Mako Mining Reports Q2 2024 Financial Results Including EPS of US$0.13 /share and Gold Sales of 12,313 Oz Au at $1,098/oz AISC

Mako Mining Corp. (TSX-V:MKO)(OTCQX:MAKOF) reported strong Q2 2024 financial results, with gold sales of $28.3 million generating $14.5 million in Mine Operating Cash Flow and $8.8 million in Net Income. The company achieved earnings per share of $0.13, selling 12,313 oz of gold at an All-In Sustaining Cost (AISC) of $1,098/oz. Key highlights include $14.6 million in Adjusted EBITDA, Cash Costs of $793/oz sold, and a cash balance of $6.7 million. The company repaid $0.8 million of debt and repurchased $2.9 million in stock. Over the last nine months, Mako has sold 35,061 ounces at $975/oz AISC, generating $41.7 million of Mine OCF and $23.6 million in net income.

Mako Mining Corp. (TSX-V:MKO)(OTCQX:MAKOF) ha riportato risultati finanziari solidi per il Q2 2024, con vendite di oro pari a 28,3 milioni di dollari, producendo un flusso di cassa operativo della miniera di 14,5 milioni di dollari e un reddito netto di 8,8 milioni di dollari. L'azienda ha raggiunto un utile per azione di 0,13 dollari, vendendo 12.313 once d'oro a un costo sostenibile totale (AISC) di 1.098 dollari/oncia. Tra i punti salienti figurano 14,6 milioni di dollari di EBITDA rettificato, costi in contanti di 793 dollari/oncia venduta, e un saldo di liquidità di 6,7 milioni di dollari. L'azienda ha rimborsato 0,8 milioni di dollari di debito e riacquistato 2,9 milioni di dollari in azioni. Negli ultimi nove mesi, Mako ha venduto 35.061 once a un costo sostenibile di 975 dollari/oncia AISC, generando 41,7 milioni di dollari di flusso di cassa operativo della miniera e 23,6 milioni di dollari di reddito netto.

Mako Mining Corp. (TSX-V:MKO)(OTCQX:MAKOF) reportó resultados financieros sólidos para el Q2 2024, con ventas de oro por 28,3 millones de dólares, generando 14,5 millones de dólares en flujo de caja operativo de mina y 8,8 millones de dólares en ingresos netos. La compañía logró ganancias por acción de 0,13 dólares, vendiendo 12.313 onzas de oro a un costo total sostenible (AISC) de 1.098 dólares/onza. Los aspectos destacados incluyen 14,6 millones de dólares en EBITDA ajustado, costos en efectivo de 793 dólares/onza vendida, y un saldo de efectivo de 6,7 millones de dólares. La compañía pagó 0,8 millones de dólares de deuda y recompró 2,9 millones de dólares en acciones. En los últimos nueve meses, Mako ha vendido 35.061 onzas a 975 dólares/onza AISC, generando 41,7 millones de dólares de flujo de caja operativo de mina y 23,6 millones de dólares en ingresos netos.

Mako Mining Corp. (TSX-V:MKO)(OTCQX:MAKOF)는 2024년 2분기 재무 실적을 발표했으며, 2830만 달러의 금 매출로 1450만 달러의 광산 운영 현금 흐름과 880만 달러의 순이익을 기록했습니다. 이 회사는 주당 0.13달러의 수익을 기록하였으며, 12,313 온스의 금을 1,098달러/온스의 전반적인 유지비(Cost AISC)로 판매했습니다. 주요 하이라이트로는 1460만 달러의 조정 EBITDA, 판매된 온스당 현금 비용 793달러, 현금 잔액 670만 달러가 포함됩니다. 회사는 80만 달러의 부채를 상환하고 290만 달러의 주식을 재매입했습니다. 지난 9개월 동안 Mako는 35,061온스를 975달러/온스 AISC로 판매하였으며, 4,170만 달러의 광산 OCF와 2360만 달러의 순이익을 창출했습니다.

Mako Mining Corp. (TSX-V:MKO)(OTCQX:MAKOF) a annoncé de solides résultats financiers pour le deuxième trimestre 2024, avec des ventes d'or de 28,3 millions de dollars, générant 14,5 millions de dollars de flux de trésorerie opérationnel de la mine et 8,8 millions de dollars de bénéfice net. L'entreprise a atteint un bénéfice par action de 0,13 dollar, ayant vendu 12 313 onces d'or à un coût total d'exploitation (AISC) de 1 098 dollars/once. Les faits saillants comprennent 14,6 millions de dollars d'EBITDA ajusté, des coûts en espèces de 793 dollars/once vendue, et un solde de trésorerie de 6,7 millions de dollars. L'entreprise a remboursé 0,8 million de dollars de dette et a racheté 2,9 millions de dollars d'actions. Au cours des neuf derniers mois, Mako a vendu 35 061 onces à un AISC de 975 dollars/once, générant 41,7 millions de dollars de flux de trésorerie opérationnel de la mine et 23,6 millions de dollars de bénéfice net.

Mako Mining Corp. (TSX-V:MKO)(OTCQX:MAKOF) berichtete über starke finanzielle Ergebnisse im Q2 2024, mit Goldverkäufen von 28,3 Millionen Dollar, die 14,5 Millionen Dollar an Betriebsgeldern der Mine und 8,8 Millionen Dollar an Nettoerträgen generierten. Das Unternehmen erzielte Gewinne pro Aktie von 0,13 Dollar, indem es 12.313 Unzen Gold zu einem All-In Sustaining Cost (AISC) von 1.098 Dollar/Unze verkaufte. Zu den wichtigsten Punkten gehören 14,6 Millionen Dollar an bereinigtem EBITDA, Bargeldkosten von 793 Dollar/Unze verkauft und ein Barguthaben von 6,7 Millionen Dollar. Das Unternehmen zahlte 0,8 Millionen Dollar Schulden zurück und kaufte 2,9 Millionen Dollar an Aktien zurück. In den letzten neun Monaten hat Mako 35.061 Unzen zu einem AISC von 975 Dollar/Unze verkauft und dabei 41,7 Millionen Dollar an Betriebsgeldern der Mine und 23,6 Millionen Dollar an Nettoerträgen erwirtschaftet.

- Strong Q2 2024 financial results with $28.3 million in revenue

- Net Income of $8.8 million and EPS of $0.13

- Gold sales of 12,313 oz at competitive AISC of $1,098/oz

- Significant Mine Operating Cash Flow of $14.5 million

- Adjusted EBITDA of $14.6 million

- Debt repayment of $0.8 million and stock repurchase of $2.9 million

- Increased cash and receivable balances by $2.4 million quarter-over-quarter

- Nine-month performance: 35,061 ounces sold at $975/oz AISC, generating $41.7 million Mine OCF

- Income tax expense accrual of $2.3 million due to higher-than-projected profits

- $0.9 million in net derivative losses on the Sailfish Silver Loan

- $0.3 million in severance to two former executives

VANCOUVER, BC / ACCESSWIRE / August 13, 2024 / Mako Mining Corp. (TSX-V:MKO)(OTCQX:MAKOF) ("Mako" or the "Company") is pleased to provide financial results for the three months ended June 30th, 2024 ("Q2 2024"). All dollar amounts referred to herein are expressed in United States dollars unless otherwise stated.

The Company's financial results for Q2 2024 reflect gold sales of US

Q2 2024 Highlights

Financial

$28.3 million in Revenue$14.6 million in Adjusted EBITDA (1)$14.5 million in Mine Operating Cash Flow ("Mine OCF") (1) (3)$8.8 million Net Income$793 Cash Costs ($/oz sold) (1) (2)$1,098 All-In Sustaining Costs ("AISC") ($/oz sold) (1) (2)Debt Repayment of

$0.8 million to Sailfish Silver LoanStock Repurchase (NCIB) of

$2.9 million Cash Balance of

$6.7 million and Gold in Sales Receivable of$3.2 million (increase of$2.4 million vs. Q1 2024)

Refers to a Non-GAAP financial measure within the meaning of National Instrument 52-112 - Non-GAAP and Other Financial Measures Disclosure ("NI 52-112"). Refer to information under the heading "Non-GAAP Measures" as well as the reconciliations later in this press release.

Refers to a Non-GAAP ratio within the meaning of NI-52-112. Refer to information under the heading "Non-GAAP Measures" later in this press release.

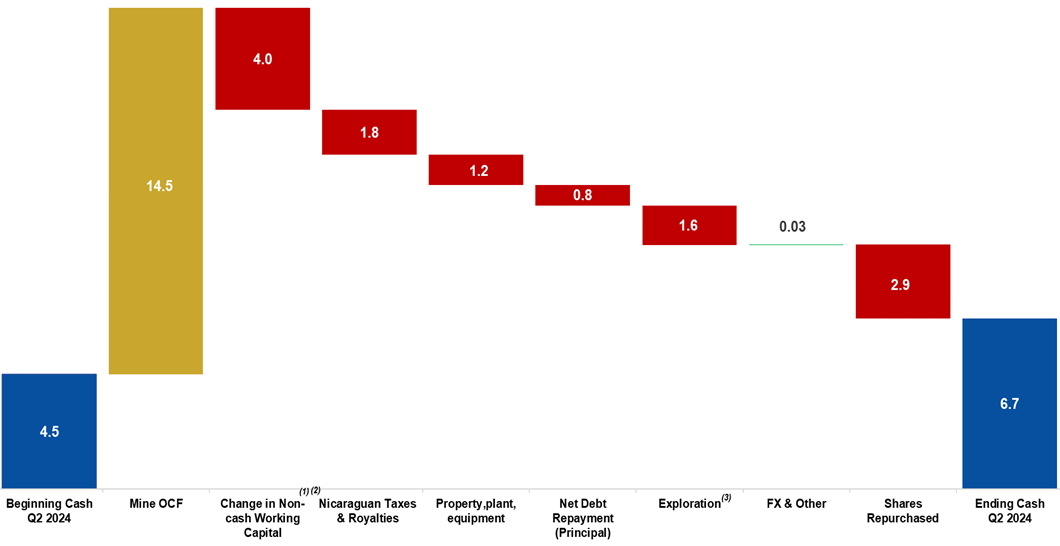

Refer to "Chart 1 - Q2 2024 - Mine OCF Calculation and Cash Reconciliation (in $ millions)" for a reconciliation of the beginning and ending cash position of the Company, including OCF.

Unusual Factors Affecting Q2 2024 Earnings

$2.3 million income tax expense accrual due to yearly anticipated profits exceeding levels projected by the3% of revenue minimum tax. Due to the high level of profitability experienced by the Company thus far in 2024, taxes are now accrued on the basis of30% of anticipated taxable earnings$0.9 million in net derivative losses on the Sailfish Silver Loan due to significantly higher silver prices$0.3 million in severance to two former executives of the Company

Growth

$179 K in exploration and evaluation expenses. This does not include an additional$1.4M of non-sustaining exploration invested during the quarter.

Akiba Leisman, Chief Executive Officer, states that "Q2 2024 was another very strong quarter for Mako, with 12,313 ounces sold at

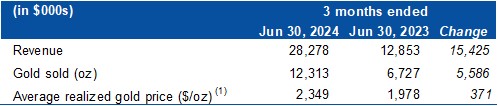

Table 1 - Revenue

Realized price before deductions from Sailfish gold streaming agreement

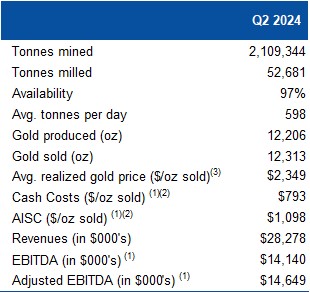

Table 2 - Operating and Financial Data

Refers to a Non-GAAP financial measure within the meaning of NI 52-112). Refer to information under the heading "Non-GAAP Measures" as well as the reconciliations later in this press release.

Refers to a Non-GAAP ratio within the meaning of NI-52-112. Refer to information under the heading "Non-GAAP Measures" later in this press release.

Realized price before deductions from Sailfish gold streaming agreement.

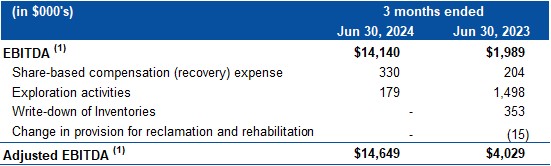

Table 3 - EBITDA Reconciliation

Refers to a Non-GAAP financial measure within the meaning of NI 52-112. Refer to information under the heading "Non-GAAP Measures" later in this press release.

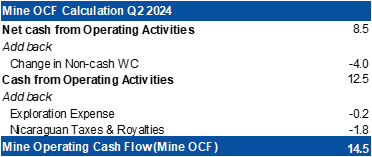

Chart 1

Q2 2024 - Mine OCF Calculation and Cash Reconciliation (in $ millions)

Refers to Non-GAAP financial measure within the meaning of NI 52-112. Refer to information under the heading "Non-GAAP Measures" later in this press release.

Includes all expenses incurred to sustain operations. Excludes Nicaraguan Taxes and Royalties, changes in Non-cash Working Capital, and Exploration expenses.

Includes US

$0.2M Exploration Expense (Regional Exploration) + US$ 1.4M Mineral Property Exploration Investment

For complete details, please refer to the financial statements and the associated management discussion and analysis for the three months ended June 30th, 2024, available on SEDAR (www.sedarplus.ca) or on the Company's website (www.makominingcorp.com).

Non-GAAP Measures

The Company has included certain non-GAAP financial measures and non-GAAP ratios in this press release such as EBITDA, Adjusted EBITDA, Mine Operating Cash Flow cash cost per ounce sold, total cash cost per ounce sold, AISC per ounce sold. These non-GAAP measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. In the gold mining industry, these are commonly used performance measures and ratios, but do not have any standardized meaning prescribed under IFRS and therefore may not be comparable to other issuers. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's underlying performance of its core operations and its ability to generate cash flow.

"EBITDA" represents earnings before interest (including non-cash accretion of financial obligation and lease obligations), income taxes and depreciation, depletion and amortization.

"Adjusted EBITDA" represents EBITDA, adjusted to exclude exploration activities, share-based compensation and change in provision for reclamation and rehabilitation.

"Cash costs per ounce sold" is calculated by deducting revenues from silver sales and dividing the sum of mining, milling and mine site administration cost.

"AISC per ounce sold" includes total cash costs (as defined above) and adds the sum of G&A, sustaining capital and certain exploration and evaluation ("E&E") costs, sustaining lease payments, provision for environmental fees, if applicable, and rehabilitation costs paid, all divided by the number of ounces sold. As this measure seeks to reflect the full cost of gold production from current operations, capital and E&E costs related to expansion or growth projects are not included in the calculation of AISC per ounce. Additionally, certain other cash expenditures, including income and other tax payments, financing costs and debt repayments, are not included in AISC per ounce.

"Mine OCF" represents operating cash flow, excluding Nicaraguan taxes and royalties, changes in non-cash working capital and exploration expenses.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako's primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package.

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, Telephone: 917-558-5289, E-mail: aleisman@makominingcorp.com or visit our website at www.makominingcorp.com and SEDAR www.sedarplus.ca.

Forward-Looking Information: Some of the statements contained herein may be considered "forward-looking information" within the meaning of applicable securities laws. Forward-looking information can be identified by words such as, without limitation, "estimate", "project", "believe", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" or variations thereon or comparable terminology. The forward-looking information contained herein reflects the Company's current beliefs and expectations, based on management's reasonable assumptions, and includes, without limitation, that the Company expects record gold ounces recovered, gold ounces sold, Adjusted EBITDA, Mine OCF and Net Income, with record low Cash Costs, Total Cash Costs and AISC in Q2; rapidly repaying debt while the Company aggressively repurchases shares through its newly instituted NCIB; Mako's primary objective to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, changes in the Company's exploration and development plans and growth parameters and its ability to fund its growth to reach its expected new record production numbers; unanticipated costs; the October 24 measures having impacts on business operations not current expected, or new sanctions being imposed by the U.S. Treasury Department or other government entity in Nicaragua in the future; and other risks and uncertainties as disclosed in the Company's public disclosure filings on SEDAR at www.sedar.com. Such information contained herein represents management's best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with information regarding the Company's Q2 2024 financial results and may not be appropriate for other purposes. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Mako Mining Corp.

View the original press release on accesswire.com