LandBridge Closes Acquisition of 46,000 Surface Acres in the Delaware Basin

Increases holdings to ~273,000 acres, with ~53,000 acres acquired in Q4 2024

LandBridge re-affirms previously-announced 2025 guidance

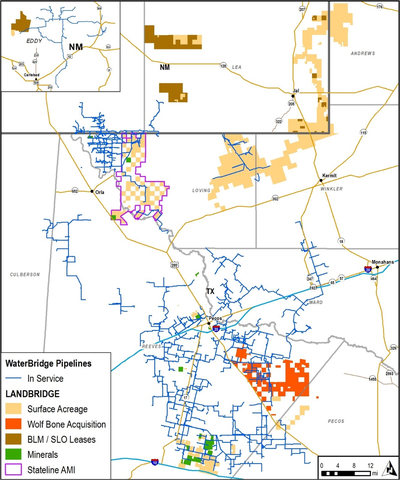

(Graphic: LandBridge)

The Wolf Bone Ranch acquisition strategically expands LandBridge’s position in

LandBridge re-affirms its recently increased 2025 Adjusted EBITDA1 guidance of

Contemporaneously with the acquisition, LandBridge closed the previously-announced private placement of Class A shares representing limited liability company interests (the “Class A Shares”) at a price of

There is no dilution to LandBridge shareholders with respect to the Repurchase of OpCo Units from LandBridge Holdings LLC. The securities offered in the Private Placement have not been registered under the Securities Act of 1933, or any state securities laws and may not be offered or sold in

In conjunction with the Private Placement, LandBridge, its directors and executive officers and LandBridge Holdings LLC entered into lock-up agreements pursuant to which they are subject to a 60-day lock up from the date of closing.

Following the closing of the Private Placement and the Repurchase, LandBridge’s management team and Five Point Energy hold an approximate

In connection with the Private Placement, Goldman Sachs & Co. LLC acted as the lead placement agent and Barclays Capital Inc. acted as a placement agent. Kelly Hart Hallman LLP served as counsel to LandBridge for the Wolf Bone Ranch acquisition. Vinson & Elkins L.L.P. served as counsel to LandBridge for the Private Placement.

Piper Sandler served as financial advisor to VTX Energy and Vitol. Gibson Dunn & Crutcher LLP served as counsel to VTX Energy and Vitol.

About LandBridge

LandBridge owns approximately 273,000 surface acres across

About Five Point

Five Point Energy is a private equity firm focused on building businesses within the environmental water management, surface management and sustainable infrastructure sectors. The firm was founded by industry veterans who have had successful careers investing in, building, and running midstream infrastructure companies. Five Point’s strategy is to buy and build assets, create companies, and grow them into sustainable enterprises with premier management teams and industry-leading E&P partners. Based in

About Vitol

Vitol is a leader in the energy sector with a presence across the spectrum: from oil to power, renewables and carbon. Vitol trades 7.3 mmbpd of crude oil and products, and charters around 6,000 sea voyages every year.

Vitol’s counterparties include national oil companies, multinationals, leading industrial companies and utilities. Founded in

Cautionary Statement Concerning Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are based on LandBridge’s current beliefs, as well as current assumptions made by, and information currently available to, LandBridge, and therefore involve risks and uncertainties that are difficult to predict. Generally, future or conditional verbs such as “will,” “would,” “should,” “could,” or “may” and the words “believe,” “anticipate,” “continue,” “intend,” “expect” and similar expressions identify forward-looking statements. These forward-looking statements include any statements regarding the Wolf Bone Ranch acquisition, including the expected benefits of the expected accretion, integration plans, synergies, opportunities and anticipated future performance, and certain projections. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, many of which are beyond our control.

Forward-looking statements include, but are not limited to, strategies, plans, objectives, expectations, intentions, assumptions, future operations and prospects and other statements that are not historical facts, including our estimated future financial performance. You should not place undue reliance on forward-looking statements. Although LandBridge believes that its plans, intentions and expectations reflected in or suggested by any forward-looking statements made herein are reasonable, LandBridge may be unable to achieve such plans, intentions or expectations and actual results, and its performance or achievements may vary materially and adversely from those projected in this press release due to a number of factors including, but not limited to: our customers’ demand for and use of our land and resources; the success of WaterBridge and Desert Environmental LLC, in executing their business strategies, including their ability to construct infrastructure, attract customers and operate successfully on our land; our customers’ ability to develop our land or any potential acquired acreage to accommodate any future surface use developments; the domestic and foreign supply of, and demand for, energy sources, including the impact of actions relating to oil price and production controls by the members of the Organization of Petroleum Exporting Countries,

Non-GAAP Financial Measures

Reconciliations of forward-looking non-GAAP financial measures to comparable GAAP measures are not available due to the challenges and impracticability of estimating certain items, particularly non-recurring gains or losses, unusual or non-recurring items, income tax benefit or expense, or one-time transaction costs and cost of revenue. We are unable to reasonably predict these because they are uncertain and depend on various factors not yet known, which could have a material impact on GAAP results for the guidance period. Because of those challenges, a reconciliation of forward-looking non-GAAP financial measures is not available without unreasonable effort.

No Offer or Solicitation

This press release shall not constitute an offer to sell, or the solicitation of an offer to buy, the securities described herein, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

1 Adjusted EBITDA is a non-GAAP financial measure. See “Non-GAAP Financial Measures” included in this press release for related disclosures.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241220795122/en/

Scott McNeely

Chief Financial Officer

LandBridge Company LLC

Contact@LandBridgeco.com

Media

Daniel Yunger / Nathaniel Shahan

Kekst CNC

kekst-landbridge@kekstcnc.com

Source: LandBridge Company LLC