LexinFintech Holdings Ltd. Reports Third Quarter 2024 Unaudited Financial Results

LexinFintech Holdings (NASDAQ: LX) announced Q3 2024 financial results showing mixed performance. Total loan origination reached RMB51.0 billion, down 19.5% year-over-year, while outstanding loan balance decreased to RMB111.2 billion. Despite declining loan volume, net profit increased 36.7% quarter-over-quarter to RMB310 million. Total operating revenue grew 4.4% year-over-year to RMB3.7 billion. The company reported improved profitability driven by record low funding costs and better asset quality. The Board approved an increased dividend payout ratio to 25% starting 2025. User base expanded with registered users reaching 223 million, up 9.3% year-over-year.

LexinFintech Holdings (NASDAQ: LX) ha annunciato i risultati finanziari del terzo trimestre 2024, mostrando una performance mista. L'originazione totale dei prestiti ha raggiunto 51,0 miliardi di RMB, in calo del 19,5% rispetto all'anno precedente, mentre il saldo dei prestiti outstanding è diminuito a 111,2 miliardi di RMB. Nonostante il calo nel volume dei prestiti, l'utile netto è aumentato del 36,7% rispetto al trimestre precedente, raggiungendo i 310 milioni di RMB. I ricavi operativi totali sono cresciuti del 4,4% rispetto all'anno passato, toccando i 3,7 miliardi di RMB. L'azienda ha riportato un miglioramento della redditività grazie ai costi di finanziamento ai minimi storici e a una migliore qualità degli attivi. Il Consiglio ha approvato un aumento del rapporto di distribuzione dei dividendi al 25% a partire dal 2025. La base utenti si è ampliata, con il numero di utenti registrati che ha raggiunto 223 milioni, in aumento del 9,3% rispetto all'anno precedente.

LexinFintech Holdings (NASDAQ: LX) anunció los resultados financieros del tercer trimestre de 2024, mostrando un rendimiento mixto. La originación total de préstamos alcanzó 51,0 mil millones de RMB, lo que representa una disminución del 19,5% interanual, mientras que el saldo de préstamos pendientes se redujo a 111,2 mil millones de RMB. A pesar de la disminución en el volumen de préstamos, las ganancias netas aumentaron un 36,7% de un trimestre a otro, alcanzando los 310 millones de RMB. Los ingresos operativos totales crecieron un 4,4% interanual, alcanzando los 3,7 mil millones de RMB. La empresa reportó una mejora en la rentabilidad impulsada por costos de financiamiento históricamente bajos y una mejor calidad de activos. La Junta aprobó un incremento en la tasa de pago de dividendos al 25% a partir de 2025. La base de usuarios se expandió, alcanzando los 223 millones de usuarios registrados, un aumento del 9,3% interanual.

LexinFintech Holdings (NASDAQ: LX)는 2024년 3분기 재무 결과를 발표하며 혼합된 성과를 보여주었습니다. 총 대출 발행액은 510억 위안에 달하여 전년 대비 19.5% 감소했으며, 미지급 대출 잔액은 1112억 위안으로 줄어들었습니다. 대출량 감소에도 불구하고 순이익은 직전 분기 대비 36.7% 증가하여 3억 1000만 위안에 달했습니다. 총 운영 수익은 전년 대비 4.4% 증가하여 37억 위안에 달했습니다. 이 회사는 사상 최저의 자금 조달 비용과 더 나은 자산 품질에 힘입어 수익성이 개선되었다고 보고했습니다. 이사회는 2025년부터 배당 지급 비율을 25%로 인상하기로 승인했습니다. 사용자 기반은 확대되어 등록 사용자가 2억 2300만 명에 달하며, 이는 전년 대비 9.3% 증가한 수치입니다.

LexinFintech Holdings (NASDAQ: LX) a annoncé les résultats financiers du troisième trimestre 2024, montrant une performance mitigée. L'origine totale des prêts a atteint 51,0 milliards de RMB, en baisse de 19,5% par rapport à l'année précédente, tandis que le solde des prêts en cours a diminué à 111,2 milliards de RMB. Malgré la baisse du volume des prêts, le bénéfice net a augmenté de 36,7% par rapport au trimestre précédent pour atteindre 310 millions de RMB. Le chiffre d'affaires total a progressé de 4,4% d'une année sur l'autre pour atteindre 3,7 milliards de RMB. L'entreprise a rapporté une rentabilité améliorée, soutenue par des coûts de financement historiquement bas et une meilleure qualité des actifs. Le Conseil d'administration a approuvé un ratio de distribution de dividendes porté à 25% à partir de 2025. La base d'utilisateurs s'est élargie, atteignant 223 millions d'utilisateurs enregistrés, soit une augmentation de 9,3% d'une année sur l'autre.

LexinFintech Holdings (NASDAQ: LX) hat die finanziellen Ergebnisse für das dritte Quartal 2024 bekannt gegeben, die eine gemischte Leistung zeigen. Die gesamte Kreditvergabe erreichte 51,0 Milliarden RMB, was einem Rückgang von 19,5% im Vergleich zum Vorjahr entspricht, während der ausstehende Kreditbetrag auf 111,2 Milliarden RMB gesenkt wurde. Trotz des Rückgangs des Kreditvolumens stieg der Nettogewinn im Vergleich zum Vorquartal um 36,7% auf 310 Millionen RMB. Der Gesamtbetriebserlös wuchs im Vergleich zum Vorjahr um 4,4% auf 3,7 Milliarden RMB. Das Unternehmen berichtete von einer verbesserten Rentabilität, die durch rekordniedrige Finanzierungskosten und eine bessere Asset-Qualität unterstützt wurde. Der Vorstand genehmigte eine Erhöhung der Ausschüttungsquote auf 25% ab 2025. Die Nutzerbasis erweiterte sich, da die registrierten Nutzer 223 Millionen erreichten, was einem Anstieg von 9,3% im Vergleich zum Vorjahr entspricht.

- Net profit increased 36.7% quarter-over-quarter to RMB310 million

- Total operating revenue grew 4.4% year-over-year to RMB3.7 billion

- Credit facilitation service income increased 10.6% YoY to RMB2,970 million

- Record low funding cost, with funding cost decreasing 33.4% YoY

- Increased dividend payout ratio to 25% starting 2025

- Total loan origination decreased 19.5% YoY to RMB51.0 billion

- Outstanding loan balance declined 7.8% YoY to RMB111.2 billion

- Active users decreased 11.4% YoY to 4.3 million

- GMV decreased 40.1% YoY to RMB827 million

- Net income decreased 16.5% YoY

Insights

The Q3 2024 results reveal a mixed performance for LexinFintech. While total loan originations declined by

Key positives include:

- Record low funding costs

- Improved asset quality with 90-day+ delinquency ratio stable at

3.7% - Increased dividend payout ratio to

25% starting 2025

However, challenges persist with declining loan volumes and GMV down

SHENZHEN, China, Nov. 25, 2024 (GLOBE NEWSWIRE) -- LexinFintech Holdings Ltd. (“Lexin” or the “Company”) (NASDAQ: LX), a leading technology-empowered personal financial service enabler in China, today announced its unaudited financial results for the quarter ended September 30, 2024.

“Total loan origination for the third quarter reached approximately RMB51.0 billion, remaining stable on a quarter-over-quarter basis, but reflecting a

“Improved profitability is part of a strong set of operational and financial results we delivered this quarter, demonstrating that we are well on track for a comprehensive business turnaround.”

“During the past quarter, our persistent efforts in executing transformation strategies led to a record low funding cost, gradual improvement in asset quality, and a substantial increase in new users with approved credit lines.”

“Considering the gradual business recovery, we remain committed to returning more value to shareholders. The Board has approved an amended dividend payout policy, increasing the payout ratio to

“Looking ahead, while we are cautious about the short-term economic outlook and anticipate that the recently released government stimulus measures targeting at an economic recovery will gradually take effect, we remain confident in Lexin’s ability to navigate through uncertainties and sustain the recovery momentum by delivering solid results quarter by quarter,” Concluded Mr. Xiao.

“During the past quarter, we have delivered another set of robust financial results,” said Mr. James Zheng, Chief Financial Officer of Lexin. “The third quarter's total operating revenue reached approximately RMB3.7 billion, up by

Third Quarter 2024 Operational Highlights:

User Base

- Total number of registered users reached 223 million as of September 30, 2024, representing an increase of

9.3% from 204 million as of September 30, 2023, and users with credit lines reached 44.1 million as of September 30, 2024, up by6.1% from 41.6 million as of September 30, 2023. - Number of active users1 who used our loan products in the third quarter of 2024 was 4.3 million, representing a decrease of

11.4% from 4.9 million in the third quarter of 2023. - Number of cumulative borrowers with successful drawdown was 33.1 million as of September 30, 2024, an increase of

6.9% from 30.9 million as of September 30, 2023.

Loan Facilitation Business

- As of September 30, 2024, we cumulatively originated RMB1,273.2 billion in loans, an increase of

21.2% from RMB1,050.7 billion as of September 30, 2023. - Total loan originations2 in the third quarter of 2024 was RMB51.0 billion, a decrease of

19.5% from RMB63.3 billion in the third quarter of 2023. - Total outstanding principal balance of loans3 reached RMB111 billion as of September 30, 2024, representing a decrease of

7.8% from RMB121 billion as of September 30, 2023.

Credit Performance4

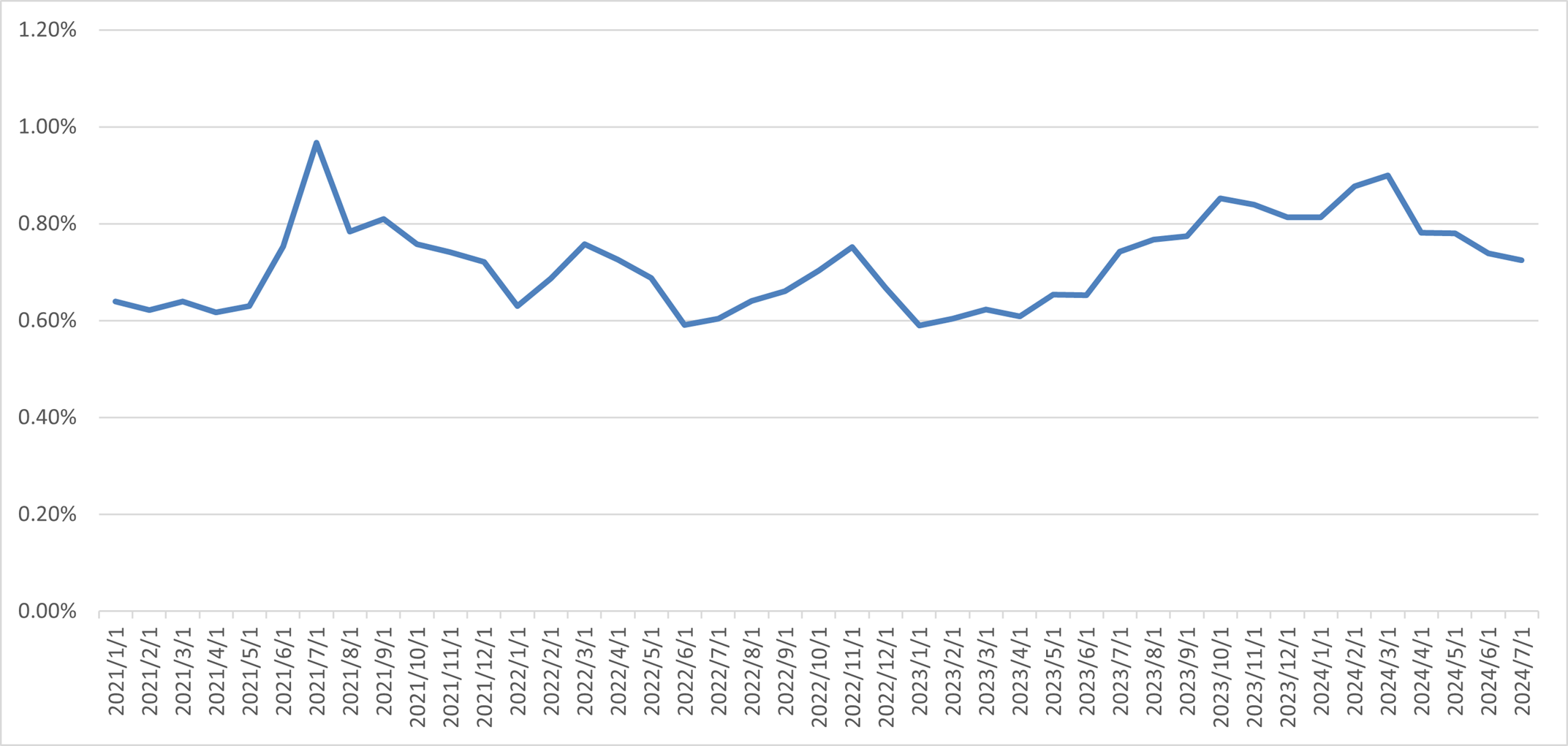

- 90 day+ delinquency ratio was

3.7% as of September 30, 2024, as compared with3.7% as of June 30, 2024. - First payment default rate (30 day+) for new loan originations was below

1% as of September 30, 2024.

Tech-empowerment Service

- For the third quarter of 2024, we served over 90 business customers with our tech-empowerment service.

- In the third quarter of 2024, the business customer retention rate5 of our tech-empowerment service was over

90% .

Installment E-commerce Platform Service

- GMV6 in the third quarter of 2024 for our installment e-commerce platform service was RMB827 million, representing a decrease of

40.1% from RMB1,381 million in the third quarter of 2023. - In the third quarter of 2024, our installment e-commerce platform service served over 240,000 users and 400 merchants.

Other Operational Highlights

- The weighted average tenor of loans originated on our platform in the third quarter of 2024 was approximately 13.2 months, as compared with 13.1 months in the third quarter of 2023.

- Repeated borrowers’ contribution7 of loans across our platform for the third quarter of 2024 was

85.5% .

Third Quarter 2024 Financial Highlights:

- Total operating revenue was RMB3,662 million, representing an increase of

4.4% from the third quarter of 2023. - Credit facilitation service income was RMB2,970 million, representing an increase of

10.6% from the third quarter of 2023. Tech-empowerment service income was RMB384 million, representing a decrease of15.5% from the third quarter of 2023. Installment e-commerce platform service income was RMB308 million, representing a decrease of16.6% from the third quarter of 2023. - Net income attributable to ordinary shareholders of the Company was RMB310 million, representing a decrease of

16.5% from the third quarter of 2023. Net income per ADS attributable to ordinary shareholders of the Company was RMB1.84 on a fully diluted basis. - Adjusted net income attributable to ordinary shareholders of the Company8 was RMB333 million, representing a decrease of

20.2% from the third quarter of 2023. Adjusted net income per ADS attributable to ordinary shareholders of the Company8 was RMB1.98 on a fully diluted basis.

__________________________

- Active users refer to, for a specified period, users who made at least one transaction during that period through our platform or through our third-party partners’ platforms using the credit line granted by us.

- Total loan originations refer to the total principal amount of loans facilitated and originated during the given period.

- Total outstanding principal balance of loans refers to the total amount of principal outstanding for loans facilitated and originated at the end of each period, excluding loans delinquent for more than 180 days.

- Loans under Intelligent Credit Platform are excluded from the calculation of credit performance. Intelligent Credit Platform (ICP) is an intelligent platform on our “Fenqile” app, under which we match borrowers and financial institutions through big data and cloud computing technology. For loans facilitated through ICP, the Company does not bear principal risk.

- Customer retention rate refers to the number of financial institution customers and partners who repurchase our service in the current quarter as a percentage of the total number of financial institution customers and partners in the preceding quarter.

- GMV refers to the total value of transactions completed for products purchased on our e-commerce and Maiya channel, net of returns.

- Repeated borrowers’ contribution for a given period refers to the principal amount of loans borrowed during that period by borrowers who had previously made at least one successful drawdown as a percentage of the total loan facilitation and origination volume through our platform during that period.

- Adjusted net income attributable to ordinary shareholders of the Company, adjusted net income per ordinary share and per ADS attributable to ordinary shareholders of the Company are non-GAAP financial measures. For more information on non-GAAP financial measures, please see the section of “Use of Non-GAAP Financial Measures Statement” and the tables captioned “Unaudited Reconciliations of GAAP and Non-GAAP Results” set forth at the end of this press release.

Third Quarter 2024 Financial Results:

Operating revenue increased by

Credit facilitation service income increased by

Loan facilitation and servicing fees-credit oriented increased by

Guarantee income decreased by

Financing income decreased by

Tech-empowerment service income decreased by

Installment e-commerce platform service income decreased by

Cost of sales decreased by

Funding cost decreased by

Processing and servicing costs increased by

Provision for financing receivables was RMB261 million for the third quarter of 2024, as compared to RMB162 million for the third quarter of 2023. The lifetime expected credit losses recognized was estimated based on the most recent performance in relation to the Company's on-balance sheet loans, taking into consideration the forward-looking factors.

Provision for contract assets and receivables was RMB244 million in the third quarter of 2024, as compared to RMB159 million in the third quarter of 2023. The increase was primarily due to the increase in loan facilitation and servicing fees.

Provision for contingent guarantee liabilities was RMB952 million in the third quarter of 2024, as compared to RMB894 million in the third quarter of 2023. The fluctuation was primarily due to the re-measurement of the expected loss rates and the origination of the off-balance sheet loans funded by certain institutional funding partners, which are accounted for under ASC 460, Guarantees.

Gross profit decreased by

Sales and marketing expenses was RMB438 million in the third quarter of 2024, as compared to RMB411 million in the third quarter of 2023. The increase was primarily due to increased investment in marketing.

Research and development expenses was RMB149 million in the third quarter of 2024, as compared to RMB127 million in the third quarter of 2023. The increase was primarily due to increased investment in technology development.

General and administrative expenses was RMB89.0 million in the third quarter of 2024, as compared to RMB85.5 million in the third quarter of 2023.

Change in fair value of financial guarantee derivatives and loans at fair value was a loss of RMB151 million in the third quarter of 2024, as compared to a loss of RMB246 million in the third quarter of 2023. The change in fair value was primarily due to the re-measurement of the expected loss rates, partially offset by the fair value gains realized as a result of the release of guarantee obligation.

Income tax expense was RMB72.2 million in the third quarter of 2024, as compared to RMB116 million in the third quarter of 2023. The change was primarily due to the decrease of income before income tax expense.

Net income decreased by

Recent Development

Amended Dividend Policy

The board of directors of the Company has approved an amended dividend payout policy, under which the payout ratio will be increased to

Conference Call

The Company’s management will host an earnings conference call at 9:00 PM U.S. Eastern time on November 25, 2024 (10:00 AM Beijing/Hong Kong time on November 26, 2024).

Participants who wish to join the conference call should register online at:

https://register.vevent.com/register/BI220a892f574848f0b2997fb493e6296f

Once registration is completed, each participant will receive the dial-in number and a unique access PIN for the conference call.

Participants joining the conference call should dial in at least 10 minutes before the scheduled start time.

A live and archived webcast of the conference call will also be available at the Company's investor relations website at http://ir.lexin.com.

About LexinFintech Holdings Ltd.

We are a leading credit technology-empowered personal financial service enabler. Our mission is to use technology and risk management expertise to make financing more accessible for young generation consumers. We strive to achieve this mission by connecting consumers with financial institutions, where we facilitate through a unique model that includes online and offline channels, installment consumption platform, big data and AI driven credit risk management capabilities, as well as smart user and loan management systems. We also empower financial institutions by providing cutting-edge proprietary technology solutions to meet their needs of financial digital transformation.

For more information, please visit http://ir.lexin.com.

To follow us on Twitter, please go to: https://twitter.com/LexinFintech.

Use of Non-GAAP Financial Measures Statement

In evaluating our business, we consider and use adjusted net income attributable to ordinary shareholders of the Company, non-GAAP EBIT, adjusted net income per ordinary share and per ADS attributable to ordinary shareholders of the Company, four non-GAAP measures, as supplemental measures to review and assess our operating performance. The presentation of the non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with U.S. GAAP. We define adjusted net income attributable to ordinary shareholders of the Company as net income attributable to ordinary shareholders of the Company excluding share-based compensation expenses, interest expense associated with convertible notes, and investment income/(loss) and we define non-GAAP EBIT as net income excluding income tax expense, share-based compensation expenses, interest expense, net, and investment income/(loss).

We present these non-GAAP financial measures because they are used by our management to evaluate our operating performance and formulate business plans. Adjusted net income attributable to ordinary shareholders of the Company enables our management to assess our operating results without considering the impact of share-based compensation expenses, interest expense associated with convertible notes, and investment income/(loss). Non-GAAP EBIT, on the other hand, enables our management to assess our operating results without considering the impact of income tax expense, share-based compensation expenses, interest expense, net, and investment income/(loss). We also believe that the use of these non-GAAP financial measures facilitates investors’ assessment of our operating performance. These non-GAAP financial measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP.

These non-GAAP financial measures have limitations as an analytical tool. One of the key limitations of using adjusted net income attributable to ordinary shareholders of the Company and non-GAAP EBIT is that they do not reflect all items of income and expense that affect our operations. Share-based compensation expenses, interest expense associated with convertible notes, income tax expense, interest expense, net, and investment income/(loss) have been and may continue to be incurred in our business and are not reflected in the presentation of adjusted net income attributable to ordinary shareholders of the Company and non-GAAP EBIT. Further, these non-GAAP financial measures may differ from the non-GAAP financial information used by other companies, including peer companies, and therefore their comparability may be limited.

We compensate for these limitations by reconciling each of the non-GAAP financial measures to the most directly comparable U.S. GAAP financial measure, which should be considered when evaluating our performance. We encourage you to review our financial information in its entirety and not rely on a single financial measure.

Exchange Rate Information Statement

This announcement contains translations of certain RMB amounts into U.S. dollars (“US$”) at specified rates solely for the convenience of the reader. Unless otherwise stated, all translations from RMB to US$ were made at the rate of RMB7.0176 to US

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. Statements that are not historical facts, including statements about Lexin’s beliefs and expectations, are forward-looking statements. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” “confident” and similar statements. Among other things, the expectation of the collection efficiency and delinquency, business outlook and quotations from management in this announcement, contain forward-looking statements. Lexin may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”), in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: Lexin’s goal and strategies; Lexin’s expansion plans; Lexin’s future business development, financial condition and results of operations; Lexin’s expectation regarding demand for, and market acceptance of, its credit and investment management products; Lexin’s expectations regarding keeping and strengthening its relationship with borrowers, institutional funding partners, merchandise suppliers and other parties it collaborates with; general economic and business conditions; and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in Lexin’s filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release, and Lexin does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor and media inquiries, please contact:

LexinFintech Holdings Ltd.

IR inquiries:

Mandy Dong

Tel: +86 (755) 3637-8888 ext. 6258

E-mail: Mandydong@lexin.com

Media inquiries:

Ruifeng Xu

Tel: +86 (755) 3637-8888 ext. 6993

E-mail: media@lexin.com

SOURCE LexinFintech Holdings Ltd.

| LexinFintech Holdings Ltd. Unaudited Condensed Consolidated Balance Sheets | |||||||||

| As of | |||||||||

| (In thousands) | December 31, 2023 | September 30, 2024 | |||||||

| RMB | RMB | US$ | |||||||

| ASSETS | |||||||||

| Current Assets | |||||||||

| Cash and cash equivalents | 2,624,719 | 2,153,594 | 306,885 | ||||||

| Restricted cash | 1,433,502 | 1,431,783 | 204,027 | ||||||

| Restricted term deposit and short-term investments | 305,182 | 266,512 | 37,978 | ||||||

| Short-term financing receivables, net(1) | 3,944,000 | 3,963,912 | 564,853 | ||||||

| Short-term contract assets and receivables, net(1) | 6,112,981 | 6,613,308 | 942,389 | ||||||

| Deposits to insurance companies and guarantee companies | 2,613,271 | 2,330,314 | 332,067 | ||||||

| Prepayments and other current assets | 1,428,769 | 1,416,024 | 201,783 | ||||||

| Amounts due from related parties | 6,989 | 11,067 | 1,577 | ||||||

| Inventories, net | 33,605 | 48,396 | 6,896 | ||||||

| Total Current Assets | 18,503,018 | 18,234,910 | 2,598,455 | ||||||

| Non-current Assets | |||||||||

| Restricted cash | 144,948 | 106,930 | 15,237 | ||||||

| Long-term financing receivables, net(1) | 200,514 | 132,946 | 18,945 | ||||||

| Long-term contract assets and receivables, net(1) | 599,818 | 404,798 | 57,683 | ||||||

| Property, equipment and software, net | 446,640 | 578,874 | 82,489 | ||||||

| Land use rights, net | 897,267 | 871,467 | 124,183 | ||||||

| Long‑term investments | 255,003 | 252,833 | 36,028 | ||||||

| Deferred tax assets | 1,232,092 | 1,374,393 | 195,849 | ||||||

| Other assets | 861,491 | 567,915 | 80,929 | ||||||

| Total Non-current Assets | 4,637,773 | 4,290,156 | 611,343 | ||||||

| TOTAL ASSETS | 23,140,791 | 22,525,066 | 3,209,798 | ||||||

| LIABILITIES | |||||||||

| Current liabilities | |||||||||

| Accounts payable | 49,801 | 32,215 | 4,591 | ||||||

| Amounts due to related parties | 2,958 | 12,358 | 1,761 | ||||||

| Short‑term borrowings | 502,013 | 552,589 | 78,743 | ||||||

| Short‑term funding debts | 3,483,196 | 2,972,938 | 423,640 | ||||||

| Deferred guarantee income | 1,538,385 | 1,135,911 | 161,866 | ||||||

| Contingent guarantee liabilities | 1,808,540 | 1,268,803 | 180,803 | ||||||

| Accruals and other current liabilities | 4,434,254 | 4,978,006 | 709,360 | ||||||

| Convertible notes | 505,450 | - | - | ||||||

| Total Current Liabilities | 12,324,597 | 10,952,820 | 1,560,764 | ||||||

| Non-current Liabilities | |||||||||

| Long-term borrowings | 524,270 | 585,024 | 83,365 | ||||||

| Long‑term funding debts | 455,800 | 444,750 | 63,376 | ||||||

| Deferred tax liabilities | 75,340 | 79,445 | 11,321 | ||||||

| Other long-term liabilities | 50,702 | 38,964 | 5,553 | ||||||

| Total Non-current Liabilities | 1,106,112 | 1,148,183 | 163,615 | ||||||

| TOTAL LIABILITIES | 13,430,709 | 12,101,003 | 1,724,379 | ||||||

| Shareholders’ equity: | |||||||||

| Class A Ordinary Shares | 199 | 201 | 30 | ||||||

| Class B Ordinary Shares | 41 | 41 | 7 | ||||||

| Treasury stock | (328,764 | ) | (328,764 | ) | (46,848 | ) | |||

| Additional paid-in capital | 3,204,961 | 3,276,302 | 466,869 | ||||||

| Statutory reserves | 1,106,579 | 1,106,579 | 157,686 | ||||||

| Accumulated other comprehensive income | (13,545 | ) | (30,201 | ) | (4,304 | ) | |||

| Retained earnings | 5,740,611 | 6,399,905 | 911,979 | ||||||

| Total shareholders’ equity | 9,710,082 | 10,424,063 | 1,485,419 | ||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | 23,140,791 | 22,525,066 | 3,209,798 | ||||||

__________________________

(1) Short-term financing receivables, net of allowance for credit losses of RMB58,594 and RMB123,569 as of December 31, 2023 and September 30, 2024, respectively.

Short-term contract assets and receivables, net of allowance for credit losses of RMB436,136 and RMB462,438 as of December 31, 2023 and September 30, 2024, respectively.

Long-term financing receivables, net of allowance for credit losses of RMB3,087 and RMB1,848 as of December 31, 2023 and September 30, 2024, respectively.

Long-term contract assets and receivables, net of allowance for credit losses of RMB61,838 and RMB35,497 as of December 31, 2023 and September 30, 2024, respectively.

| LexinFintech Holdings Ltd. Unaudited Condensed Consolidated Statements of Operations | |||||||||||||||||||

| For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||||||

| (In thousands, except for share and per share data) | 2023 | 2024 | 2023 | 2024 | |||||||||||||||

| RMB | RMB | US$ | RMB | RMB | US$ | ||||||||||||||

| Operating revenue: | |||||||||||||||||||

| Credit facilitation service income | 2,685,574 | 2,970,294 | 423,264 | 6,939,100 | 8,287,865 | 1,181,011 | |||||||||||||

| Loan facilitation and servicing fees-credit oriented | 1,533,203 | 1,850,850 | 263,744 | 3,443,293 | 4,701,514 | 669,960 | |||||||||||||

| Guarantee income | 638,595 | 620,117 | 88,366 | 1,809,862 | 2,086,656 | 297,346 | |||||||||||||

| Financing income | 513,776 | 499,327 | 71,154 | 1,685,945 | 1,499,695 | 213,705 | |||||||||||||

| Tech-empowerment service income | 453,944 | 383,592 | 54,661 | 1,213,571 | 1,279,683 | 182,353 | |||||||||||||

| Installment e-commerce platform service income | 369,417 | 308,257 | 43,926 | 1,394,975 | 977,213 | 139,252 | |||||||||||||

| Total operating revenue | 3,508,935 | 3,662,143 | 521,851 | 9,547,646 | 10,544,761 | 1,502,616 | |||||||||||||

| Operating cost | |||||||||||||||||||

| Cost of sales | (359,683 | ) | (308,097 | ) | (43,903 | ) | (1,291,547 | ) | (966,777 | ) | (137,765 | ) | |||||||

| Funding cost | (131,640 | ) | (87,717 | ) | (12,500 | ) | (437,674 | ) | (268,980 | ) | (38,329 | ) | |||||||

| Processing and servicing cost | (445,845 | ) | (602,362 | ) | (85,836 | ) | (1,420,946 | ) | (1,708,785 | ) | (243,500 | ) | |||||||

| Provision for financing receivables | (161,807 | ) | (261,126 | ) | (37,210 | ) | (446,586 | ) | (568,783 | ) | (81,051 | ) | |||||||

| Provision for contract assets and receivables | (159,443 | ) | (243,725 | ) | (34,731 | ) | (426,631 | ) | (564,445 | ) | (80,433 | ) | |||||||

| Provision for contingent guarantee liabilities | (894,174 | ) | (951,738 | ) | (135,622 | ) | (2,269,269 | ) | (2,714,808 | ) | (386,857 | ) | |||||||

| Total operating cost | (2,152,592 | ) | (2,454,765 | ) | (349,802 | ) | (6,292,653 | ) | (6,792,578 | ) | (967,935 | ) | |||||||

| Gross profit | 1,356,343 | 1,207,378 | 172,049 | 3,254,993 | 3,752,183 | 534,681 | |||||||||||||

| Operating expenses: | |||||||||||||||||||

| Sales and marketing expenses | (410,651 | ) | (437,996 | ) | (62,414 | ) | (1,303,728 | ) | (1,323,036 | ) | (188,531 | ) | |||||||

| Research and development expenses | (126,582 | ) | (148,930 | ) | (21,222 | ) | (377,447 | ) | (427,162 | ) | (60,870 | ) | |||||||

| General and administrative expenses | (85,526 | ) | (88,952 | ) | (12,676 | ) | (279,082 | ) | (279,146 | ) | (39,778 | ) | |||||||

| Total operating expenses | (622,759 | ) | (675,878 | ) | (96,312 | ) | (1,960,257 | ) | (2,029,344 | ) | (289,179 | ) | |||||||

| Change in fair value of financial guarantee derivatives and loans at fair value | (245,568 | ) | (151,431 | ) | (21,579 | ) | 41,158 | (835,615 | ) | (119,074 | ) | ||||||||

| Interest expense, net | (14,354 | ) | (4,531 | ) | (646 | ) | (40,238 | ) | (6,447 | ) | (919 | ) | |||||||

| Investment loss | (568 | ) | (2,224 | ) | (317 | ) | (1,107 | ) | (1,874 | ) | (267 | ) | |||||||

| Others, net | 13,010 | 8,406 | 1,198 | 29,866 | 44,434 | 6,332 | |||||||||||||

| Income before income tax expense | 486,104 | 381,720 | 54,393 | 1,324,415 | 923,337 | 131,574 | |||||||||||||

| Income tax expense | (115,479 | ) | (72,163 | ) | (10,283 | ) | (270,567 | ) | (185,626 | ) | (26,451 | ) | |||||||

| Net income | 370,625 | 309,557 | 44,110 | 1,053,848 | 737,711 | 105,123 | |||||||||||||

| Net income attributable to ordinary shareholders of the Company | 370,625 | 309,557 | 44,110 | 1,053,848 | 737,711 | 105,123 | |||||||||||||

| Net income per ordinary share attributable to ordinary shareholders of the Company | |||||||||||||||||||

| Basic | 1.13 | 0.93 | 0.13 | 3.21 | 2.23 | 0.32 | |||||||||||||

| Diluted | 1.10 | 0.92 | 0.13 | 3.06 | 2.22 | 0.32 | |||||||||||||

| Net income per ADS attributable to ordinary shareholders of the Company | |||||||||||||||||||

| Basic | 2.25 | 1.87 | 0.27 | 6.42 | 4.46 | 0.64 | |||||||||||||

| Diluted | 2.20 | 1.84 | 0.26 | 6.12 | 4.44 | 0.63 | |||||||||||||

| Weighted average ordinary shares outstanding | |||||||||||||||||||

| Basic | 328,993,585 | 331,356,003 | 331,356,003 | 328,524,266 | 330,806,594 | 330,806,594 | |||||||||||||

| Diluted | 355,221,352 | 336,606,267 | 336,606,267 | 364,767,295 | 335,151,610 | 335,151,610 | |||||||||||||

| LexinFintech Holdings Ltd. Unaudited Condensed Consolidated Statements of Comprehensive Income | |||||||||||||||||||

| For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||||||

| (In thousands) | 2023 | 2024 | 2023 | 2024 | |||||||||||||||

| RMB | RMB | US$ | RMB | RMB | US$ | ||||||||||||||

| Net income | 370,625 | 309,557 | 44,110 | 1,053,848 | 737,711 | 105,123 | |||||||||||||

| Other comprehensive income | |||||||||||||||||||

| Foreign currency translation adjustment, net of nil tax | 38 | (5,424 | ) | (773 | ) | (20,544 | ) | (16,655 | ) | (2,373 | ) | ||||||||

| Total comprehensive income | 370,663 | 304,133 | 43,337 | 1,033,304 | 721,056 | 102,750 | |||||||||||||

| Total comprehensive income attributable to ordinary shareholders of the Company | 370,663 | 304,133 | 43,337 | 1,033,304 | 721,056 | 102,750 | |||||||||||||

| LexinFintech Holdings Ltd. Unaudited Reconciliations of GAAP and Non-GAAP Results | |||||||||||||||||||

| For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||||||

| (In thousands, except for share and per share data) | 2023 | 2024 | 2023 | 2024 | |||||||||||||||

| RMB | RMB | US$ | RMB | RMB | US$ | ||||||||||||||

| Reconciliation of Adjusted net income attributable to ordinary shareholders of the Company to Net income attributable to ordinary shareholders of the Company | |||||||||||||||||||

| Net income attributable to ordinary shareholders of the Company | 370,625 | 309,557 | 44,110 | 1,053,848 | 737,711 | 105,123 | |||||||||||||

| Add: Share-based compensation expenses | 26,237 | 20,986 | 2,990 | 84,893 | 67,379 | 9,601 | |||||||||||||

| Interest expense associated with convertible notes | 19,791 | - | - | 61,864 | 5,695 | 812 | |||||||||||||

| Investment loss | 568 | 2,224 | 317 | 1,107 | 1,874 | 267 | |||||||||||||

| Adjusted net income attributable to ordinary shareholders of the Company | 417,221 | 332,767 | 47,417 | 1,201,712 | 812,659 | 115,803 | |||||||||||||

| Adjusted net income per ordinary share attributable to ordinary shareholders of the Company | |||||||||||||||||||

| Basic | 1.27 | 1.00 | 0.14 | 3.66 | 2.46 | 0.35 | |||||||||||||

| Diluted | 1.17 | 0.99 | 0.14 | 3.29 | 2.42 | 0.35 | |||||||||||||

| Adjusted net income per ADS attributable to ordinary shareholders of the Company | |||||||||||||||||||

| Basic | 2.54 | 2.01 | 0.29 | 7.32 | 4.91 | 0.70 | |||||||||||||

| Diluted | 2.35 | 1.98 | 0.28 | 6.59 | 4.85 | 0.69 | |||||||||||||

| Weighted average shares used in calculating net income per ordinary share for non-GAAP EPS | |||||||||||||||||||

| Basic | 328,993,585 | 331,356,003 | 331,356,003 | 328,524,266 | 330,806,594 | 330,806,594 | |||||||||||||

| Diluted | 355,221,352 | 336,606,267 | 336,606,267 | 364,767,295 | 335,151,610 | 335,151,610 | |||||||||||||

| Reconciliations of Non-GAAP EBIT to Net income | |||||||||||||||||||

| Net income | 370,625 | 309,557 | 44,110 | 1,053,848 | 737,711 | 105,123 | |||||||||||||

| Add: Income tax expense | 115,479 | 72,163 | 10,283 | 270,567 | 185,626 | 26,451 | |||||||||||||

| Share-based compensation expenses | 26,237 | 20,986 | 2,990 | 84,893 | 67,379 | 9,601 | |||||||||||||

| Interest expense, net | 14,354 | 4,531 | 646 | 40,238 | 6,447 | 919 | |||||||||||||

| Investment loss | 568 | 2,224 | 317 | 1,107 | 1,874 | 267 | |||||||||||||

| Non-GAAP EBIT | 527,263 | 409,461 | 58,346 | 1,450,653 | 999,037 | 142,361 | |||||||||||||

Additional Credit Information

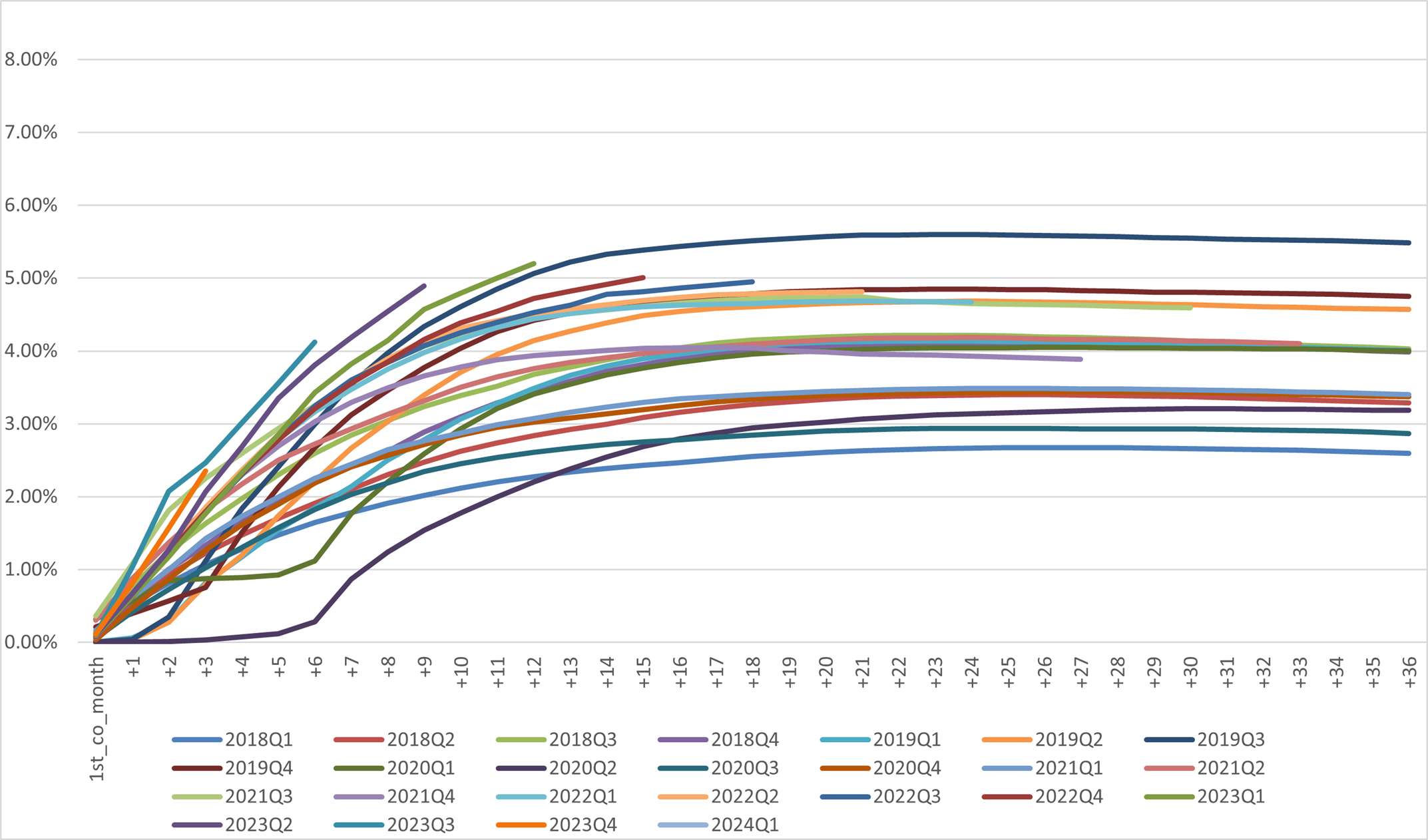

Vintage Charge Off Curve1

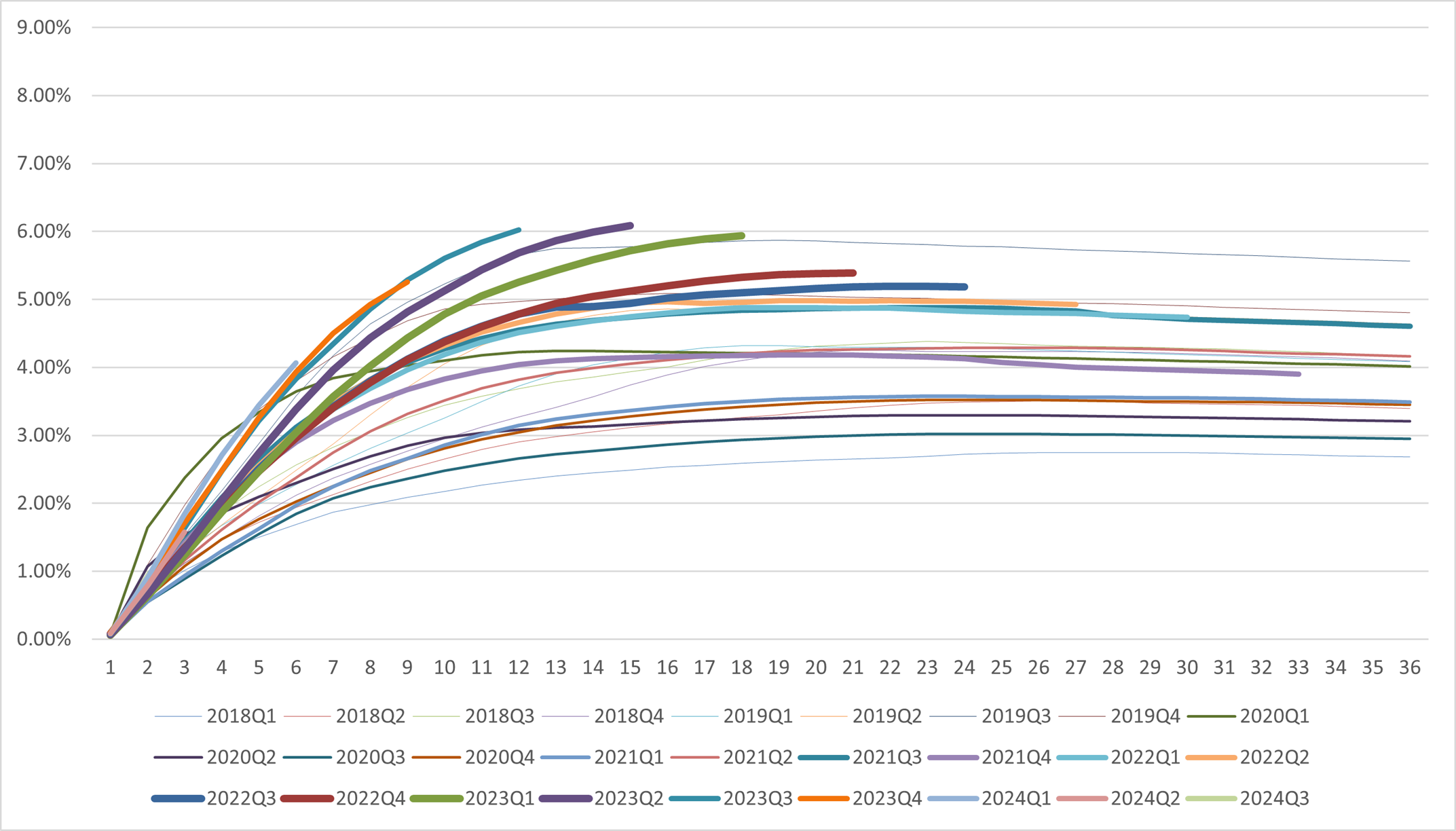

Dpd30+/GMV by Performance Windows1

First Payment Default 30+1

1. Loans facilitated under ICP are excluded from the chart.