Mako Mining Reports Fourth Quarter and Full Year 2023 Financial Results, Including Q4 EPS of US$0.145 /share and Q4 Gold Sales of 13,481 Oz at $817/oz AISC

VANCOUVER, BC / ACCESSWIRE / April 11, 2024 / Mako Mining Corp. (TSXV:MKO)(OTCQX:MAKOF) ("Mako" or the "Company") is pleased to provide financial results for the three months ended December 31st, 2023 ("Q4 2023") and the 3rd full year of financial results since declaring commercial production on July 1st, 2021 at its San Albino gold mine ("San Albino") in northern Nicaragua. All dollar amounts referred to herein are expressed in United States dollars unless otherwise stated.

The Company's financial results for Q4 2023 reflect record gold sales of US

Q4 2023 Highlights

Financial

$26.5 million in Revenue$15.3 million in Adjusted EBITDA (1)$16.8 million in Mine Operating Cash Flow ("Mine OCF") (1) (3)$9.5 million Net Income$695 Cash Costs ($/oz sold) (1) (2)$817 All-In Sustaining Costs ("AISC") ($/oz sold) (1) (2)- Debt Repayment of

$6.9 million

- Refers to a Non-GAAP financial measure within the meaning of National Instrument 52-112 - Non-GAAP and Other Financial Measures Disclosure ("NI 52-112"). Refer to information under the heading "Non-GAAP Measures" as well as the reconciliations later in this press release.

- Refers to a Non-GAAP ratio within the meaning of NI-52-112. Refer to information under the heading "Non-GAAP Measures" later in this press release.

- Refer to "Chart 1 - Q4 2023 - Mine OCF Calculation and Cash Reconciliation (in $ millions)" for a reconciliation of the beginning and ending cash position of the Company, including OCF.

Growth

$1.0 million in exploration and evaluation expenses ($0.2 million in areas surrounding San Albino and approximately$0.8 million at Las Conchitas).

Akiba Leisman, Chief Executive Officer, states that "Q4 2023 was a record quarter on every significant financial and operating metric, including a record for gold ounces recovered, gold ounces sold, Adjusted EBITDA, Mine OCF and Net Income, with record low Cash Costs and AISC. The cash flow coming from the mine is enabling us to invest in exploration while we strengthen our balance sheet in anticipation of the announced acquisition of Goldsource Mines later this quarter."

Table 1 - Revenue

- Realized price before deductions from Sailfish streaming agreement

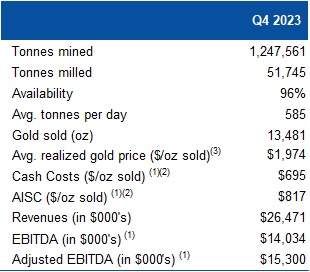

Table 2 - Operating and Financial Data

- Refers to a Non-GAAP financial measure within the meaning of NI 52-112). Refer to information under the heading "Non-GAAP Measures" as well as the reconciliations later in this press release.

- Refers to a Non-GAAP ratio within the meaning of NI-52-112. Refer to information under the heading "Non-GAAP Measures" later in this press release.

- Realized price before deductions from Sailfish gold streaming agreement.

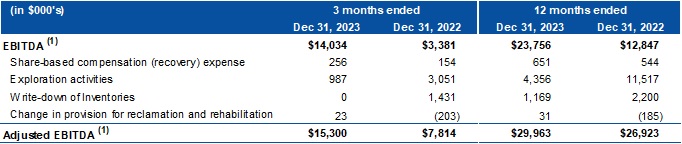

Table 3 - EBITDA Reconciliation

- Refers to a Non-GAAP financial measure within the meaning of NI 52-112. Refer to information under the heading "Non-GAAP Measures" later in this press release.

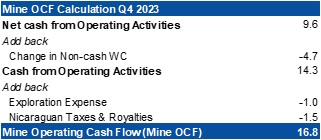

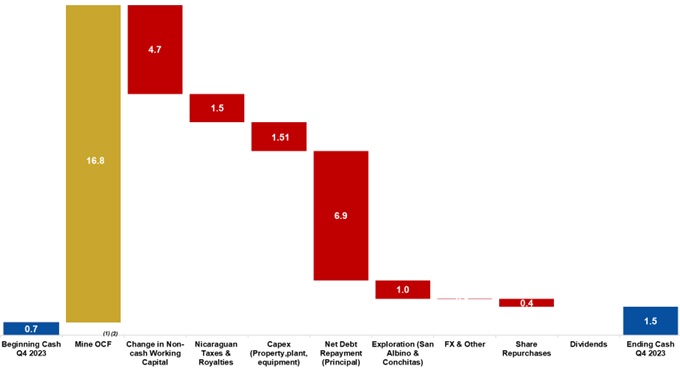

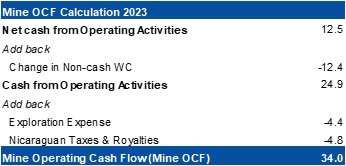

Chart 1

Q4 2023 - Mine OCF Calculation and Cash Reconciliation (in $ millions)

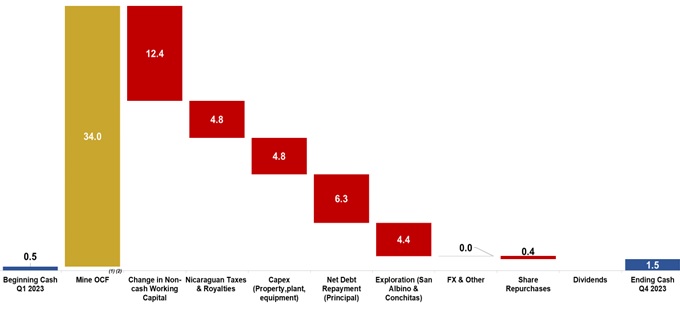

Chart 2

2023 - Mine OCF Calculation and Cash Reconciliation (in $ millions)

- Refers to Non-GAAP financial measure within the meaning of NI 52-112. Refer to information under the heading "Non-GAAP Measures" later in this press release.

- Includes all expenses incurred to sustain operations. Excludes Nicaraguan Taxes and Royalties, changes in Non-cash Working Capital, and Exploration expenses.

For complete details, please refer to the financial statements and the associated management discussion and analysis for the twelve months ended December 31st, 2023, available on SEDAR (www.sedar.com) or on the Company's website (www.makominingcorp.com).

Non-GAAP Measures

The Company has included certain non-GAAP financial measures and non-GAAP ratios in this press release such as EBITDA, Adjusted EBITDA, Mine Operating Cash Flow cash cost per ounce sold, total cash cost per ounce sold, AISC per ounce sold. These non-GAAP measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. In the gold mining industry, these are commonly used performance measures and ratios, but do not have any standardized meaning prescribed under IFRS and therefore may not be comparable to other issuers. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's underlying performance of its core operations and its ability to generate cash flow.

"EBITDA" represents earnings before interest (including non-cash accretion of financial obligation and lease obligations), income taxes and depreciation, depletion and amortization.

"Adjusted EBITDA" represents EBITDA, adjusted to exclude exploration activities, share-based compensation and change in provision for reclamation and rehabilitation.

"Cash costs per ounce sold" is calculated by deducting revenues from silver sales and dividing the sum of mining, milling and mine site administration cost.

"Total cash costs per ounce sold" is calculated by deducting revenues from silver sales from production cash costs and production taxes and royalties and dividing the sum by the number of gold ounces sold. Production cash costs include mining, milling, mine site security and mine site administration costs.

"AISC per ounce sold" includes total cash costs (as defined above) and adds the sum of G&A, sustaining capital and certain exploration and evaluation ("E&E") costs, sustaining lease payments, provision for environmental fees, if applicable, and rehabilitation costs paid, all divided by the number of ounces sold. As this measure seeks to reflect the full cost of gold production from current operations, capital and E&E costs related to expansion or growth projects are not included in the calculation of AISC per ounce. Additionally, certain other cash expenditures, including income and other tax payments, financing costs and debt repayments, are not included in AISC per ounce.

"Mine OCF" represents operating cash flow, excluding Nicaraguan taxes and royalties, changes in non-cash working capital and exploration expenses.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako's primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package.

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, Telephone: 917-558-5289, E-mail: aleisman@makominingcorp.com or visit our website at www.makominingcorp.com and SEDAR www.sedar.com.

Forward-Looking Information: Some of the statements contained herein may be considered "forward-looking information" within the meaning of applicable securities laws. Forward-looking information can be identified by words such as, without limitation, "estimate", "project", "believe", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" or variations thereon or comparable terminology. The forward-looking information contained herein reflects the Company's current beliefs and expectations, based on management's reasonable assumptions, and includes, without limitation, that the Company expects record gold ounces recovered, gold ounces sold, Adjusted EBITDA, Mine OCF and Net Income, with record low Cash Costs, Total Cash Costs and AISC in Q4; rapidly repaying debt while the Company aggressively repurchases shares through its newly instituted NCIB; Mako's primary objective to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package, the anticipated acquisition of Goldsource Mines by the end of Q1 2024. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, changes in the Company's exploration and development plans and growth parameters and its ability to fund its growth to reach its expected new record production numbers; unanticipated costs; the October 24 measures having impacts on business operations not current expected, or new sanctions being imposed by the U.S. Treasury Department or other government entity in Nicaragua in the future; and other risks and uncertainties as disclosed in the Company's public disclosure filings on SEDAR at www.sedar.com. Such information contained herein represents management's best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with information regarding the Company's Q4 2023 financial results and may not be appropriate for other purposes. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Mako Mining Corp.

View the original press release on accesswire.com