MicroVision Announces Third Quarter 2022 Results

MicroVision, a leader in automotive lidar solutions, reported its Q3 2022 results on October 27, 2022. Revenue was $0, down from $0.7 million in Q3 2021. The net loss increased to $12.9 million, compared to $9.4 million in the previous year. Adjusted EBITDA was negative $8.5 million, worsening from negative $6.2 million. Cash reserves fell to $83.3 million from $115.4 million at year-end 2021. Despite these setbacks, the company has started sample sales to OEMs and anticipates increased sales into 2023, highlighting a potential recovery ahead.

- Started sample sales to OEMs and Tier 1s, indicating product validation and market engagement.

- Expectations of increased sample sales into next year, suggesting potential revenue growth.

- Revenue for Q3 2022 was $0, a significant decline from $0.7 million in Q3 2021.

- Net loss increased to $12.9 million from $9.4 million year-over-year.

- Adjusted EBITDA worsened to negative $8.5 million from negative $6.2 million in the previous year.

- Cash reserves declined to $83.3 million from $115.4 million at the end of 2021.

Insights

Analyzing...

REDMOND, WA / ACCESSWIRE / October 27, 2022 / MicroVision, Inc. (NASDAQ:MVIS), a leader in MEMS-based solid-state automotive lidar and ADAS solutions, today announced its third quarter 2022 results.

"We are very pleased to announce that MicroVision has successfully delivered on all the objectives set out earlier this year. The support of MAVIN on the NVIDIA drive platform provides yet another validation of our product that we believe will surpass OEM expectations in new, more complex highway driving scenarios," said Sumit Sharma, MicroVision's Chief Executive Officer. "Our pixel-by-pixel approach to Class 1, which we believe is a first in the industry, coupled with the most compelling hardware design enables OEMs to explore more placement options along with superior specs and highway pilot capabilities."

"I am also pleased to report that we have started sample sales to OEMs and Tier 1s in Q4 2022, as we continue to expand our engagement with them and demonstrate the capabilities of our hardware and software solution. We expect our sample sales to increase into next year and will provide updates in early 2023 on our drive-by-wire system centered on our lidar hardware and our high-speed highway pilot ADAS software, and other important achievements in 2023," continued Sharma.

Key Financial Highlights for Q3 2022

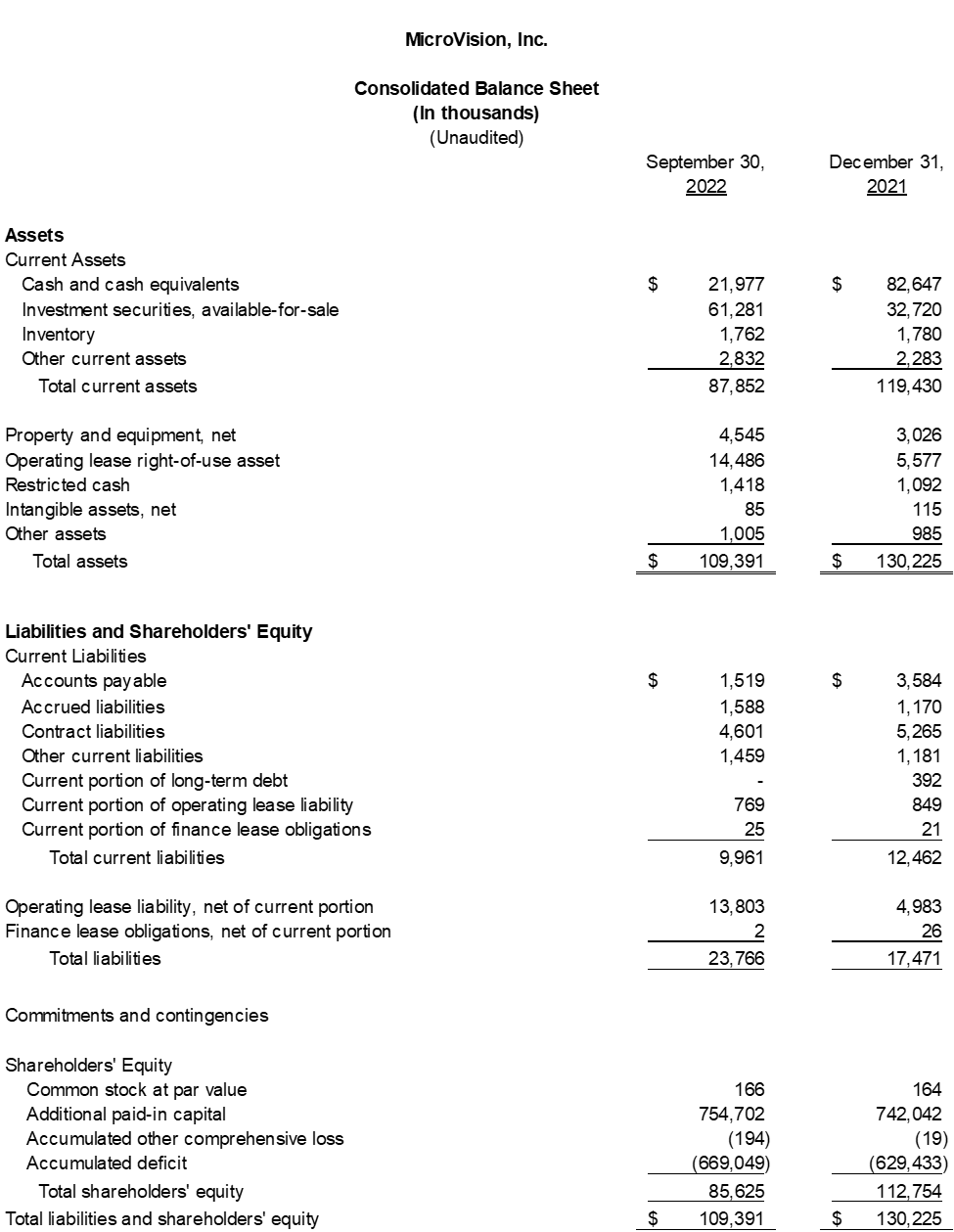

- Revenue for the third quarter of 2022 was

$0 , compared to$0.7 million for the third quarter of 2021. As stated in prior quarters, the Company did not receive any cash for this revenue. - Net loss for the third quarter of 2022 was

$12.9 million , or$0.08 per share, which includes$4.1 million of non-cash, share-based compensation expense, compared to a net loss of$9.4 million , or$0.06 per share, which includes$2.8 million of non-cash, share-based compensation expense, for the third quarter of 2021. - Adjusted EBITDA for the third quarter of 2022 was negative

$8.5 million , compared to negative$6.2 million for the third quarter of 2021. - Cash used in operating activities for the third quarter of 2022 was

$9.0 million , compared to$10.0 million for the third quarter of 2021. - The Company ended the third quarter of 2022 with

$83.3 million in cash and cash equivalents including investment securities, compared to$115.4 million at the end of December 31, 2021. As of September 30, 2022, the Company has the ability, at its discretion, to offer and sell just over$70.0 million of equity securities pursuant to its June 2021 ATM facility.

Conference Call and Webcast: Q3 2022 Results

MicroVision will host a conference call and webcast, consisting of prepared remarks by management, a slide presentation, and a question-and-answer session at 2:00 PM PT/5:00 PM ET on Thursday, October 27, 2022 to discuss the financial results and provide a business update. Analysts and investors may pose questions to management during the live webcast on October 27, 2022.

The live webcast and slide presentation can be accessed on the Company's Investor Relations website under the Events tab at https://ir.microvision.com/events . The webcast will be archived on the website for future viewing.

About MicroVision

MicroVision is a pioneering company in MEMS-based laser beam scanning technology that integrates MEMS, lasers, optics, hardware, algorithms and machine learning software into its proprietary technology to address existing and emerging markets. The Company's integrated approach uses its proprietary technology today to develop automotive lidar sensors and provide solutions for advanced driver-assistance systems (ADAS), leveraging its experience building augmented reality micro-display engines, interactive display modules, and consumer lidar modules.

For more information, visit the Company's website at www.microvision.com, on Facebook at www.facebook.com/microvisioninc, follow MicroVision on Twitter at @MicroVision, and LinkedIn at https://www.linkedin.com/company/microvision/.

MicroVision is a trademark of MicroVision, Inc. in the United States and other countries. All other trademarks are the properties of their respective owners.

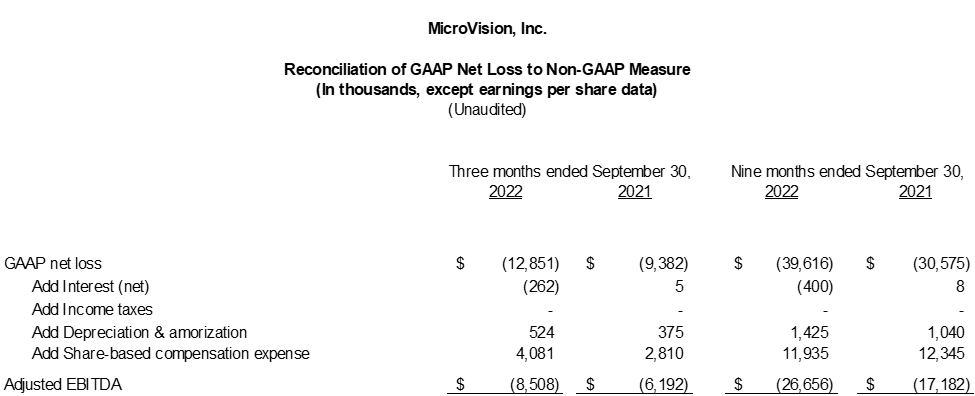

Non-GAAP information

To supplement MicroVision's condensed financial statements presented in accordance with GAAP, the Company presents investors with the non-GAAP financial measure "adjusted EBITDA." Adjusted EBITDA consists of GAAP net income (loss) excluding the impact of the following: interest income and interest expense; income tax expense; depreciation and amortization; and share-based compensation.

MicroVision believes that the presentation of adjusted EBITDA provides important supplemental information to management and investors regarding financial and business trends, provides consistency and comparability with MicroVision's past financial reports, and facilitates comparisons with other companies in the Company's industry, many of which use similar non-GAAP financial measures to supplement their GAAP results. Internally, management uses this non-GAAP measure when evaluating operating performance because the exclusion of the items described above provides an additional useful measure of the Company's operating results and facilitates comparisons of the Company's core operating performance against prior periods and its business objectives. Externally, the Company believes that adjusted EBITDA is useful to investors in their assessment of MicroVision's operating performance and the valuation of the Company.

Adjusted EBITDA is not calculated in accordance with GAAP, and should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Non-GAAP financial measures have limitations in that they do not reflect all of the costs associated with the operations of MicroVision's business as determined in accordance with GAAP. The Company expects to continue to incur expenses similar to the non-GAAP adjustments described above, and exclusion of these items from its non-GAAP financial measure should not be construed as an inference that these costs are unusual or infrequent. The Company compensates for limitations of the measure by prominently disclosing GAAP net income (loss), which the Company believes is the most directly comparable GAAP measure, and providing investors with a reconciliation from GAAP net income (loss) to adjusted EBITDA.

MicroVision has included a reconciliation of GAAP net income (loss) to adjusted EBITDA for the relevant periods.

Forward-Looking Statements

Certain statements contained in this release, including the Company's plans regarding product demonstration, product capabilities, and expected sales are forward-looking statements that involve a number of risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those projected in such forward-looking statements include the risk its ability to operate with limited cash or to raise additional capital when needed; market acceptance of its technologies and products or for products incorporating its technologies; the failure of its commercial partners to perform as expected under its agreements, including from the impact of COVID-19 (coronavirus); its financial and technical resources relative to those of its competitors; its ability to keep up with rapid technological change; government regulation of its technologies; its ability to enforce its intellectual property rights and protect its proprietary technologies; the ability to obtain customers and develop partnership opportunities; the timing of commercial product launches and delays in product development; the ability to achieve key technical milestones in key products; dependence on third parties to develop, manufacture, sell and market its products; potential product liability claims; its ability to maintain its listing on The Nasdaq Stock Market, and other risk factors identified from time to time in the Company's SEC reports, including the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other reports filed with the SEC. These factors are not intended to represent a complete list of the general or specific factors that may affect the Company. It should be recognized that other factors, including general economic factors and business strategies, may be significant, now or in the future, and the factors set forth in this release may affect the Company to a greater extent than indicated. Except as expressly required by federal securities laws, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changes in circumstances or any other reason.

Investor Relations Contact

Jeff Christensen and Matt Kreps

Darrow Associates Investor Relations

MVIS@darrowir.com

SOURCE: MicroVision, Inc.

View source version on accesswire.com:

https://www.accesswire.com/722697/MicroVision-Announces-Third-Quarter-2022-Results