McEwen Mining Issues Correction: Grey Fox Gold Resources Hit a Significant Milestone

McEwen Mining (NYSE: MUX) has announced significant increases in gold resources at the Grey Fox deposit, part of the Fox Complex. The Indicated Resource grew by 32% to 1,538,000 ounces of gold, while the Inferred Resource increased by 95% to 458,000 ounces.

Key highlights include:

- Discovery cost of US $14.46 per ounce

- Lower cut-off grade (from 2.30 g/t Au to 1.60 g/t Au) due to higher gold price assumptions ($2,000 vs $1,725)

- Gibson zone showed notable growth with Indicated resources up 109% to 290,000 oz

- Whiskey-Jack zone contains 116,000 oz at 5.7 g/t Au, being 97% Indicated

The Grey Fox deposit, located 3km South-East of the Black Fox Mine, contains over 150 distinct mineralized lenses across 1.4 square kilometers. The resource growth is attributed to exploration drilling success and updated economic parameters.

McEwen Mining (NYSE: MUX) ha annunciato significativi aumenti delle risorse aurifere presso il deposito Grey Fox, parte del Fox Complex. La Risorsa Indicata è aumentata del 32% raggiungendo 1.538.000 once d'oro, mentre la Risorsa Inferita è cresciuta del 95% raggiungendo 458.000 once.

I punti salienti includono:

- Costo di scoperta di 14,46 USD per oncia

- Taglio del grado inferiore (da 2,30 g/t Au a 1,60 g/t Au) a causa di assunzioni più alte sul prezzo dell'oro (2.000 USD rispetto a 1.725 USD)

- La zona Gibson ha mostrato una crescita notevole con risorse indicate aumentate del 109% a 290.000 oz

- La zona Whiskey-Jack contiene 116.000 oz a 5,7 g/t Au, essendo il 97% indicata

Il deposito Grey Fox, situato a 3 km a sud-est della miniera Black Fox, contiene oltre 150 lenti mineralizzate distinte su 1,4 chilometri quadrati. La crescita delle risorse è attribuita al successo delle trivellazioni esplorative e ai parametri economici aggiornati.

McEwen Mining (NYSE: MUX) ha anunciado aumentos significativos en los recursos de oro en el depósito Grey Fox, parte del Fox Complex. El Recurso Indicado creció un 32% hasta alcanzar 1,538,000 onzas de oro, mientras que el Recurso Inferido aumentó un 95% hasta 458,000 onzas.

Los puntos clave incluyen:

- Costo de descubrimiento de 14.46 USD por onza

- Menor grado de corte (de 2.30 g/t Au a 1.60 g/t Au) debido a suposiciones de precios de oro más altas (2,000 USD frente a 1,725 USD)

- La zona Gibson mostró un crecimiento notable con recursos indicados que aumentaron un 109% a 290,000 oz

- La zona Whiskey-Jack contiene 116,000 oz a 5.7 g/t Au, siendo el 97% indicada

El depósito Grey Fox, ubicado a 3 km al sureste de la mina Black Fox, contiene más de 150 lentes mineralizadas distintas en 1.4 kilómetros cuadrados. El crecimiento de los recursos se atribuye al éxito de la perforación de exploración y a los parámetros económicos actualizados.

McEwen Mining (NYSE: MUX)가 Grey Fox 광구에 있는 금 자원의 상당한 증가를 발표했습니다. 이곳은 Fox Complex의 일부입니다. 지시 자원은 32% 증가하여 1,538,000 온스로 늘어났고, 추정 자원은 95% 증가하여 458,000 온스로 증가했습니다.

주요 내용은 다음과 같습니다:

- 온스당 발견 비용 14.46 USD

- 금 가격 가정 증가에 따라 컷오프 그레이드가 낮아짐 (2.30 g/t Au에서 1.60 g/t Au로 변경, 2,000 USD 대 1,725 USD)

- 기브슨 구역은 지시 자원이 109% 증가하여 290,000 oz에 도달하며 주목할 만한 성장을 보였습니다.

- 휘스키-잭 구역은 116,000 oz를 포함하며, 5.7 g/t Au로 97%가 지시 자원입니다.

Grey Fox 광구는 Black Fox 광산에서 남동쪽으로 3km 떨어진 곳에 위치하며, 1.4 제곱킬로미터에 걸쳐 150개 이상의 독특한 광물화 렌즈를 포함합니다. 자원 성장은 탐사 굴착의 성공과 업데이트된 경제적 매개변수에 기인합니다.

McEwen Mining (NYSE: MUX) a annoncé des augmentations significatives des ressources en or au dépôt Grey Fox, qui fait partie du Fox Complex. La ressource indiquée a augmenté de 32% pour atteindre 1.538.000 onces d'or, tandis que la ressource inférée a crû de 95% pour atteindre 458.000 onces.

Les points clés incluent :

- Coût de découverte de 14,46 USD par once

- Grade de coupure plus bas (de 2,30 g/t Au à 1,60 g/t Au) en raison d'hypothèses de prix de l'or plus élevées (2.000 USD contre 1.725 USD)

- La zone Gibson a montré une croissance notable avec des ressources indiquées en hausse de 109% à 290.000 oz

- La zone Whiskey-Jack contient 116.000 oz à 5,7 g/t Au, dont 97% sont indiquées

Le dépôt Grey Fox, situé à 3 km au sud-est de la mine Black Fox, contient plus de 150 lentilles minéralisées distinctes sur 1,4 kilomètre carré. La croissance des ressources est attribuée au succès des forages d'exploration et aux paramètres économiques mis à jour.

McEwen Mining (NYSE: MUX) hat signifikante Zuwächse der Goldreserven im Grey Fox Deposit, das Teil des Fox Complex ist, bekannt gegeben. Die angezeigte Ressource wuchs um 32% auf 1.538.000 Unzen Gold, während die vermutete Ressource um 95% auf 458.000 Unzen anstieg.

Die wichtigsten Highlights sind:

- Entdeckungskosten von 14,46 USD pro Unze

- Niedrigere Abbaustufe (von 2,30 g/t Au auf 1,60 g/t Au) aufgrund höherer Annahmen zum Goldpreis (2.000 USD im Vergleich zu 1.725 USD)

- Die Gibson-Zone zeigte bemerkenswertes Wachstum mit angezeigten Ressourcen, die um 109% auf 290.000 oz gestiegen sind

- Die Whiskey-Jack-Zone enthält 116.000 oz mit 5,7 g/t Au und ist zu 97% angezeigt

Das Grey Fox Deposit, das 3 km südöstlich der Black Fox Mine liegt, enthält über 150 verschiedene mineralisierte Linsen auf einer Fläche von 1,4 Quadratkilometern. Das Wachstum der Ressourcen wird auf den Erfolg der Explorationsbohrungen und aktualisierte wirtschaftliche Parameter zurückgeführt.

- None.

- None.

TORONTO, Feb. 04, 2025 (GLOBE NEWSWIRE) -- McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is providing minor corrections to yesterday’s press release. Please note that the resource statements remain unchanged. The corrections are related to Table 2 numbers, specifically the percentage differences between 2021 and December 2024. In addition, the price of gold used in 2021 was

McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to report a significant increase in the estimated gold (Au) resources at the Fox Complex’s Grey Fox deposit to December 31st, 2024, compared to the last estimate in the 2021 Fox Complex PEA (refer to Table 1). The discovery cost of this increase was US

The increase in resources at Grey Fox can be attributed to a number of factors: exploration drilling discovering and extending new and existing gold lenses; a higher gold price used to calculate the resource, from US

Rob McEwen, Chairman and Chief Owner, said, “Our investment in exploration on the Fox Complex properties has successfully expanded our gold resources, which will enable us to both increase annual production and extend the mine life. Grey Fox is one of several exploration targets contributing to the growth of gold resources and enhancing the future production at our Fox Complex.”

Table 1. Grey Fox Mineral Resource Update as of December 31st, 2024

| Resource | Cut-off Grade | Quantity | Grade Gold | Contained Metal |

| Classification | Gold (g/t) | ('000 t) | (g/t) | Gold (oz) |

| Measured | 1.60 | - | - | - |

| Indicated | 1.60 | 13,135 | 3.64 | 1,538,000 |

| Total Measured + Indicated | 1.60 | 13,135 | 3.64 | 1,538,000 |

| Inferred | 1.60 | 4,319 | 3.30 | 458,000 |

| Total Inferred | 1.60 | 4,319 | 3.30 | 458,000 |

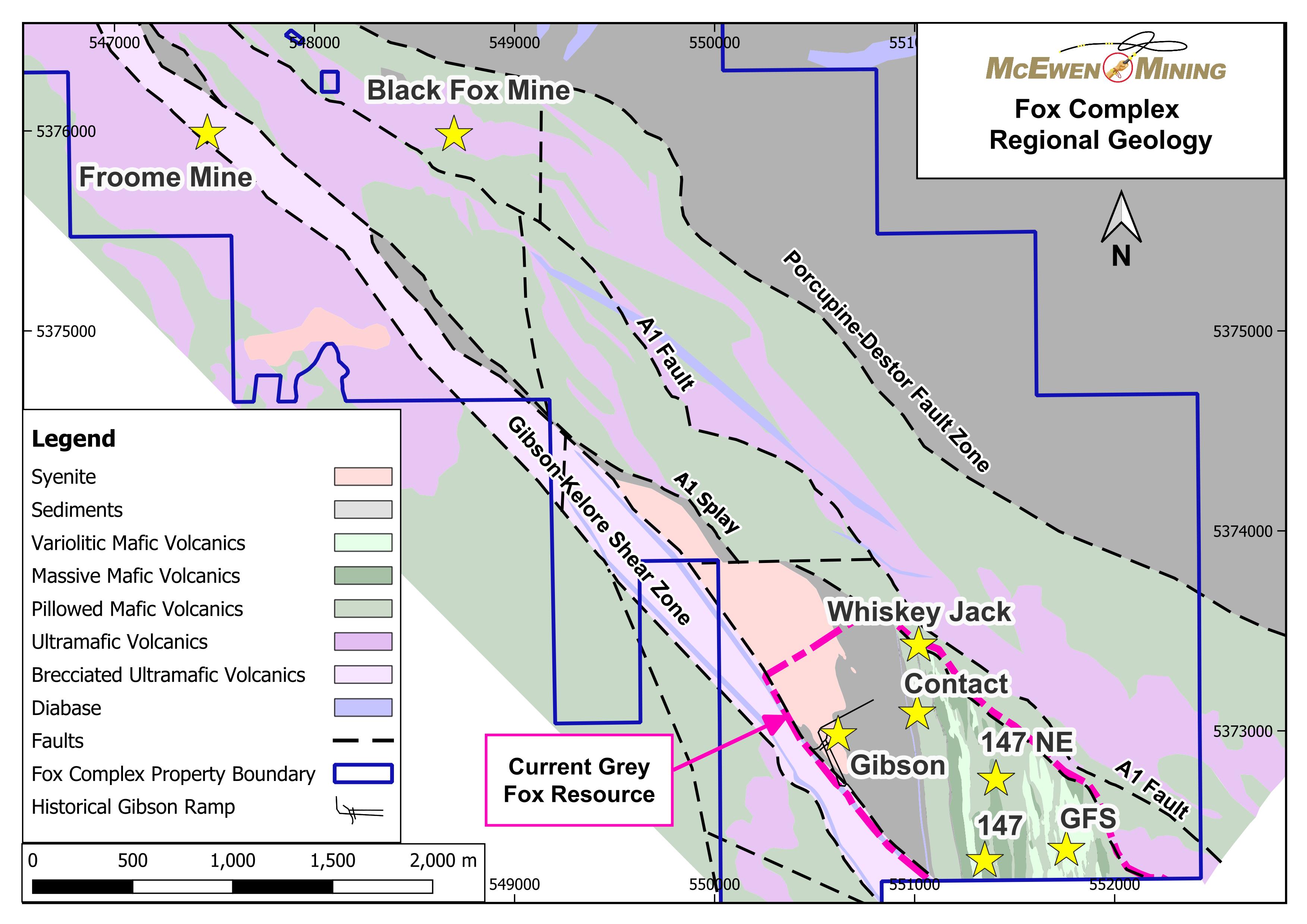

The Grey Fox deposit is located approximately 3 kilometers South-East of McEwen Mining’s Black Fox Mine and about 75 kilometers East of Timmins, Ontario, Canada (see Figure 1). The geology of the Fox Complex shown in Figure 1 is highly favourable for structurally controlled gold mineralization principally due its proximity to the world-class Porcupine-Destor Fault Zone and subordinate splay faults such as the A-1 and Gibson-Kelore. In addition, there is a large intrusive porphyry (syenite) body at Grey Fox which could also have been a ‘heat-engine’ for much of the gold mineralization. Current geological modeling of Grey Fox by McEwen Mining indicates the presence of over 150 distinct mineralized lenses in an area of about 1.4 square kilometers, with many of the lenses extending to the bedrock surface. The high concentration of lenses in such a compact area may indicate a robust mineralized system at Grey Fox. This is especially evidenced at the Gibson zone, where our drilling has confirmed mineralization from near surface (<25 m) down to vertical depths exceeding 800 m. In addition, the majority of these mineralized lenses remain open at depth.

Figure 1. Plan View Map of the Eastern Fox Complex

Referring to Table 2 below it can be seen that the 2024 resource update resulted in an increase (compared to the 2021 PEA) in contained gold for the zones, for both the Indicated and Inferred categories, except for a slight decrease in Indicated at the South Zone. Of particular interest are the increases at Gibson because of the historical Gibson Ramp which, when recommissioned, could provide access for early production ounces from Grey Fox. Gibson’s Indicated resource increased

Table 2. Comparison by Zone Between the 2021 PEA Resource and the December 31st, 2024 Resource Update

| Classification | Zone | Quantity ('000 t) | Grade Gold (g/t) | Contained Metal - Gold (oz) | ||||||||||||||||

| PEA 2021 | Dec 2024 | % Change | PEA 2021 | Dec 2024 | % Change | PEA 2021 | Dec 2024 | % Change | ||||||||||||

| Indicated | Contact Zone | 2,346 | 3,449 | +47 | % | 5.06 | 3.61 | -29 | % | 382,000 | 400,000 | +5 | % | |||||||

| 147 Zone | 1,952 | 3,159 | +62 | % | 4.89 | 3.85 | -21 | % | 307,000 | 391,000 | +28 | % | ||||||||

| 147NE Zone | 863 | 1,247 | +44 | % | 5.40 | 4.01 | -26 | % | 150,000 | 161,000 | +7 | % | ||||||||

| South Zone | 1,267 | 1,547 | +22 | % | 4.69 | 3.62 | -23 | % | 191,000 | 180,000 | -6 | % | ||||||||

| Gibson Zone | 1,137 | 3,097 | +172 | % | 3.79 | 2.91 | -23 | % | 139,000 | 290,000 | +109 | % | ||||||||

| WJ Zone | - | 636 | - | - | 5.69 | - | - | 116,000 | - | |||||||||||

| Inferred | Contact Zone | 259 | 609 | +135 | % | 4.58 | 3.34 | -27 | % | 38,000 | 65,000 | +72 | % | |||||||

| 147 Zone | 246 | 532 | +116 | % | 4.85 | 4.23 | -13 | % | 38,000 | 72,000 | +89 | % | ||||||||

| 147NE Zone | 64 | 120 | +88 | % | 7.51 | 5.28 | -30 | % | 15,000 | 20,000 | +33 | % | ||||||||

| South Zone | 135 | 460 | +241 | % | 4.38 | 3.52 | -20 | % | 19,000 | 52,000 | +174 | % | ||||||||

| Gibson Zone | 982 | 2,587 | +164 | % | 3.95 | 2.94 | -25 | % | 125,000 | 245,000 | +96 | % | ||||||||

| WJ Zone | - | 11 | - | - | 9.40 | - | - | 3,000 | - | |||||||||||

| Note: Numbers may not sum due to rounding. | ||||||||||||||||||||

Also noteworthy to mention is that the resource for the Whiskey-Jack (WJ) zone is categorized as

The discovery cost per ounce of gold (since the 2021 PEA resource estimate) was US

Table 3 provides a comparison of the 2021 PEA resource estimate with the December 31st, 2024 resource update. The decrease in grade reflects the lower cut-off used in the calculation of mineral resources using potential underground mining scenario shapes due to an increase in the gold price used, which has risen from US

Table 3. Comparison of the 2021 PEA Resource Estimate to the Year-End 2024 Resource Estimate

| PEA 2021 | ||||

| Classification | Cut-off Grade | Quantity | Grade Gold | Contained Metal |

| Gold (g/t) | ('000 t) | (g/t) | Gold (oz) | |

| Measured Resource | 2.30 | - | - | - |

| Indicated Resource | 2.30 | 7,566 | 4.80 | 1,168,000 |

| Total Measured + Indicated | 2.30 | 7,566 | 4.80 | 1,168,000 |

| Inferred Resource | 2.30 | 1,685 | 4.36 | 236,000 |

| Total Inferred | 2.30 | 1,685 | 4.36 | 236,000 |

| Grey Fox Mineral Resource Update as of December 31st, 2024 | ||||

| Classification | Cut-off Grade | Quantity | Grade Gold | Contained Metal |

| Gold (g/t) | ('000 t) | (g/t) | Gold (oz) | |

| Measured Resource | 1.60 | - | - | - |

| Indicated Resource | 1.60 | 13,135 | 3.64 | 1,538,000 |

| Total Measured + Indicated | 1.60 | 13,135 | 3.64 | 1,538,000 |

| Inferred Resource | 1.60 | 4,319 | 3.30 | 458,000 |

| Total Inferred | 1.60 | 4,319 | 3.30 | 458,000 |

| Changes in the Elements of the Resource Estimation - December 31st, 2024 vs. PEA 2021 | ||||

| Classification | Quantity | Grade Gold | Contained Metal | |

| ('000 t) | (g/t) | Gold (oz) | ||

| Measured Resource | - | - | - | |

| Indicated Resource | + | - | + | |

| Total Measured + Indicated | +74% | - | +32% | |

| Inferred Resource | + | - | + | |

| Total Inferred | +156% | - | +95% | |

| Note: Numbers may not sum due to rounding. | ||||

Technical Information

Technical information pertaining to the Fox Complex exploration contained in this news release has been prepared under the supervision of Sean Farrell, P.Geo., Exploration Manager, who is a Qualified Person as defined by Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure for Mineral Projects."

The technical information related to resource and reserve estimates in this news release has been reviewed and approved by Luke Willis, P.Geo., McEwen Mining’s Director of Resource Modelling and is a Qualified Person as defined by SEC S-K 1300 and Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure for Mineral Projects."

Footnotes to Tables 1-3

- Mineral resources are not mineral reserves and do not have demonstrated economic viability.

- All figures are rounded to reflect the relative accuracy of the estimates.

- Composites were capped where appropriate.

- Historical mineral resources stated for the 2021 PEA are reported at a cut-off grade of 2.30 g/t gold, assuming an underground extraction scenario, a gold price of US

$1,725 per ounce, and a metallurgical recovery of 85 percent. - Updated mineral resources for December 2024 are reported at a cut-off grade of 1.60 g/t gold, assuming an underground extraction scenario, a gold price of US

$2,000 per ounce, and a metallurgical recovery of 90 percent.

CONCERNING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements and information, including "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements and information expressed, as at the date of this news release, McEwen Mining Inc.'s (the "Company") estimates, forecasts, projections, expectations or beliefs as to future events and results. Forward-looking statements and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the forward-looking statements and information include, but are not limited to, fluctuations in the market price of precious metals, mining industry risks, political, economic, social and security risks associated with foreign operations, the ability of the Company to receive or receive in a timely manner permits or other approvals required in connection with operations, risks associated with the construction of mining operations and commencement of production and the projected costs thereof, risks related to litigation, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of mineral resources and reserves, foreign exchange volatility, foreign exchange controls, foreign currency risk, and other risks. Readers should not place undue reliance on forward-looking statements or information included herein, which speak only as of the date hereof. The Company undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. See McEwen Mining's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, Quarterly Report on Form 10-Q for the three months ended March 31, 2024, June 30, 2024, and September 30, 2024, and other filings with the Securities and Exchange Commission, under the caption "Risk Factors", for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information regarding the Company. All forward-looking statements and information made in this news release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by the management of McEwen Mining Inc.

ABOUT MCEWEN MINING

McEwen Mining Inc. is a gold and silver producer with operations in Nevada (USA), Canada, Mexico, and Argentina. The company also owns

Focused on enhancing productivity and extending the life of its assets, the Company's goal is to increase its share price and provide investor yield. Rob McEwen, Chairman and Chief Owner, has a personal investment in the companies of US

McEwen Mining's shares are publicly traded on the New York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX) under the symbol "MUX".

Want News Fast?

Subscribe to our email list by clicking here:

https://www.mcewenmining.com/contact-us/#section=followUs

and receive news as it happens!

| WEB SITE | SOCIAL MEDIA | |||

| www.mcewenmining.com | McEwen Mining | Facebook: | facebook.com/mcewenmining | |

| LinkedIn: | linkedin.com/company/mcewen-mining-inc- | |||

| CONTACT INFORMATION | Twitter: | twitter.com/mcewenmining | ||

| 150 King Street West | Instagram: | instagram.com/mcewenmining | ||

| Suite 2800, PO Box 24 | ||||

| Toronto, ON, Canada | McEwen Copper | Facebook: | facebook.com/ mcewencopper | |

| M5H 1J9 | LinkedIn: | linkedin.com/company/mcewencopper | ||

| Twitter: | twitter.com/mcewencopper | |||

| Relationship with Investors: | Instagram: | instagram.com/mcewencopper | ||

| (866)-441-0690 - Toll free line | ||||

| (647)-258-0395 | Rob McEwen | Facebook: | facebook.com/mcewenrob | |

| Mihaela Iancu ext. 320 | LinkedIn: | linkedin.com/in/robert-mcewen-646ab24 | ||

| info@mcewenmining.com | Twitter: | twitter.com/robmcewenmux | ||

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/cb7d1604-3095-4dd1-8918-fffb057d67c3