KORE MINING DISCOVERS THREE NEW DRILL TARGETS AT THE IMPERIAL GOLD PROJECT

KORE Mining Ltd. announced the conclusion of a regional mapping program at the Imperial Gold project, resulting in the identification of three new exploration drill targets: Smoketree, Ironwood, and Wolverines. This brings the total number of drill targets in the Mesquite-Imperial-Picacho District to nine. The program utilized over 100 person-days for data analysis and mapping, revealing promising mineralization. The company plans to conduct a follow-up drill program in Q2 2022 and continues to expand its exploration strategies to enhance discovery potential.

- Identification of three new drill targets: Smoketree, Ironwood, Wolverines.

- Expansion of the Acacia target to over 1.5 km of mineralized strike.

- Surface sampling highlights include 1.0 g/t and 0.6 g/t gold.

- Follow-up drill program planned for Q2 2022.

- None.

Completion of Regional Mapping Program Leads to New Targets In the Mesquite-Imperial-Picacho District

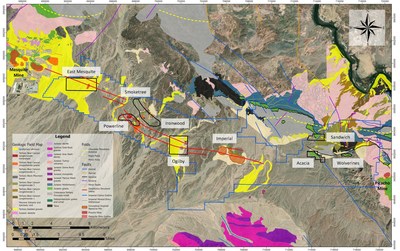

VANCOUVER, BC, March 8, 2022 /PRNewswire/ - KORE Mining Ltd. (TSXV: KORE ) (OTCQX: KOREF) ("KORE" or the "Company") is pleased to announce the completion of data analysis for the 100+ person-day regional mapping campaign at the Imperial Gold project ("Imperial"), leading to the discovery of three new exploration drill targets (Figure 1). This brings a total of nine highly prospective drill targets identified in the Mesquite-Imperial-Picacho District ("District"); a District that captures 28 kilometers ("km") of strike from Equinox Gold's (TSX: EQX) operating Mesquite gold mine ("Mesquite") to the historic Picacho gold mine ("Picacho"). Various additional stream sediment and rock chip assays and analyses are pending. The mapping program focused on establishing vectoring strategies through the Bear Canyon conglomerate, a late alluvial unit which covers most of the property.

New Discovery Highlights:

- Discovers three new target areas: Smoketree, Ironwood, and Wolverines

- Expanded Acacia target to over 1.5 km of mineralized strike with new outcrop areas

- Highlights from surface sampling include 1.0 g/t and 0.6 g/t gold

- Expanded the existing Powerline target to over 2 km mineralized length

- Collected 123 soil and rock samples while mapping previously undiscovered mineralized outcrop between the Imperial deposit and the Mesquite mine – assays pending

- Commissioned follow-up man-portable drill program for Q2 2022

Mapping Program Highlights:

- Established new vectoring strategy for detecting gold mineralization in areas with little or no surface outcrop exposure

- Gold mineralization detected in numerous distinct Tertiary Bear Canyon conglomerates

- Incorporated 130,000+ acres of lithologic mapping and data into regional geologic model

- Integrated regional structural model encompassing an area over 2,300,000 acres

- Established regional hand sample library to standardize regional mapping and allow high confidence identification of rock units

KORE's CEO Scott Trebilcock commented, "With nine high potential oxide gold drill targets identified to date, KORE continues to successfully develop the knowledge and exploration strategies to target and make new discoveries at the Mesquite-Imperial-Picacho district exploration project. The amount of outcrop and anomalous gold at surface continues to exceed expectations."

Regional Scale Interpretation

Gold occurrences on the Imperial Gold Project are primarily controlled by regional scale east to west and west-northwest to east-southeast trending thrust faults that have been interpreted across the entire 28km strike length of the property. These thrust faults bring the sheets of the crystalline basement closer to surface and within economically mineable depths. Along these faults, secondary and tertiary structural and lithological controls periodically create "hot spots" of gold mineralization, each generally 1 to 2km in strike length. Gold grade correlates strongly with degree of brecciation in all known target areas. Brecciation is generally tectonic in nature, although hydrothermal and volcanic mineralized breccias have been observed in some locales. Mapping efforts have revealed that late tertiary alluvial cover units are often mineralized with low grade gold proximal to mineralized gneiss occurrences. This allows for the indirect detection of mineralized gneiss occurrences that have little or no surface expression. Alteration styles observed across all prospect areas mentioned in this report are chloritization of mafic minerals, hematite +- jarosite +- goethite along fractures or brecciated zones, local to pervasive sericitization, kaolinite alteration, silicification, and quartz + carbonate veining.

Powerline Area Prospects (Powerline, Smoketree, and Ironwood targets)

The Powerline prospect area outcrop consists of two east to west trending strongly brecciated thrust sheets of mineralized conglomerate and gneiss, together totaling ~130m of exposure. WorldView-3 spectral satellite data indicated that these outcrops were within a large chlorite alteration zone. Detailed follow up mapping and sampling efforts have since established approximately 2km of mineralized strike length.

While the majority of the Powerline prospect area is covered by the Tertiary Bear Canyon conglomerate, several of these outcrops are strongly altered and mineralized, indicating that they may be overlying mineralized gneiss in the subsurface.

A person portable drill that produces nearly NQ sized core samples up to 30 feet depth will be used in Q2 2022 to further define this zone and improve geologic understanding.

Sandwich Target Area

The Sandwich zone was first identified in 2019 during early-stage reconnaissance mapping and is most notable for having the highest intensity of alteration observed on the property. This target area has a strike length of 1.4km and mineralization is structurally controlled by the regionally extensive, WNW trending thrust faults. The intensity of the alteration is primarily controlled by the degree of brecciation of the host rock. Mineralized veins were observed in the stratigraphically overlying and relatively impermeable Winterhaven Formation, suggesting that the Winterhaven may have acted as a lithocap to ascending gold bearing fluids.

This prospect area terminates against a large-offset strike slip fault, which transported a sliver of mineralized basement 1.5km to the south creating the "Acacia" target area.

Acacia Target Area

In April 2021, a batch of regional reconnaissance stream sediment samples yielded a 1.6km long trend of 12 samples assaying over 0.1 g/t, including one sample assaying 3.7 g/t and two additional samples over 1.0 g/t. Follow-up work led to the widespread discovery of visible gold flakes and nuggets, generally fine grained but some as large as 4mm. Mapping has delineated a 1.8km gneiss outcrop.

The Acacia target is interpreted as a faulted sliver of the Sandwich zone transported via the dextral Gatuna Wash fault. The mineralization in both zones is primarily controlled by E-W trending regionally extensive thrust faults, particularly the Gatuna-Sortan, Chocolate Mountains, and Copper Basin faults.

Wolverines Target Area

SWIR Geo-enhanced imagery, which combines infrared and visible light bands to graphically display differences in rock reflectivity spectra, revealed a ~1km long outcrop of altered and brecciated gneiss. This area is characterized by its widespread evidence of historical mining activity, such as old vibrating screen apparatuses, bulldozer activity, and abandoned camp sites. The prospect area remains dramatically under sampled, with follow up work scheduled for Q2 2022.

East Mesquite Target Area

In 2019, KORE executed a regional ground induced polarization ("IP") survey which interpreted a continuous regional scale structure connecting the operating Mesquite mine to the East Mesquite prospect area. The interpreted structure was drilled by Equinox Gold in September 2021 and resulted in their "best hole drilled year-to-date" with 78 meter of 1.2 g/t – see news September 8, 2021. Given that most of the target area is covered by late alluvial cover units, targeting will rely heavily on geophysics.

Ogilby Target Area

The Ogilby target area is notable for returning one of the highest assays on the property at 1.4 g/t. IP sections from Imperial to Ogilby show anomalies similar in size and character to those at the known Imperial deposit, strongly suggesting that the geology is continuous between these zones. Anomalous samples have thus far clustered along the northernmost line of geophysical anomaly, which includes a 300 meter long trend of faulted and mineralized Bear Canyon conglomerate. Follow up sampling is currently in progress and several assays are pending.

Sampling and Mapping Program Details

KORE has established a new methodology for mapping the Tertiary Bear Canyon conglomerate, which covers the majority of the property and typically overlies the host rock (gneiss) of the Imperial deposit. This new strategy makes it possible to detect gold occurrences in prospect areas that have little to no host rock exposure. By studying these units across the entire property, the program discovered that the Bear Canyon conglomerate can become mineralized through two mechanisms: 1) an offshed type, consisting of mineralized clasts of gneiss in a matrix that may or may not be altered 2) by pervasive fluid flow and/or quartz carbonate veining, especially along faults. Leading researchers were consulted throughout the course of the mapping effort, with one researcher making a site visit to help establish a framework for the program. Sampling of historic core has revealed that Tertiary Bear Canyon conglomerate in close proximity the mineralized gneiss host rock can also become mineralized contemporaneously and can achieve gold values above cut-off grade of the Imperial gold deposit. While the Bear Canyon Conglomerate does not appear to be as good a host rock as the gneiss, mineralized Bear Canyon conglomerate is an excellent indictor for being within close distance to both a mineralizing source and likely mineralized gneiss host rock.

Having the intact Imperial deposit to "tune" or "fingerprint" this method greatly enhances the Company's confidence to target new discoveries under the Bear Canyon conglomerate along the 28km trend. Both types of mineralized conglomerate units are observed near the Imperial deposit, both at surface and in drill core.

Areas that show trace gold mineralization can be followed up on by a person portable drilling system, capable of testing targets to depths of 30 feet. This program was successfully permitted and implemented in 2021.

In 2021, KORE's mapping team collected 94 rock samples and 29 stream sediment samples. Stream sediment samples collected averaged 4.0 kilogram in weight and were taken at an average depth of 0.4 meters below surface.

KORE is committed to operating within the stringent environmental and labour standards of California.

Figure 1 shows the new geologic model compiled from 2021 field work, scientific, and historic data, Imperial gold resource outline, the Mesquite mine, and the 9 property wide targets.

About the Imperial Gold Project

KORE owns

The Mesquite-Imperial-Picacho District centers on KORE's Imperial project. Imperial is a structurally controlled intermediate sulfidation epithermal gold deposit. The

Imperial has a mineral resource estimate and a positive preliminary economic assessment effective April 6, 2020 with the following highlights:

- Robust economics: US

$ 343 million NPV5% post-tax with44% IRR at US$ 1,450 per ounce gold - Low capital intensity project with only US

$ 143 million pre-production capital cost - Average 146,000 ounces gold per year over 8 years for 1.2 million ounces total production

- Technically simple project: shallow open pit, run-of-mine heap leach with existing infrastructure

- Value enhancement through Mesquite-Imperial-Picacho District exploration and resource expansion

The Company's NI 43-101 compliant resource and preliminary economic assessment is titled "Preliminary Economic Assessment – Technical Report Imperial Gold Project" effective as of April 6, 2020 and revised and amended on June 10, 2021, prepared by Terre Lane and Todd Harvey of Global Resource Engineering and Glen Cole of SRK Consulting (Canada) Inc. can be found under the Company's profile on SEDAR (www.sedar.com) and on the Company's website.

About KORE Mining

KORE Mining is focused on responsibly creating value from its portfolio of gold assets in California, USA. The Company is advancing the Imperial project towards development while continuing to explore across both district-scale gold assets. Management and Board, along with strategic investor, Eric Sprott (

On behalf of KORE Mining Ltd

"Scott Trebilcock"

Chief Executive Officer

(888) 407-5450

Investor Relations

Arlen Hansen, KIN Communications

1-888-684-6730

kore@kincommunications.com

Technical information with respect to the District and Imperial Gold Project contained in this news release has been reviewed and approved by Marc Leduc, P.Eng, who is KORE's COO and is the qualified person under National Instrument 43-101 responsible for the technical matters of this news release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

This news release contains forward-looking statements relating to the future operations of the Company and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "will", "may", "should", "anticipate", "expects", "intends", "indicates" and similar expressions. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding the future plans and objectives of the Company are forward- looking statements.

Forward–looking statements in this news release include, but are not limited to, statements with respect to: the strategy, timing and implementation of permit regional exploration drilling in the 28-kilometer Mesquite-Imperial-Picacho District ("Regional Exploration Drilling"); the timing of submitting Environmental Assessment report(s) for one or more areas of the Imperial project; potential actions, behavior or position of the Bureau of Land Management (the "BLM"); the underexplored and prospective nature of the Imperial Regional Exploration Drilling area; the results of the preliminary economic assessments for the Imperial Project, including future project opportunities, the projected NPV, permit timelines, the current mineral resource estimate, and the ability to obtain the requisite permits; the market and future price of and demand for gold; the opportunities of expansion at the Imperial Project; and the ability to work cooperatively with stakeholders, including all levels of government. Such forward–looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. In connection with the forward–looking information contained in this presentation, the Company has made numerous assumptions, including, among others: there being no significant change to current geotechnical, metallurgical, hydrological and other physical conditions at the Imperial Project; exploration, permitting, and development of the Imperial Project being consistent with current expectations and planning; the geological, permitting and economic advice that the Company has received is reliable and is based upon practices and methodologies which are consistent with industry standards; and other planning assumptions. While the Company considers these assumptions to be reasonable, these assumptions are inherently subject to significant uncertainties and contingencies.

Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward–looking information. Known risk factors include, among others: the outcome of BLM's review processes for permitting, including the final outcome(s) of BLM's mineral claim validity examination(s) and administrative review process(es) with respect to the Imperial Zone, including a change to the findings from the mineral claim validity examination conducted in 2002 for the mill sites at the Imperial Zone, resulting in the Company having to move its future Imperial Zone project support facilities to areas that are not within the Indian Pass mineral withdrawal area; the possibility that BLM may require and/or conduct further mineral claim validity examinations with respect to the Imperial project, and the outcome and final determination of such examination could, among other things, invalidate one or more mining claims; the possibility that BLM or other governmental authority review of the Regional Exploration Drilling program, delays or changes the Company's plan for Regional Exploration Drilling permitting, which could result, among other things, in delays, additional project requirements, additional costs and uncertainty of meeting anticipated program milestones; the exploration drill program may not be completed as planned; the need to obtain additional financing; uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other government approvals.

Additional risks and uncertainties are described in the "Risks" sections of (i) the Company's Annual Information Form for the year ended December 31, 2020 prepared as of April 29, 2021, and (ii) the Company's Management's Discussion and Analysis for the nine months ended September 30, 2021, both available under the Company's issuer profile on www.sedar.com.

Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

There is no certainty that all or any part of the mineral resource will be converted into mineral reserve. It is uncertain if further exploration will allow improving the classification of the Indicated or Inferred mineral resource. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/kore-mining-discovers-three-new-drill-targets-at-the-imperial-gold-project-301497828.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/kore-mining-discovers-three-new-drill-targets-at-the-imperial-gold-project-301497828.html

SOURCE Kore Mining

FAQ

What are the new exploration drill targets identified by KORE Mining?

How many drill targets has KORE Mining identified in the Mesquite-Imperial-Picacho District?

What are the highlights from the recent surface sampling at KORE Mining's project?