Lithium Ionic Announces Feasibility Study Results for the Bandeira Lithium Project, Minas Gerais, Brazil

Lithium Ionic has released the Feasibility Study results for their Bandeira Lithium Project in Minas Gerais, Brazil. The project is set to produce 178,000 tonnes per annum (tpa) of spodumene concentrate with a 14-year mine life. The study reveals strong project economics, with an after-tax NPV8 of $1.3 billion and an IRR of 40%. Operating costs are forecasted at $444 per tonne. Capital expenditure is estimated at $266 million, with a payback period of 3.4 years.

The project will feature underground mining and responsible tailings management, minimizing environmental impact. Estimated local economic contributions include $915 million in taxes and a peak workforce of 870. Construction permits are on track, with approvals expected by Q3 2024. The study confirms the company's path to becoming a near-term lithium producer, with opportunities for further optimization and regional growth.

- 178,000tpa spodumene concentrate production.

- 14-year mine life.

- After-tax NPV8 of $1.3 billion.

- 40% IRR after-tax.

- All-in operating costs of $444/t.

- Total CAPEX of $266 million with 3.4 years payback.

- Minimal land-use footprint with underground mining.

- Responsible tailings management reducing water usage.

- $915 million in estimated taxes payable.

- 870 peak local workforce.

- $677 million in local procurement.

- Approval for construction permits expected by Q3 2024.

- Excellent local infrastructure and logistics.

- Initial capital expenditure of $266 million.

- Operating costs depend on spodumene concentrate price, which may fluctuate.

- Sensitivity analysis reveals strong project dependence on lithium prices.

- Conservative spodumene price forecast results in longer payback period.

- 178,000tpa of spodumene concentrate production (

5.5% Li2O) - 14-year mine life

- After-tax NPV8 of US

$1.3B ; IRR of40% - All-in operating costs of

$444 /t SC5.5

*All amounts expressed in U.S. dollars unless otherwise noted

TORONTO, May 29, 2024 (GLOBE NEWSWIRE) -- Lithium Ionic Corp. (TSXV: LTH; OTCQX: LTHCF; FSE: H3N) (“Lithium Ionic” or the “Company”) is pleased to announce the results of a Feasibility Study (“FS” or “Study”) for its

Highlights of the Feasibility Study for the Bandeira Project:

- Mine Life & Production: 14-year underground mining operation producing an average of 178,000t of high-quality spodumene concentrate grading

5.5% Li2O (“SC5.5”). - Strong Project Economics: After-tax net present value (“NPV8%”) of US

$1.3 billion and after-tax internal rate of return (“IRR”) of40% at average SC5.5 price of$2,277 /t. - Industry-leading Operating Costs: All-in LOM OPEX of

$444 /t of SC5.5 - Low Capital Intensity: Total capital expenditure (“CAPEX”) of US

$266 million (including a15% contingency) with after-tax payback of 3.4 years. LOM sustaining costs of US$ 81 million . - Minimal Land-use Footprint: The development plan contemplates an underground mining operation with a simple processing circuit to optimize recoveries while minimizing the impact on the environment and local communities.

- Responsible Tailings Management: For safety and environmental reasons, the mine will utilize dry stacking waste disposal, which among other benefits will reduce water usage and facilitating site rehabilitation.

- Local Social & Economic Contributions: Total estimated taxes payable of

$915 million , a peak local workforce of ~870 direct employees, and an estimated$677 million procuring goods and services within Brazil over the life of mine. - Construction Permits on Track for mid-2024: The LAC license application submitted in November is currently under review by the state agency. Approval is expected in early Q3 2024.

Blake Hylands, P.Geo., Chief Executive Officer of Lithium Ionic, commented, “This study marks an important developmental milestone, confirming the strong results from our PEA in late 2023 and solidifying our path to becoming a near-term lithium producer. Furthermore, it outlines the significant positive impacts Bandeira will have through employment, tax contributions, and local procurement. While we are very pleased with the results of the study, the Company intends to move project engineering forward to the basic engineering phase where a value-add process will take place to further optimize and streamline capital and operating costs. Several opportunities identified in the feasibility stage will be subjected to trade-off studies, prior to entering the detailed engineering phase to ensure the project value and operational efficiencies are maximized. We look forward to continuing to rapidly advance Bandeira towards production, recognizing that this will deliver the most value to our shareholder, however we are very excited by the growth opportunities and development potential at our other regional properties which could present significant future scale opportunities for the Company.”

Bandeira Definitive Feasibility Study Results

The Feasibility Study for the Bandeira Project, completed by Atkins Réalis (formerly SNC Lavalin), is the culmination of over 12 months of comprehensive work involving the expertise of all engineering disciplines as well as market studies. This includes detailed planning for the mine, process design, plant layout, infrastructure, and product logistics. The study supports a robust project with strong economic viability, featuring a minimal footprint underground mine, an efficient and straightforward processing circuit, and a safe, sustainable dry stack tailings facility. The FS builds on and confirms the strong results from the Preliminary Economic Assessment (“PEA”) completed in October 2023.

Table 1. Bandeira FS – Summary of Key Results and Assumptions

| Project Economics | |

| Post - Tax NPV8 | |

| Post - Tax IRR | |

| Pre - Tax NPV8 | |

| Pre - Tax IRR | |

| Annual Revenue – LOM Average | |

| Average Annual After-Tax Free Cash Flow (after repayment of initial capital, years 4-14) | |

| Payback | 41 months |

| Production Profile | |

| Total Project Life (LOM) | 14 years |

| Total LOM production (ore mined) | 17.2 Mt |

| Total SC5.5 production (LOM) | 2,493 kt (338.3 kt LCE) |

| Nominal Plant Capacity | 1.30 Mtpa |

| Average plant throughput | 1.23 Mtpa |

| Run-of-Mine grade, Li2O (mine diluted) | |

| Average Annual Production of Spodumene Concentrate @ | 178 ktpa (24.2 ktpa LCE) |

| Metallurgical Recovery (SC5. | |

| CAPEX & OPEX | |

| Initial Capital Costs | |

| Sustaining CAPEX | |

| Operating costs (FOB / t SC5.5) | |

| Economic Assumptions & Parameters | |

| Spodumene Concentrate Price ( | |

| Exchange rate (USD:BRL) | |

| Discount Rate | |

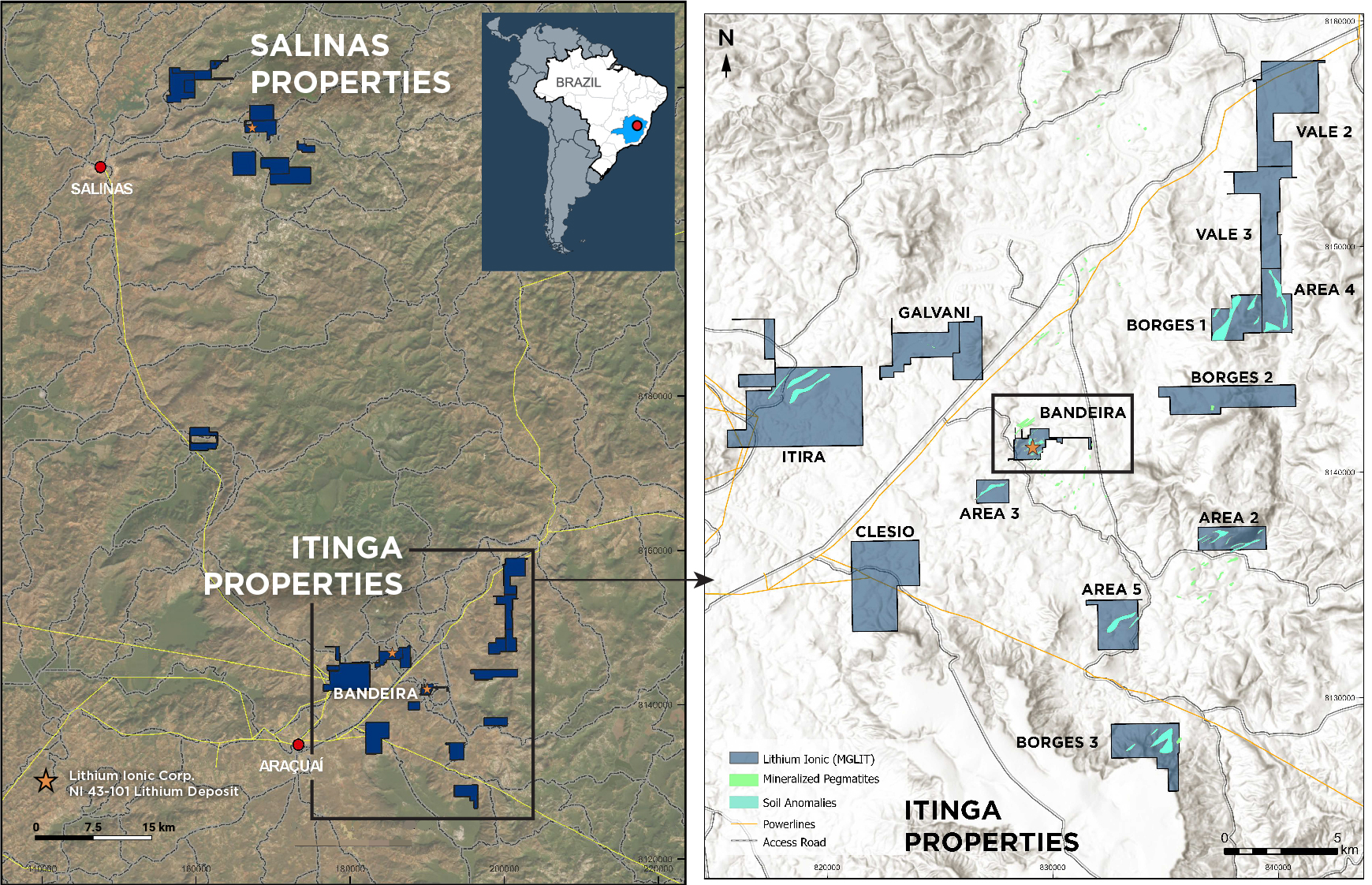

Project Location and Infrastructure

The Bandeira property covers 157 hectares, representing only approximately

The Bandeira site is well-connected via major highways, facilitating the transport of materials and personnel. The project site is approximately 570 kilometers from the port of Ilhéus in Bahia, which serves as a key logistical point for exporting lithium concentrate to international markets, including Shanghai, China. The proximity to Araçuaí provides access to essential services and amenities, enhancing operational efficiency.

A key infrastructure component for the Bandeira Project was secured in October 2023 through an agreement with Cemig Distribuição S.A. (“Cemig”). This agreement facilitates the construction and electrification of essential power infrastructure, including three kilometers of new transmission lines and a new substation adjacent to the future Bandeira mine and will ensure that the Project will be powered by low-cost, renewable hydroelectric power, aligning with the Company’s commitment to operating sustainably.

Figure 1. Bandeira Project Location

View Figure 1 here:

https://www.globenewswire.com/NewsRoom/AttachmentNg/292fd9e3-464e-4594-9846-0b8d3bc160f1

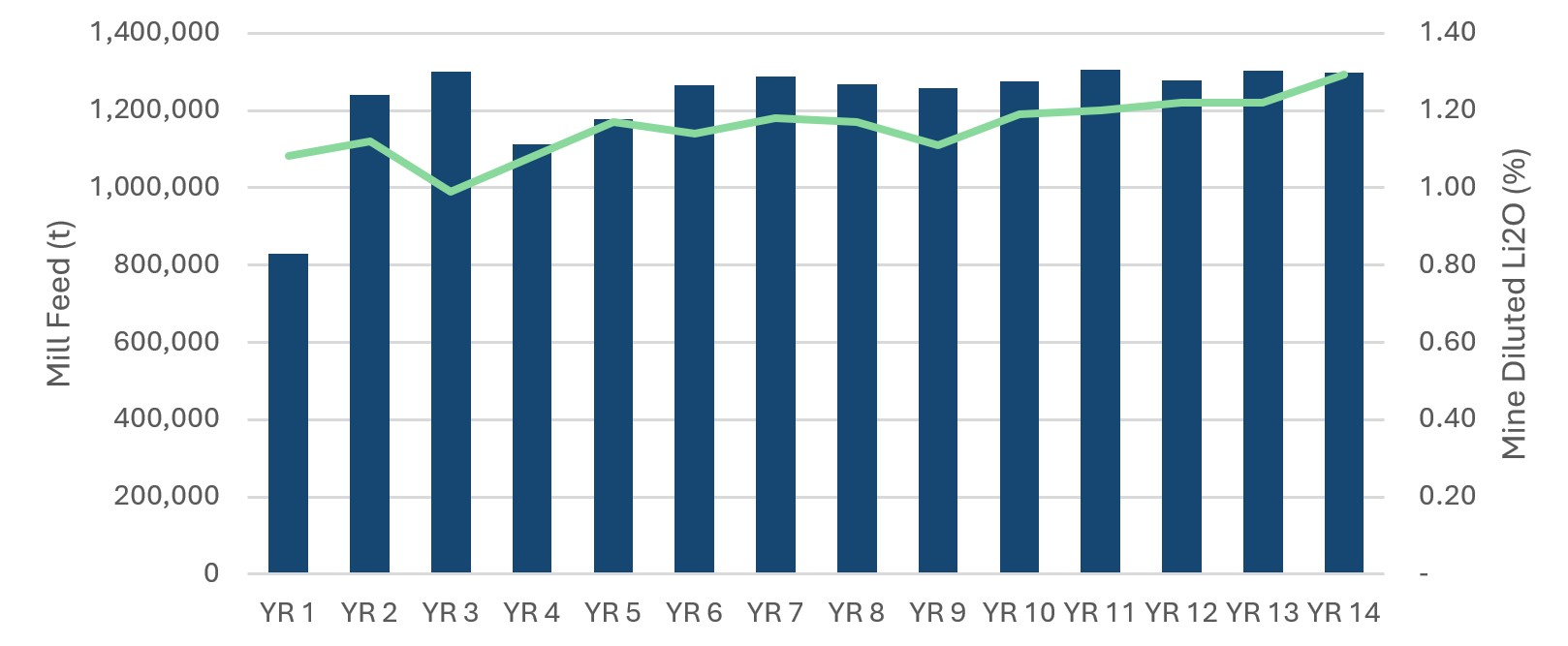

Mining Operations

The Bandeira project is designed to incorporate dual underground mining operations, ensuring efficient extraction of its deposits. The primary orebodies, representing approximately

Figure 2. ROM to Plant Feed and Li2O grade, %

View Figure 2 here:

https://www.globenewswire.com/NewsRoom/AttachmentNg/c62c719b-e95c-43cb-a87a-d81498287171

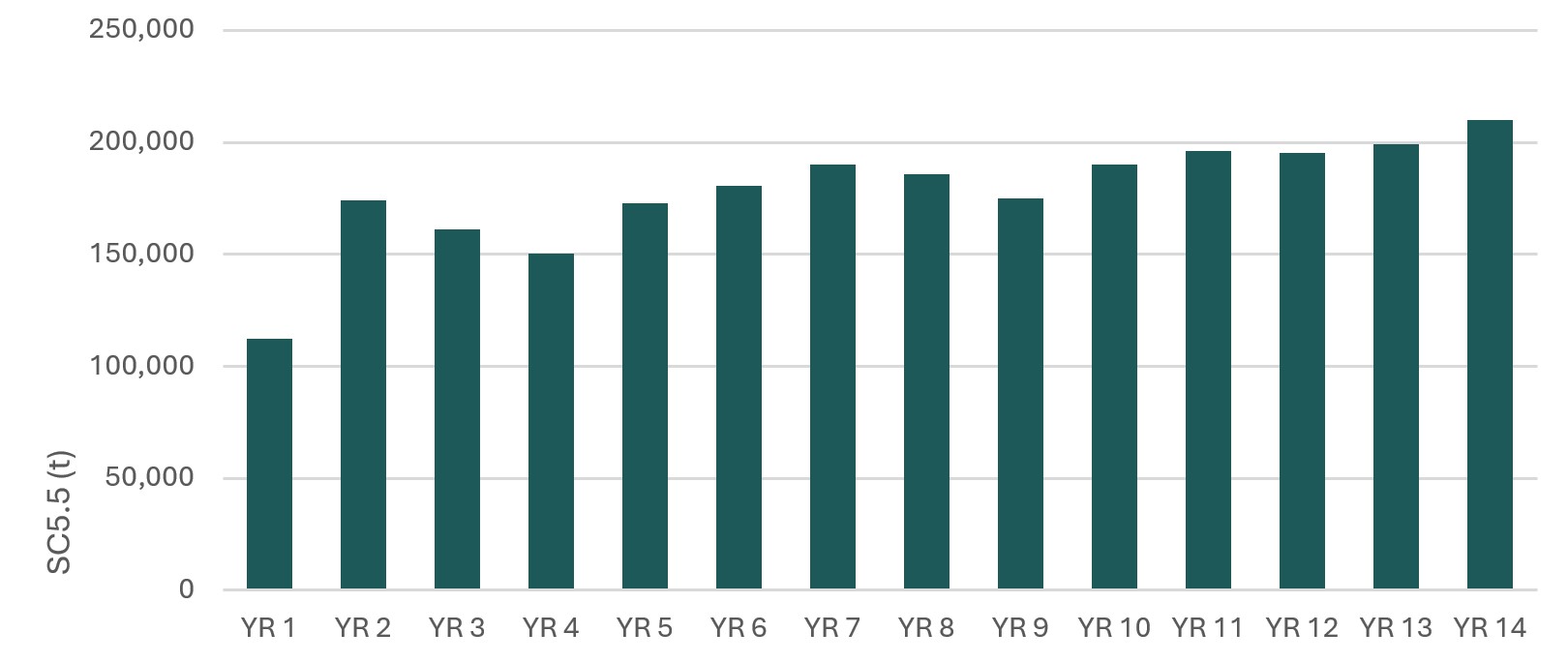

Figure 3. Annual Production of Spodumene Concentrate grading

View Figure 3 here:

https://www.globenewswire.com/NewsRoom/AttachmentNg/6e174968-c2e0-43ba-8bc2-0bebba4af38b

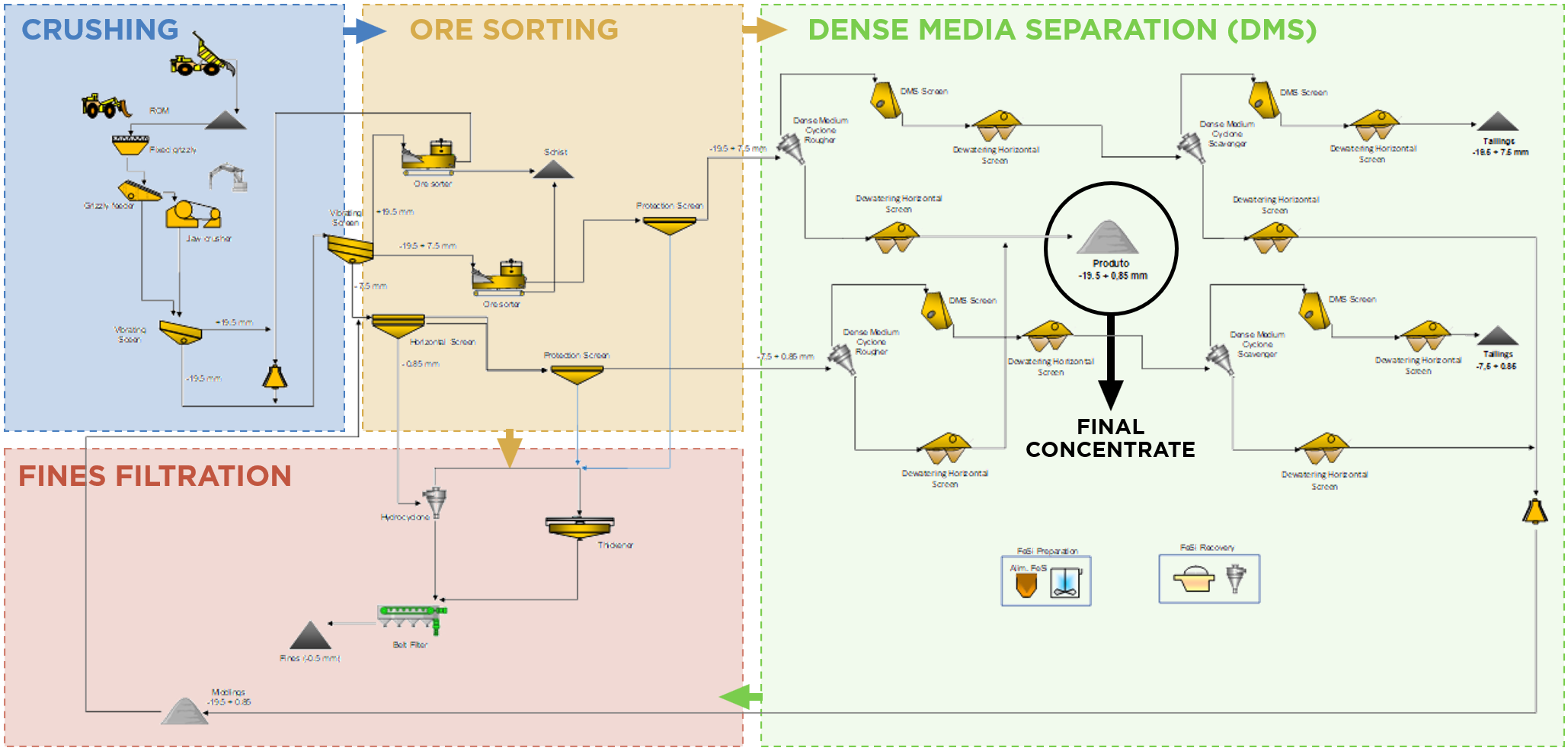

Mineral Processing

The mineral processing flowsheet for the Bandeira project is designed to maximize lithium recovery and quality. It features a two-stage crushing circuit, which includes a Jaw crusher and a Gyratory Cone crusher, followed by dry screening classification. The coarse and mid fractions undergo ore sorting and Dense Media Separation (DMS) to produce a final SC5.5 Li2O concentrate. See Figure 4 for a visual representation of the process flowsheet.

The underground mine is expected to produce ore with an average Li2O grade of

This efficient mineral processing approach ensures that we can maximize lithium recovery while maintaining the highest product quality. A higher quality chemical grade spodumene results in lower conversion costs therefore could potentially be sold at premium prices.

Figure 4: Bandeira process flow diagram

View Figure 4 here:

https://www.globenewswire.com/NewsRoom/AttachmentNg/599b88e7-4263-4690-bb7f-b549c16fe9c9

Capital Costs

Initial capital costs for the Bandeira Project are estimated at

Table 2. Project Capital Costs (CAPEX) Breakdown

| Initial CAPEX | |

| Mine | |

| Plant | |

| Engineering Service | |

| General Infrastructure & Others | |

| Pre-operation | |

| Contingency ( | |

| LOM Sustaining CAPEX | |

| SUDENE Federal Tax Incentive (%, reduction in Corporate Income Tax) | |

*Discrepancies in the totals are due to rounding effects.

Operating Costs

The operating costs of the Bandeira Project are estimated to be US

Table 3. Project Operating Costs (OPEX)

| Operating costs (per tonne of ore processed) | |

| Mining | |

| Processing | |

| SG&A | |

| Operating costs (per tonne of | |

| Mining | |

| Processing + Tailings handling | |

| SG&A | |

| Transportation costs to customer destination (Project Mine Site to Shanghai Port, China) | |

*Discrepancies in the totals are due to rounding effects.

Project Economics and Sensitivities

The after-tax NPV8 for the Bandeira Project is

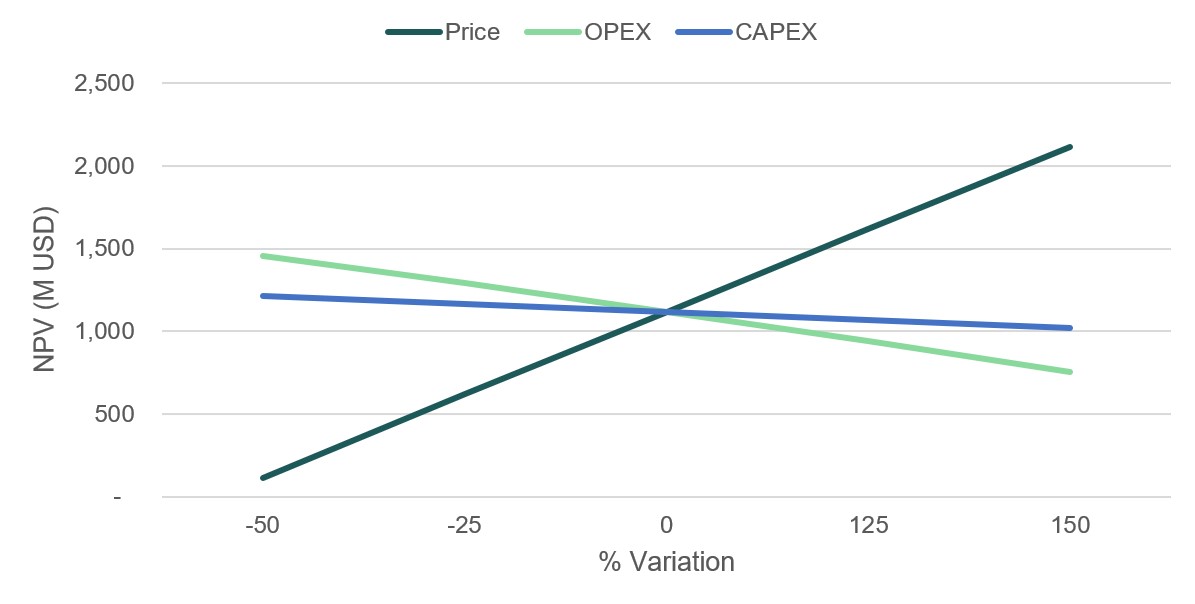

Sensitivity analyses completed as part of the FS demonstrate that the Project's value is strongly influenced by the selling price of spodumene concentrate. As demonstrated in Figure 5, while capital (CAPEX) and operational (OPEX) costs impact the Net Present Value (NPV), their effects are relatively minor compared to concentrate price fluctuations. Given the expected increase in lithium demand, Bandeira is well-positioned to capitalize on favourable market conditions and benefit from rising spodumene prices.

Figure 5: Sensitivity Analysis for Spodumene

View Figure 5 here:

https://www.globenewswire.com/NewsRoom/AttachmentNg/50bdb0c1-09eb-47b8-b540-684fbe5dba21

Table 4. After-Tax NPV and IRR Sensitivity to Spodumene Price

| Low Case | Base Case | High Case | |

| LOM Avg Spodumene Price (SC5.5) | |||

| NPV | |||

| IRR | |||

| Payback | 4.3 years | 3.4 years | 2.2 years |

Lithium Market Outlook & Spodumene Concentrate Price Forecast

A long-term spodumene concentrate price of US

The conservative spodumene concentrate selling price forecasts in the early years of the Bandeira mine life of

Lithium has emerged as a critical component in the global energy transition, with an annual consumption growth rate exceeding

Bandeira Mineral Resource Estimate

On April 12, 2024, the Company reported an updated NI 43-101 mineral resource estimate (“MRE”) for Bandeira of 23.68 million tonnes (“Mt”) grading

The Bandeira FS proven and probable reserves, however, utilizes an NI 43-101 mineral resource estimate with an earlier data cut-off of November 13, 2023, which includes 186 drill holes (41,831 metres). This study mine plan is therefore based on a smaller estimate of 20.95Mt grading

The inclusion of the larger April 2024 MRE, as well as the additional drilling completed after the March 2024 data cut-off represents important future upside to the Project. The mine plan will be updated to incorporate the expanded mineral resource estimate in the next phase of project development.

The MRE was completed by independent Brazilian consultancy, GE21 Consultoria Mineral Ltda ("GE21").

Table 5: Bandeira Mineral Resource Estimate (base case cut-off grade of 0.5 % Li2O)

| Category | Resource (Mt) | Grade (% Li2O) | Contained LCE (kt) |

| Measured | 3.42 | 1.39 | 117.61 |

| Indicated | 17.52 | 1.34 | 578.92 |

| Measured + Indicated | 20.95 | 1.35 | 696.52 |

| Inferred | 16.91 | 1.40 | 583.53 |

Notes related to the Mineral Resource Estimate:

- The spodumene pegmatite domains were modelled using composites with Li2O grades greater than

0.3% . - The mineral resource estimates were prepared by the CIM Standards and the CIM Guidelines, using geostatistical and classical methods, plus economic and mining parameters appropriate to the deposit.

- Mineral Resources are not ore reserves or demonstrably economically recoverable.

- Grades reported using dry density.

- The effective date of the MRE is November 13, 2023.

- Geologist Carlos José Evangelista da Silva (MAIG #7868) is the QP responsible for the Mineral Resources.

- The MRE numbers provided have been rounded to estimate relative precision. Values cannot be added due to rounding.

- The MRE is delimited by MGLIT Bandeira Target Claims (ANM).

- The MRE was estimated using ordinary kriging in 12m x 12m x 4m blocks.

- The MRE report table was produced using Leapfrog Geo software.

- The reported MRE only contains fresh rock domains.

- The MRE was restricted by RPE3 with grade shell using

0.5% Li2O cut-off. - To convert percentage lithium (Li) to percentage lithium oxide (Li2O), multiply by 2.153; to convert Li to lithium carbonate (Li2CO3), multiply by 5.323. To convert a percentage of lithium oxide (Li2O) to lithium carbonate (Li2CO3), multiply by 2.472.

Project Advancement & Optimization Opportunities

Lithium Ionic is committed to progressing the Bandeira Project towards production, aiming to become a leading lithium producer in Brazil’s Lithium Valley. This goal is supported by the following ongoing activities:

Permitting Process and Government Engagement: The Company continues to advance the permitting process and actively engage with governmental agencies. The next major permitting milestone, the approval of the Licença Ambiental Concomitante (LAC), is expected by early Q3 2024.

Next Phase of Engineering: The Bandeira Project will proceed to the next phase of engineering, focusing on implementing the optimization opportunities identified during the feasibility stage. This phase will include an expanded mineral deposit, which among other positive impacts could potentially extend the mine life. Significant opportunities have also been identified to streamline capital and operating costs, enhancing overall efficiency and optimization of the Project.

Feasibility Study Contributors and Methodology

Lithium Ionic engaged AtkinsRéalis (formerly SNC Lavalin) to coordinate the Feasibility Study, which covers engineering, process design, mine layout, risk assessment, and logistics for transporting the concentrate from Araçuaí, Minas Gerais, to the port of Ilhéus, Bahia, and then to Shanghai, China. The certification of mineral resources was conducted by GE21, with geologist Carlos José Evangelista Silva serving as the qualified professional for the estimation.

Underground mine studies were led by mining engineer Rubens Mendonça from Planminas, who signed off as the qualified professional for this discipline. The mineral processing studies were consolidated and defined by Tony Lipiec, Process Engineer and Vice President Global, Minerals & Metals Processing at AtkinsRéalis. Environmental studies were reviewed by Branca Horta from GE21, who signed off as the qualified professional for this area. The economic and financial model was validated by L&M Advisory, with João Augusto Hilario de Souza as the qualified professional.

The Feasibility Study considers Mineral Resources categorized as Measured and Indicated, converting

This comprehensive and collaborative approach ensures that the Feasibility Study encompasses all critical aspects, providing a robust foundation for the successful development and operation of the Project.

Report Filing

The complete NI 43-101 technical report associated with the FS will be available on SEDAR+ at www.sedarplus.ca under the Company’s issuer profile, as well as the Company’s website at www.lithiumionic.com within 45 calendar days.

Qualified Persons

The FS is prepared by independent representatives of AtkinsRéalis, GE21, Planminas and L&M each of whom are Qualified Person as defined by NI 43-101 Standards of Disclosure for Mineral Projects. Each of the QPs are independent of Lithium Ionic and have reviewed and confirmed that this news release fairly and accurately reflects, in the form and context in which it appears, the information contained in the respective sections of the Bandeira FS for which they are responsible. The affiliation and areas of responsibility for each QP involved in preparing the Bandeira FS are provided below.

Mineral Resource Estimate: Carlos José Evangelista, Geologist from GE21

Underground mine studies: Engineer, Rubens Mendonça from Planminas

The mineral processing studies were consolidated and defined by Tony Lipiec, Process Engineer and Vice President Global, Minerals & Metals Processing at AtkinsRéalis

Environmental studies: Branca Horta from GE21

Tailings Disposal systems: Porfírio Cabaleiro from GE21

The economic and financial model was certified and validated by João Augusto Hilario de Souza from L&M Advisory, as the qualified professional.

On behalf of the Board of Directors of Lithium Ionic Corp.

Blake Hylands

Chief Executive Officer, Director

About Lithium Ionic Corp.

Lithium Ionic is a Canadian mining company exploring and developing its lithium properties in Brazil. Its Itinga and Salinas group of properties cover 14,182 hectares in the northeastern part of Minas Gerais state, a mining-friendly jurisdiction that is quickly emerging as a world-class hard-rock lithium district. Its Feasibility-stage Bandeira Project is situated in the same region as CBL’s Cachoeira lithium mine, which has produced lithium for +30 years, as well as Sigma Lithium Corp.’s Grota do Cirilo project, which hosts the largest hard-rock lithium deposit in the Americas.

Investor and Media Inquiries:

+1 647.316.2500

info@lithiumionic.com

Cautionary Note Regarding Forward-Looking Statements

This press release contains statements that constitute “forward-statements.” Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Although the Company believes, in light of the experience of its officers and directors, current conditions and expected future developments and other factors that have been considered appropriate that the expectations reflected in this forward-looking information are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct. When used in this press release, the words “estimate”, “project”, “belief”, “anticipate”, “intend”, “expect”, “plan”, “predict”, “may” or “should” and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this press release include information relating to the prospectivity of the Project, the economic viability of the Project, future spodumene prices, the Company’s ability to obtain financing, the Company’s ability to develop the Project, the Company’s ability to obtain the requisite permits and approvals to develop the Project, the Company’s exploration program and other mining projects and prospects thereof, and the Company’s future plans. Such statements and information reflect the current view of the Company. Risks and uncertainties that may cause actual results to differ materially from those contemplated in those forward-looking statements and information. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

Information and links in this press release relating to other mineral resource companies are from their sources believed to be reliable, but that have not been independently verified by the Company.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this press release.

FAQ

What are the production expectations for Lithium Ionic's Bandeira Project?

What is the after-tax NPV8 and IRR for Lithium Ionic's Bandeira Project?

What are the operating costs for the Bandeira Project?

What is the estimated capital expenditure for the Bandeira Project?

When are construction permits expected for the Bandeira Project?