Meridian Drills Multiple High-Grade Intercepts at Cabaçal Including 20.9m @ 6.5g/t AuEq (4.4% CuEq)

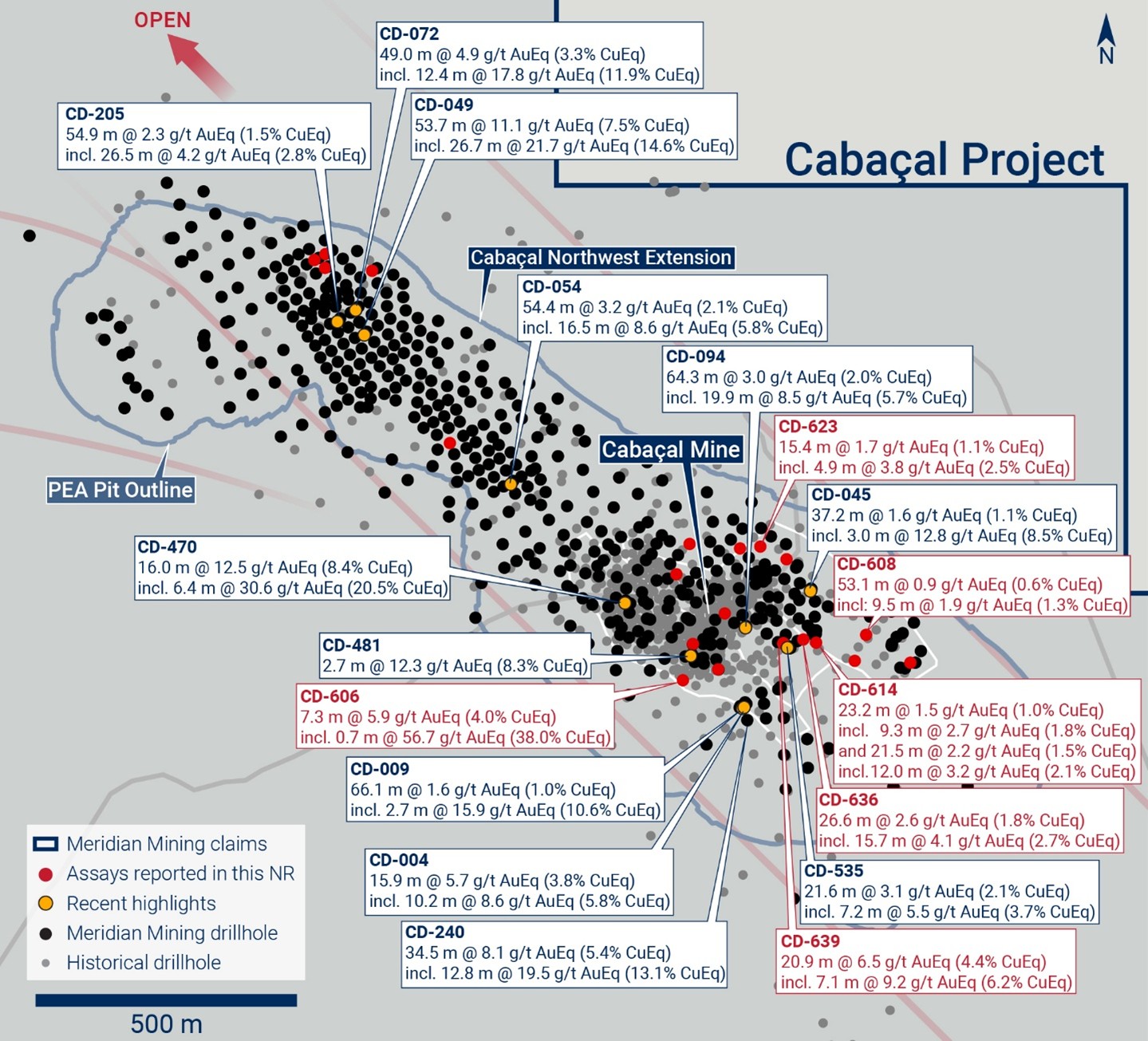

Meridian Mining has reported significant drilling results from its Cabaçal Cu-Au-Ag VMS project. Key highlights include intercepts of 20.9m @ 6.5g/t AuEq (4.4% CuEq) from CD-639, 26.6m @ 2.6g/t AuEq (1.8% CuEq) from CD-636, and 7.3m @ 5.9g/t AuEq (4.0% CuEq) from CD-606.

The drilling program has confirmed multiple stacked layers of VMS mineralization with high-grade Au-Cu-Ag content. Notable results include a gold-dominant zone grading up to 56.7g/t Au. The company recently completed a CAD 17.2M capital raise and is focusing on advancing Cabaçal's and Santa Helena's resource development program in 2025.

The drilling campaign is in its final phases of Pre-Feasibility Study (PFS), with ongoing infill drilling expected to conclude in the first half of the year. The program aims to consolidate information where historical data has been lost and contribute core samples for definitive feasibility study metallurgy.

Meridian Mining ha riportato risultati significativi dai suoi progetti di perforazione nel Cabaçal Cu-Au-Ag VMS. I punti salienti includono intercettazioni di 20,9 m @ 6,5 g/t AuEq (4,4% CuEq) da CD-639, 26,6 m @ 2,6 g/t AuEq (1,8% CuEq) da CD-636 e 7,3 m @ 5,9 g/t AuEq (4,0% CuEq) da CD-606.

Il programma di perforazione ha confermato più strati sovrapposti di mineralizzazione VMS con contenuti elevati di Au-Cu-Ag. Risultati notevoli includono una zona dominata dall'oro con un grado fino a 56,7 g/t Au. L'azienda ha recentemente completato un finanziamento di capitale di 17,2 milioni di CAD e si sta concentrando sull'avanzamento del programma di sviluppo delle risorse di Cabaçal e Santa Helena nel 2025.

La campagna di perforazione è nelle fasi finali dello Studio di Pre-Fattibilità (PFS), con perforazioni di infill in corso che si prevede si concluderanno nella prima metà dell'anno. Il programma mira a consolidare le informazioni dove i dati storici sono stati persi e a contribuire con campioni di nucleo per la metallurgia dello studio di fattibilità definitivo.

Meridian Mining ha reportado resultados de perforación significativos de su proyecto Cabaçal Cu-Au-Ag VMS. Los aspectos destacados incluyen intersecciones de 20.9 m @ 6.5 g/t AuEq (4.4% CuEq) de CD-639, 26.6 m @ 2.6 g/t AuEq (1.8% CuEq) de CD-636, y 7.3 m @ 5.9 g/t AuEq (4.0% CuEq) de CD-606.

El programa de perforación ha confirmado múltiples capas apiladas de mineralización VMS con alto contenido de Au-Cu-Ag. Resultados notables incluyen una zona dominante de oro con un grado de hasta 56.7 g/t Au. La compañía completó recientemente una recaudación de capital de 17.2 millones de CAD y se está enfocando en avanzar el programa de desarrollo de recursos de Cabaçal y Santa Helena en 2025.

La campaña de perforación está en sus fases finales del Estudio de Pre-Factibilidad (PFS), con perforaciones de infill en curso que se espera concluyan en la primera mitad del año. El programa tiene como objetivo consolidar información donde se han perdido datos históricos y contribuir con muestras de núcleo para la metalurgia del estudio de factibilidad definitivo.

Meridian Mining은 Cabaçal Cu-Au-Ag VMS 프로젝트에서 중요한 시추 결과를 보고했습니다. 주요 하이라이트로는 CD-639에서 20.9m @ 6.5g/t AuEq (4.4% CuEq), CD-636에서 26.6m @ 2.6g/t AuEq (1.8% CuEq), CD-606에서 7.3m @ 5.9g/t AuEq (4.0% CuEq) 등이 있습니다.

시추 프로그램은 고품질 Au-Cu-Ag 함량을 가진 여러 겹의 VMS 광물화를 확인했습니다. 주목할 만한 결과로는 최대 56.7g/t Au의 금 우세 구역이 포함됩니다. 이 회사는 최근 1,720만 CAD의 자본 조달을 완료했으며, 2025년까지 Cabaçal과 Santa Helena의 자원 개발 프로그램을 추진하는 데 집중하고 있습니다.

시추 캠페인은 예비 타당성 조사(PFS)의 최종 단계에 있으며, 진행 중인 인필 시추는 올해 상반기 내에 마무리될 것으로 예상됩니다. 이 프로그램은 역사적 데이터가 손실된 곳에서 정보를 통합하고, 확정된 타당성 조사 금속 공학을 위한 핵 샘플을 기여하는 것을 목표로 하고 있습니다.

Meridian Mining a rapporté des résultats de forage significatifs de son projet Cabaçal Cu-Au-Ag VMS. Les points clés incluent des interceptions de 20,9 m @ 6,5 g/t AuEq (4,4% CuEq) de CD-639, 26,6 m @ 2,6 g/t AuEq (1,8% CuEq) de CD-636, et 7,3 m @ 5,9 g/t AuEq (4,0% CuEq) de CD-606.

Le programme de forage a confirmé plusieurs couches superposées de minéralisation VMS avec une teneur élevée en Au-Cu-Ag. Des résultats notables incluent une zone dominée par l'or avec un grade allant jusqu'à 56,7 g/t Au. L'entreprise a récemment complété une levée de fonds de 17,2 millions de CAD et se concentre sur l'avancement du programme de développement des ressources de Cabaçal et Santa Helena en 2025.

La campagne de forage est dans ses phases finales d'étude de pré-faisabilité (PFS), avec des forages de remplissage en cours qui devraient se terminer dans la première moitié de l'année. Le programme vise à consolider les informations là où les données historiques ont été perdues et à contribuer des échantillons de carottes pour la métallurgie de l'étude de faisabilité définitive.

Meridian Mining hat bedeutende Bohrergebnisse aus seinem Cabaçal Cu-Au-Ag VMS-Projekt gemeldet. Zu den wichtigsten Highlights gehören Interzeptionen von 20,9 m @ 6,5 g/t AuEq (4,4% CuEq) aus CD-639, 26,6 m @ 2,6 g/t AuEq (1,8% CuEq) aus CD-636 und 7,3 m @ 5,9 g/t AuEq (4,0% CuEq) aus CD-606.

Das Bohrprogramm hat mehrere gestapelte Schichten von VMS-Mineralisierung mit hohem Gehalt an Au-Cu-Ag bestätigt. Bemerkenswerte Ergebnisse umfassen eine golddominierte Zone mit einem Gehalt von bis zu 56,7 g/t Au. Das Unternehmen hat kürzlich eine Kapitalerhöhung von 17,2 Millionen CAD abgeschlossen und konzentriert sich darauf, das Ressourcenentwicklungsprogramm von Cabaçal und Santa Helena im Jahr 2025 voranzutreiben.

Die Bohrkampagne befindet sich in den letzten Phasen der Voruntersuchung (PFS), wobei die laufenden Infill-Bohrungen voraussichtlich in der ersten Jahreshälfte abgeschlossen werden. Das Programm zielt darauf ab, Informationen zu konsolidieren, wo historische Daten verloren gegangen sind, und Kernproben für die Metallurgie der endgültigen Machbarkeitsstudie bereitzustellen.

- Multiple high-grade intercepts including 20.9m @ 6.5g/t AuEq (4.4% CuEq)

- Successfully raised CAD 17.2M in recent capital raise

- Gold-dominant zone discovered with grades up to 56.7g/t Au

- Nearing completion of Pre-Feasibility Study

- Some historical data has been lost and requires new drilling to replace

- Mining void encountered in CD-609 drilling

HIGHLIGHTS:

Meridian drills layers of shallow Au-Cu-Ag high-grade mineralization at Cabaçal

CD-639: 20.9m @ 6.5g/t AuEq (

4.4% CuEq) from 95.3m; including:7.1m @ 9.2g/t AuEq (

6.2% CuEq) from 104.0m

CD-636: 26.6m @ 2.6g/t AuEq (

1.8% CuEq) from 176.3m including:15.7m @ 4.1g/t AuEq (

2.7% CuEq) from 187.2m

CD-606: 7.3m @ 5.9g/t AuEq (

4.0% CuEq) from 78.7m

Near surface up-dip extensions of high-grade Au-Cu-Ag mineralization added

High-grade gold dominant zone grading up to 56.7g/t Au drilled at Cabaçal

LONDON, UK / ACCESS Newswire / February 24, 2025 / Meridian Mining UK. S (TSX:MNO)(Frankfurt/Tradegate:2MM)(OTCQX:MRRDF) ("Meridian" or the "Company") is pleased to provide a drilling update from the advanced Cabaçal Cu-Au-Ag VMS project ("Cabaçal"). These results ("Table 1") are highlighted by CD-639's 20.9m @ 6.5g/t AuEq (

Mr. Gilbert Clark, CEO, comments: "Today's excellent results are all adding to the strengths of the advanced stage Cabaçal Au-Cu-Ag project. Since October last year, an updated geological model has been guiding the ongoing drill program, and these new "targeted" intercepts are the result of this model. We are in the last phases of Cabaçal's PFS, and these and the future results will be used in Cabaçal's subsequent studies. With the recent capital raise of CAD 17.2M now closed, the Company is focused on advancing Cabaçal's and Santa Helena's resource development program and its belt scale exploration programs in 2025."

Cabaçal Update

Today's results reported from Cabaçal have returned excellent results following the completion of our geological review of Cabaçal.

Several holes were drilled into the up-dip section of Cabaçal's Eastern Copper Zone ("ECZ"), the northeast and shallowest flank of the deposit. These were designed as infill holes for further confidence in the early phases of the potential starter pit. Results include:

CD-623: 15.4m @ 1.7g/t AuEq (

1.1% CuEq) from 16.2m; including:4.9m @ 3.8g/t AuEq (

2.5% CuEq) from 24.0m;

CD-634: 14.4m @ 1.1g/t AuEq (

0.7% CuEq) from 39.0m; including:7.4m @ 1.9g/t AuEq (

1.3% CuEq) from 39.0m; and

CD-625: 9.9m @ 1.1g/t AuEq (

0.7% CuEq) from 23.5m.

ECZ targeted drilling is ongoing, with infill of the potential starter pit shell to confirm zones of historical geological data.

A number of holes have been drilled into the Central Copper Zone ("CCZ") of Cabaçal. CD-639 traversed the upper stacked layers of disseminated mineralization before traversing the Cu-rich basal layer. This basal zone returned 20.9m @ 6.5g/t AuEq (

CD-614 confirmed shallow Cu dominant mineralization, returning 23.2m @ 1.5g/t AuEq (

1Sample CBDS89751: 22.05- 22.5m;

Strong supporting positions assisting with modelling in this area include results from adjacent holes:

CD-636: 26.6m @ 2.6g/t AuEq (

1.8% CuEq) from 176.3m; including:15.7m @ 4.1g/t AuEq (

2.7% CuEq) from 187.2m;

CD-608: 53.1m @ 0.9g/t AuEq (

0.6% CuEq) from 64.3m; including:9.5m @ 1.9g/t AuEq (

1.3% CuEq) from 82.1m; and

CD-617: 7.3m @ 2.8g/t AuEq (

1.9% CuEq) from 90.4m.

Some of the CCZ holes have been drilled at orthogonal angles, to intersect projected extensions of known Au-Cu-Ag mineralization unable to be drilled on the regular grid due to topographic constraints. Drill hole CD-639 was drilled at a steep angle to the south-east to cross a fence of historical vertical holes in which data was incomplete. Holes CD-636, CD-614, CD-608, CD-617 were drilled at moderate to steep angles to the south. CD-614 was drilled from a position where historical drilling in JUSPD-025 had returned indications of shallow copper mineralization with a sample of up to

Several holes were drilled into Cabaçal's Southern Copper Zone ("SCZ") down-dip section. CD-606 twinned a hole with lost data, but records indicating that a sample returning >5g/t gold had been encountered. CD-606 intercepted a gold-dominant zone returning 7.3m @ 5.9g/t Au from 78.7m, including a sample returning 0.73m @ 56.7 g/t Au from 80.5m. CD-611, drilled at a slight rotation to strike, returned multiple intersections including 7.0m @ 1.3g/t AuEq (

A number of holes were drilled to test lower grade sectors of the Cabaçal's Northwest Extension, returning mineralization but without a projection of the higher-grade lodes. The principle focus of the infill program which is expected to conclude in the first half of the year will be on consolidating information where data has been lost from the historical records, after attempts to locate those were exhausted. Drilling will also contribute core to the final phase of metallurgy for the definitive feasibility study, which will include samples representing the first five years of planned production.

About Meridian

Meridian Mining is focused on:

The development and exploration of the advanced stage Cabaçal VMS gold‐copper project;

The initial resource definition at the second higher-grade VMS asset at Santa Helena as the first stage of the Cabaçal Hub development strategy;

Regional scale exploration of the Cabaçal VMS belt to expand the Cabaçal Hub strategy; and

Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil).

The Preliminary Economic Assessment technical report (the "PEA Technical Report") dated March 30, 2023, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Preliminary Economic Assessment, Mato Grosso, Brazil" outlines a base case after-tax NPV5 of USD 573 million and

The Cabaçal Mineral Resource estimate consists of Indicated resources of 52.9 million tonnes at 0.6g/t gold,

Readers are encouraged to read the PEA Technical Report in its entirety. The PEA Technical Report may be found on the Company's website at www.meridianmining.co and under the Company's profile on SEDAR+ at www.sedarplus.ca.

The qualified persons for the PEA Technical Report are: Robert Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering), Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering), Simon Tear (PGeo, EurGeol), Principal Geological Consultant of H&SC, Marcelo Batelochi, (MAusIMM, CP Geo), Geological Consultant of MB Geologia Ltda, Joseph Keane (Mineral Processing Engineer; P.E), of SGS, and Guilherme Gomides Ferreira (Mine Engineer MAIG) of GE21 Consultoria Mineral.

On behalf of the Board of Directors of Meridian Mining UK S

Mr. Gilbert Clark - CEO and Director

Meridian Mining UK S

8th Floor, 4 More London Riverside

London SE1 2AU, United Kingdom

Email: info@meridianmining.co

Ph: +1 778 715-6410 (BST)

Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at: www.meridianmining.co

Technical Notes

Samples have been analysed at ALS laboratory in Lima, Peru. Samples are dried, crushed with

Au_recovery_ppm = 5.4368ln(Au_Grade_ppm)+88.856

Cu_recovery_pct = 2.0006ln(Cu_Grade_pct)+94.686

Ag_recovery_ppm = 13.342ln(Ag_Grade_ppm)+71.037

Recoveries based on 2022 metallurgical testwork on core submitted to SGS Lakefield

Qualified Person

Mr. Erich Marques, B.Sc., FAIG, Chief Geologist of Meridian Mining and a Qualified Person as defined by National Instrument 43-101, has reviewed, and verified the technical information in this news release.

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedarplus.ca. While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

Table 1: Assay results reported in this release.

Hole-Id | Dip | Azi | EOH | Zone | Int | AuEq | CuEq | Au | Cu | Ag | From |

|---|---|---|---|---|---|---|---|---|---|---|---|

CD-640 | -90 | 000 | 69.5 | ECZ |

|

|

|

|

|

|

|

|

|

|

|

| 12.5 | 1.6 | 1.1 | 0.2 | 0.9 | 6.1 | 46.9 |

|

|

|

| Including | 7.7 | 2.2 | 1.5 | 0.3 | 1.3 | 9.1 | 47.7 |

CD-639 | -70 | 246 | 133.1 | CCZ |

|

|

|

|

|

|

|

|

|

|

|

| 22.5 | 0.6 | 0.4 | 0.2 | 0.3 | 0.5 | 33.5 |

|

|

|

| Including | 2.3 | 2.6 | 1.7 | 1.4 | 0.9 | 1.2 | 47.5 |

|

|

|

|

| 1.5 | 0.6 | 0.4 | 0.1 | 0.4 | 0.4 | 58.0 |

|

|

|

|

| 15.8 | 0.6 | 0.4 | 0.3 | 0.3 | 0.4 | 61.5 |

|

|

|

|

| 2.1 | 1.4 | 0.9 | 0.6 | 0.6 | 0.9 | 89.7 |

|

|

|

|

| 20.9 | 6.5 | 4.4 | 3.8 | 1.9 | 5.8 | 95.3 |

|

|

|

| Including | 7.1 | 9.2 | 6.2 | 6.9 | 1.6 | 5.0 | 104.0 |

|

|

|

| Including | 3.4 | 13.9 | 9.3 | 11.0 | 2.0 | 7.0 | 104.0 |

|

|

|

| Including | 2.6 | 18.0 | 12.1 | 7.1 | 7.2 | 27.2 | 113.6 |

CD-638 | -60 | 046 | 86.6 | ECZ |

|

|

|

|

|

|

|

|

|

|

|

| 1.4 | 0.7 | 0.5 | 0.1 | 0.5 | 0.9 | 18.6 |

|

|

|

|

| 3.5 | 0.6 | 0.4 | 0.0 | 0.4 | 0.2 | 44.0 |

|

|

|

|

| 1.5 | 0.6 | 0.4 | 0.1 | 0.4 | 0.2 | 50.0 |

|

|

|

|

| 11.7 | 0.7 | 0.4 | 0.2 | 0.3 | 1.6 | 54.0 |

|

|

|

| Including | 1.6 | 2.7 | 1.8 | 0.8 | 1.3 | 8.6 | 62.2 |

|

|

|

|

| 1.5 | 1.3 | 0.9 | 0.3 | 0.7 | 2.8 | 70.7 |

CD-636 | -45 | 179 | 212.2 | CCZ | Subparallel Hole | ||||||

|

|

|

|

| 7.0 | 0.4 | 0.3 | 0.0 | 0.3 | 0.6 | 59.0 |

|

|

|

|

| 4.0 | 0.3 | 0.2 | 0.0 | 0.2 | 0.5 | 69.0 |

|

|

|

|

| 2.3 | 0.4 | 0.3 | 0.0 | 0.3 | 0.5 | 75.0 |

|

|

|

|

| 3.3 | 0.5 | 0.3 | 0.0 | 0.4 | 0.7 | 82.0 |

|

|

|

|

| 4.6 | 0.7 | 0.4 | 0.0 | 0.5 | 0.9 | 89.1 |

|

|

|

|

| 12.0 | 0.4 | 0.3 | 0.0 | 0.3 | 0.5 | 96.0 |

|

|

|

|

| 13.7 | 1.2 | 0.8 | 0.6 | 0.4 | 0.9 | 132.3 |

|

|

|

| Including | 3.0 | 1.8 | 1.2 | 1.9 | 0.1 | 1.6 | 143.0 |

|

|

|

|

| 3.2 | 0.3 | 0.2 | 0.3 | 0.0 | 0.2 | 163.8 |

|

|

|

|

| 26.6 | 2.6 | 1.8 | 1.4 | 0.9 | 3.8 | 176.3 |

|

|

|

| Including | 15.7 | 4.1 | 2.7 | 2.1 | 1.4 | 6.0 | 187.2 |

|

|

|

| Including | 1.0 | 19.2 | 12.9 | 14.8 | 2.9 | 14.5 | 190.2 |

CD-635 | -50 | 060 | 149.1 | CNWE |

|

|

|

|

|

|

|

|

|

|

|

| 3.4 | 0.4 | 0.3 | 0.2 | 0.2 | 0.2 | 42.0 |

|

|

|

|

| 2.9 | 0.3 | 0.2 | 0.1 | 0.2 | 0.7 | 53.1 |

|

|

|

|

| 4.3 | 1.3 | 0.9 | 0.4 | 0.6 | 2.8 | 70.0 |

|

|

|

| Including | 2.0 | 2.4 | 1.6 | 0.7 | 1.1 | 5.4 | 72.3 |

|

|

|

|

| 3.0 | 0.4 | 0.3 | 0.0 | 0.3 | 2.3 | 82.0 |

|

|

|

|

| 5.5 | 0.7 | 0.4 | 0.1 | 0.4 | 1.6 | 112.8 |

|

|

|

|

| 3.9 | 0.7 | 0.5 | 0.2 | 0.4 | 2.7 | 126.3 |

|

|

|

|

| 5.9 | 0.5 | 0.3 | 0.1 | 0.3 | 1.3 | 133.4 |

CD-634 | -60 | 045 | 75.7 | ECZ |

|

|

|

|

|

|

|

|

|

|

|

| 3.2 | 0.4 | 0.3 | 0.0 | 0.3 | 0.4 | 14.9 |

|

|

|

|

| 1.3 | 0.5 | 0.3 | 0.1 | 0.3 | 0.7 | 31.0 |

|

|

|

|

| 14.4 | 1.1 | 0.7 | 0.4 | 0.5 | 2.9 | 39.0 |

|

|

|

| Including | 7.4 | 1.9 | 1.3 | 0.7 | 0.8 | 4.9 | 39.0 |

|

|

|

| Including | 4.8 | 2.4 | 1.6 | 1.0 | 1.0 | 5.9 | 39.0 |

CD-632 | -53 | 059 | 64.6 | CNWE |

|

|

|

|

|

|

|

|

|

|

|

| 2.0 | 0.4 | 0.3 | 0.1 | 0.2 | 2.1 | 18.2 |

|

|

|

|

| 3.3 | 0.5 | 0.3 | 0.1 | 0.3 | 0.9 | 30.8 |

CD-631 | -50 | 060 | 55.0 | CNWE |

|

|

|

|

|

|

|

|

|

|

|

| 4.1 | 0.5 | 0.3 | 0.3 | 0.1 | 0.2 | 13.7 |

|

|

|

|

| 1.5 | 0.3 | 0.2 | 0.3 | 0.0 | 0.2 | 33.0 |

|

|

|

|

| 3.6 | 0.5 | 0.3 | 0.2 | 0.2 | 1.1 | 38.4 |

CD-629 | -56 | 060 | 75.3 | CNWE |

|

|

|

|

|

|

|

|

|

|

|

| 2.1 | 0.4 | 0.3 | 0.4 | 0.1 | 0.3 | 23.9 |

|

|

|

|

| 1.4 | 1.3 | 0.9 | 0.9 | 0.3 | 5.7 | 33.6 |

|

|

|

|

| 1.0 | 1.0 | 0.7 | 0.3 | 0.5 | 1.1 | 39.0 |

|

|

|

|

| 4.1 | 0.5 | 0.3 | 0.2 | 0.3 | 1.3 | 50.7 |

|

|

|

|

| 0.8 | 0.5 | 0.3 | 0.2 | 0.1 | 13.2 | 58.3 |

CD-628 | -53 | 059 | 85.6 | CNWE |

|

|

|

|

|

|

|

|

|

|

|

| 6.0 | 1.0 | 0.7 | 0.6 | 0.3 | 0.7 | 13.5 |

|

|

|

| Including | 1.5 | 3.3 | 2.2 | 1.9 | 1.1 | 2.4 | 16.4 |

|

|

|

|

| 10.6 | 0.5 | 0.3 | 0.2 | 0.2 | 0.6 | 22.6 |

|

|

|

|

| 11.0 | 0.5 | 0.4 | 0.2 | 0.3 | 1.3 | 37.0 |

|

|

|

|

| 18.7 | 0.7 | 0.5 | 0.4 | 0.2 | 0.9 | 50.8 |

|

|

|

| Including | 0.9 | 6.8 | 4.5 | 6.1 | 0.5 | 3.0 | 63.6 |

CD-627 | -45 | 239 | 106.5 | CNWE | Subparallel Hole | ||||||

|

|

|

|

| 2.9 | 0.6 | 0.4 | 0.1 | 0.4 | 0.5 | 53.9 |

|

|

|

|

| 4.6 | 0.8 | 0.5 | 0.1 | 0.4 | 1.6 | 64.7 |

|

|

|

|

| 2.8 | 1.0 | 0.6 | 0.2 | 0.5 | 2.4 | 71.5 |

CD-626 | -46 | 225 | 249.6 | SCZ | Subparallel Hole | ||||||

|

|

|

|

| 2.6 | 0.5 | 0.3 | 0.0 | 0.3 | 1.1 | 46.4 |

|

|

|

|

| 5.4 | 0.4 | 0.3 | 0.0 | 0.3 | 0.6 | 59.6 |

|

|

|

|

| 8.0 | 0.3 | 0.2 | 0.0 | 0.2 | 0.5 | 68.0 |

|

|

|

|

| 3.0 | 0.4 | 0.3 | 0.0 | 0.3 | 0.5 | 78.0 |

|

|

|

|

| 5.7 | 0.4 | 0.3 | 0.1 | 0.2 | 0.8 | 126.0 |

|

|

|

|

| 3.7 | 0.2 | 0.2 | 0.2 | 0.1 | 0.1 | 138.3 |

|

|

|

|

| 14.9 | 0.8 | 0.5 | 0.2 | 0.4 | 1.0 | 144.7 |

|

|

|

| Including | 7.3 | 1.0 | 0.7 | 0.1 | 0.6 | 1.4 | 148.7 |

|

|

|

|

| 5.6 | 1.2 | 0.8 | 0.4 | 0.6 | 1.1 | 161.9 |

|

|

|

|

| 9.6 | 3.5 | 2.4 | 0.9 | 1.7 | 9.5 | 182.9 |

|

|

|

| Including | 7.0 | 4.5 | 3.0 | 1.2 | 2.2 | 12.4 | 184.4 |

|

|

|

| Including | 4.9 | 5.7 | 3.8 | 1.7 | 2.7 | 14.5 | 184.4 |

|

|

|

| Including | 2.0 | 11.4 | 7.7 | 3.5 | 5.3 | 29.8 | 184.4 |

CD-625 | -50 | 047 | 99.9 | ECZ |

|

|

|

|

|

|

|

|

|

|

|

| 9.9 | 1.1 | 0.7 | 0.1 | 0.7 | 3.0 | 23.5 |

|

|

|

|

| 2.1 | 1.5 | 1.0 | 0.4 | 0.8 | 5.1 | 44.8 |

|

|

|

|

| 2.0 | 3.5 | 2.3 | 1.0 | 1.7 | 4.5 | 49.6 |

CD-623 | -60 | 044 | 75.1 | ECZ |

|

|

|

|

|

|

|

|

|

|

|

| 15.4 | 1.7 | 1.1 | 0.3 | 1.0 | 4.9 | 16.2 |

|

|

|

| Including | 4.9 | 3.8 | 2.5 | 0.6 | 2.2 | 12.4 | 24.0 |

|

|

|

|

| 0.9 | 2.9 | 1.9 | 0.4 | 1.7 | 6.8 | 42.7 |

|

|

|

|

| 1.6 | 1.2 | 0.8 | 0.3 | 0.6 | 2.3 | 46.3 |

CD-619 | -90 | 000 | 75.1 | CSTH | Gabbro and TAC | ||||||

CD-617 | -75 | 193 | 120.7 | CCZ |

|

|

|

|

|

|

|

|

|

|

|

| 20.8 | 0.6 | 0.4 | 0.0 | 0.4 | 0.9 | 31.6 |

|

|

|

|

| 23.9 | 0.5 | 0.4 | 0.0 | 0.4 | 0.8 | 58.7 |

|

|

|

|

| 1.2 | 0.5 | 0.4 | 0.1 | 0.3 | 1.0 | 84.5 |

|

|

|

|

| 7.3 | 2.8 | 1.9 | 0.8 | 1.4 | 6.0 | 90.4 |

|

|

|

| Including | 3.8 | 4.8 | 3.2 | 1.3 | 2.4 | 10.2 | 93.1 |

CD-614 | -45 | 181 | 199.6 | CCZ | Subparallel Hole | ||||||

|

|

|

|

| 23.2 | 1.5 | 1.0 | 0.1 | 1.0 | 2.3 | 17.8 |

|

|

|

| Including | 9.3 | 2.7 | 1.8 | 0.1 | 1.8 | 3.8 | 21.6 |

|

|

|

| Including | 0.9 | 10.2 | 6.9 | 0.5 | 6.6 | 14.2 | 21.6 |

|

|

|

|

| 22.4 | 0.6 | 0.4 | 0.0 | 0.4 | 1.0 | 43.0 |

|

|

|

|

| 6.5 | 0.7 | 0.4 | 0.1 | 0.4 | 0.7 | 72.0 |

|

|

|

|

| 7.8 | 0.5 | 0.3 | 0.2 | 0.2 | 0.9 | 81.2 |

|

|

|

|

| 21.5 | 2.2 | 1.5 | 1.2 | 0.8 | 1.1 | 111.2 |

|

|

|

| Including | 12.0 | 3.2 | 2.1 | 1.9 | 1.0 | 1.5 | 119.0 |

|

|

|

| Including | 1.2 | 12.7 | 8.5 | 8.6 | 2.8 | 4.4 | 126.2 |

|

|

|

|

| 9.4 | 0.5 | 0.3 | 0.3 | 0.1 | 1.0 | 153.5 |

|

|

|

|

| 8.8 | 1.6 | 1.1 | 0.3 | 0.9 | 4.8 | 165.0 |

|

|

|

| Including | 4.2 | 2.5 | 1.7 | 0.4 | 1.4 | 8.1 | 167.6 |

CD-611 | -46 | 092 | 171.7 | SCZ |

| ||||||

|

|

|

|

| 9.9 | 0.6 | 0.4 | 0.1 | 0.4 | 0.9 | 64.0 |

|

|

|

|

| 3.9 | 2.3 | 1.5 | 0.7 | 1.1 | 3.2 | 89.4 |

|

|

|

|

| 7.0 | 1.3 | 0.9 | 1.2 | 0.1 | 0.4 | 112.7 |

|

|

|

| Including | 1.8 | 4.5 | 3.0 | 4.3 | 0.2 | 1.1 | 117.9 |

|

|

|

|

| 2.0 | 0.5 | 0.3 | 0.5 | 0.1 | 0.3 | 123.8 |

|

|

|

|

| 23.2 | 0.8 | 0.6 | 0.6 | 0.2 | 0.5 | 128.1 |

|

|

|

|

| 14.6 | 1.5 | 1.0 | 0.4 | 0.8 | 2.6 | 153.8 |

|

|

|

| Including | 6.1 | 1.9 | 1.3 | 0.5 | 1.0 | 2.9 | 157.9 |

CD-609 | -89 | 000 | 133.3 | SCZ |

|

|

|

|

|

|

|

|

|

|

|

| 2.1 | 5.2 | 3.5 | 1.9 | 2.3 | 6.8 | 47.0 |

|

|

|

|

| 14.5 | 1.3 | 0.9 | 0.8 | 0.4 | 1.3 | 65.0 |

|

|

|

|

| 3.7 | 1.4 | 1.0 | 0.3 | 0.8 | 2.7 | 81.9 |

|

|

|

|

| 2.8 | 0.5 | 0.4 | 0.2 | 0.2 | 1.5 | 108.8 |

|

|

|

|

| 6.4 | 0.8 | 0.5 | 0.2 | 0.5 | 1.4 | 117.1 |

CD-608 | -47 | 179 | 170.8 | ECZ | Subparallel Hole | ||||||

|

|

|

|

| 4.0 | 0.3 | 0.2 | 0.0 | 0.2 | 0.5 | 50.0 |

|

|

|

|

| 53.1 | 0.9 | 0.6 | 0.1 | 0.6 | 1.4 | 64.3 |

|

|

|

| Including | 9.5 | 1.9 | 1.3 | 0.1 | 1.2 | 2.8 | 82.1 |

|

|

|

| Including | 4.2 | 1.5 | 1.0 | 0.6 | 0.7 | 2.1 | 113.3 |

CD-606 | -90 | 000 | 139.2 | SCZ |

|

|

|

|

|

|

|

|

|

|

|

| 7.3 | 5.9 | 4.0 | 5.9 | 0.0 | 0.2 | 78.7 |

|

|

|

| Including | 0.73 | 56.7 | 38.0 | 56.7 | 0.0 | 0.3 | 80.5 |

|

|

|

|

| 1.4 | 0.6 | 0.4 | 0.2 | 0.3 | 0.3 | 88.7 |

|

|

|

|

| 3.2 | 1.2 | 0.8 | 0.2 | 0.7 | 4.2 | 93.0 |

|

|

|

|

| 3.4 | 1.3 | 0.9 | 0.6 | 0.5 | 6.0 | 100.0 |

|

|

|

|

| 0.6 | 2.1 | 1.4 | 0.7 | 1.0 | 6.1 | 106.6 |

CD-598 | -89 | 000 | 87.3 | CCZ |

|

|

|

|

|

|

|

|

|

|

|

| 2.8 | 0.6 | 0.4 | 0.0 | 0.4 | 0.9 | 12.8 |

|

|

|

|

| 3.9 | 0.5 | 0.4 | 0.0 | 0.4 | 1.0 | 21.2 |

|

|

|

|

| 0.8 | 1.0 | 0.7 | 1.0 | 0.1 | 0.1 | 35.9 |

|

|

|

|

| 6.4 | 1.5 | 1.0 | 1.1 | 0.4 | 0.4 | 39.0 |

|

|

|

| Including | 4.0 | 2.4 | 1.6 | 1.7 | 0.6 | 0.6 | 40.9 |

|

|

|

|

| 9.3 | 0.7 | 0.5 | 0.5 | 0.2 | 0.4 | 51.8 |

|

|

|

|

| 5.4 | 1.1 | 0.7 | 0.3 | 0.6 | 1.4 | 68.4 |

CD-563 | -59 | 041 | 102.6 | CCZ |

|

|

|

|

|

|

|

|

|

|

|

| 17.9 | 0.4 | 0.3 | 0.1 | 0.2 | 0.5 | 21.8 |

|

|

|

|

| 3.3 | 0.2 | 0.2 | 0.2 | 0.1 | 0.1 | 47.7 |

|

|

|

|

| 7.0 | 1.0 | 0.7 | 0.6 | 0.4 | 1.9 | 55.1 |

|

|

|

|

| 14.4 | 0.6 | 0.4 | 0.3 | 0.2 | 1.1 | 67.3 |

|

|

|

| Including | 4.4 | 1.1 | 0.7 | 0.5 | 0.4 | 1.9 | 71.5 |

|

|

|

|

| 0.4 | 1.5 | 1.0 | 0.3 | 0.9 | 4.2 | 85.3 |

SOURCE: Meridian Mining SE

View the original press release on ACCESS Newswire

FAQ

What are the latest significant drill results from Meridian's Cabaçal project (MRRDF)?

How much capital did Meridian Mining (MRRDF) recently raise?

What is the highest gold grade reported in the latest Cabaçal drilling results (MRRDF)?

When will Meridian Mining (MRRDF) complete its infill drilling program at Cabaçal?