence-Prozess von EXIM durchläuft, weist NioCorp darauf hin, dass es keine Garantie für die Sicherung der Fremdfinanzierung oder für den Zeitplan des Antragsverfahrens gibt.

- Potential $800 million EXIM Bank financing under review

- Expansion of product portfolio to include rare earth oxides and titanium tetrachloride

- Project already fully permitted by Nebraska state

- Strategic positioning amid China's export restrictions on critical minerals

- No guarantee of securing EXIM financing

- Timeline for financing approval remains uncertain

- Additional project activities and updates required by EXIM

Insights

NioCorp's drilling program advances $800M EXIM financing effort, upgrades mineral classifications amid critical mineral supply concerns from China.

NioCorp's upcoming 9-hole drilling campaign at the Elk Creek Project represents a methodical progression in the project development cycle. While in scope, this campaign serves a strategic purpose: converting Indicated Resources to Measured Resources and Probable Reserves to Proven Reserves. These classifications aren't merely technical distinctions—they represent increased geological confidence that forms the backbone of a bankable feasibility study.

The timing aligns with broader geopolitical tensions, as China's threatened restrictions on critical minerals exports creates urgency for domestic alternatives. NioCorp's project targets niobium, scandium, and rare earth elements—all classified as strategic materials with applications in defense and high-technology industries.

What's particularly interesting is NioCorp's planned process engineering improvements that will incorporate light and heavy magnetic rare earth oxides and enable production of both ferroniobium and niobium oxide as commercial products. This production flexibility could significantly enhance project economics by creating multiple revenue streams responsive to market conditions.

The drilling campaign's integration with the

NioCorp's drilling program directly supports obtaining $800M EXIM financing, advancing critical minerals project amid China supply threats.

This drilling initiative represents a critical catalyst in NioCorp's financing strategy. The direct connection between this technical work and accessing up to

The financial implications extend beyond mere capital raising. By pursuing EXIM Bank financing, NioCorp is positioning the Elk Creek Project as a strategic national asset aligned with U.S. economic security interests, particularly as China threatens export restrictions on critical minerals. This geopolitical dimension potentially enhances the financing prospects while addressing broader supply chain vulnerabilities.

NioCorp's planned engineering improvements—including the addition of rare earth processing capabilities and multiple niobium products—potentially diversifies revenue streams and could improve overall project economics. These enhancements suggest management is optimizing the project's commercial profile to strengthen the financing case.

The company's transparent disclosure about EXIM's requirement for an updated mine plan and capital cost assessment indicates they're in substantive discussions with the lender. However, their cautionary statements about timeline uncertainty and financing success reflect appropriate risk acknowledgment. This drilling program represents tangible progress toward potentially unlocking significant capital, though considerable financing uncertainty remains until a final commitment is secured.

12-week drilling campaign in Nebraska, to launch later this month, is designed to support the conversion of a portion of the current indicated resource into measured resources and the subsequent conversion of a portion of the current probable mineral reserve into proven mineral reserves in an updated feasibility study

An updated feasibility study is necessary as part of the due diligence process of the application for debt financing NioCorp is seeking from the U.S. Export-Import Bank

NioCorp's critical minerals project is designed to potentially produce certain critical minerals that China now threatens to withhold from the U.S. and Western allies

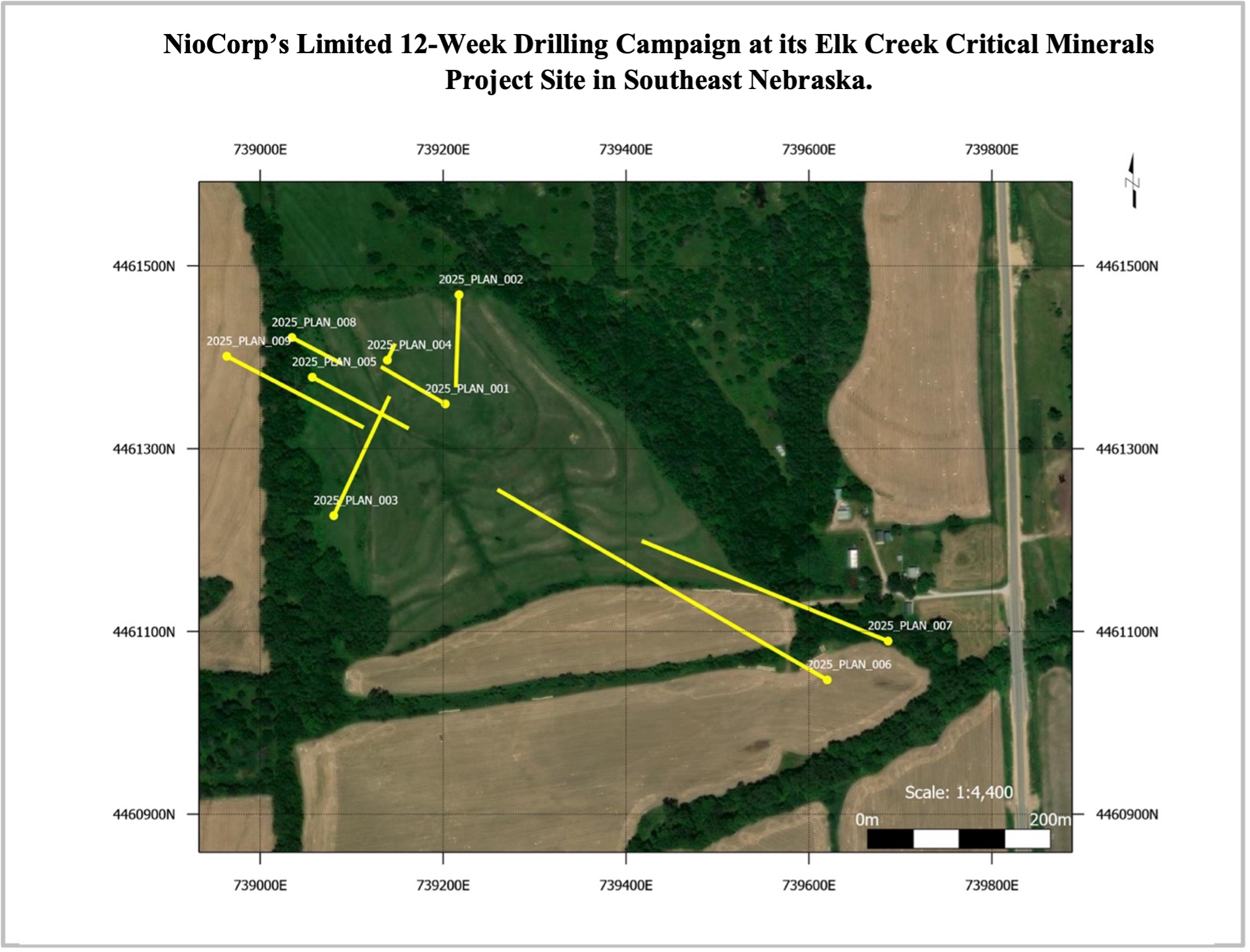

CENTENNIAL, CO / ACCESS Newswire / April 23, 2025 / NioCorp Developments Ltd. ("NioCorp" or the "Company") (NASDAQ:NB) is launching a limited 9-hole drilling campaign later this month designed to support the conversion of a portion of its current Indicated Resources into Measured Resources and the subsequent conversion of a portion of its current Probable Mineral Reserves into Proven Mineral Reserves at its Nebraska-based Elk Creek Critical Minerals Project (the "Elk Creek Project").

The drilling campaign will supplement previous exploratory drilling and will operate under existing permits issued by the State of Nebraska. The drilling campaign is intended to complement other technical and economic analyses necessary to update the feasibility study for the Elk Creek Project. An updated feasibility study is necessary as part of the due diligence process for up to

In addition to the updates to Mineral Resources and Mineral Reserves update, NioCorp expects to finalize engineering of its new and more efficient production process which incorporates the potential addition of light and heavy magnetic rare earth oxides, the planned production of titanium in the form of titanium tetrachloride, and the potential to produce both ferroniobium and niobium oxide as commercial products.

"With China's recent moves to restrict exports to the U.S. of heavy rare earths and other defense-critical minerals, it is all the more urgent to get strategic assets such as the Elk Creek Project to full financing, construction, and commercial operation as rapidly as possible," said Mark A. Smith, Executive Chairman and CEO of NioCorp. "To that end, we are excited to launch this drilling campaign in order to continue progressing our debt financing effort with EXIM and move this fully permitted Project forward to construction."

As previously announced, as part of the diligence process, EXIM has identified additional project activities to be undertaken, including, among other things, an updated mine plan and updated Elk Creek Project capital costs. However, there can be no assurance what further project activities or matters EXIM may request in connection with the application process. NioCorp is currently unable to estimate how long the application process with EXIM may take, and there can be no assurances that the Company will be able to successfully negotiate a final commitment of debt financing from EXIM.

Qualified Persons:

Scott Honan, M.Sc., SME-RM, COO of NioCorp Developments Ltd., a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical information contained in the news release.

Jacob Anderson, CPG, MAusIMM, of Dahrouge Geological Consulting Ltd., a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical information contained within the news release.

# # #

FOR MORE INFORMATION:

Jim Sims, Corporate Communications Officer, NioCorp Developments Ltd., (720) 334-7066, jim.sims@niocorp.com

@NioCorp $NB #Niobium #Scandium #rareearth #neodymium #dysprosium #terbium #ElkCreek #EV #electricvehicle

ABOUT NIOCORP

NioCorp is developing a critical minerals project in Southeast Nebraska that is expected to produce niobium, scandium, and titanium. The Company also is evaluating the potential to produce several rare earths from the Project. Niobium is used to produce specialty alloys as well as High Strength, Low Alloy ("HSLA") steel, which is a lighter, stronger steel used in automotive, structural, and pipeline applications. Scandium is a specialty metal that can be combined with Aluminum to make alloys with increased strength and improved corrosion resistance. Scandium is also a critical component of advanced solid oxide fuel cells. Titanium is used in various lightweight alloys and is a key component of pigments used in paper, paint and plastics and is also used for aerospace applications, armor, and medical implants. Magnetic rare earths, such as neodymium, praseodymium, terbium, and dysprosium are critical to the making of Neodymium-Iron-Boron ("NdFeB") magnets, which are used across a wide variety of defense and civilian applications.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of applicable Canadian securities laws (collectively, "forward-looking statements"). Forward-looking statements may include, but are not limited to, statements regarding initiatives designed to support the conversion of resources and reserves into higher categories; NioCorp's expectation to finalize engineering of its new and more efficient production process; NioCorp's expectation of producing niobium, scandium, and titanium, and the potential of producing rare earths, at the Elk Creek Project; and NioCorp's ability to secure sufficient project financing to complete construction of the Elk Creek Project and move it to commercial operation. Forward-looking statements are typically identified by words such as "plan," "believe," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "project," "continue," "could," "may," "might," "possible," "potential," "predict," "should," "would" and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of NioCorp and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. Forward-looking statements reflect material expectations and assumptions, including, without limitation, expectations and assumptions relating to: NioCorp's ability to receive sufficient project financing for the construction of the Elk Creek Project on acceptable terms or at all; the future price of metals; the stability of the financial and capital markets; NioCorp's ability to service debt and meet the payment obligations thereunder; and current estimates and assumptions regarding the business combination with GX Acquisition Corp. II (the "Business Combination") and the standby equity purchase agreement (the "Yorkville Equity Facility Financing Agreement" and, together with the Business Combination, the "Transactions") with YA II PN, Ltd., an investment fund managed by Yorkville Advisors Global, LP, and their benefits. Such expectations and assumptions are inherently subject to uncertainties and contingencies regarding future events and, as such, are subject to change. Forward-looking statements involve a number of risks, uncertainties or other factors that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those discussed and identified in public filings made by NioCorp with the U.S. Securities and Exchange Commission and with the applicable Canadian securities regulatory authorities and the following: NioCorp's ability to operate as a going concern; NioCorp's requirement of significant additional capital; NioCorp's ability to receive sufficient project financing for the construction of the Elk Creek Project on acceptable terms or at all; NioCorp's ability to receive a final commitment of financing from the Export-Import Bank of the United States on an acceptable timeline, on acceptable terms, or at all; NioCorp's ability to recognize the anticipated benefits of the Transactions, including NioCorp's ability to access the full amount of the expected net proceeds under the Yorkville Equity Facility Financing Agreement; NioCorp's ability to continue to meet the listing standards of Nasdaq; risks relating to NioCorp's common shares, including price volatility, lack of dividend payments and dilution or the perception of the likelihood of any of the foregoing; the extent to which NioCorp's level of indebtedness and/or the terms contained in agreements governing NioCorp's indebtedness or the Yorkville Equity Facility Financing Agreement may impair NioCorp's ability to obtain additional financing; covenants contained in agreements with NioCorp's secured creditors that may affect its assets; NioCorp's limited operating history; NioCorp's history of losses; the material weaknesses in NioCorp's internal control over financial reporting, NioCorp's efforts to remediate such material weaknesses and the timing of remediation; the possibility that NioCorp may qualify as a passive foreign investment company under the U.S. Internal Revenue Code of 1986, as amended (the "Code"); the potential that the Transactions could result in NioCorp becoming subject to materially adverse U.S. federal income tax consequences as a result of the application of Section 7874 and related sections of the Code; cost increases for NioCorp's exploration and, if warranted, development projects; a disruption in, or failure of, NioCorp's information technology systems, including those related to cybersecurity; equipment and supply shortages; variations in the market demand for, and prices of, niobium, scandium, titanium and rare earth products; current and future offtake agreements, joint ventures, and partnerships; NioCorp's ability to attract qualified management; estimates of mineral resources and reserves; mineral exploration and production activities; feasibility study results; the results of metallurgical testing; the results of technological research; changes in demand for and price of commodities (such as fuel and electricity) and currencies; competition in the mining industry; changes or disruptions in the securities markets; legislative, political or economic developments, including changes in federal and/or state laws that may significantly affect the mining industry; trade policies and tensions, including tariffs; inflationary pressures; the impacts of climate change, as well as actions taken or required by governments related to strengthening resilience in the face of potential impacts from climate change; the need to obtain permits and comply with laws and regulations and other regulatory requirements; the timing and reliability of sampling and assay data; the possibility that actual results of work may differ from projections/expectations or may not realize the perceived potential of NioCorp's projects; risks of accidents, equipment breakdowns, and labor disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in development programs; operating or technical difficulties in connection with exploration, mining, or development activities; management of the water balance at the Elk Creek Project site; land reclamation requirements related to the Elk Creek Project; the speculative nature of mineral exploration and development, including the risks of diminishing quantities of grades of reserves and resources; claims on the title to NioCorp's properties; potential future litigation; and NioCorp's lack of insurance covering all of NioCorp's operations.

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of NioCorp prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

All subsequent written and oral forward-looking statements concerning the matters addressed herein and attributable to NioCorp or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to herein. Except to the extent required by applicable law or regulation, NioCorp undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date hereof to reflect the occurrence of unanticipated events.

SOURCE: NioCorp Developments Ltd.

View the original press release on ACCESS Newswire