McEwen Mining: Grey Fox Exploration Update - Exploration Has Opened Up New Possibilities For Resource and Production Growth

McEwen Mining has released new assay results from its Grey Fox deposit in Ontario's Timmins region. Key highlights include high-grade drill results of 10.2 g/t Au over 11.1m at Whiskey Jack. The deposit shows similarities to the Hishikari Gold Mine, with potential for stacked epithermal gold-bearing veins. Current geological modeling indicates over 50 distinct mineralized lenses in a 1.3 square kilometer area, with 90% of the current Grey Fox resource (1.4 million ounces) within 300 meters from surface. An updated Mineral Resource estimate for the Fox Complex will be released in Q1 2025. The company has announced a $9.7 million exploration campaign for 2025, planning 69,500 meters of drilling.

McEwen Mining ha pubblicato nuovi risultati di analisi del suo giacimento Grey Fox nella regione di Timmins, in Ontario. I punti salienti includono risultati di perforazione di alta qualità di 10,2 g/t Au su 11,1m a Whiskey Jack. Il giacimento presenta somiglianze con la Miniera d'Oro Hishikari, con potenziale per vene aurifere epithermali sovrapposte. L'attuale modellazione geologica indica oltre 50 lenti mineralizzate distinte in un'area di 1,3 chilometri quadrati, con il 90% della riserva attuale di Grey Fox (1,4 milioni di once) a meno di 300 metri dalla superficie. Una stima aggiornata delle risorse minerali per il Complesso Fox sarà pubblicata nel primo trimestre del 2025. L'azienda ha annunciato una campagna di esplorazione da 9,7 milioni di dollari per il 2025, pianificando 69.500 metri di perforazione.

McEwen Mining ha publicado nuevos resultados de análisis de su depósito Grey Fox en la región de Timmins, Ontario. Los puntos clave incluyen resultados de perforación de alta ley de 10.2 g/t Au sobre 11.1m en Whiskey Jack. El depósito muestra similitudes con la Mina de Oro Hishikari, con potencial para vetas de oro epitermaícas apiladas. La modelización geológica actual indica más de 50 lentes mineralizades distintas en un área de 1.3 kilómetros cuadrados, con el 90% de los recursos actuales de Grey Fox (1.4 millones de onzas) a menos de 300 metros de la superficie. Se publicará una estimación actualizada de Recursos Minerales para el Complejo Fox en el primer trimestre de 2025. La compañía ha anunciado una campaña de exploración de 9.7 millones de dólares para 2025, con la planificación de 69,500 metros de perforación.

맥이웬 마이닝이 온타리오 팀민스 지역의 그레이 폭스 광산에서 새로운 시추 결과를 발표했습니다. 주요 하이라이트는 Whiskey Jack에서 10.2 g/t Au over 11.1m의 고품질 시추 결과입니다. 이 광산은 히시키리 금광과 유사성을 보이며, 중첩된 열수 금맥의 잠재력이 있습니다. 현재의 지질 모델링에 따르면 1.3 제곱킬로미터 지역에 50개 이상의 독립적인 광물화 렌즈가 있으며, 현재 그레이 폭스 자원(140만 온스)의 90%가 수면에서 300미터 이내에 있습니다. Fox Complex에 대한 업데이트된 광물 자원 추정치는 2025년 1분기에 발표될 예정입니다. 회사는 2025년을 위해 970만 달러 탐사 캠페인을 발표했으며, 69,500미터의 시추를 계획하고 있습니다.

McEwen Mining a publié de nouveaux résultats d'analyses de son gisement Grey Fox dans la région de Timmins, en Ontario. Les faits marquants incluent des résultats de forage de haute qualité de 10,2 g/t Au sur 11,1m à Whiskey Jack. Le gisement présente des similitudes avec la mine d'or Hishikari, avec un potentiel pour des veines aurifères épithermales superposées. La modélisation géologique actuelle indique plus de 50 lentilles minéralisées distinctes dans une zone de 1,3 kilomètre carré, avec 90% des ressources actuelles de Grey Fox (1,4 million d'onces) à moins de 300 mètres de la surface. Une estimation mise à jour des ressources minérales pour le Complexe Fox sera publiée au premier trimestre 2025. L'entreprise a annoncé une campagne d'exploration de 9,7 millions de dollars pour 2025, prévoyant 69 500 mètres de forage.

McEwen Mining hat neue Analyseergebnisse von seinem Grey Fox Lagerstätte in der Region Timmins, Ontario veröffentlicht. Zu den wichtigsten Highlights gehören hochgradige Bohrergebnisse von 10,2 g/t Au über 11,1m bei Whiskey Jack. Das Lager zeigt Ähnlichkeiten zur Hishikari Goldmine mit Potenzial für übereinanderliegende epithermale goldhaltige Adern. Aktuelle geologische Modelle weisen mehr als 50 unterschiedliche mineralisierte Linsen in einem Gebiet von 1,3 Quadratkilometern aus, wobei 90% der aktuellen Grey Fox Ressource (1,4 Millionen Unzen) innerhalb von 300 Metern von der Oberfläche liegen. Eine aktualisierte Schätzung der Mineralressourcen für den Fox-Komplex wird im ersten Quartal 2025 veröffentlicht. Das Unternehmen hat eine 9,7 Millionen Dollar umfassende Explorationskampagne für 2025 angekündigt und plant 69.500 Meter an Bohrungen.

- High-grade drill results showing 10.2 g/t Au over 11.1m at Whiskey Jack

- Current Grey Fox resource of 1.4 million Indicated and Inferred gold ounces

- $9.7 million exploration campaign planned for 2025 with 69,500 meters of drilling

- 90% of current resource lies within 300 meters from surface, suggesting favorable mining conditions

- Multiple new mineralized lenses identified in Gibson zone since last resource update

- None.

Insights

The Grey Fox exploration update reveals significant high-grade gold intercepts, with standout results of

The presence of both epithermal and orogenic mineralization systems significantly enhances the property's potential. The current 1.4 million ounces resource at Grey Fox is concentrated within 300 meters of surface, suggesting substantial depth potential. The

The Gibson Ramp's strategic location near multiple newly defined vein sets positions the project well for efficient future production. The planned Q1 2025 resource update could materially impact MUX's valuation, particularly if the drilling program continues to deliver high-grade results.

The dual mineralization system at Grey Fox presents a compelling geological setup. The identification of over 50 distinct mineralized lenses within just 1.3 square kilometers, combined with evidence suggesting drilling is still above the 'boiling zone', indicates significant untapped potential at depth.

The structural similarities between the Black Fox Mine and Grey Fox deposit, coupled with minimal drilling between these areas, presents an excellent exploration opportunity. The geological model suggesting stacked epithermal veins alongside orogenic zones mirrors highly productive systems globally.

Assay Highlights:

24GF-1508: 10.2 g/t Au over 11.1 m (0.30 opt Au over 36.4 ft)

24GF-1513: 11.2 g/t Au over 5.8 m (0.33 opt Au over 19.0 ft)

24GF-1512: 4.6 g/t Au over 6.6 m (0.13 opt Au over 21.7 ft)

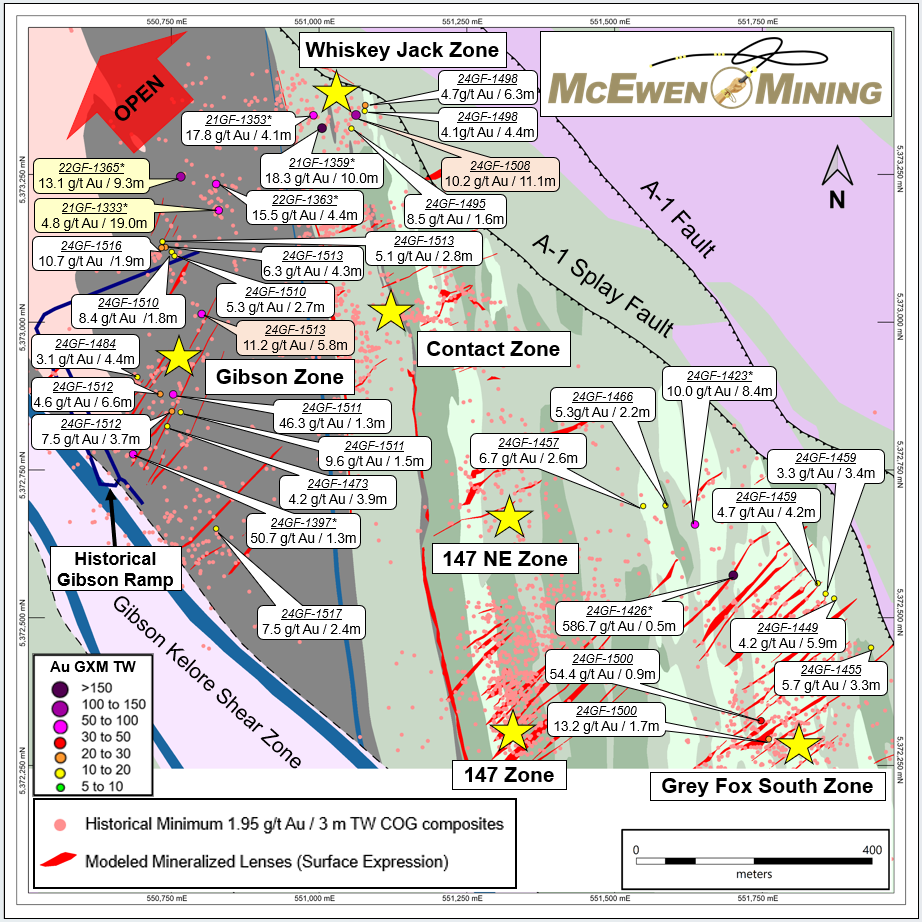

See Assays in Figure 2. All assay length intervals are true widths unless otherwise noted.

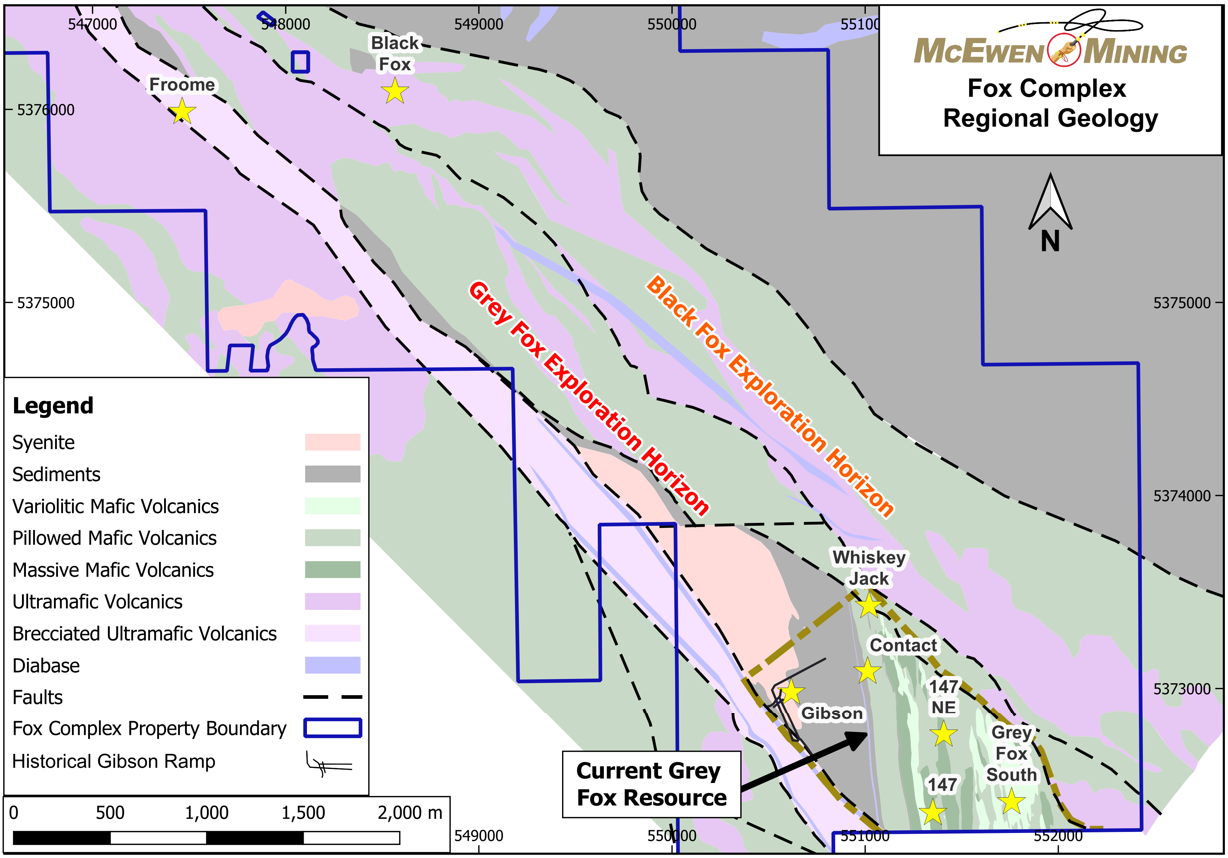

TORONTO, Dec. 02, 2024 (GLOBE NEWSWIRE) -- McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to provide new assay results from its Grey Fox deposit, part of the Fox Complex located in the Timmins region of Ontario, Canada. Grey Fox is located in the southern part of the Black Fox property and comprises six zones, known as Gibson, Whiskey Jack, Contact, 147, 147NE and Grey Fox South (see Figure 1).

Highlights:

- High-grade drill hole results include: 10.2 grams per tonne (g/t) Au over 11.1 m at Whiskey Jack.

- Geological investigations demonstrate similarities between the Grey Fox Deposit and the Hishikari Gold Mine.

- Potential for stacked epithermal gold-bearing veins over & adjacent to an orogenic gold system.

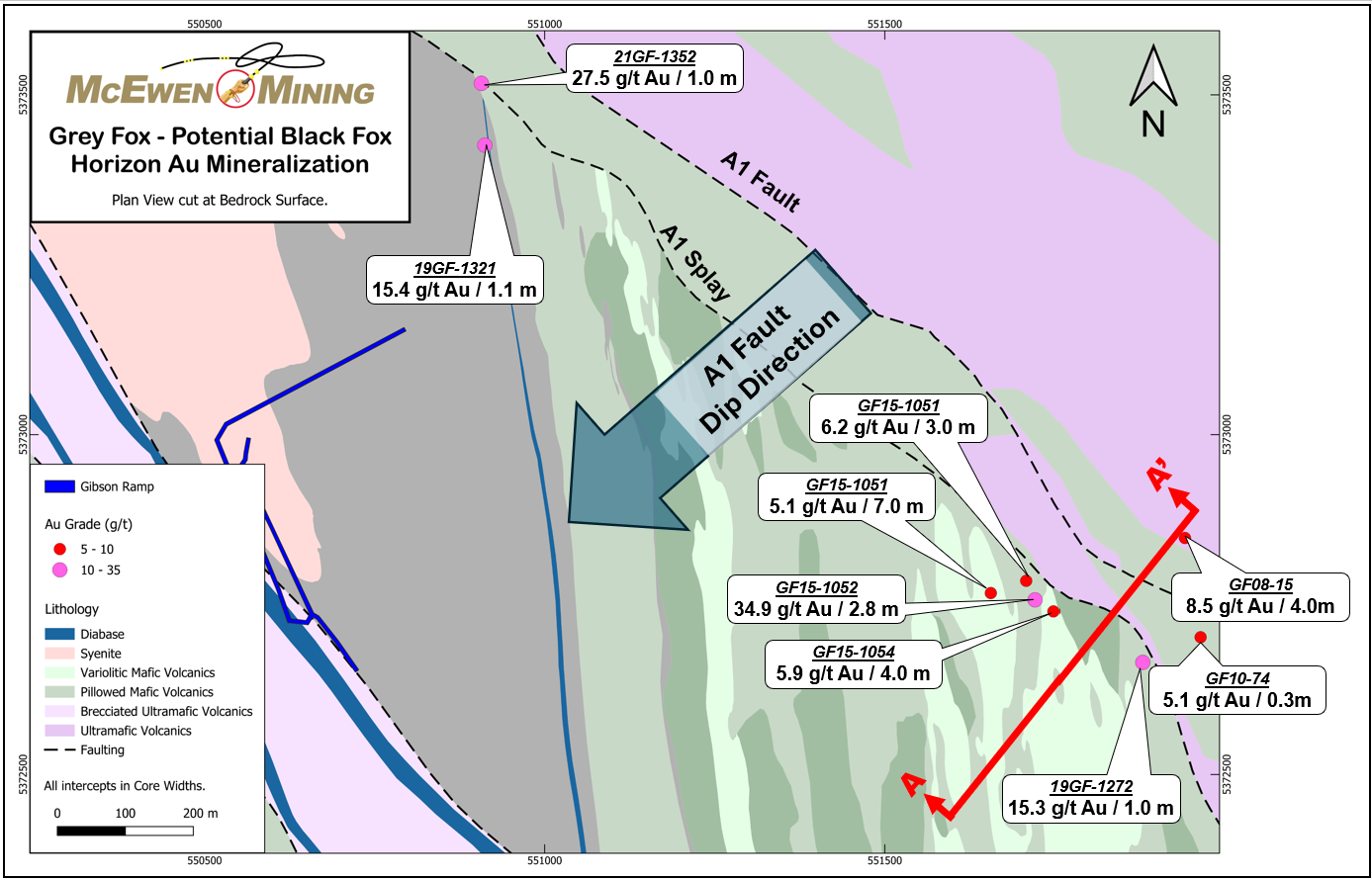

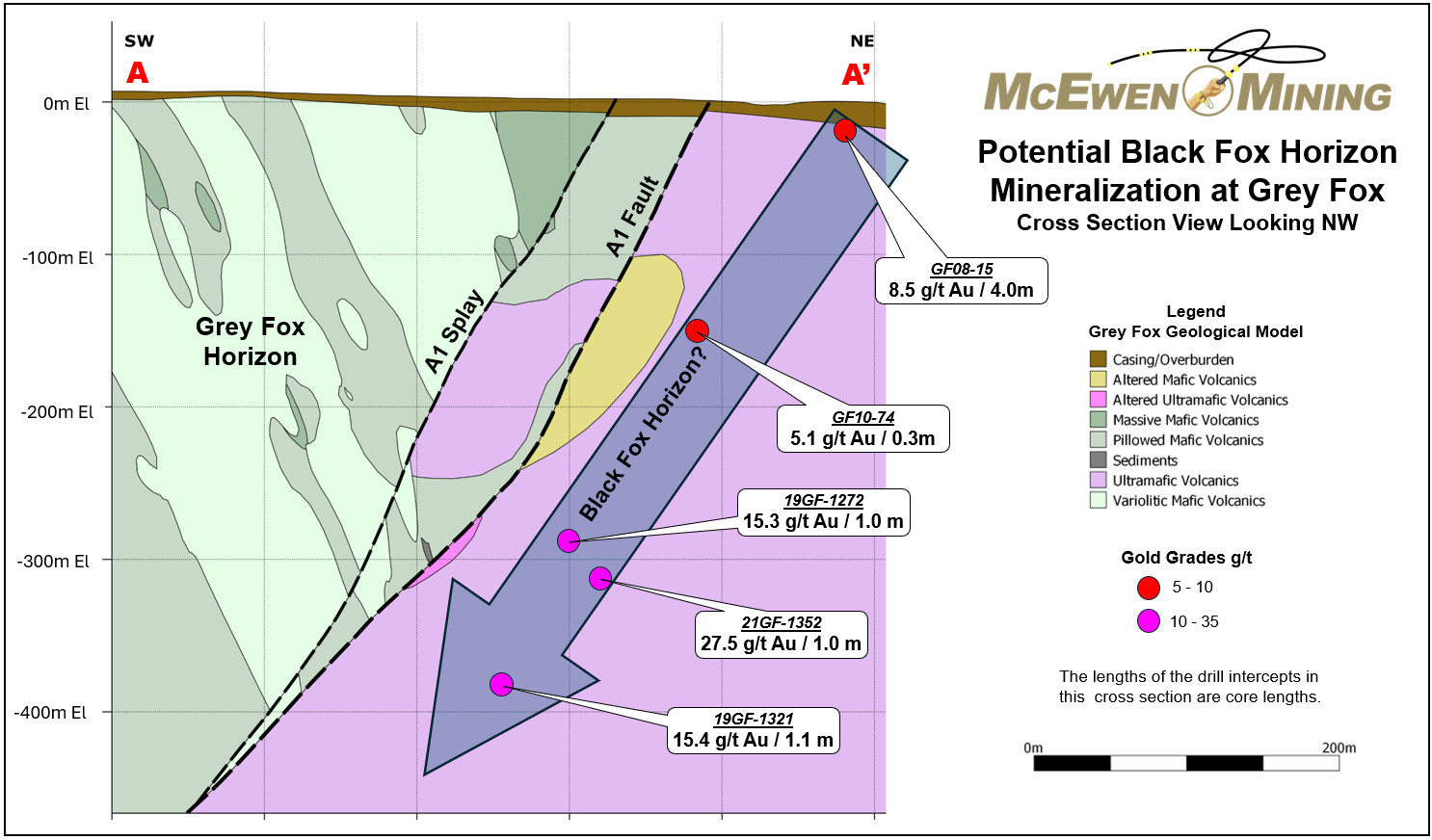

- An example of the potential for additional orogenic gold mineralization similar to the Black Fox Mine can be seen in Figures 5 and 6.

- An updated Mineral Resource estimate for the entire Fox Complex will be released in Q1 of 2025, including Grey Fox (current resource of 1.4 million Indicated and Inferred gold ounces) and Stock (current resource of 0.46 million Indicated and Inferred gold ounces) (see Table 2).

- The Black Fox Mine was a 1-million-ounce orogenic gold producer. The Black Fox Exploration Horizon extends from the Black Fox Mine for 3 kilometers to the Grey Fox Deposit (see Figure 1).

Rob McEwen, Chairman and Chief Owner said, “Our investment in exploration at Grey Fox, in the southern portion of the Black Fox property, is generating an exciting future for two specific reasons. Firstly, our team is focused on drilling to add gold ounces into our production pipeline. Secondly, we are impressed by the depth potential. There are two styles of gold mineralization, epithermal veining and orogenic lenses, both gold-rich at the top of the systems. Based on our past and recent drilling, it appears that the Fox Complex has the opportunity to expand its production profile, and the depth potential is still wide open.”

Current geological modeling of Grey Fox indicates the presence of over 50 distinct mineralized lenses in an area of only about 1.3 square kilometers in size, with many of the lenses extending to the bedrock surface.

In addition, over

Surface expressions of the modelled mineralized zones are generally parallel and strike northeast to southwest suggesting a strong, long-lived mineralizing system. Geological investigations suggest two distinct gold mineralizing systems of stacked epithermal veins and orogenic zones within close proximity. This observation opens the potential for a ‘Hishikari-type' epithermal vein system beside orogenic gold zones.

The Hishikari gold mine in Japan is one of the richest gold mines in the world, in production since 1985. To date, the mine produced 8.6 million ounces of gold, with an average grade of 30-40 g/t gold. It has a cluster of 125 low-sulphidation epithermal veins, within an area measuring 500 to 1,000 meters wide by 3,000 meters long. The veins are 1 to 3 meters wide to a maximum of 8 meters, and are ’blind’, as they don’t come to the surface, starting at 100 metres below the surface, with the top of the boiling zone at approximately 200 meters below the surface. In the boiling zone at Hishikari, the quartz veins are noted for having crustiform banding, while at Grey Fox only thin intersections of similar textures have generally been intersected to date, which suggests that most of the current drilling is still above the boiling zone.

Table 1 below shows recent assay results and some previously released key assay intercepts received for the Grey Fox Deposit.

Table 1. Drill Results From the Grey Fox Deposit

| Hole ID | From (m) | To (m) | Core Length (m) | True Width (m) | True Width (ft) | Au Grade (g/t) | Grade x True Width (GxM) |

| 24GF-1517 | 558.5 | 561.5 | 3.0 | 2.4 | 7.8 | 7.5 | 17.9 |

| Including | 560.5 | 561.5 | 1.0 | 0.8 | 2.6 | 16.0 | 12.7 |

| 24GF-1516 | 105.2 | 107.6 | 2.4 | 1.9 | 6.1 | 10.7 | 20.0 |

| Including | 106.9 | 107.6 | 0.7 | 0.5 | 1.7 | 16.1 | 8.2 |

| 24GF-1513 | 114.0 | 118.0 | 4.0 | 2.8 | 9.2 | 5.1 | 14.3 |

| Including | 115.1 | 118.0 | 2.9 | 2.1 | 6.7 | 6.0 | 12.4 |

| &Including | 115.1 | 116.0 | 0.9 | 0.7 | 2.2 | 15.5 | 10.3 |

| And | 139.0 | 145.0 | 6.0 | 4.3 | 14.0 | 6.3 | 27.0 |

| Including | 139.0 | 141.0 | 2.0 | 1.4 | 4.7 | 17.8 | 25.3 |

| And | 442.0 | 450.0 | 8.0 | 5.8 | 18.9 | 11.2 | 64.8 |

| Including | 444.9 | 450.0 | 5.1 | 3.7 | 12.0 | 17.2 | 63.0 |

| &Including | 446.0 | 447.0 | 1.0 | 0.7 | 2.4 | 72.7 | 52.5 |

| 24GF-1512 | 107.4 | 111.5 | 4.1 | 3.7 | 12.2 | 7.5 | 27.8 |

| Including | 107.4 | 108.2 | 0.8 | 0.7 | 2.4 | 37.1 | 26.9 |

| And | 156.6 | 164.0 | 7.5 | 6.6 | 21.7 | 4.6 | 30.4 |

| Including | 160.4 | 161.2 | 0.8 | 0.7 | 2.3 | 39.6 | 28.1 |

| 24GF-1511 | 241.0 | 243.0 | 2.0 | 1.3 | 4.2 | 46.3 | 59.2 |

| Including | 241.0 | 242.0 | 1.0 | 0.7 | 2.2 | 88.3 | 58.7 |

| And | 334.0 | 336.2 | 2.2 | 1.5 | 5.0 | 9.6 | 14.6 |

| Including | 334.0 | 335.0 | 0.9 | 0.7 | 2.2 | 16.1 | 10.8 |

| 24GF-1510 | 106.0 | 108.0 | 2.0 | 1.8 | 5.8 | 8.4 | 14.9 |

| Including | 107.0 | 108.0 | 1.0 | 0.9 | 2.9 | 12.3 | 10.9 |

| And | 118.0 | 121.0 | 3.0 | 2.7 | 8.7 | 5.3 | 14.1 |

| Including | 119.1 | 120.0 | 0.9 | 0.8 | 2.7 | 15.5 | 12.6 |

| 24GF-1508 | 149.4 | 163.9 | 14.5 | 11.1 | 36.5 | 10.2 | 113.3 |

| Including | 149.4 | 154.3 | 5.0 | 3.8 | 12.5 | 27.7 | 105.4 |

| 24GF-1500 | 116.5 | 117.6 | 1.1 | 0.9 | 3.0 | 54.4 | 49.5 |

| And | 176.0 | 178.0 | 2.0 | 1.7 | 5.5 | 13.2 | 22.0 |

| Including | 176.0 | 177.0 | 1.0 | 0.8 | 2.7 | 24.5 | 20.4 |

| 24GF-1498 | 120.0 | 124.9 | 4.9 | 4.3 | 14.3 | 4.1 | 17.8 |

| And | 132.0 | 139.1 | 7.1 | 6.3 | 20.8 | 4.7 | 29.7 |

| Including | 135.0 | 136.5 | 1.5 | 1.3 | 4.4 | 19.0 | 25.4 |

| 24GF-1495 | 73.0 | 75.0 | 2.0 | 1.6 | 5.2 | 8.4 | 13.5 |

| 24GF-1484 | 153.0 | 159.0 | 6.0 | 4.4 | 14.3 | 3.1 | 13.6 |

| Including | 153.0 | 154.0 | 1.0 | 0.7 | 2.4 | 16.1 | 11.7 |

| 24GF-1473 | 170.0 | 175.0 | 5.0 | 3.9 | 12.7 | 4.2 | 16.1 |

| Including | 173.0 | 174.0 | 1.0 | 0.8 | 2.5 | 17.5 | 13.5 |

| 24GF-1466 | 287.3 | 290.0 | 2.8 | 2.2 | 7.2 | 5.3 | 11.8 |

| Including | 289.0 | 290.0 | 1.0 | 0.8 | 2.6 | 14.0 | 11.2 |

| 24GF-1459 | 100.0 | 105.0 | 5.0 | 4.2 | 13.8 | 4.7 | 19.9 |

| Including | 102.0 | 103.0 | 1.0 | 0.8 | 2.8 | 18.0 | 15.1 |

| And | 139.0 | 143.0 | 4.0 | 3.4 | 11.0 | 3.3 | 11.2 |

| Including | 139.0 | 140.0 | 1.0 | 0.8 | 2.8 | 10.3 | 8.7 |

| 24GF-1457 | 276.0 | 279.0 | 3.0 | 2.6 | 8.6 | 6.7 | 17.6 |

| Including | 276.0 | 277.0 | 1.0 | 0.9 | 2.9 | 13.0 | 11.4 |

| 24GF-1455 | 195.0 | 198.7 | 3.7 | 3.3 | 10.7 | 5.7 | 18.5 |

| 24GF-1449 | 73.0 | 80.0 | 7.0 | 5.9 | 19.2 | 4.2 | 24.7 |

| Including | 74.0 | 75.0 | 1.0 | 0.8 | 2.7 | 21.1 | 17.7 |

| 21GF-1333* | 378.4 | 403.6 | 25.2 | 19.0 | 62.2 | 4.8 | 90.4 |

| 21GF-1353* | 231.9 | 236.9 | 5.0 | 4.1 | 13.5 | 17.8 | 73.3 |

| 21GF-1359* | 246.0 | 259.1 | 13.1 | 10.0 | 32.7 | 18.3 | 182.1 |

| 22GF-1363* | 442.4 | 447.4 | 5.0 | 4.4 | 14.4 | 15.5 | 68.3 |

| 22GF-1365* | 144.9 | 157.1 | 12.2 | 9.3 | 30.6 | 13.1 | 122.3 |

| 24GF-1397* | 154.0 | 156.0 | 2.0 | 1.3 | 4.3 | 50.7 | 66.2 |

| 24GF-1424* | 93.0 | 102.5 | 9.5 | 8.4 | 27.4 | 10.0 | 83.6 |

| 24GF-1426* | 200.3 | 200.9 | 0.7 | 0.5 | 1.8 | 586.7 | 315.2 |

| Gold grades in the table are uncapped. * indicates previously reported drill results. GxM over 50 are highlighted in bold. | |||||||

Figure 1 is a plan view map showing the multiple zones at Grey Fox in relation to the rest of the Fox Complex, also demonstrating that the Fox Complex can be divided into the Grey Fox Exploration Horizon and the Black Fox Exploration Horizon, based on geological similarities to the current Grey Fox resource and the Black Fox Mine, respectively. Minimal drilling has been completed between the Black Fox mine and the current Grey Fox resource. When looking at Figure 1 it can also be seen that between the Black Fox Mine and the current Grey Fox resource area there are similarities in terms of structure (faults) and rock types.

Much of the drilling since 2021 was concentrated at the Gibson and Whiskey Jack zones. Many of the new results reported in this news release from recent drilling confirm promising grades of mineralization for both zones e.g., 24GF-1508: 10.2 g/t Au over 11.1 m at Whiskey Jack (see Figure 2) and 24GF-1513: 11.2 g/t Au over 5.8 m at Gibson (see Figure 2).

Figure 1. Plan View Map for the Fox Complex

Figure 2. Plan View Surface Geology Map with New and Previously Released Results for Its Various Zones. * Denotes Previously Released Intercepts. Note: TW = True Width; COG = Cut Off Grade.

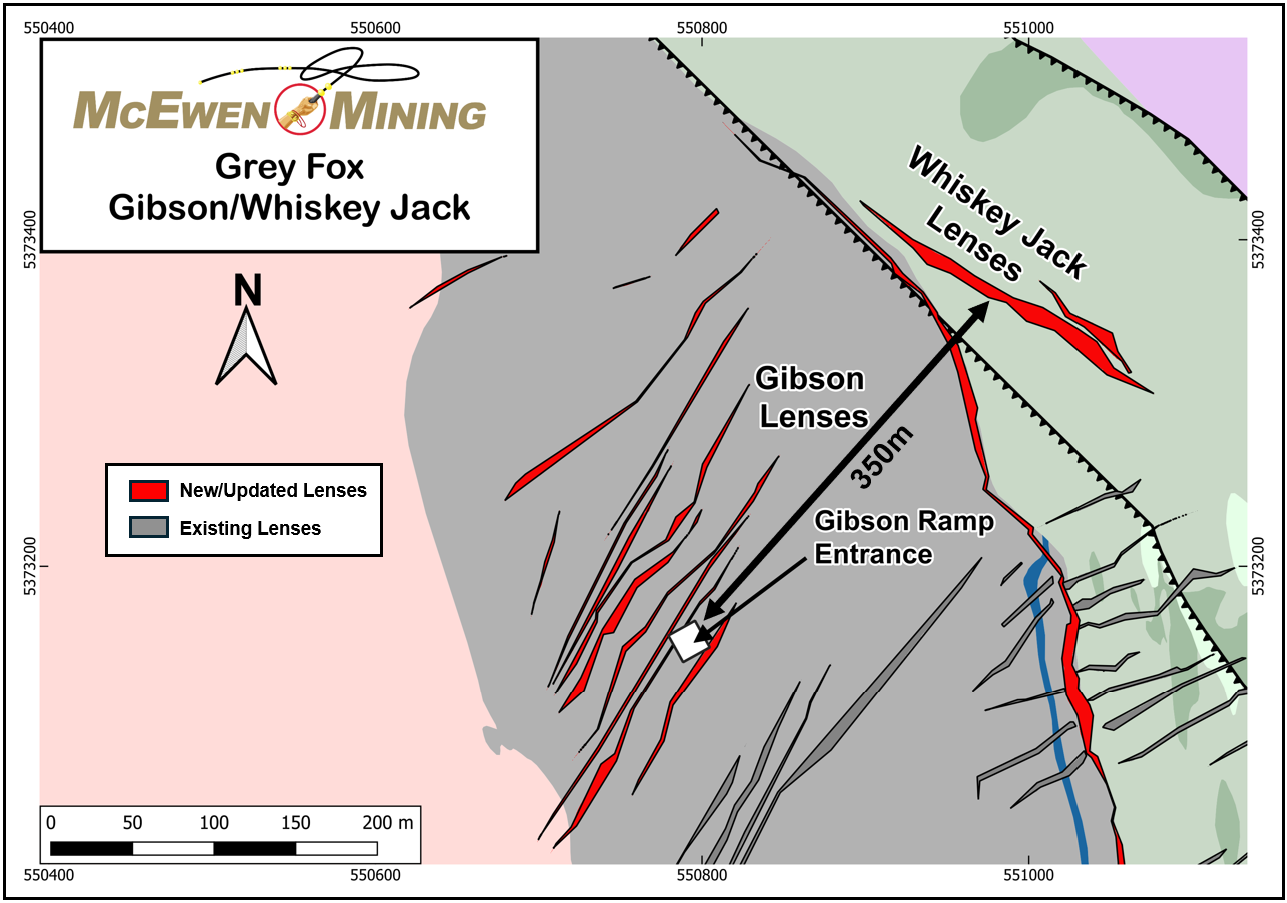

Of the 50 lenses identified at Grey Fox, multiple new lenses have been identified for the Gibson zone since the last resource update at Grey Fox, released in 2021. The mineralization within the Gibson zone is characterized by narrow, steeply dipping, continuous, epithermal vein sets and is still open to the northwest and down-dip (see Figure 2). Many of these new mineralized lenses are in close proximity to the historical Gibson Ramp and could be accessed via underground or open pit mining methods.

Figure 3. Zoomed in Plan View Map for the Gibson & Whiskey Jack Zones at Grey Fox, Showing New (Red) and Existing (Grey) Lenses.

The entrance to the Gibson Ramp is about 350 meters from the central portion of the Whiskey Jack zone. There are multiple newly defined epithermal vein sets between the ramp entrance and the Whiskey Jack zone. Figure 2 demonstrates that drillhole intercepts like 22GF-1365 (13.1 g/t Au over 9.3 m) and 21GF-1333 (4.8 g/t Au over 19.0 m) lie on some of these newly defined epithermal vein sets between the Gibson Ramp and the Whiskey Jack zone. The Gibson ramp is well located and a suitable platform for additional exploration and future production.

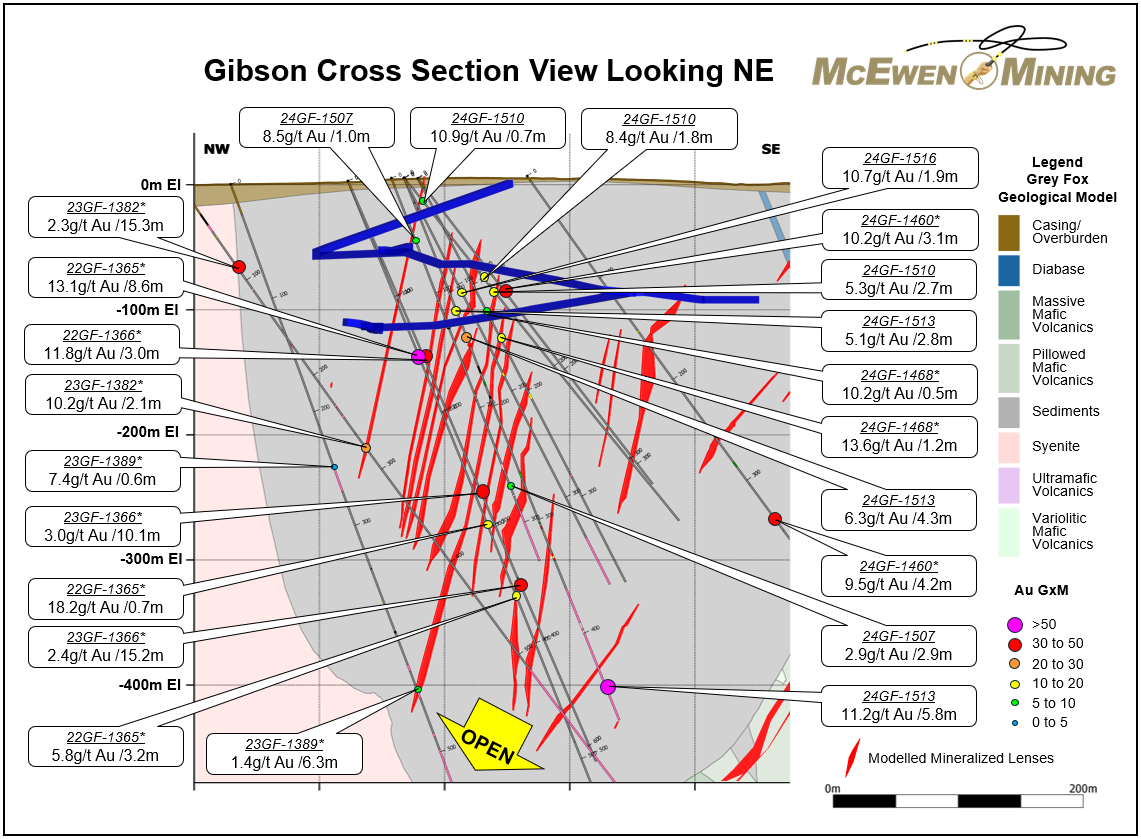

Figure 4 is a cross section through the Gibson zone at Grey Fox. Many of the mineralized lenses are close to the Gibson Ramp. These lenses could offer the flexibility of multiple production areas.

Figure 4. Grey Fox-Gibson Zone Cross Section (Looking NE). The Mineralized Lenses Are Open at Depth. Note their Close Proximity to the Gibson Ramp (Shown in Blue).

Figure 5. Plan View Map for the Areas Under and Adjacent to the Grey Fox Deposit. A-A' Denotes a Cross Section Represented in Figure 6, Showing the Locations of Some of the Historic Orogenic Intercepts Adjacent to and Under the Grey Fox Deposit.

Referring to Figures 5 & 6, it can be seen that there are orogenic-style intercepts located in the Black Fox Horizon adjacent to the current Grey Fox deposit. These intercepts represent a good exploration target to expand the current Grey Fox resource especially at depth, as these orogenic systems are known to often extend for many kilometers below the surface.

Figure 6. Cross Section Looking NW for the Black Fox Exploration Horizon Adjacent to the Grey Fox Deposit.

Resource Updates

The drill results from 2021 to October 21st, 2024 will be incorporated into the latest Grey Fox resource update, which will be released in Q1 2025, as part of an updated total Mineral Resources Estimate for the Fox Complex, portions of which have been disclosed in 2024.

Table 2. Current Gold Resources at the Fox Complex

| MEASURED | INDICATED | MEASURED + INDICATED | INFERRED | |||||||||

| Tonnes (000s) | Au Grade (g/t) | Contained Au (oz) | Tonnes (000s) | Au Grade (g/t) | Contained Au (oz) | Tonnes (000s) | Au Grade (g/t) | Contained Au (oz) | Tonnes (000s) | Au Grade (g/t) | Contained Au (oz) | |

| Froome | 378 | 3.88 | 47,000 | 265 | 3.93 | 34,000 | 643 | 3.90 | 81,000 | 143 | 3.44 | 16,000 |

| Grey Fox | 7,566 | 4.80 | 1,168,000 | 7,566 | 4.80 | 1,168,000 | 1,685 | 4.35 | 236,000 | |||

| Stock West & Main | 1,938 | 3.31 | 206,000 | 1,938 | 3.31 | 206,000 | 1,386 | 2.96 | 132,000 | |||

| Fuller | 1,149 | 4.25 | 157,000 | 1,149 | 4.25 | 157,000 | 693 | 3.41 | 76,000 | |||

| Stock East | 866 | 2.70 | 75,000 | 866 | 2.70 | 75,000 | 579 | 2.66 | 50,000 | |||

| Others | 504 | 6.42 | 104,000 | 1,221 | 2.19 | 86,000 | 1,725 | 3.43 | 190,000 | 254 | 5.02 | 41,000 |

| Total Fox Complex | 882 | 5.32 | 151,000 | 13,005 | 4.13 | 1,726,000 | 13,887 | 4.20 | 1,877,000 | 4,740 | 3.62 | 551,000 |

Outline of the 2025 Drill Campaign

The 2025 exploration campaign at Grey Fox will begin on January 6th with a budget of

The upcoming surveys are designed to extend the geophysical data into areas that had previously not been covered. This will allow for the creation of a much more robust model that integrates our better understanding of the geology and geophysics at the Grey Fox deposit. These surveys will aid in identifying Black Fox-style mineralization, which lies stratigraphically below Grey Fox, both towards the northwest and also back to the southeast towards Grey Fox (described in the press release dated September 11th, 2024).

Technical Information

Technical information pertaining to the Fox Complex exploration contained in this news release has been prepared under the supervision of Sean Farrell, P.Geo., Chief Exploration Geologist, who is a Qualified Person as defined by Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure for Mineral Projects."

The technical information related to resource and reserve estimates in this news release has been reviewed and approved by Luke Willis, P.Geo., McEwen Mining’s Director of Resource Modelling and is a Qualified Person as defined by SEC S-K 1300 and Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure for Mineral Projects."

New analyses reported herein were submitted as ½ core samples and assayed by the photon assay method at the accredited laboratory MSA Labs (ISO 9001 & ISO 17025) in Timmins, Ontario, Canada.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements and information, including "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements and information expressed, as at the date of this news release, McEwen Mining Inc.'s (the "Company") estimates, forecasts, projections, expectations or beliefs as to future events and results. Forward-looking statements and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the forward-looking statements and information include, but are not limited to, fluctuations in the market price of precious metals, mining industry risks, political, economic, social and security risks associated with foreign operations, the ability of the Company to receive or receive in a timely manner permits or other approvals required in connection with operations, risks associated with the construction of mining operations and commencement of production and the projected costs thereof, risks related to litigation, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of mineral resources and reserves, foreign exchange volatility, foreign exchange controls, foreign currency risk, and other risks. Readers should not place undue reliance on forward-looking statements or information included herein, which speak only as of the date hereof. The Company undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. See McEwen Mining's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, Quarterly Report on Form 10-Q for the three months ended March 31, 2024, June 30, 2024, and September 30, 2024, and other filings with the Securities and Exchange Commission, under the caption "Risk Factors", for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information regarding the Company. All forward-looking statements and information made in this news release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by the management of McEwen Mining Inc.

ABOUT MCEWEN MINING

McEwen Mining Inc. is a gold and silver producer with operations in Nevada (USA), Canada, Mexico, and Argentina. The company also owns

Focused on enhancing productivity and extending the life of its assets, the Company's goal is to increase its share price and provide investor yield. Rob McEwen, Chairman and Chief Owner, has a personal investment in the companies of US

McEwen Mining's shares are publicly traded on the New York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX) under the symbol "MUX".

Want News Fast?

Subscribe to our email list by clicking here:

https://www.mcewenmining.com/contact-us/#section=followUs

and receive news as it happens!

| WEB SITE | SOCIAL MEDIA | |||||

| www.mcewenmining.com | McEwen Mining | Facebook: | facebook.com/mcewenmining | |||

| LinkedIn: | linkedin.com/company/mcewen-mining-inc- | |||||

| CONTACT INFORMATION | Twitter: | twitter.com/mcewenmining | ||||

| 150 King Street West | Instagram: | instagram.com/mcewenmining | ||||

| Suite 2800, PO Box 24 | ||||||

| Toronto, ON, Canada | McEwen Copper | Facebook: | facebook.com/ mcewencopper | |||

| M5H 1J9 | LinkedIn: | linkedin.com/company/mcewencopper | ||||

| Twitter: | twitter.com/mcewencopper | |||||

| Relationship with Investors: | Instagram: | instagram.com/mcewencopper | ||||

| (866)-441-0690 - Toll free line | ||||||

| (647)-258-0395 | Rob McEwen | Facebook: | facebook.com/mcewenrob | |||

| Mihaela Iancu ext. 320 | LinkedIn: | linkedin.com/in/robert-mcewen-646ab24 | ||||

| info@mcewenmining.com | Twitter: | twitter.com/robmcewenmux | ||||

Figures accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/8e0db487-7576-4efa-afc1-6d348c34c32d

https://www.globenewswire.com/NewsRoom/AttachmentNg/fb92f8f1-d2b5-4d93-878b-afa07cfcdc3a

https://www.globenewswire.com/NewsRoom/AttachmentNg/152b4c28-e194-4c33-9ae2-cf08ccfad27b

https://www.globenewswire.com/NewsRoom/AttachmentNg/136ade32-7863-4dd4-9f66-67d7f8b4e1bc

https://www.globenewswire.com/NewsRoom/AttachmentNg/35cdd797-bf2d-4cb4-94f8-420daab5e8b1

https://www.globenewswire.com/NewsRoom/AttachmentNg/adef3ae0-4c2f-4e43-b3f2-7a8b07c9e1c4

FAQ

What are the latest drill results from McEwen Mining's Grey Fox deposit?

When will McEwen Mining (MUX) release the updated mineral resource estimate for Fox Complex?

How much is McEwen Mining (MUX) investing in Grey Fox exploration for 2025?