Meridian Announces Maiden Mineral Resource Estimate for Cabaçal Deposit

Meridian Mining UK S has announced its maiden Mineral Resource estimate for the Cabaçal copper-gold-silver VMS Deposit in Mato Grosso, Brazil. The estimate includes Indicated Resources of 52.9 Mt @ 0.6g/t Au, 0.3% Cu, and 1.4g/t Ag, translating to 1.1 million ounces of gold. Additionally, Inferred Resources stand at 10.3Mt @ 0.7g/t Au. The deposit extends over 1.9km and features a high-grade zone. Ongoing drilling shows promise with strong mineralization and ongoing assessments for resource expansion.

- Indicated Resources of 52.9 Mt @ 0.6g/t Au, 0.3% Cu, and 1.4g/t Ag, totaling 1.1 million ounces of gold.

- Inferred Resources of 10.3 Mt @ 0.7g/t Au, showing potential for future upgrades.

- The Cabaçal Deposit is near-surface, enhancing the feasibility for open-pit mining.

- Ongoing drilling intercepts strong mineralization, indicating further resource expansion.

- The mineral resource estimate is not a mineral reserve and does not demonstrate economic viability.

Indicated Resources of 52.9Mt @ 0.6g/t Au,

plus

Inferred Resources of 10.3Mt @ 0.7g/t Au,

LONDON, UK / ACCESSWIRE / September 26, 2022 / Meridian Mining UK S (TSX:MNO)(Frankfurt/Tradegate:2MM)(OTCQB:MRRDF) ("Meridian" or the "Company") is pleased to announce its maiden Mineral Resource estimate for the Cabaçal copper-gold-silver VMS Deposit "Cabaçal" in Mato Grosso, Brazil.

The Mineral Resource estimate was provided by specialist group, H&S Consultants Pty Ltd ("H&SC") and comprises Indicated Resources of 52.9 Mt @ 0.6g/t Au,

Significantly, the resource is near-surface, and extends over 1.9km with a prominent high-grade shallow gold zone in the Cabaçal Northwest Extension. Ongoing drilling on the margins of the resource has intercepted strong zones of copper-gold mineralization; further drill results are pending.

Highlights Reported Today

- Meridian announces a new Mineral Resource Estimate for the Cabaçal Cu-Au-Ag deposit.

- Indicated resources of 52.9Mt @ 0.6g/t Au,

0.3% Cu and 1.4g/t Ag;- 1.1M ounces gold, 168.0 Kt of copper and 2.4M ounces of silver;

- Inferred Resources of 10.3Mt @ 0.7g/t Au,

0.2% Cu & 1.1g/t Ag;- 0.2M ounces gold, 24.5 Kt of copper and 0.4M ounces of silver;

- Indicated resources of 52.9Mt @ 0.6g/t Au,

- Cabaçal's Au-Cu-Ag resource extends over 1.9km in length and remains open;

- Ongoing drilling has encountered multiple zones of Cu-Au-Ag mineralization;

- Extensions along strike to the northwest, down-dip and up-dip remain under evaluation;

- High grade Cabaçal Northwest Extension to be initial focus for future mine schedule studies;

- Cabaçal's metallurgical results used to estimate recovery for metals;

- Future results from Cabaçal's "resource expansion drill program" to be included in a 2023 Mineral Resource update.

Gilbert Clark Executive Chairman and Dr Adrian McArthur, CEO and President, jointly comment: "Today's Mineral Resource publication confirms Meridian's Cabaçal copper-gold-silver project to be one of the most significant resources still held by a junior within a large tenement package covering the hosting VMS belt. Meridian's technical team has done a remarkable job in delivering this resource in only 18 months since the start of drilling. The metallurgical work completed by the Company demonstrates that the Indicated Resource category 1.1 million ounces of gold, 168 thousand tonnes of copper and 2.4 million ounces of silver are amenable to processing through conventional flotation and gravity processes. The resource is located at shallow depths and shows excellent potential for a long life stand-alone open-pit within the upside of the greater Cabaçal VMS belt. Ongoing drilling has been very positive, and we look forward to Cabaçal's future development and growth."

Cabaçal's Resource Estimate

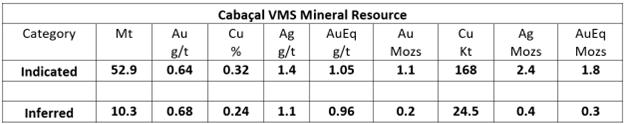

Table 1 - Cabaçal Mineral Resource (Effective Date August 21st, 2022, 0.3 g/t AuEq cut-off)

- Estimates are based on the Technical Report titled, "Independent Technical Report, Mineral Resource Estimate for the Cabaçal VMS deposit, Cabaçal Project, State of Mato Grosso, Brazil".

- The Independent and Qualified Person responsible for the mineral resource estimate is Simon Tear, P.Geo. of H & S Consultants Pty. Ltd., Sydney, Australia, and the effective date of the Mineral Resource is 21st August, 2022.

- Mineral resources are not mineral reserves and do not have demonstrated economic viability.

- Resources were compiled at 0.1, 0.2, 0.3, 0.4, 0.5, 0.6 g/t AuEq cut-off grades.

- Density was based on 18,826 measured density samples (weight in air/weight in water technique) which were modelled unconstrained using Ordinary Kriging. Overall average density of the deposit is 2.79t/m3.

- Reported tonnage and grade figures are rounded from raw estimates to reflect the order of accuracy of the estimate.

- Minor variations may occur during the addition of rounded numbers.

- Estimations used metric units (metres, tonnes and g/t).

- Gold equivalents are calculated as AuEq(g/t) = (Au(g/t) * %Recovery[1]) + (1.492*(Cu% * %Recovery)) + (0.013*(Ag(g/t) * %Recovery)), where:

- Au_recovery_ppm = 5.4368ln(Au_Grade_ppm)+88.856

- Cu_recovery_pct = 2.0006ln(Cu_Grade_pct)+94.686

- Ag_recovery_ppm = 13.342ln(Ag_Grade_ppm)+71.037

- Recoveries based on 2022 metallurgical testwork on core submitted to SGS Lakefield.

- Gold price US

$1,650 /oz; Silver US$21.35 /oz; Copper US$3.59 /lb (Metal prices used were derived from CIBC August 2022 long term banking consensus).

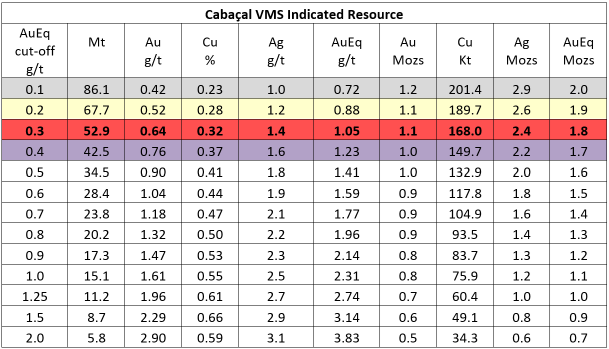

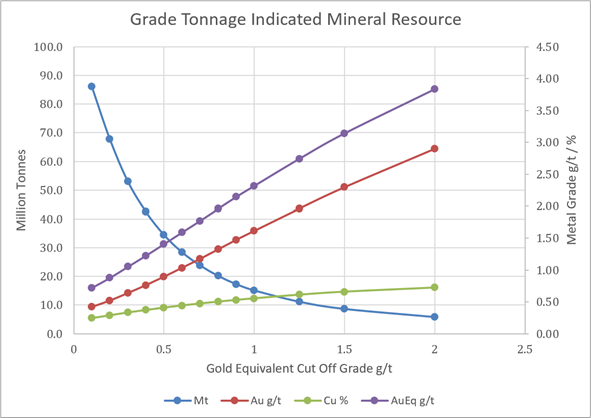

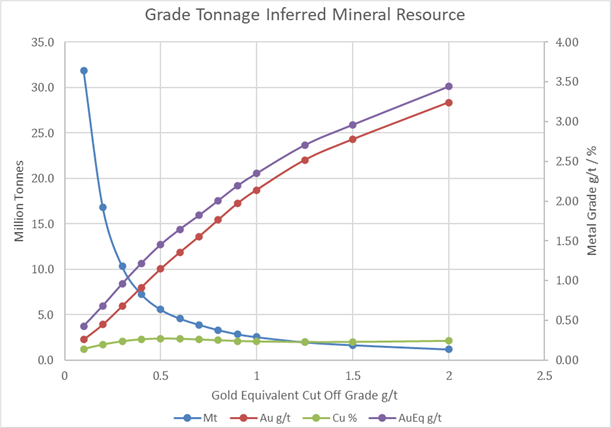

Table 2 - Sensitivity to AuEq Cut-off grade for Cabaçal VMS Indicated Resource Block Model (Resource Estimate is for 0.3 g/t AuEq cut-off; tabulation of other cut-off values for information only)

(Depletion for gold and copper factored in)

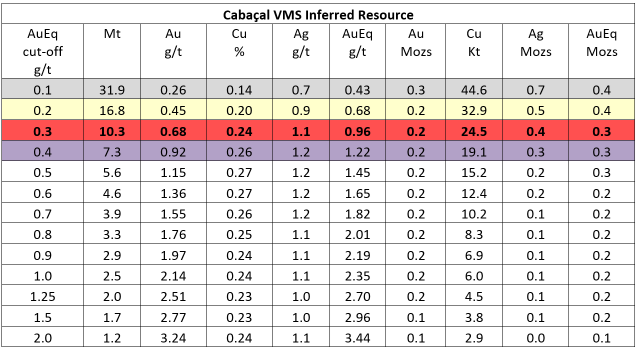

Table 3 - Sensitivity to AuEq Cut-off grade for Cabaçal VMS Indicated Resource Block Model

Table 4 - Sensitivity to AuEq Cut-off grade for Cabaçal VMS Inferred Resource Block Model (Resource Estimate is for 0.3 g/t AuEq cut-off; tabulation of other cut-off values for information only)

Table 5 - Sensitivity to AuEq Cut-off grade for Cabaçal VMS Inferred Resource Block Model

Project Background

The Cabaçal Cu-Au-Ag project (the "Project" or the "Property"), is located in the State of Mato Grosso, Brazil.

Geologically, the Project is located in the Proterozoic Jaurú-Santa Helena domain on the southwest margin of the Amazon Craton. It comprises a number of exploration and mining licences hosting 50 strike kilometres of Proterozoic metamorphosed volcano-sedimentary stratigraphy prospective for volcanic massive sulphide ("VMS") mineralization.

BP Minerals ("BPM") identified the exploration potential of the belt in the 1980's and completed substantial exploration works including the discovery and development of the Cabaçal Au-Cu-Ag mine (then known as the Manati mine), which opened in 1987. Rio Tinto ("RTZ") acquired BP Minerals in 1989 and maintained the property for two years before ceasing production in 1991 and withdrawing from exploration in the general area.

There is no current mining activity on the project area and the aim of the Company is to conduct resource definition programs and open-pit mine development studies focussed on the Cabaçal Cu-Au-Ag mine and its extensions. The Company is also conducting exploration within the broader belt for new VMS discoveries.

VMS mineral systems can often generate clusters of deposits, providing exploration discovery opportunities from both near-mine and regional exploration targets.

Prospect Geology

The Cabaçal deposit and other known targets are related to a Paleoproterozoic volcanogenic massive, stringer and disseminated sulphide system located within deformed metavolcanic-sedimentary rocks of the Alto Jaurú Greenstone Belt. The meta-sediment package consists of a basalt-dominated bimodal sequence dated at 1853 +/- 15 Ma (dated by U-Pb method on zircon from the Manuel Leme Formation; Pinho et al., 2010). This places it at around the same age as other significant Paleoproterozoic VMS districts (e.g., Flin Flon, Canada: 1890 Ma; Bergslagen and Skellefte districts, Sweden: 1890 Ma, Jerome, United States: 1760 Ma; Pembine-Wausau Terrane, United States: 1870 Ma).

The Cabaçal host sequence is interpreted to lie on the overturned eastern limb of an east-verging anticline. An associated laterally extensive chert-pelite unit is thought to be an exhalative unit and acts as a marker horizon. Mineralization comprises massive, stockwork/breccia style, stringer and disseminated sulphides dominated by primary chalcopyrite and lesser pyrite and sphalerite. The gold content of the deposit is relatively high, enhanced by a later-stage hydrothermal overprint superimposed on the original VMS mineral system. Both shallow-dipping and steeper-dipping late-stage vein sets were identified during the mine development.

There is a shallow weathering profile, typically 10-15m deep.

The deposit strikes approximately northwest-southeast with a 20o dip to the southwest and a 10o plunge to the southeast. It outcrops along its northern margin.

Exploration History

In the early 1980's, BPM identified three new greenstone belts in northwest Mato Grosso (which they named the Jaurú, Araputanga and Cabaçal Belts) and established about 800,000 hectares of licences over this area. RTZ assumed ownership of the project following its acquisition of BPM in 1989.

BPM initially undertook regional geological mapping, stream geochemical programs and an aerial geophysical INPUT survey, defining a series of Cu-Pb-Zn-Au anomalies and various conductors associated with metavolcanic - metasedimentary stratigraphy. This was followed by prospect-scale soil surveys, ground geophysics and exploratory drilling. The Cabaçal and Santa Helena VMS deposits were discovered during this exploration phase. Historical drilling during the BPM-RTZ campaigns between 1981 to 1989 amounted to 768 diamond holes for 79,088.6m (dominantly NQ core with some HQ, BQ, and AQ core sizes). The immediate Cabaçal mine area was intensely drilled (in places on a 10x10m grid), whilst the extensions were drilled on a 100x100m grid, with predominantly vertical holes.

Mining was initiated on the Cabaçal deposit in April 1987, and it operated until August 1991 when RTZ closed it. The historical Cabaçal gold mine processed 973,031 t @ 4.91g/t Au,

The Company has undertaken the following general exploration activities during 2021-2022 with the focus on the Cabaçal area:

- Surface geochemical surveys (1,092 soil samples; 57 rock chip samples);

- Surface and down-hole geophysics;

- 95 down-hole electromagnetic ("BHEM") surveys;

- 104-line kilometres of surface Fixed Loop Transient ElectroMagnetic surveys;

- 11-line kilometres of surface Pole-Dipole Induced Polarization surveys;

- 6-line kilometres of surface Dipole- Dipole Induced Polarization surveys;

- 41-line kilometres of surface Gradient Array Induced Polarization surveys;

- Remote sensing - WorldView-3 satellite survey over the Cabaçal Belt;

- Topographic control with Geosan Geotecnologia Eireli and EMBRATOP providing high-resolution drone orthophotography, digital terrane models, and selected collar surveys;

- In-house field checks and surveys of historical collar positions; and

- Digital data compilation, with in-house and sub-contracted compilation of data from scanned reports retrieved from the archives of RTZ.

The Company engaged independent consulting geologists H&SC to complete a resource estimate for the Cabaçal gold-copper-silver deposit, results of which are illustrated in Figure 1 to Figure 7 and Table 1 to Table 5. The Cabaçal VMS Mineral Resource is based on data and assays from 848 diamond core drill holes for a total of 87,268 metres.

Key Assumptions & Parameters

Geological logging is consistent and is based on a full set of logging codes covering lithology, alteration, and mineralization.

The drillhole assay data comprised on average 0.8m sample intervals. Meridian sampling is typically between 0.3 - 1.0m intervals generally under geological control. For grade interpolation the complete drilling dataset was composited to 1m intervals for gold, copper and silver and subsequently modelled. The unconstrained 1m compositing produced a total of 40,467 composites.

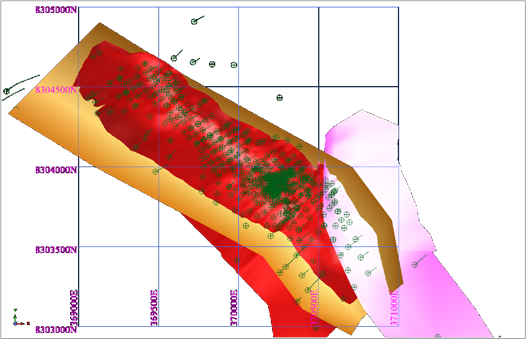

The geological interpretation was supplied by the Company and modified by H&SC as a series of 3D wireframe surfaces created via sectional interpretation. This included the bounding basal contact to the mineralization, and a base of complete oxidation and a base of partial oxidation. A detailed topographic surface, from 1m gridded LiDAR data, was also supplied. All data was rotated 45o by H&SC to a north-south orthogonal national grid for ease of working.

The interpreted VMS body and its associated mineralization has overall (rotated) grid dimensions of 600m (X) by 2,200m (Y) by 300m (Z) with a 20o dip to the west and a 10o plunge to grid southeast. Mineralization is close to surface (350mRL approx.) in the northeast and terminates at approximately 60mRL in the south. The Mineral Resource is contained within a notional-pit outline down to 60m RL: the pit has a 45o hangingwall slope and a 25o footwall slope. Drillhole spacing was nominally on 10-20m spacing in the centre of the deposit extending to 50-100m in the periphery.

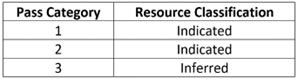

Grade interpolation used Multiple Indicator Kriging for gold with the E-Type estimate (average panel grade for gold) used for reporting the Mineral Resources. Block size was 10m (X) by 10m (Y) by 5m (Z) with an SMU of 5m by 5m by 2.5m and no sub-blocking. Two domains were delineated based on the density of drilling with three sub-domains for complete oxidation, partial oxidation, and fresh rock. The two domains were treated separately with regards to the variography, but the grade interpolation used the same search parameters with soft boundaries. Ordinary Kriging was used for the grade interpolation of the copper and silver composite values.

The density data comprised 18,862 data points which were subsequently modelled unconstrained using Ordinary Kriging, using similar search parameters and rotations to the global metal grade interpolation.

The MIK method is a non-linear modelling method and works without the need for conventional top cutting. An adjustment was made to the gold mean for the top indicator class for the fresh rock sub-domains in the block support correction (volume-variance effect). No top cutting was considered required for the copper or silver data.

A three pass search strategy was applied to the gold grade interpolation. Search ellipse parameters are listed below. The search ellipse orientations generally reflected the overall attitude of the deposit.

An additional three pass search strategy was used for the OK modelling to ensure all gold blocks had a copper, silver, or density grade. A minor difference in the search parameters for the OK modelling was the use of 12 minimum data for passes 1 and 2 with Pass 3 having a minimum number of 6 data.

Allocation of the classification of the Mineral Resources is derived from the search pass numbers which essentially is a function of the drillhole sample data point distribution with consideration of other aspects. These included an assessment of the geological model, drillhole spacing (and thus the data point spacing), the results of the variography, sampling method and representivity including QAQC, the quality of density data, core recoveries, the grade interpolation modelling method and the uncertainty associated with the location of the historic underground workings.

Depletion from historic mining was factored into the gold interpolation using a third party model for the workings. Copper depletion was based on deducting the production figures from the Mineral Resources. No account of silver depletion has been included as there are no reports for any silver production (any depletion impact for silver is considered to be not significant).

The Inferred Mineral Resources in this estimate have a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be updated to an Indicated Mineral Resource with continued exploration.

The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

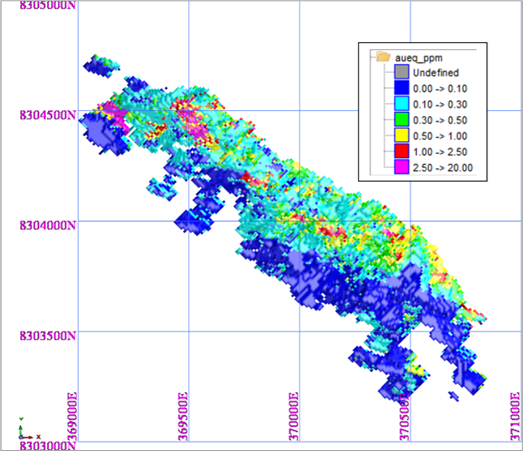

Figure 1: Gold Composite Distribution in Plan View

(Data cropped for improved viewing; zoom for better resolution)

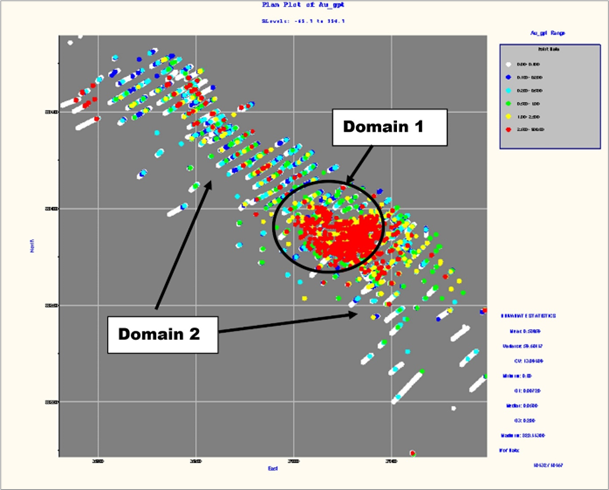

Figure 2: Basal Contact for Mineralization and Nominal Pit Shape

(red = basal Contact, purple = gabbro unit, brown = nominal pit, green circles - drillholes)

Figure 3: Global Block Grade Distribution for AuEq for Fresh Rock Sub-domain in Plan View

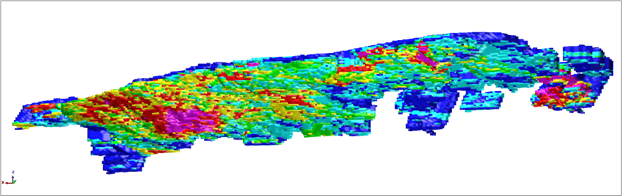

Figure 4: Global Block Grade Distribution for AuEq for All Sub-domains -Footwall

(View looking up to south)

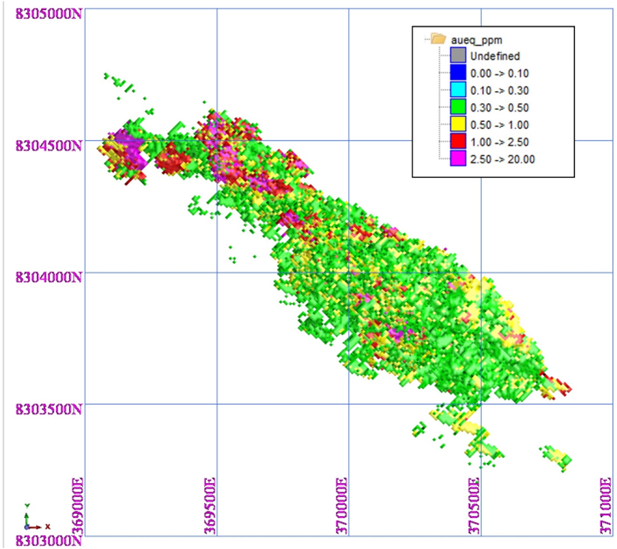

Figure 5: Mineral Resources Global Block Grade Distribution for AuEq (for a 0.3g/t AuEq cut off) Plan View

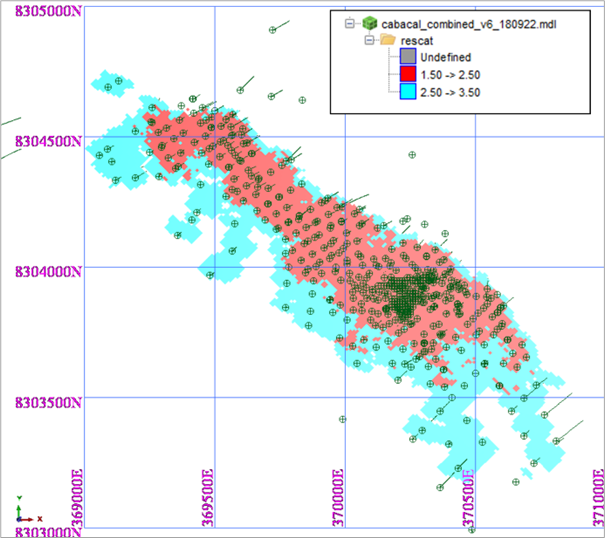

Figure 6: Mineral Resources - Resource Classification

(red = Indicated; cyan = Inferred)

An example of a cross section from the southern part of the deposit is included. The figure shows the block grades and composite values for gold in the rotated grid.

Figure 7: Mineral Resources - Cross Section Example (rotated grid)

(Zoom for better resolution)

Metallurgical Testwork

The gold equivalent cut-off grade is based on metallurgical testwork results from core drilled during Meridian's 2021-2022 campaign and are in line with historical production records. Recovery equations based on metal grades have been determined as follows:

- Au_recovery_ppm = 5.4368ln(Au_Grade_ppm)+88.856

- Cu_recovery_pct = 2.0006ln(Cu_Grade_pct)+94.686

- Ag_recovery_ppm = 13.342ln(Ag_Grade_ppm)+71.037

The Gold Equivalence formula is based on CIBC August 2022 long term banking consensus of US

The Company's estimates of the adjusted grades factoring in metal recoveries are:

Table 6 - Meridian recovery-adjusted metal values at 0.3 AuEq cut-off grade

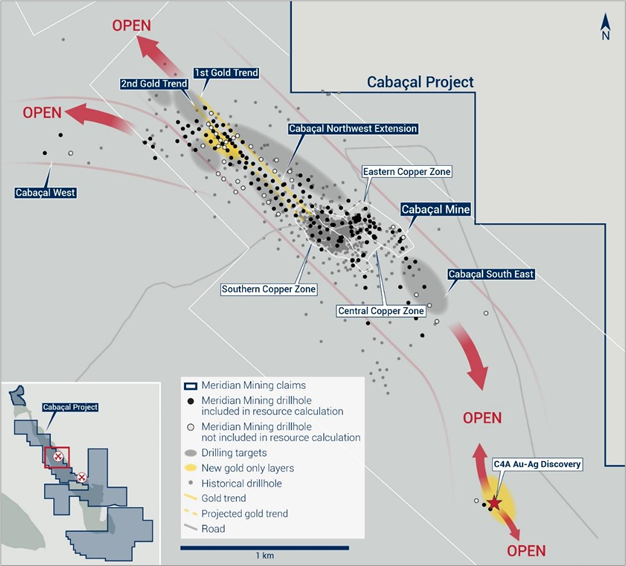

Figure 8: Drill status map, showing distribution of holes included in the resource and holes completed since the resource cut-off date

Future Programme

The Company is strongly encouraged by recent drill results, both for the potential in adding metal to the future resource upgrade, but also in extending the drill grid along strike and down dip (Figure 8). Strong sulphide mineralization and zones of visible gold have been encountered with assays pending. Results will be released shortly and show the upside that still remains for this Cabaçal resource. A focus of ongoing drilling will include 25 x 25 m infill drilling to target high-grade trends within Cabaçal and its extensions, to better define potential higher-grade starter pits. Evaluation of satellite targets is planned, such has the Company's C4-A South Au-Ag discovery, and, pending environmental permitting, the Santa Helena deposit.

About Cabaçal

In November 2020, Meridian signed a Purchase Agreement to acquire

Meridian has defined an open trend of shallow copper-gold mineralization centred on the Cabaçal Mine. This mineralization trends northwest-southeast, sub-crops along its northeast limits and dips to the southwest at 26° and is up 90m thick; presenting excellent open-pit geometry and mineral endowment. Meridian is currently focused on infilling drilling along a 2,000m corridor along this trend.

Cabaçal's base and precious metal-rich mineralization is hosted by volcanogenic type, massive, semi-massive, stringer, and disseminated sulphides within units of deformed metavolcanic-sedimentary rocks ("VMS"). A later stage sub-vertical gold overprint event has emplaced high-grade gold mineralization truncating the dipping VMS layers. It was explored and developed by BP Minerals/Rio-Tinto from 1983 to 1991 and then by the Vendors in the mid 2000's. This historical exploration database includes over 83,000 metres of drilling, extensive regional mapping, soil surveys, metallurgy from production reports and both surface and airborne geophysics. The majority of Cabaçal's prospects remain to be tested.

Cabaçal has excellent infrastructure with access by all-weather road, industrial electricity provided by the adjacent hydroelectric power station supplying this clean energy grid, and local communities provide a large population from which to draw employees. Cabaçal consists of 1 mining license, 1 mining lease application and 4 exploration claims which total 28,324 hectares. A further three licences totalling 15,941 hectares are awaiting formal transfer from the ANM following the licence auction system.

About Meridian

Meridian Mining UK S is focused on the acquisition, exploration, and development activities in Brazil. The Company is currently focused on resource development of the Cabaçal VMS copper-gold project, exploration in the Jaurú & Araputanga Greenstone belts located in the state of Mato Grosso, exploring the Espigão polymetallic project and the Mirante da Serra manganese project in the State of Rondônia Brazil.

On behalf of the Board of Directors of Meridian Mining UK S

Dr. Adrian McArthur

CEO, President, and Director

Executive Chairman

Meridian Mining UK S

Email: info@meridianmining.net.br

Ph: +1 (778) 715-6410 (PST)

Qualified Person

Dr Adrian McArthur, B.Sc. Hons, PhD. FAusIMM., CEO and President of Meridian as well as a Qualified Person as defined by National Instrument 43-101, has supervised the preparation of the technical information in this news release.

Independent Geologist, Mr Marcelo Antonio Batelochi (of MB Geologia Ltda, Belo Horizonte, Minas Gerais, Brazil), a Qualified Person under the meaning of National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"), completed inspections of the Project between the 7th to 11th June 2021, and 29th August to 1st September 2022. The general aim of the field inspection work was to verify and validate the field information from historical and current exploration campaigns, to support the preparation the 43-101 Mineral Resource report being coordinated by H&S Consultants Pty Ltd of Sydney, Australia

Independent Geologist, Simon Tear, P.Geo, EurGeol of H & S Consultants Pty. Ltd. of Sydney, Australia, is the Qualified Person, as defined under NI 43-101, for the Cabaçal VMS Mineral Resource. Mr. Tear has reviewed and approved the contents of this press release.

The complete Technical Report prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") will be filed within 45 days of this news release.

Stay up to date by subscribing for news alerts here: https://meridianmining.co/subscribe/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at www.meridianmining.co

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedar.com. While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

[1] Au, Cu and Ag recovery formula calculated from 2022 Cabaçal Metallurgical test program conducted SGS Lakefield, Canada.

SOURCE: Meridian Mining UK S

View source version on accesswire.com:

https://www.accesswire.com/717359/Meridian-Announces-Maiden-Mineral-Resource-Estimate-for-Cabaal-Deposit

FAQ

What are the indicated resources reported by Meridian Mining for the Cabaçal deposit?

What does the inferred resource estimate for the Cabaçal project include?

When will the technical report for the Cabaçal Mineral Resource be available?

What is the significance of the Cabaçal deposit's resource extension?