Mako Mining Is on Track for Record Gold Sales in Q4 2023 With Significantly Improved Balance Sheet

- Exceptional production results with high mill head grades and 86.6% recoveries

- Record-breaking quarter in gold ounces recovered and sold

- Repayment of US$1.6M to Sailfish and US$3.0M to Wexford

- Reduction of accounts payable by approximately US$4.0M

- Increase in cash balance by over US$1.0M

- Initiation of an aggressive exploration program

- Repurchase of 242.6K shares of stock at an average price of C$2.06

- None.

Insights

Analyzing...

VANCOUVER, BC / ACCESSWIRE / December 8, 2023 / Mako Mining Corp. (TSXV:MKO);(OTCQX:MAKOF) ("Mako" or the "Company") is pleased to provide the following update:

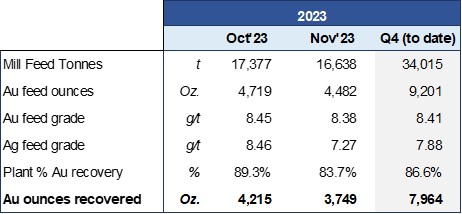

After the Company resumed its original processing plan (see Press Release dated Oct 11th, 2023), Mako has recorded outstanding production results. Since the beginning of Q4 2023, Mako has sold in excess of 10K Oz. of Au, which includes 7,964 Oz. of Au recovered in October and November and the 2,234 Oz. of Au delivered but not sold in Q3 2023 (see Press Release dated November 14th, 2023).

Mill head grades have been exceptionally high during the quarter averaging 8.41 g/t Au at

Since the beginning of Q4 2023, the Company has repaid US

1 Payments made Wexford on Nov 21st (U$S 1.0M), Nov 30th (US

LEGAL*57088264.1

Akiba Leisman, CEO of Mako states that "the amount of cash flow coming from the mine in just the first two months of the quarter is extraordinary. The Company is on track for record gold sales and gold ounces recovered, which has significantly strengthened its balance sheet. This is setting up the Company to invest in a very large internally funded exploration program for 2024 while returning a significant amount of capital to shareholders."

Qualified Person

John Rust, a metallurgical engineer, and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Rust is a senior metallurgist and a consultant to the Company.

On behalf of the Board,

Akiba Leisman

CEO

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako's primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package.

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, Telephone: 917-558-5289, E-mail: aleisman@makominingcorp.com or visit our website at www.makominingcorp.com and SEDAR www.sedarplus.ca.

Forward-Looking Information: Some of the statements contained herein may be considered "forward-looking information" within the meaning of applicable securities laws. Forward-looking information can be identified by words such as, without limitation, "estimate", "project", "believe", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" or variations thereon or comparable terminology. The forward-looking information contained herein reflects the Company's current beliefs and expectations, based on management's reasonable assumptions, and includes, without limitation that the Company`s debt reduction, head grades, recoveries and gold sales are preliminary in nature and have not been audited by a third party and that Mako's primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, changes in the Company's exploration and development plans and growth parameters and its ability to fund its growth to reach its expected new record production numbers; unanticipated costs; the October 24 measures having impacts on business operations not current expected, or new sanctions being imposed by the U.S. Treasury Department or other government entity in Nicaragua in the future; and other risks and uncertainties as disclosed in the Company's public disclosure filings on SEDAR at www.sedar.com. Such information contained herein represents management's best judgment as of the date hereof, based on information currently available. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Mako Mining Corp.

View the original press release on accesswire.com