MicroVision Announces Fourth Quarter and Full Year 2024 Results

MicroVision (NASDAQ:MVIS) reported Q4 2024 financial results with revenue of $1.7 million, down from $5.1 million in Q4 2023. The company posted a net loss of $31.2 million ($0.14 per share) compared to $19.7 million loss in Q4 2023.

The company secured a $75 million convertible note facility and raised an additional $8 million through equity sale. MicroVision ended Q4 2024 with $74.7 million in cash and cash equivalents. A production commitment with ZF is expected to generate $30-$50 million in revenue over the next 12-18 months, primarily from AMR/AGV customers.

Business highlights include engagement with top-tier automotive OEMs on seven high-volume RFQs, strengthened leadership with the hiring of former Aptiv CTO Glen DeVos, and improved cost structure resulting in reduced cash burn. The company maintains access to additional capital of up to $161 million subject to certain conditions.

MicroVision (NASDAQ:MVIS) ha riportato i risultati finanziari del quarto trimestre 2024 con ricavi di 1,7 milioni di dollari, in calo rispetto ai 5,1 milioni di dollari nel quarto trimestre 2023. L'azienda ha registrato una perdita netta di 31,2 milioni di dollari (0,14 dollari per azione) rispetto a una perdita di 19,7 milioni di dollari nel quarto trimestre 2023.

L'azienda ha ottenuto una linea di credito convertibile da 75 milioni di dollari e ha raccolto ulteriori 8 milioni di dollari attraverso la vendita di azioni. MicroVision ha chiuso il quarto trimestre 2024 con 74,7 milioni di dollari in contante e equivalenti. Un impegno di produzione con ZF dovrebbe generare 30-50 milioni di dollari di ricavi nei prossimi 12-18 mesi, principalmente da clienti AMR/AGV.

I punti salienti dell'attività includono l'impegno con i principali OEM automobilistici su sette RFQ ad alto volume, il rafforzamento della leadership con l'assunzione dell'ex CTO di Aptiv Glen DeVos, e una struttura dei costi migliorata che ha portato a una riduzione del consumo di cassa. L'azienda mantiene l'accesso a capitale aggiuntivo fino a 161 milioni di dollari soggetto a determinate condizioni.

MicroVision (NASDAQ:MVIS) informó los resultados financieros del cuarto trimestre de 2024 con ingresos de 1,7 millones de dólares, una disminución respecto a los 5,1 millones de dólares en el cuarto trimestre de 2023. La compañía reportó una pérdida neta de 31,2 millones de dólares (0,14 dólares por acción) en comparación con una pérdida de 19,7 millones de dólares en el cuarto trimestre de 2023.

La empresa aseguró una línea de crédito convertible de 75 millones de dólares y recaudó 8 millones de dólares adicionales a través de la venta de acciones. MicroVision terminó el cuarto trimestre de 2024 con 74,7 millones de dólares en efectivo y equivalentes. Un compromiso de producción con ZF se espera que genere 30-50 millones de dólares en ingresos durante los próximos 12-18 meses, principalmente de clientes AMR/AGV.

Los aspectos destacados del negocio incluyen el compromiso con los principales OEM automotrices en siete RFQ de alto volumen, el fortalecimiento del liderazgo con la contratación del ex CTO de Aptiv, Glen DeVos, y una estructura de costos mejorada que ha resultado en una reducción del consumo de efectivo. La empresa mantiene acceso a capital adicional de hasta 161 millones de dólares sujeto a ciertas condiciones.

마이크로비전 (NASDAQ:MVIS)은 2024년 4분기 재무 결과를 발표했으며, 수익은 170만 달러로, 2023년 4분기 510만 달러에서 감소했습니다. 이 회사는 2023년 4분기 1970만 달러의 손실에 비해 3120만 달러의 순손실 ($0.14 per share)을 기록했습니다.

회사는 7500만 달러의 전환사채 시설을 확보하고, 주식 판매를 통해 추가로 800만 달러를 모금했습니다. 마이크로비전은 2024년 4분기를 7470만 달러의 현금 및 현금성 자산으로 마감했습니다. ZF와의 생산 약속은 향후 12-18개월 동안 주로 AMR/AGV 고객으로부터 3000만-5000만 달러의 수익을 창출할 것으로 예상됩니다.

비즈니스 하이라이트에는 7개의 대량 RFQ에 대한 주요 자동차 OEM과의 협력, 전 Aptiv CTO인 글렌 드보스의 영입을 통한 리더십 강화, 현금 소모 감소로 이어진 비용 구조 개선이 포함됩니다. 이 회사는 특정 조건에 따라 최대 1억6100만 달러의 추가 자본에 접근할 수 있습니다.

MicroVision (NASDAQ:MVIS) a annoncé les résultats financiers du quatrième trimestre 2024 avec des revenus de 1,7 million de dollars, en baisse par rapport à 5,1 millions de dollars au quatrième trimestre 2023. L'entreprise a affiché une perte nette de 31,2 millions de dollars (0,14 dollar par action) par rapport à une perte de 19,7 millions de dollars au quatrième trimestre 2023.

L'entreprise a sécurisé une ligne de crédit convertible de 75 millions de dollars et a levé 8 millions de dollars supplémentaires par le biais de la vente d'actions. MicroVision a terminé le quatrième trimestre 2024 avec 74,7 millions de dollars en liquidités et équivalents. Un engagement de production avec ZF devrait générer 30-50 millions de dollars de revenus au cours des 12 à 18 prochains mois, principalement de la part de clients AMR/AGV.

Les points saillants de l'activité incluent l'engagement avec des OEM automobiles de premier plan sur sept RFQ à fort volume, le renforcement de la direction avec l'embauche de l'ancien CTO d'Aptiv, Glen DeVos, et une structure de coûts améliorée qui a conduit à une réduction de la consommation de liquidités. L'entreprise conserve l'accès à un capital supplémentaire pouvant atteindre 161 millions de dollars, sous réserve de certaines conditions.

MicroVision (NASDAQ:MVIS) hat die finanziellen Ergebnisse des vierten Quartals 2024 veröffentlicht, mit Einnahmen von 1,7 Millionen Dollar, ein Rückgang von 5,1 Millionen Dollar im vierten Quartal 2023. Das Unternehmen verzeichnete einen Nettoverlust von 31,2 Millionen Dollar (0,14 Dollar pro Aktie) im Vergleich zu einem Verlust von 19,7 Millionen Dollar im vierten Quartal 2023.

Das Unternehmen sicherte sich eine konvertierbare Kreditlinie über 75 Millionen Dollar und sammelte zusätzlich 8 Millionen Dollar durch den Verkauf von Eigenkapital. MicroVision schloss das vierte Quartal 2024 mit 74,7 Millionen Dollar in Bargeld und liquiden Mitteln. Ein Produktionsengagement mit ZF wird voraussichtlich 30-50 Millionen Dollar an Einnahmen in den nächsten 12-18 Monaten generieren, hauptsächlich von AMR/AGV-Kunden.

Zu den Geschäftshighlights gehören das Engagement mit führenden Automobil-OEMs bei sieben hochvolumigen RFQs, die Stärkung der Führung durch die Einstellung des ehemaligen CTO von Aptiv, Glen DeVos, und eine verbesserte Kostenstruktur, die zu einem reduzierten Bargeldverbrauch geführt hat. Das Unternehmen hat Zugang zu zusätzlichem Kapital von bis zu 161 Millionen Dollar, vorbehaltlich bestimmter Bedingungen.

- Secured $75M convertible note facility plus $8M additional equity funding

- Production commitment with ZF expected to generate $30-50M revenue in 12-18 months

- Engaged in seven high-volume RFQs with top-tier automotive OEMs

- Improved cost structure with reduced cash burn

- Strong cash position of $74.7M with access to additional $161M capital

- Revenue declined to $1.7M in Q4 2024 from $5.1M in Q4 2023

- Net loss increased to $31.2M from $19.7M year-over-year

- Q4 revenue fell short of expectations due to customer delay

- Continued cash burn of $15M in operations during Q4 2024

Insights

MicroVision's Q4 2024 results reveal a complex financial picture with both concerning metrics and encouraging developments. Revenue dropped to

The net loss widened significantly to

MicroVision's financial engineering warrants attention. The company has strengthened its balance sheet with

The production commitment with ZF targeting

MicroVision's strategic positioning reveals a multi-vertical approach that's starting to crystallize after years of development. Their prioritization of industrial AMR/AGV applications represents a pragmatic pivot toward near-term revenue opportunities while maintaining their longer-term automotive aspirations.

The hiring of Glen DeVos, Aptiv's former CTO, is particularly significant. Aptiv is a major Tier 1 automotive supplier with extensive ADAS experience, suggesting MicroVision is bolstering leadership with industry veterans who understand the extended qualification cycles and technical requirements of automotive OEMs. This executive addition could accelerate their automotive traction.

The ZF production commitment provides critical manufacturing scale and credibility. ZF is one of the world's largest automotive suppliers, and this arrangement addresses a key investor concern about MicroVision's ability to meet potential high-volume demand. It also suggests their integrated hardware-software approach is beginning to resonate with industrial customers.

Their streamlined cost structure, while maintaining engagement with automotive OEMs, indicates a strategic shift toward capital efficiency while preserving optionality. This balanced approach allows them to pursue near-term industrial revenue while remaining positioned for potentially larger automotive opportunities as ADAS adoption increases.

The development of three distinct verticals—industrial, automotive, and defense—creates multiple potential revenue streams, though each has different qualification timelines and scalability characteristics. The industrial AMR/AGV market offers the clearest path to meaningful 2025 revenue.

REDMOND, WA / ACCESS Newswire / March 26, 2025 / MicroVision, Inc. (NASDAQ:MVIS), a technology pioneer delivering advanced perception solutions in autonomy and mobility, today announced its fourth quarter 2024 results.

Key Business Highlights

Significant momentum toward near-term revenue opportunities from multiple leading industrial companies in the autonomous mobile robot (AMR) and automated guided vehicle (AGV) sector.

Actively engaged with top-tier global automotive OEMs, with seven high-volume RFQs for passenger vehicles and custom development opportunities.

Secured production commitment to ensure continuous and uninterrupted supply of sensors and integrated software to meet anticipated volume demand.

Deepened executive leadership expertise with the hiring of Glen DeVos, former CTO of Aptiv, to lead the enhancement of our product portfolio and expansion of our customer solutions.

Streamlined cost structure in 2024, resulting in sequential improvement in cash burn.

Secured a

$75 million convertible note facility with an institutional investor, plus raised an additional$8 million in the first quarter of 2025 through an equity sale to the same investor.

"MicroVision is well positioned to secure revenue opportunities for 2025, primarily from three verticals: industrial, automotive, and defense," said Sumit Sharma, MicroVision's Chief Executive Officer. "Our unique value proposition continues to be our integrated perception software with our MAVIN and MOVIA sensors. We continue to offer compelling solutions to industrial customers and automotive OEMs at attractive price points."

Sharma continued, "With a well-capitalized balance sheet including

Key Financial Highlights for Q4 2024 and Full Year 2024

Revenue for the fourth quarter of 2024 was

$1.7 million , compared to$5.1 million for the fourth quarter of 2023. Excluding the one-time revenue from Microsoft of$4.6 million in Q4 2023, the revenue growth in Q4 2024 was driven by demand primarily from industrial customers. Q4 revenue was short of our expectations as a customer was delayed into 2025.Net loss for the fourth quarter of 2024 was

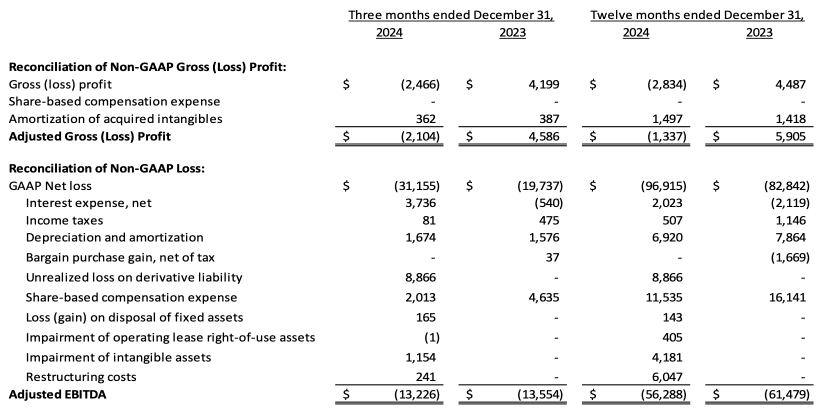

$31.2 million , or$0.14 per share, which includes$2.0 million of non-cash, share-based compensation expense and$13.2 million of the new convertible note-related expense, compared to a net loss of$19.7 million , or$0.10 per share, which includes$4.6 million of non-cash, share-based compensation expense, for the fourth quarter of 2023.Adjusted EBITDA for the fourth quarter of 2024 was a

$13.2 million loss, compared to a$13.6 million loss for the fourth quarter of 2023.Cash used in operations in the fourth quarter of 2024 was

$15.0 million , compared to cash used in operations in the fourth quarter of 2023 of$16.6 million .The Company ended the fourth quarter of 2024 with

$74.7 million in cash and cash equivalents, including investment securities, compared to$73.8 million at December 31, 2023.

Subsequent to the fourth quarter, the Company bolstered its financial position by entering into an agreement to raise up to

Conference Call and Webcast: Q4 2024 Results

MicroVision will host a conference call and webcast, consisting of prepared remarks by management, a slide presentation, and a question-and-answer session at 1:30 PM PT/4:30 PM ET on Wednesday, March 26, 2025 to discuss the financial results and provide a business update. Analysts and investors may pose questions to management during the live webcast on March 26, 2025.

The live webcast and slide presentation can be accessed on the Company's Investor Relations website under the Events tab HERE. The webcast will be archived on the website for future viewing.

About MicroVision

MicroVision drives global adoption of innovative perception solutions to make mobility and autonomy safer. Fueled by engineering excellence in Redmond, Washington and Hamburg, Germany, MicroVision develops and supplies an integrated solution built on its perception software stack, incorporating application software and processing data from differentiated sensor systems. MicroVision's proprietary technology solutions deliver enhanced safety for a variety of industrial applications, including robotics, automated warehouse, and agriculture, and the automotive industry accelerating advanced driver-assistance systems (ADAS) and autonomous driving, as well as for military applications. With deep roots in MEMS-based laser beam scanning technology that integrates MEMS, lasers, optics, hardware, algorithms and machine learning software, MicroVision has the expertise to deliver safe mobility at the speed of life.

For more information, visit the Company's website at www.microvision.com, on Facebook at www.facebook.com/microvisioninc, and LinkedIn at https://www.linkedin.com/company/microvision/.

MicroVision, MAVIN, MOSAIK, and MOVIA are trademarks of MicroVision, Inc. in the United States and other countries. All other trademarks are the properties of their respective owners.

Non-GAAP information

To supplement MicroVision's condensed financial statements presented in accordance with GAAP, the Company presents investors with the non-GAAP financial measures "adjusted EBITDA" and "adjusted Gross Profit." Adjusted EBITDA consists of GAAP net income (loss) excluding the impact of the following: interest income and interest expense; income tax expense; depreciation and amortization; bargain purchase gain; gains and losses on derivatives and disposals; share-based compensation; impairment charges; and restructuring costs. Adjusted Gross Profit is calculated as GAAP gross profit before share-based compensation expense and the amortization of acquired intangibles included in cost of revenue.

MicroVision believes that the presentation of adjusted EBITDA and adjusted Gross Profit provides important supplemental information to management and investors regarding financial and business trends, provides consistency and comparability with MicroVision's past financial reports, and facilitates comparisons with other companies in the Company's industry, many of which use similar non-GAAP financial measures to supplement their GAAP results. Internally, management uses these non-GAAP measures when evaluating operating performance because the exclusion of the items described above provides an additional useful measure of the Company's operating results and facilitates comparisons of the Company's core operating performance against prior periods and its business objectives. Externally, the Company believes that adjusted EBITDA and adjusted Gross Profit are useful to investors in their assessment of MicroVision's operating performance and the valuation of the Company.

Adjusted EBITDA and adjusted Gross Profit are not calculated in accordance with GAAP, and should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Non-GAAP financial measures have limitations in that they do not reflect all of the costs associated with the operations of MicroVision's business as determined in accordance with GAAP. The Company expects to continue to incur expenses similar to the non-GAAP adjustments described above, and exclusion of these items from its non-GAAP financial measures should not be construed as an inference that these costs are unusual or infrequent.

The Company compensates for limitations of the adjusted EBITDA measure by prominently disclosing GAAP net income (loss), which the Company believes is the most directly comparable GAAP measure, and providing investors with a reconciliation from GAAP net income (loss) to adjusted EBITDA.

Similarly for adjusted Gross Profit, the Company compensates for limitations of the measure by prominently disclosing GAAP gross profit which is the difference between Revenue and Cost of revenue, which the Company believes is the most directly comparable GAAP measure, and providing investors with a reconciliation by backing out share-based compensation expense and the amortization of acquired intangibles included in cost of revenue.

Forward-Looking Statements

Certain statements contained in this release, including customer engagement and the likelihood of success; opportunities for revenue and cash; expense reduction; market position; product portfolio; product and manufacturing capabilities; access to capital and capital-raising opportunities; and expected revenue, expenses and cash usage are forward-looking statements that involve a number of risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those projected in such forward-looking statements include the risk its ability to operate with limited cash or to raise additional capital when needed; market acceptance of its technologies and products or for products incorporating its technologies; the failure of its commercial partners to perform as expected under its agreements; its financial and technical resources relative to those of its competitors; its ability to keep up with rapid technological change; government regulation of its technologies; its ability to enforce its intellectual property rights and protect its proprietary technologies; the ability to obtain customers and develop partnership opportunities; the timing of commercial product launches and delays in product development; the ability to achieve key technical milestones in key products; dependence on third parties to develop, manufacture, sell and market its products; potential product liability claims; its ability to maintain its listing on The Nasdaq Stock Market, and other risk factors identified from time to time in the Company's SEC reports, including the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other reports filed with the SEC. These factors are not intended to represent a complete list of the general or specific factors that may affect the Company. It should be recognized that other factors, including general economic factors and business strategies, may be significant, now or in the future, and the factors set forth in this release may affect the Company to a greater extent than indicated. Except as expressly required by federal securities laws, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changes in circumstances or any other reason.

Investor Relations Contact

Jeff Christensen

Darrow Associates Investor Relations

MVIS@darrowir.com

Media Contact

MicroVision, Inc.

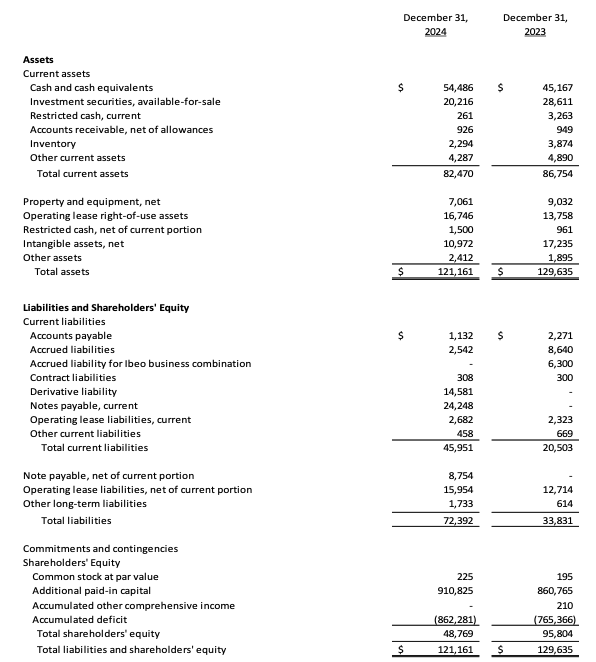

Consolidated Balance Sheets

(In thousands)

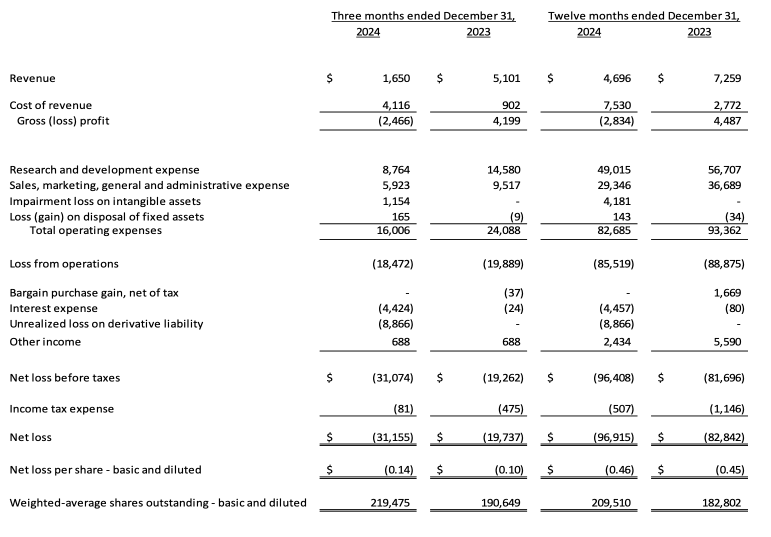

MicroVision, Inc.

Consolidated Statements of Operations

(In thousands, except per share data)

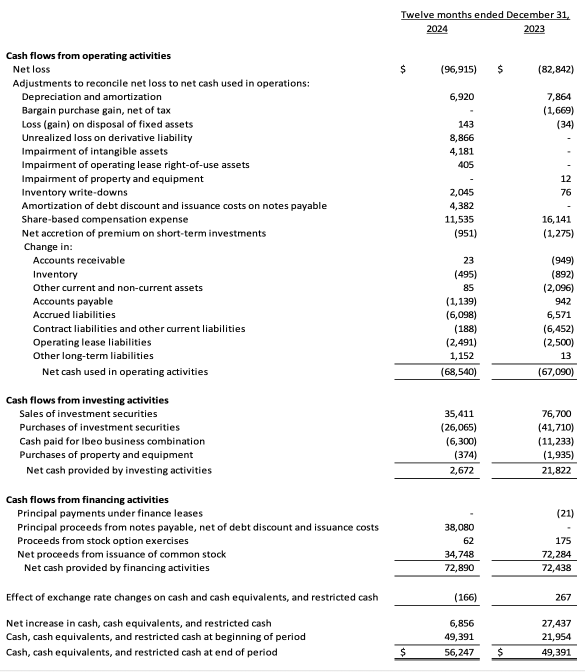

MicroVision, Inc.

Consolidated Statements of Cash Flows

(In thousands)

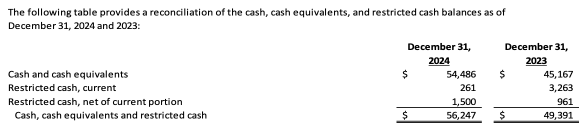

MicroVision, Inc.

Reconciliation of GAAP to Non-GAAP Measures

(In thousands)

SOURCE: MicroVision, Inc.

View the original press release on ACCESS Newswire