MEDIROM Healthcare Technologies Inc. Announces November 2024 Key Performance Indicators (KPIs)

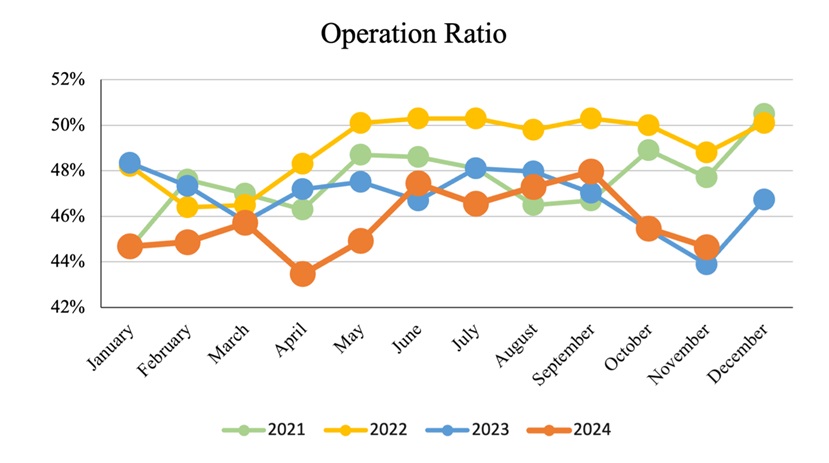

MEDIROM Healthcare Technologies (NASDAQ: MRM) released its November 2024 KPIs, showing mixed performance in its salon operations. Total customers served increased to 75,760 from 75,290 year-over-year, with sales per customer rising slightly to JPY 7,055 from JPY 7,045. The repeat ratio remained stable at 77.5%, while operation ratio improved to 44.6% from 43.9%.

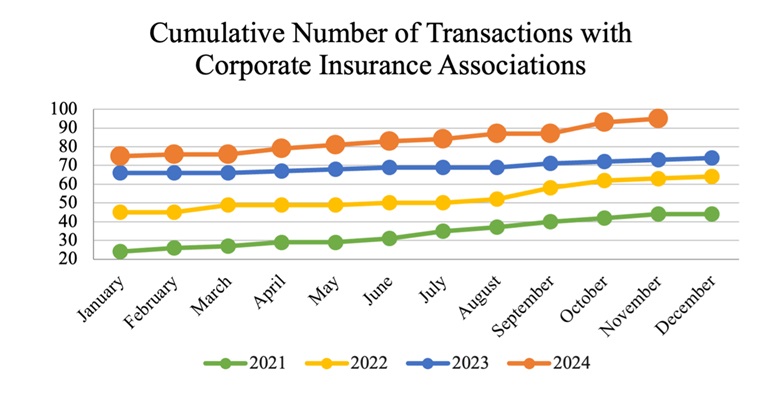

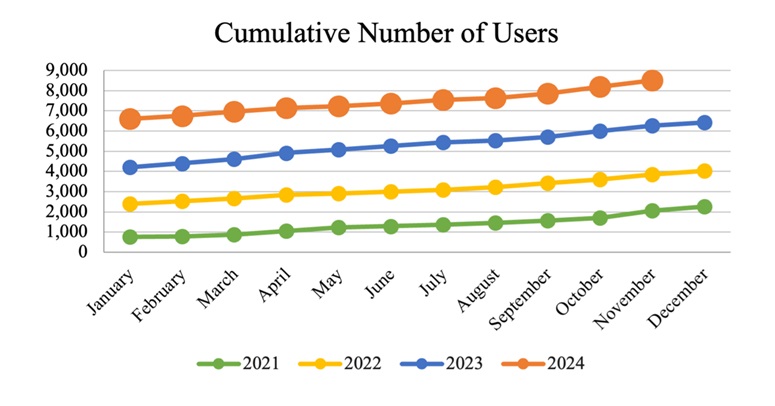

In the Health Tech Business segment, the company's Lav® app, which provides health guidance programs, continued to expand. As of November 2024, MEDIROM has secured contracts with 95 corporate insurance associations, and the cumulative number of Lav® app users reached 8,515 individuals.

MEDIROM Healthcare Technologies (NASDAQ: MRM) ha pubblicato i suoi KPI di novembre 2024, mostrando prestazioni miste nelle sue operazioni di salone. Il numero totale di clienti serviti è aumentato a 75.760 rispetto a 75.290 dello scorso anno, con le vendite per cliente che sono leggermente aumentate a JPY 7.055 rispetto a JPY 7.045. Il tasso di clienti che ritornano è rimasto stabile al 77,5%, mentre il tasso operativo è migliorato a 44,6% rispetto al 43,9% precedente.

Nella segmento di business Health Tech, l'app di MEDIROM, Lav®, che fornisce programmi di guida alla salute, ha continuato a espandersi. A novembre 2024, MEDIROM ha stipulato contratti con 95 associazioni assicurative aziendali, e il numero cumulativo di utenti dell'app Lav® ha raggiunto 8.515 persone.

MEDIROM Healthcare Technologies (NASDAQ: MRM) publicó sus KPI de noviembre de 2024, mostrando un rendimiento mixto en sus operaciones de salón. El total de clientes atendidos aumentó a 75,760 desde 75,290 en el año anterior, con las ventas por cliente que aumentaron ligeramente a JPY 7,055 desde JPY 7,045. La tasa de repetición se mantuvo estable en 77.5%, mientras que la tasa de operación mejoró a 44.6% desde el 43.9% anterior.

En el segmento de negocio de Health Tech, la aplicación Lav® de la compañía, que ofrece programas de orientación en salud, continuó expandiéndose. A noviembre de 2024, MEDIROM ha asegurado contratos con 95 asociaciones de seguros corporativos, y el número acumulativo de usuarios de la app Lav® alcanzó 8,515 individuos.

MEDIROM 헬스케어 기술 (NASDAQ: MRM)는 2024년 11월 KPI를 발표하며 살롱 운영에서 혼합된 성과를 보였습니다. 총 고객 수는 작년 75,290명에서 75,760명으로 증가했으며, 고객당 매출은 JPY 7,045에서 JPY 7,055로 소폭 상승했습니다. 재방문 비율은 77.5%로 안정세를 유지했으며, 운영 비율은 43.9%에서 44.6%로 개선되었습니다.

헬스 테크 사업 부문에서 MEDIROM의 건강 안내 프로그램을 제공하는 Lav® 앱은 계속 확장되고 있습니다. 2024년 11월 현재 MEDIROM은 95개 법인 보험 협회와 계약을 체결했으며, Lav® 앱 사용자 수는 8,515명에 도달했습니다.

MEDIROM Healthcare Technologies (NASDAQ: MRM) a publié ses KPI de novembre 2024, montrant une performance mixte dans ses opérations de salon. Le nombre total de clients servis a augmenté à 75,760 contre 75,290 l'année précédente, avec les ventes par client qui ont légèrement augmenté à JPY 7,055 contre JPY 7,045. Le taux de répétition est resté stable à 77,5%, tandis que le ratio opérationnel s'est amélioré à 44,6% contre 43,9% l'année précédente.

Dans le segment des technologies de la santé, l'application Lav® de l'entreprise, qui fournit des programmes de conseil en santé, a continué à s'étendre. En novembre 2024, MEDIROM a sécurisé des contrats avec 95 associations d'assurance d'entreprise, et le nombre cumulé d'utilisateurs de l'application Lav® a atteint 8,515 individus.

MEDIROM Healthcare Technologies (NASDAQ: MRM) veröffentlichte ihre KPIs für November 2024 und zeigte ein gemischtes Ergebnis in ihren Salonbetrieben. Die Gesamtzahl der bedienten Kunden stieg von 75.290 auf 75.760 im Jahresvergleich, während der Umsatz pro Kunde leicht auf JPY 7.055 von JPY 7.045 anstieg. Die Wiederholungsquote blieb stabil bei 77,5%, während sich die Betriebskostenquote von 43,9% auf 44,6% verbesserte.

Im Geschäftsbereich Health Tech setzte die Lav®-App des Unternehmens, die Gesundheitsleitungsprogramme anbietet, ihre Expansion fort. Bis November 2024 hat MEDIROM Verträge mit 95 Unternehmensversicherungsverbänden gesichert, und die kumulative Anzahl der Lav®-App-Nutzer erreichte 8.515 Personen.

- Customer base expanded with total customers served increasing to 75,760 from 75,290 YoY

- Operation ratio improved to 44.6% from 43.9% YoY

- Health Tech Business expanded to 95 corporate insurance associations

- Lav® app user base grew to 8,515 cumulative users

- Minimal sales per customer growth (only JPY 10 increase YoY)

- Repeat ratio remained flat at 77.5% with no improvement YoY

Insights

The November 2024 KPIs for MEDIROM Healthcare Technologies reveal a mixed but generally stable operational performance. Total customers served showed a marginal increase of

The Health Tech segment demonstrates promising growth with the Lav® app reaching 8,515 cumulative users and 95 corporate insurance association contracts. This expansion aligns with Japan's government initiatives to increase health guidance implementation rates, presenting a significant market opportunity given current implementation rates are well below targets (

While the salon business shows stability, the real growth driver appears to be the Health Tech division, which is capitalizing on regulatory tailwinds and digital transformation in healthcare delivery. For a company with a market cap of approximately

MEDIROM's digital health platform Lav® is strategically positioned in Japan's mandatory health guidance market. The sustained monthly growth in corporate contracts and user base demonstrates market validation. The platform's remote delivery model addresses a critical pain point in traditional health guidance programs by reducing dropout rates through convenient access.

The expanding footprint in the corporate insurance sector, with 95 associations now contracted, suggests strong product-market fit. This is particularly relevant given the government's push to achieve

The increasing ICT adoption rate exceeding

Total Customers Served: 75,760 – Sales Per Customer: JPY 7,055 – Customer Repeat Ratio:

TOKYO, Dec. 23, 2024 (GLOBE NEWSWIRE) -- MEDIROM Healthcare Technologies Inc. (NasdaqCM: MRM), a holistic healthcare company based in Japan (the “Company”), today announced its major Key Performance Indicators, or KPIs, updated for the month of November 2024. Data is provided for all salons for which comparable financial and customer data is available and excludes certain salons where such information is not available.

Salon Operation Business

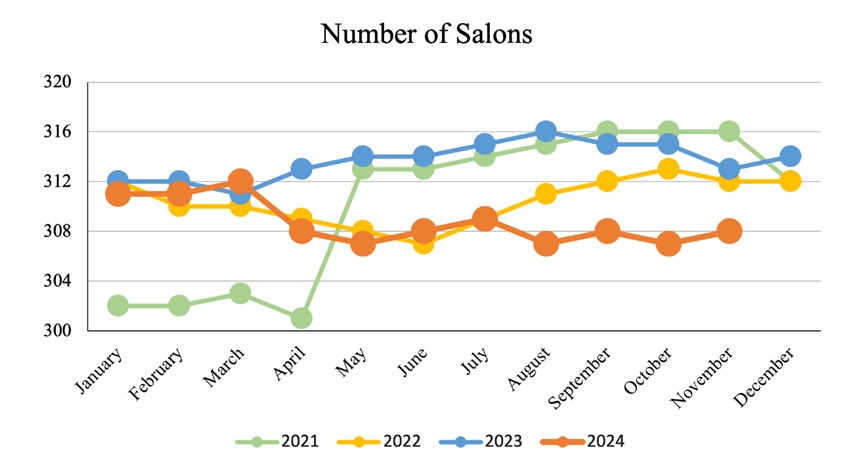

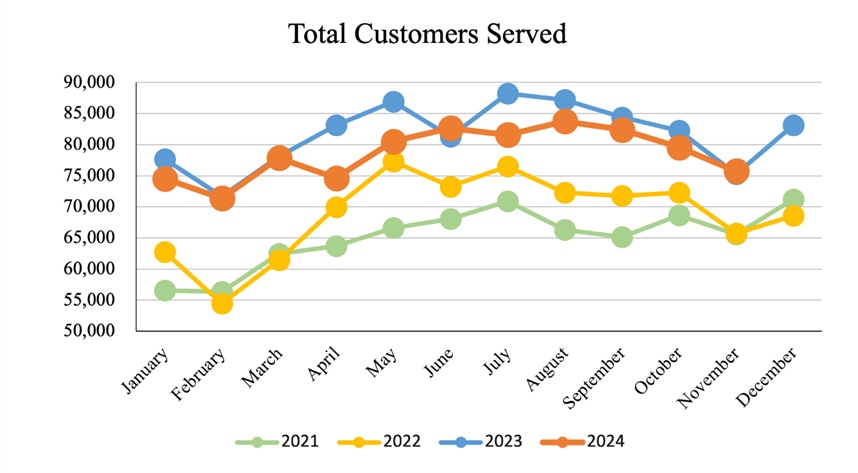

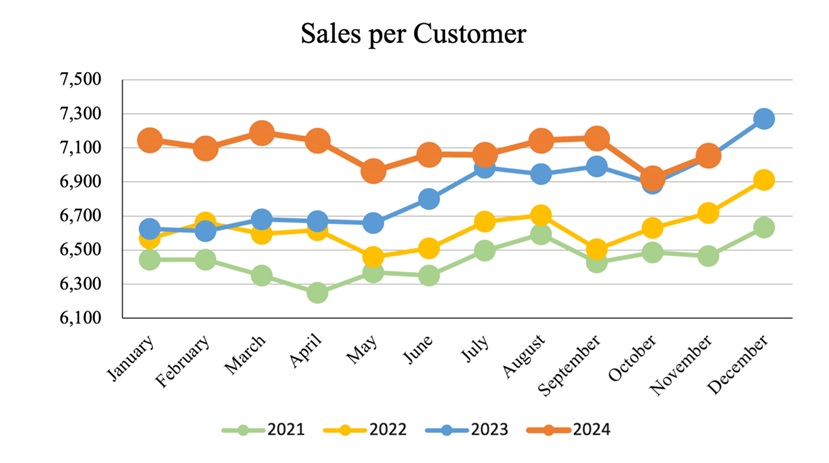

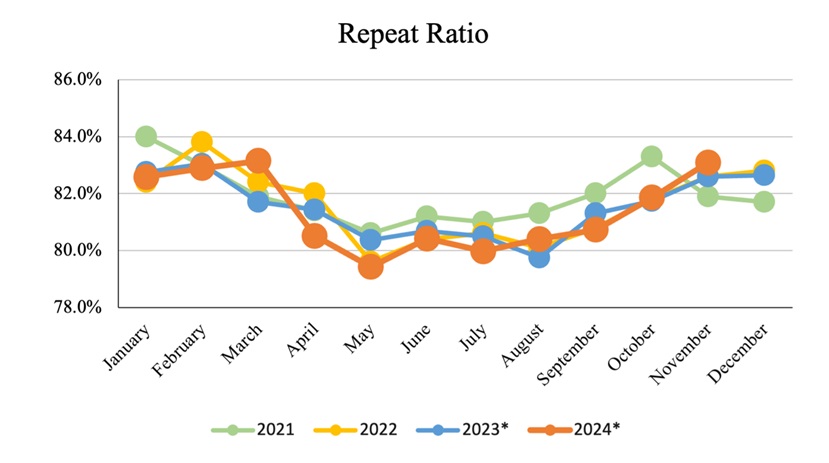

The following monthly KPIs provide insight into the business fundamentals and progress of the Company, updated for the month of November 2024:

- Total customers served increased to 75,760 in November 2024 from 75,290 in the year-ago period.

- Sales per customer increased to JPY 7,055 in November 2024 from JPY 7,045 in the year-ago period.

- Repeat ratio, which indicates the percentage of repeat customers, was

77.5% in 2024, the same as77.5% in the year-ago period. - Operation ratio was

44.6% in November 2024, up from43.9% in the year-ago period.

| Number of Salons(*1) | Number of Salons with Data(*2) | Total Customers Served(*3) | Sales per Customer(*4) | Repeat Ratio(*5) | Operation Ratio(*6) | |

| November-23 | 313 | 289 | 75,290 | JPY 7,045 | ||

| December-23 | 314 | 290 | 83,124 | JPY 7,271 | ||

| January-24 | 311 | 287 | 74,533 | JPY 7,147 | ||

| February-24 | 311 | 287 | 71,376 | JPY 7,099 | ||

| March-24 | 312 | 288 | 77,854 | JPY 7,190 | ||

| April-24 | 308 | 285 | 74,621 | JPY 7,143 | ||

| May-24 | 307 | 284 | 80,512 | JPY 6,964 | ||

| June-24 | 308 | 285 | 82,656 | JPY 7,061 | ||

| July-24 | 309 | 286 | 81,580 | JPY 7,060 | ||

| August-24 | 307 | 283 | 83,770 | JPY 7,144 | ||

| September-24 | 308 | 284 | 82,401 | JPY 7,158 | ||

| October-24 | 307 | 282 | 79,571 | JPY 6,923 | ||

| November-24 | 308 | 283 | 75,760 | JPY 7,055 | ||

(*1) Number of Salons: Includes the Company’s directly-operated salons and franchisees’ salons.

(*2) Number of Salons with Data: The number of salons for which comparable financial and customer data is available.

(*3) Total Customers Served: The number of customers served at salons for which comparable financial and customer data is available.

(*4) Sales Per Customer: The ratio of total salon sales to number of treated customers at all salons for which comparable financial and customer data is available.

(*5) Repeat Ratio: The ratio of repeat customer visits to total customer visits in the applicable month for all salons for which comparable financial and customer data is available.

(*6) Operation Ratio: The ratio of therapists’ in-service time to total therapists’ working hours (including stand-by time) for the applicable month for all salons for which comparable financial and customer data is available.

* Repeat ratios shown in the chart above do not include salons in public bath houses. In November 2024, the repeat ratios for all salons and salons in public bathhouses only were

*Since July 2021, the salon operation business has been managed by Wing Inc., which is a wholly-owned subsidiary of the Company.

Health Tech Business (Lav®)

The Company offers a government-specific health guidance program (the “Program”) using Lav®, an on-demand training application developed by the Company. The Program is designed to be less burdensome for the users and is delivered through a completely remote support style using the web remote interview and chat function of Lav®. This approach helps to reduce the dropout rate of conventional specific health guidance programs.

The Program provides support to medical professionals, such as public health nurses, dietitians, etc., that assist eligible individuals (age between 40 and 74) who are at risk of developing lifestyle-related diseases that can be caused by an unbalanced diet, lack of sleep, lack of exercise, smoking, stress, and other factors, by reviewing their lifestyle habits through specific health checkups that focus on metabolic syndrome. The implementation of specific health checkups and specific health guidance has become mandatory for medical insurers in Japan, including national health insurance and employee health insurance providers, since April 2008.

The Ministry of Health, Labor and Welfare has set a nationwide target of at least

As of November 2024, the Company has entered into contracts with 95 corporate insurance associations, and the cumulative number of users of the Company’s Lav® app has exceeded 8,000 people, bringing the total to 8,515 individuals.

| Number of New Contracts with Corporate Insurance Associations(*1) | Number of New Users(*2) | Cumulative Number of Contracts with Corporate Insurance Associations(*3) | Cumulative Number of Users | |

| November-23 | 1 | 256 | 73 | 6,262 |

| December-23 | 1 | 161 | 74 | 6,423 |

| January-24 | 1 | 174 | 75 | 6,597 |

| February-24 | 1 | 152 | 76 | 6,749 |

| March-24 | 1 | 203 | 76 | 6,952 |

| April-24 | 3 | 187 | 79 | 7,139 |

| May-24 | 2 | 99 | 81 | 7,238 |

| June-24 | 2 | 131 | 83 | 7,369 |

| July-24 | 1 | 166 | 84 | 7,535 |

| August-24 | 3 | 109 | 87 | 7,644 |

| September-24 | 0 | 221 | 87 | 7,865 |

| October-24 | 6 | 320 | 93 | 8,185 |

| November-24 | 2 | 330 | 95 | 8,515 |

(*1) Number of new contracts with corporate insurance associations entered into in the applicable month to implement specified health guidance program offered by the Company.

(*2) Number of new users that started using specified health guidance offered by the Company in the applicable month.

(*3) Cumulative number of contracts with corporate insurance associations excluding the number of terminated contracts.

Forward-Looking Statements

Certain statements in this press release are forward-looking statements for purposes of the safe harbor provisions under the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements may include estimates or expectations about the Company’s possible or assumed operational results, financial condition, business strategies and plans, market opportunities, competitive position, industry environment, and potential growth opportunities. In some cases, forward-looking statements can be identified by terms such as “may,” “will,” “should,” “design,” “target,” “aim,” “hope,” “expect,” “could,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “predict,” “project,” “potential,” “goal,” or other words that convey the uncertainty of future events or outcomes. These statements relate to future events or to the Company’s future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, levels of activity, performance, or achievements to be different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond the Company’s control and which could, and likely will, affect actual results, levels of activity, performance or achievements. Any forward-looking statement reflects the Company’s current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to the Company’s operations, results of operations, growth strategy and liquidity. Some of the factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements in this press release include:

- the Company’s ability to achieve its development goals for its business and execute and evolve its growth strategies, priorities and initiatives;

- the Company’s ability to sell certain of its owned salons to investors, and receive management fees from such sold salons, on acceptable terms;

- changes in Japanese and global economic conditions and financial markets, including their effects on the Company’s expansion in Japan and certain overseas markets;

- the Company’s ability to achieve and sustain profitability in its Digital Preventative Healthcare Segment;

- the fluctuation of foreign exchange rates, which affects the Company’s expenses and liabilities payable in foreign currencies;

- the Company’s ability to hire and train a sufficient number of therapists and place them at salons in need of additional staffing;

- changes in demographic, unemployment, economic, regulatory or weather conditions affecting the Tokyo region of Japan, where the Company’s relaxation salon base is geographically concentrated;

- the Company’s ability to maintain and enhance the value of its brands and to enforce and maintain its trademarks and protect its other intellectual property;

- the financial performance of the Company’s franchisees and the Company’s limited control with respect to their operations;

- the Company’s ability to raise additional capital on acceptable terms or at all;

- the Company’s level of indebtedness and potential restrictions on the Company under the Company’s debt instruments;

- changes in consumer preferences and the Company’s competitive environment;

- the Company’s ability to respond to natural disasters, such as earthquakes and tsunamis, and to global pandemics, such as COVID-19; and

- the regulatory environment in which the Company operates.

More information on these risks and other potential factors that could affect the Company’s business, reputation, results of operations, financial condition, and stock price is included in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including in the “Risk Factors” and “Operating and Financial Review and Prospects” sections of the Company’s most recently filed periodic report on Form 20-F and subsequent filings, which are available on the SEC website at www.sec.gov. The Company assumes no obligation to update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ from those anticipated in these forward-looking statements, even if new information becomes available in the future.

About MEDIROM Healthcare Technologies Inc.

MEDIROM, a holistic healthcare company, operates 308 (as of November 30, 2024) relaxation salons across Japan, Re.Ra.Ku® being its leading brand, and provides healthcare services. In 2015, MEDIROM entered the health tech business and launched new healthcare programs using an on-demand training app called “Lav®”, which is developed by the Company. MEDIROM also entered the device business in 2020 and has developed a smart tracker “MOTHER Bracelet®”. In 2023, MEDIROM launched REMONY, a remote monitoring system for corporate clients, and has received orders from a broad range of industries, including nursing care, transportation, construction, and manufacturing, among others. MEDIROM hopes that its diverse health-related product and service offerings will help it collect and manage healthcare data from users and customers and enable it to become a leader in big data in the healthcare industry. For more information, visit https://medirom.co.jp/en.

Contacts

Investor Relations Team

ir@medirom.co.jp

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/044097ba-afae-4c7e-873a-d6c864729cce

https://www.globenewswire.com/NewsRoom/AttachmentNg/095a807a-8dbc-43a6-9a11-0a2a1417d3db

https://www.globenewswire.com/NewsRoom/AttachmentNg/a31937c9-e59c-4cff-9c46-0e75e4440dd2

https://www.globenewswire.com/NewsRoom/AttachmentNg/f2fcdb5d-8393-46d1-9f3d-73d7a4e2ecb4

https://www.globenewswire.com/NewsRoom/AttachmentNg/e6ed0bcb-54f5-419b-b54d-d3f0086f4bdc

https://www.globenewswire.com/NewsRoom/AttachmentNg/ec917127-1447-4db9-bf54-c489f757898e

https://www.globenewswire.com/NewsRoom/AttachmentNg/09ed0042-eb22-4eb2-b449-6ad4bb0b1298