Laser Photonics Highlights Key Investment Points for New Investors

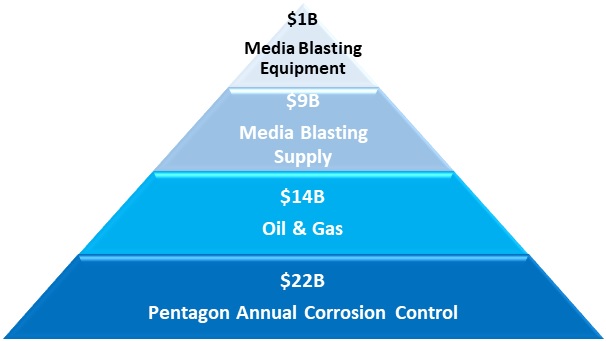

Laser Photonics Corporation (LASE) announces its IPO roadshow highlights, revealing its goal to disrupt the $46 billion industrial market for corrosion removal. The company emphasizes its Cleantech laser technology as a safer, cleaner, and cost-effective alternative to hazardous methods like sandblasting. As of June 30, 2022, LPC reports early revenue growth and profitability. The firm is targeting new applications while extending its distribution channels and diversifying its customer base, aiming to leverage regulatory pressures favoring sustainable solutions.

- LPC demonstrates early revenue growth and has begun generating profits.

- The company targets a $46 billion domestic market, aligning with growing regulatory pressures for safer cleaning methods.

- LPC's Cleantech technology offers a disruptive solution, presenting a cost-effective and environmentally friendly alternative to traditional methods.

- None.

Insights

Analyzing...

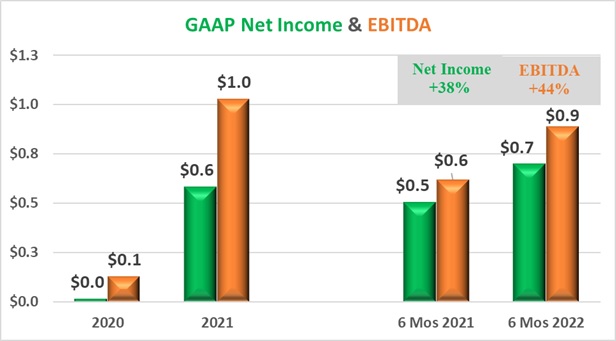

Track-record of strong revenue growth and profits

Disruptive Cleantech laser technology addresses

Safer, cheaper, cleaner solutions align with government regulation and labor pressure to move away from more hazardous existing methods

ORLANDO, FL / ACCESSWIRE / October 6, 2022 / Laser Photonics Corporation (NASDAQ:LASE), ("LPC"), a leading global industrial developer of Cleantech laser systems for laser cleaning and other materials applications, announces key highlights from its recent IPO roadshow. All information contained in this release are pursuant to a registration statement on Form S-1 (File No. 333-261129) that was declared effective by the U.S. Securities and Exchange Commission on September 29, 2022. The shares began trading on September 30, 2022, on the Nasdaq Capital Market under the ticker symbol "LASE."

"Our IPO represents a major milestone in our strategy to disrupt the

Financial Performance (as of 6/30/2022)

LPC is in the early stages of revenue growth…

…but is already generating profits

Market Drivers

Tupuola continued, "Today, government entities such as OSHA and the EPA and labor unions have recognized the harmful impact on workers and the environment and are now applying pressure on companies that continue to use these out-of-date technologies. With our "Made in America" products, we believe we can offer superior alternatives to traditional abrasives, driving our financial performance and creating shareholder value over the long-term."

1) LPC estimates its target markets for laser cleaning to be

2) Environmental and Safety - Laserblasting is the safe, clean, efficient and affordable alternative to existing techniques

- Regulatory pressure from the EPA, FDA and OSHA to phase out existing cleaning using abrasives and chemical processes due to known environmental and health effects

- Labor unions and organizations are applying pressure due to the impact of traditional methods on the health and safety of their members

- Traditional methods generate a significant amount of energy and environmental waste that is eliminated by lower power Cleantech Laser Blasting

3) Increasing Demand for High Power Lasers

Application demands for higher power lasers have made these the fastest growing segment of the laser market, with a growing

Company-Specific Drivers

1) Cleantech Laser Blasting is highly disruptive

We intend to target new applications early in the development cycle and drive adoption by leveraging our strong customer relationships, engineering expertise and competitive production costs.

2) Cleantech Laser Blasting is a multi-market and multi-product approach

We plan to diversify our products and end markets to reduce risk.

3) Extend our distribution channels and reach

We plan to add distribution channels globally to extend our reach both geographically and within specific target markets, including automotive, aerospace, defense, energy and manufacturing. Additionally, we plan to expand our direct sales force and add key account managers for large customers such as Fortune 500 and government organizations.

4) Broaden our diverse customer base

We see a significant opportunity to penetrate existing customers further and add new customers to our existing base of Blue Chip customers. LPC CleanTech Laser Blasting products address the corrosion needs of multiple industries, including automotive OEMs (e.g., Daimler); manufacturing (e.g., Coca-Cola); shipbuilding and maritime (e.g., Norfolk Naval Shipyard); space exploration and aerospace (e.g., NASA); heavy equipment (e.g., Caterpillar); nuclear decommissioning and energy; oil and gas; medical and aerospace.

Conclusion

"We have a rare opportunity to participate and lead the market for laser-blasting, an opportunity that could last decades. We believe a perfect storm is brewing given the technological advancements, the regulatory and labor environment and access to the capital markets, and we look forward to capitalizing on this opportunity," concluded Tupuola.

IPO Details

On September 30, 2022, LPC announced the pricing of its underwritten initial public offering of 3,000,000 shares of common stock at a public offering price of

Alexander Capital, LP acted as the sole book-running manager for the offering. Culhane Meadows PLLC and Lucosky Brookman LLP served as co-counsel to Laser Photonics. Cozen O'Connor, P.C. served as counsel to the underwriters.

The securities described above are being offered by Laser Photonics pursuant to a registration statement on Form S-1 (File No. 333-261129) that was declared effective by the U.S. Securities and Exchange Commission on September 29, 2022. The offering is being made only by means of a prospectus forming a part of the effective registration statement. A copy of the final prospectus related to the offering, when available, may be obtained from Alexander Capital, LP, 17 State Street 5th Floor, New York, NY 10004, Attention: Equity Capital Markets, or by calling (212) 687-5650 or emailing info@alexandercapitallp.com.

This press release does not constitute an offer to sell or the solicitation of an offer to buy these securities, and shall not constitute an offer, solicitation or sale in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of that state or jurisdiction. Any offers, solicitations or offers to buy, or any sales of securities will be made in accordance with the registration requirements of the Securities Act of 1933, as amended.

Forward-Looking Statements

This press release may include "forward-looking statements." To the extent that the information presented in this press release discusses financial projections, information, or expectations about our business plans, results of operations, products or markets, or otherwise makes statements about future events, such statements are forward-looking. Such forward-looking statements can be identified by the use of words such as "should", "may," "intends," "anticipates," "believes," "estimates," "projects," "forecasts," "expects," "plans," and "proposes." Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. You are urged to carefully review and consider any cautionary statements and other disclosures, including the statements made under the heading "Risk Factors" and elsewhere in documents that we file from time to time with the Securities Exchange Commission. Forward-looking statements speak only as of the date of the document in which they are contained, and Laser Photonics Corporation does not undertake any duty to update any forward-looking statements except as may be required by law.

About Laser Photonics Corporation

Laser Photonics is a vertically-integrated manufacturer and R&D Center of Excellence for industrial laser technologies and systems. LPC seeks to disrupt the

Laser Photonics Investor Relations Contact:

Brian Siegel, IRC®, M.B.A.

Senior Managing Director

Hayden IR

(346) 396-8696

brian@haydenir.com

SOURCE: Laser Photonics Corp.

View source version on accesswire.com:

https://www.accesswire.com/719103/Laser-Photonics-Highlights-Key-Investment-Points-for-New-Investors