15 Million Consumers Who Shopped for Holiday Gifts in 2021 Don't Plan to This Year

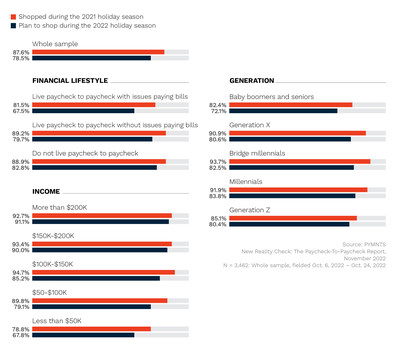

LendingClub Corporation (NYSE: LC) released its 16th edition of the Reality Check: Paycheck-To-Paycheck research series, revealing that 60% of U.S. consumers lived paycheck to paycheck as of October 2022, a 4-point increase from the previous year. Nearly 25% of shoppers expect to spend less this holiday season compared to 2021, with 79% planning to shop, down from 88%. About 39% will utilize financing for purchases, indicating increased financial strain. Younger generations are more likely to finance purchases, highlighting shifting consumer behaviors amid rising living costs.

- 39% of consumers plan to use financing options for holiday purchases, indicating potential for LendingClub's services.

- Despite financial strains, 79% of consumers still intend to shop during the holiday season.

- 60% of consumers reported living paycheck to paycheck, indicating financial distress among the population.

- 25% of shoppers expect to spend less this year compared to last, reflecting reduced consumer confidence.

Nearly a Quarter of Consumers Who Plan to Shop This Holiday Season Expect to Spend Less Than Last Year

Almost 4 in 10 Shoppers Intend to Finance One or More Holiday Purchase in 2022

SAN FRANCISCO, Nov. 16, 2022 /PRNewswire/ -- LendingClub Corporation (NYSE: LC), the parent company of LendingClub Bank, America's leading digital marketplace bank, today released findings from the 16th edition of the Reality Check: Paycheck-To-Paycheck research series, conducted in partnership with PYMNTS. The Holiday Shopping Edition examines the financial lifestyles and spending choices of U.S. consumers going into the 2022 holiday shopping season.

Against a backdrop of ongoing inflation and increased cost of living,

According to the report, financially struggling consumers cited a nearly full saturation of their credit card balances in October 2022. Consumers living paycheck to paycheck with issues paying their bills reported using an estimated

"More consumers who have historically managed their budgets comfortably are feeling the financial strain, which will impact their spending behavior as we head into the holiday shopping season," said Anuj Nayar, Financial Health Officer at LendingClub. "Average monthly household expenses have gone up

Fifteen million consumers who shopped for holiday gifts in 2021 don't plan to do so this year. Moreover, nearly one-quarter of consumers who do plan to shop during the 2022 holiday season expect to spend less than last year.

Amid rising prices for goods and services, the research finds that

Even so, many consumers will try to save money this holiday season by finding the best deals. Low prices and discounts will drive more of shoppers' holiday spending in 2022 than convenience. In fact, low prices and discounts will determine where

Even though consumers may be searching for discounts and buying less this year, it doesn't mean they will all be spending less. Forty-three percent of consumers who expect to increase their spending cite higher prices as the reason.

Nearly four in 10 holiday shoppers intend to use financing – such as credit cards, personal loans and buy now pay later (BNPL) – to pay for one or more of their holiday purchases in 2022. This includes one-quarter of consumers who are not living paycheck to paycheck and half of financially struggling paycheck-to-paycheck consumers. That's a slightly higher share than the

As of October 2022, younger generations are also highly likely to finance at least one of their holiday purchases, with

Financially struggling consumers anticipate relying on more payment alternatives than the average sample. In fact, while

"As many believe that a recession is approaching, now is the time for consumers to deploy financial survival strategies that can help them shore up their personal balance sheets for the new year," continued Nayar. "The data is telling us we'll pay more this holiday season and one of the worst things consumers can do is finance gifts on a credit card that they don't intend to pay off at the end of the month, especially in a rising interest rate environment. For example, if you have an outstanding credit card balance of

To view the full report, visit: https://www.pymnts.com/study/reality-check-paycheck-to-paycheck-holiday-shopping-inflation-credit/

New Reality Check: The Paycheck-To-Paycheck Report — The Holiday Shopping Edition is based on a census-balanced survey of 3,462 U.S. consumers that was conducted from Oct. 6 to Oct. 24 as well as analysis of other economic data. The Paycheck-To-Paycheck series expands on existing data published by government agencies, such as the Federal Reserve System and the Bureau of Labor Statistics, to provide a deep look into the core elements of American consumers' financial wellness: income, savings, debt and spending choices. Our sample was balanced to match the U.S. adult population in a set of key demographic variables:

LendingClub Corporation (NYSE: LC) is the parent company of LendingClub Bank, National Association, Member FDIC. LendingClub Bank is the leading digital marketplace bank in the U.S., where members can access a broad range of financial products and services designed to help them pay less when borrowing and earn more when saving. Based on more than 150 billion cells of data and over

For Investors: IR@lendingclub.com

Media Contact: Press@lendingclub.com

PYMNTS Contact: information@PYMNTS.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/15-million-consumers-who-shopped-for-holiday-gifts-in-2021-dont-plan-to-this-year-301679682.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/15-million-consumers-who-shopped-for-holiday-gifts-in-2021-dont-plan-to-this-year-301679682.html

SOURCE LendingClub Corporation

FAQ

What does the latest LendingClub report say about consumer spending for the 2022 holiday season?

How many consumers are living paycheck to paycheck according to LendingClub's report?

What percentage of consumers plan to use financing for their holiday purchases this year?