Kinross completes Great Bear Preliminary Economic Assessment

Kinross Gold (TSX: K, NYSE: KGC) has released a positive update on its Great Bear project in Red Lake, Ontario, Canada. The Preliminary Economic Assessment (PEA) reveals impressive annual production exceeding 500,000 ounces of gold, with low All-In Sustaining Costs (AISC) of approximately $800 per ounce. These figures suggest strong profit margins for the project. Additionally, drilling beyond the PEA inventory has uncovered high-grade mineralization at depth, indicating potential for future resource expansion. This development marks a significant milestone for Kinross, potentially bolstering its production portfolio and financial outlook in the coming years.

Kinross Gold (TSX: K, NYSE: KGC) ha pubblicato un aggiornamento positivo riguardo al suo progetto Great Bear a Red Lake, Ontario, Canada. La Valutazione Economica Preliminare (PEA) rivela un'impressionante produzione annuale che supera le 500.000 once d'oro, con bassi Costi Totali di Sostenibilità (AISC) di circa 800 dollari per oncia. Questi dati suggeriscono forti margini di profitto per il progetto. Inoltre, le perforazioni oltre l'inventario PEA hanno rivelato mineralizzazione ad alta gradazione in profondità, indicando un potenziale per l'espansione delle risorse in futuro. Questo sviluppo segna un traguardo significativo per Kinross, potenzialmente rafforzando il suo portafoglio di produzione e le prospettive finanziarie nei prossimi anni.

Kinross Gold (TSX: K, NYSE: KGC) ha lanzado una actualización positiva sobre su proyecto Great Bear en Red Lake, Ontario, Canadá. La Evaluación Económica Preliminar (PEA) revela una impresionante producción anual que supera las 500,000 onzas de oro, con bajos Costos Totales de Sostenimiento (AISC) de aproximadamente 800 dólares por onza. Estas cifras sugieren fuertes márgenes de beneficio para el proyecto. Además, la perforación más allá del inventario de la PEA ha descubierto mineralización de alta calidad a profundidad, lo que indica un potencial de expansión de recursos en el futuro. Este desarrollo marca un hito significativo para Kinross, potencialmente fortaleciendo su cartera de producción y su perspectiva financiera en los próximos años.

킨로스 골드 (TSX: K, NYSE: KGC)가 캐나다 온타리오주 레드 레이크에 위치한 그레이트 베어 프로젝트에 대한 긍정적인 업데이트를 발표했습니다. 초기 경제 평가(PEA)는 50만 온스를 초과하는 인상적인 연간 금 생산량을 보여주며, 온스당 약 800달러의 낮은 총 유지 비용(AISC)을 보고합니다. 이러한 수치는 프로젝트의 강력한 이익 마진을 시사합니다. 또한 PEA 재고를 초과하는 채굴에서 깊은 곳에서 고급 광물화가 발견되었습니다, 이는 미래 자원의 확장 가능성을 나타냅니다. 이 개발은 킨로스에게 중요한 이정표가 되어 향후 몇 년 동안 생산 포트폴리오와 재무 전망을 강화할 가능성이 있습니다.

Kinross Gold (TSX: K, NYSE: KGC) a publié une mise à jour positive concernant son projet Great Bear à Red Lake, Ontario, Canada. L'Évaluation Économique Préliminaire (PEA) révèle une production annuelle impressionnante dépassant 500 000 onces d'or, avec de faibles Coûts Totaux de Soutien (AISC) d'environ 800 dollars par once. Ces chiffres suggèrent de fortes marges bénéficiaires pour le projet. De plus, les forages au-delà de l'inventaire PEA ont révélé une minéralisation de haute qualité en profondeur, ce qui indique un potentiel d'expansion des ressources à l'avenir. Ce développement marque une étape significative pour Kinross, renforçant potentiellement son portefeuille de production et ses perspectives financières dans les années à venir.

Kinross Gold (TSX: K, NYSE: KGC) hat ein positives Update zu seinem Great Bear-Projekt in Red Lake, Ontario, Kanada veröffentlicht. Die Vorläufige Wirtschaftlichkeitsuntersuchung (PEA) zeigt eine beeindruckende Jahresproduktion von über 500.000 Unzen Gold, mit geringen Gesamtnachhaltigkeitskosten (AISC) von etwa 800 Dollar pro Unze. Diese Zahlen deuten auf hohe Gewinnmargen für das Projekt hin. Darüber hinaus entdeckten Bohrungen jenseits des PEA-Inventars hochgradige Mineralisierung in der Tiefe, was auf ein Potenzial für zukünftige Ressourcenerweiterungen hinweist. Diese Entwicklung stellt einen bedeutenden Meilenstein für Kinross dar und könnte das Produktionsportfolio sowie die finanziellen Aussichten in den kommenden Jahren stärken.

- Annual gold production projected to exceed 500,000 ounces

- Low All-In Sustaining Costs (AISC) of approximately $800 per ounce

- High-grade mineralization discovered at depth beyond PEA inventory

- Potential for resource expansion and extended mine life

- None.

Insights

The completion of the Preliminary Economic Assessment (PEA) for Kinross Gold's Great Bear project marks a significant milestone. With projected annual production exceeding 500,000 ounces and an impressively low All-In Sustaining Cost (AISC) of

The low AISC is particularly noteworthy, as it places Great Bear in the lower quartile of global gold production costs. This cost advantage could provide Kinross with substantial profit margins, especially in a strong gold price environment. The ongoing high-grade mineralization discoveries at depth suggest potential for resource expansion beyond the current PEA inventory, which could further enhance the project's value proposition.

Kinross's Great Bear PEA results are likely to be well-received by investors. The projected 500,000+ ounce annual production represents a significant boost to Kinross's overall output, potentially increasing the company's total production by

This cost efficiency could translate into strong free cash flow generation, enhancing Kinross's financial flexibility for future growth or shareholder returns. However, investors should note that significant capital expenditure will be required to bring the project online. The market will likely focus on the project's timeline and funding strategy in the near term.

While the economic aspects of the Great Bear PEA are promising, it's important to consider the project's ESG implications. The Red Lake district has a long mining history, which could facilitate community acceptance and potentially streamline permitting processes. However, Kinross must ensure robust environmental management practices, particularly given the ongoing exploration and potential for expansion.

Investors should look for details on Kinross's plans for sustainable water management, energy efficiency and local community engagement. These factors will be critical for the project's long-term success and social license to operate. Additionally, the company's approach to Indigenous partnerships and economic participation will be a key area to watch, as it could significantly impact the project's development timeline and overall sustainability profile.

Annual production over 500,000 ounces1

Impressive margins with low AISC2 of ~

Drilling beyond PEA inventory shows high-grade mineralization at depth

TORONTO, Sept. 10, 2024 (GLOBE NEWSWIRE) -- Kinross Gold Corporation (TSX: K, NYSE: KGC) (“Kinross” or the “Company”) today is pleased to provide an update on the Great Bear project (the “Project”), located in Red Lake, Ontario, Canada.

This news release contains forward-looking information about expected future events and financial and operating performance of the Company. We refer to the risks and assumptions set out in our Cautionary Statement on Forward-Looking Information located on page 13 of this release. All dollar amounts are expressed in U.S. dollars, unless otherwise noted.

Kinross has completed a Preliminary Economic Assessment (PEA) for the Great Bear project which supports the Company’s acquisition thesis of a top tier high-margin operation in a stable jurisdiction with strong infrastructure. Based on mineral resources drilled to date, the PEA outlines a high-grade combined open pit and underground mine with an initial planned mine life of approximately 12 years and production cost of sales3 of

Kinross has also released an updated mineral resource estimate increasing the inferred resource estimate by 568koz. to 3.884 Moz. which is in addition to the existing M&I resource estimate of 2.738 Moz4. The mineral resource estimate and PEA for the Great Bear project are available here.

CEO Commentary:

"This PEA marks an important milestone for Great Bear and reaffirms our view of it as a high-quality asset with robust economics and a clear path to become a world class operating mine," said Paul Rollinson, Chief Executive Officer of Kinross Gold Corporation. "The Project represents a strong combination of high-margin production and modest capital requirements, with the opportunity for significant resource growth in the future.

“This PEA represents the first view of unlocking Great Bear’s full potential. Based on surface drilling to date, the PEA provides an initial snapshot in time of the Project. The ongoing drilling to depth has already shown multiple wide, high-grade intercepts beyond the current resource used in the PEA. This deep drilling from surface demonstrates the continuation of mineralization at depth and the upside potential for further resource and mine life additions in the future as we progress exploration from depth.

“These positive results are underpinned by a strong mining jurisdiction with a skilled labour pool and solid regional infrastructure. We have both the financial and technical resources to advance the development of this exciting new Project in our portfolio."

________________________

1 Annual production over 500,000 ounces for the first 8 years.

2 AISC is a non-GAAP financial measure. The definition and purpose of this non-GAAP financial measure is included on page 11 of this news release. Non-GAAP financial measures and ratios have no standardized meaning under IFRS and therefore, may not be comparable to similar measures presented by other issuers. Please see average production cost of sales in the table entitled “PEA study financial highlights” for the related estimated GAAP financial measure.

3 “Production cost of sales per ounce” is defined as production cost of sales divided by total ounces sold. In the PEA, production costs of sales is referred to as production cash costs.

4 See the table below titled “Great Bear Summary of project mineral resources” for grade and quantity of mineral resource estimate.

Key PEA Highlights:

- The Great Bear PEA demonstrates a top-tier high margin operation in a stable jurisdiction in Ontario, Canada. The Project is located within the prolific Red Lake Greenstone Belt 24 kilometres from Red Lake, a town with a long history of mining, significant infrastructure including a paved highway and provincial power lines, and access to experienced, skilled labour.

- The results from the PEA affirm that Great Bear has the potential to be a cornerstone asset with a top tier production profile, low costs, and significant value.

- The PEA mine plan demonstrates an excellent estimated internal rate of return (IRR) and after-tax net present value (NPV) at a range of gold prices.

| PEA study physical highlights5 | |

| Annual production (koz. / first 8 years) | 518 |

| Annual production (koz. / life of mine average) | 431 |

| Life of mine production (Moz. Au) | 5.3 |

| Mill Processing rate (tpd) | 10,000 |

| Underground peak mining rate (tpd) | 6,000 |

| Life of mine tonnes processed (million tonnes) | 44.6 |

| Average grade processed (g/t Au) | 3.87 |

| Average recovery rate (% Au) | 95.7 |

| PEA study financial highlights | ||

| Average production cost of sales (per Au oz.)3,6 | ||

| Average all-in sustaining costs (per Au oz.)2,5 | ||

| Total initial construction capital cost (US$ millions) | ||

| Total capitalized mine development (US$ millions) | ||

| Total initial project capital (US$ millions) | ||

| Great Bear IRR and NPV estimates based on gold price7,8,9,10 | ||

| IRR | ||

| NPV | ||

| Payback period (years) | 2.7 | 1.7 |

________________________

5 The PEA is preliminary in nature and is based, in part, on Inferred Mineral Resources. Inferred Mineral Resources are considered too geologically speculative to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that the economic forecasts on which the PEA is based will be realized.

6 Average production cost of sales and average AISC represent costs for projected production for the life of mine.

7 The economic analysis of the project was carried out using a discounted cash flow approach on a pre-tax and after-tax basis, based on a long-term gold price of

8 An exchange rate of 0.74 USD per 1.00 CAD was assumed to convert CAD market price projections and particular components of the capital cost estimates into USD.

9 The IRR on total investment that is presented in the economic analysis was calculated assuming

10 The NPV was calculated from the after-tax cash flow generated by the project, based on a discount rate of

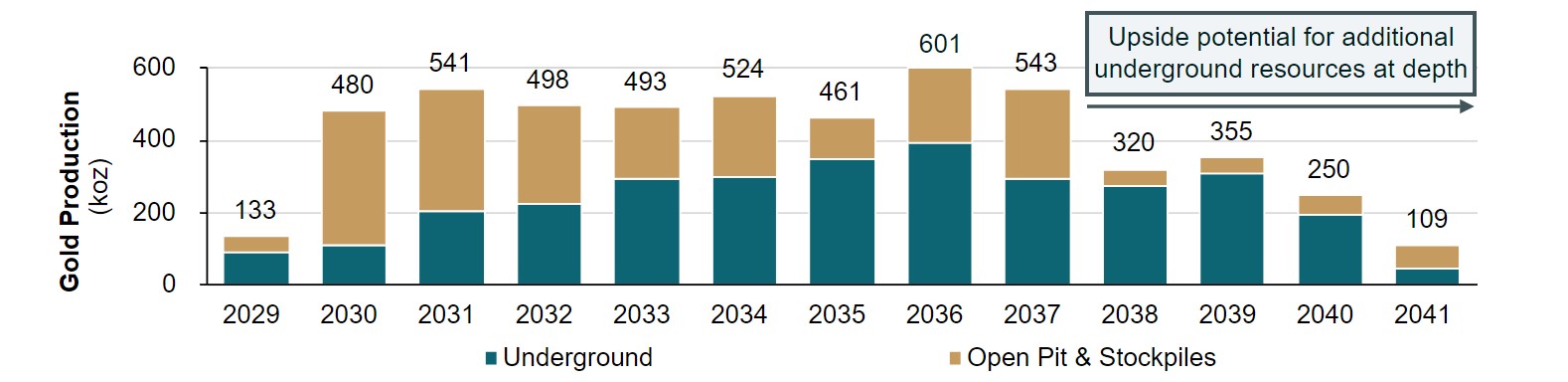

Mine Plan

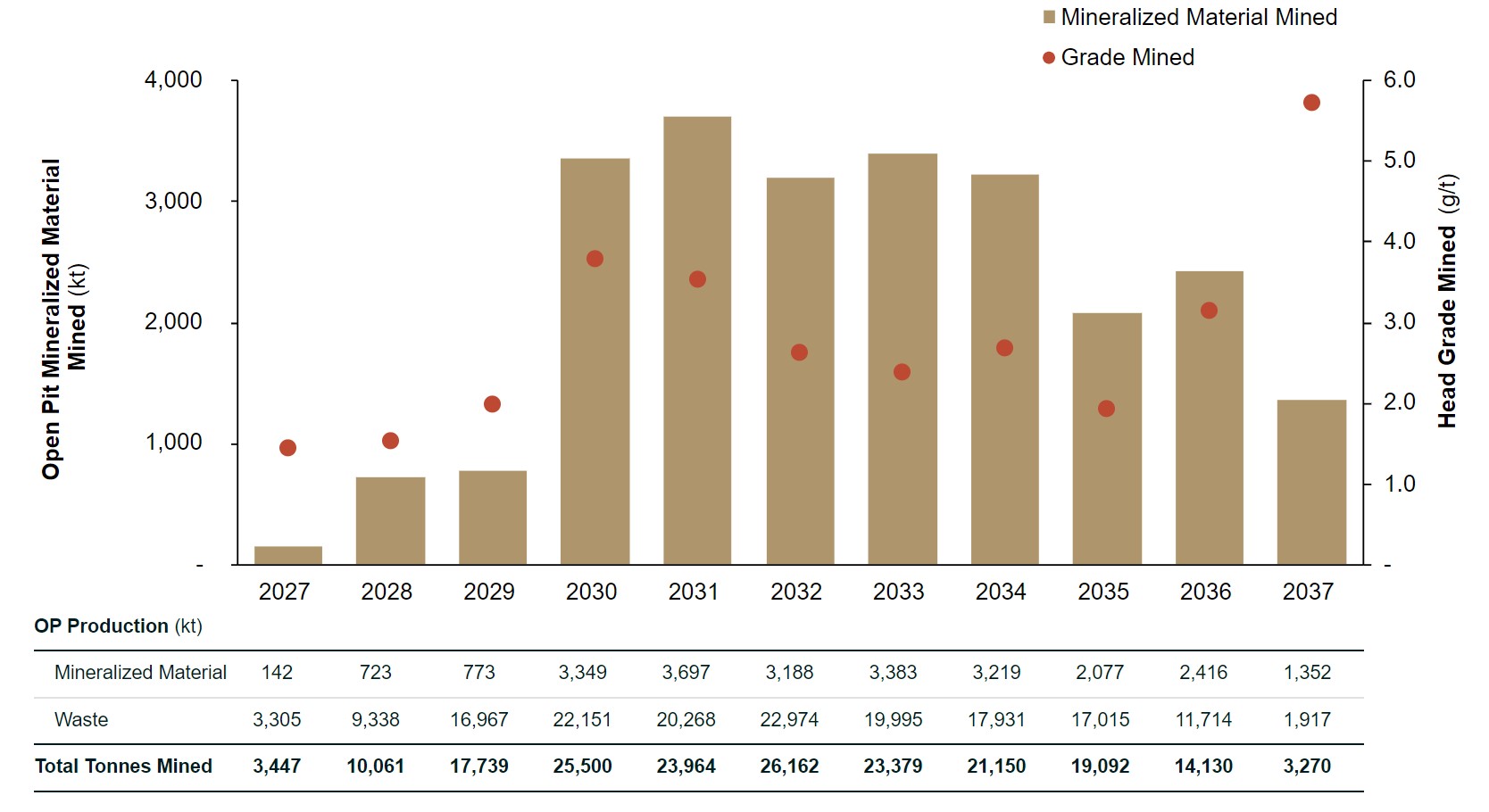

The initial mine plan outlines concurrent open pit and underground mining over the first 8 years followed by combined underground mining and stockpile processing in years 8 to 12. The decision to mine the open pit and underground concurrently from the start provides significant production flexibility and time to continue exploration drilling from underground to further expand the resource and mine life.

The PEA demonstrates an initial life-of-mine (LOM) of approximately 12 years with total production of approximately 5.3 Moz. of gold. However this represents a point in time estimate of the mine plan and is only a window into the long-term potential of the asset given the limitations of drilling at depth from surface. Exploration drilling at depths up to 1,600 metres has already demonstrated continuation of high-grade mineralization with strong widths well below the current PEA inventory, highlighting the upside potential of this asset.

The high-grade open pit will be mined with a dual fleet strategy to provide selective mining of the high-grade material and lower cost mining of the waste, mining a peak of 26 million tonnes of material, and providing a peak of 9,000 tpd of mineralized material.

Figure 1: Open Pit mining plan

A figure accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/c0000d00-833d-44c3-bb2b-c9f6256efdf9

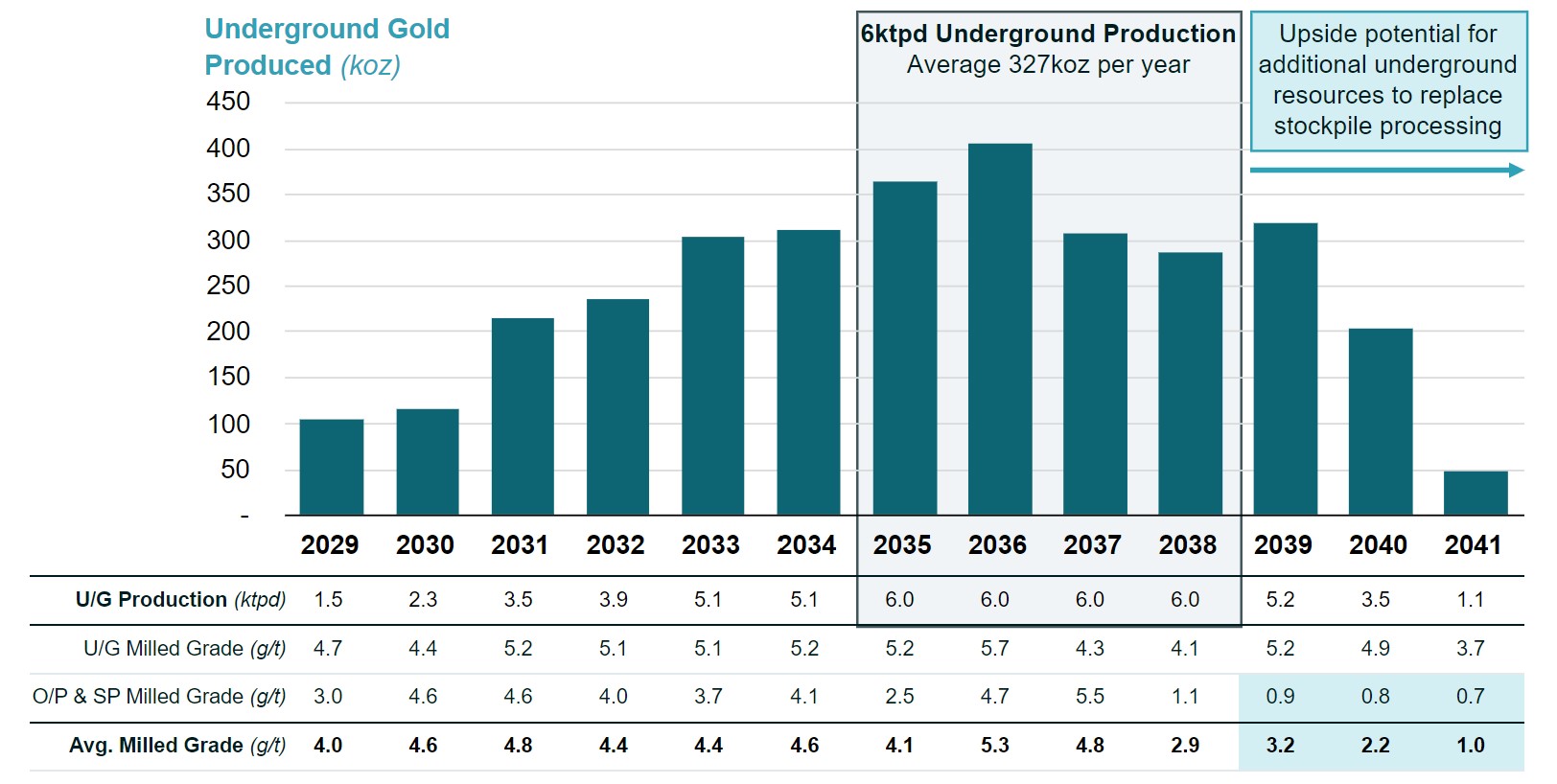

For the underground, the primary mining method is long hole open stoping with paste backfill and cemented rock fill. First stope production is expected to begin in 2029, subject to permitting, and to continue for 12 years with a peak production rate of 6,000 tpd, with potential to expand beyond this run rate as extensions to the underground resource are targeted. At peak, the underground will have a mining rate of 6,000 tpd between 2035 and 2038, producing an average of 327koz. per annum.

Figure 2: Underground mining plan

A figure accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/db93d57c-524e-4059-a891-d0e374224711

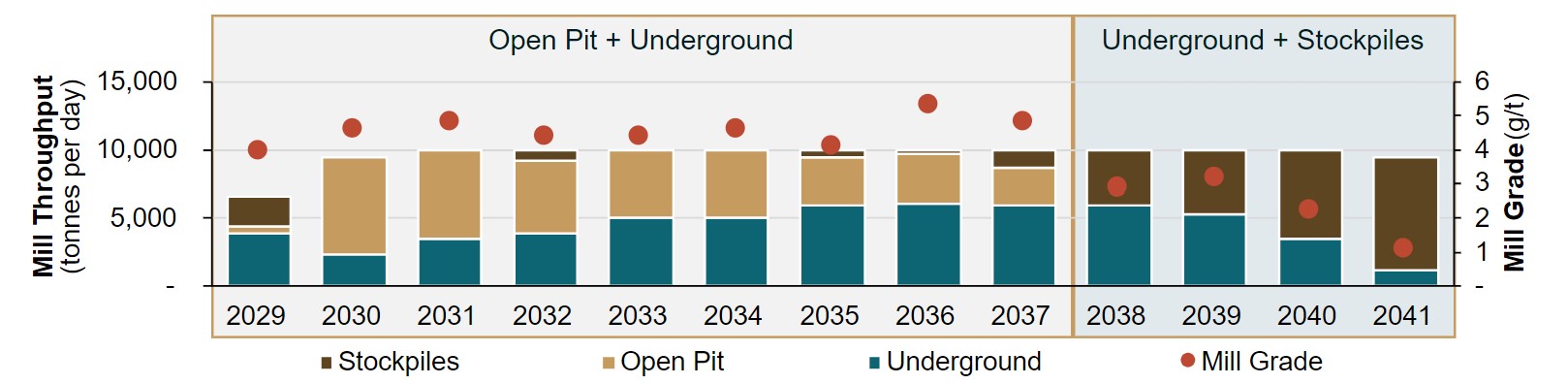

The combination of the open pit and underground production in the years 1 to 8 will allow for processing of higher-grade material and stockpiling of the remaining feed to supplement underground production in the latter years of the mine life. This strategy drives a milled grade of 4.6 g/t in years 1 to 8 and an average production of 518koz. per annum over these years.

Figure 3: Concurrent Open Pit and Underground Gold Production

A figure accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/5e007df4-b44f-49a2-86f8-dc548712d631

Figure 4: Mill Throughput

A figure accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/0eaceeda-6b16-47d2-b979-b54899734d36

| Open pit mining operations | |

| LOM material mined | 187.9 Mt |

| LOM plant feed mined | 24.3 Mt |

| Average grade | 3.0 g/t Au |

| Strip ratio | 6.7 (waste: plant feed) |

| Peak mining rate (all materials) | 26.2 Mtpa |

| Mining unit cost (including capitalized mining) | |

| Underground mining operations | |

| LOM plant feed mined | 20.3 Mt |

| Average grade | 4.9 g/t Au |

| Steady State Mining Rate (plant feed) | 6,000 tpd |

| Mining unit cost (excluding capitalized mining) | |

Mill, Processing and Tailings Design

For the PEA, a conventional milling circuit for free milling mineralization was selected, targeting an average processing rate of 10,000 tpd. This scale of plant configuration simplifies construction, drives high margins and production scale in the early years with selective processing of higher-grade material when mining both open pit and underground, and avoids oversizing the mill for a potential underground only scenario in the latter years of the mine life at Great Bear.

Kinross has completed a comprehensive metallurgical test work program including detailed chemical head analysis, mineralogy, gold deportment, comminution, and leaching and gravity recovery testing across a selection of composite samples. The results of the test work program indicated clean metallurgy with no deleterious elements and very strong recoveries, with average LOM recovery of

Based on the metallurgical test results, Great Bear’s processing plant has been designed as a conventional circuit with a proposed flowsheet including semi-autogenous grinding (SAG) and ball milling, pebble crushing, gravity concentration, leaching followed by carbon-in-pulp adsorption (CIP), elution, electrowinning, and smelting to produce gold doré.

| Key Processing Data | |

| Mill processing rate (tpd) | 10,000 |

| Total plant feed (Mt) | 44.6 |

| LOM avg. feed grade (g/t Au) | 3.87 |

| LOM contained gold (Moz) | 5.5 |

| LOM avg. recovery (% Au) | 95.7 |

| LOM recovered gold (Moz) | 5.3 |

Kinross has invested substantial effort into early technical studies and design for tailings processing and management facilities at Great Bear leveraging the best available technologies to ensure the highest environmental standards.

As a result, the PEA design includes the addition of a desulphurization flotation circuit to remove sulphides and render the tailings non-acid generating, and a rigorous design criteria for all tailings storage facilities at the site.

As well, the LP Viggo Pit has been pulled forward to be mined during project construction in order to provide a robust in-pit tailings storage facility for the sulphide concentrate from the desulphurization flotation circuit, eliminating the need for a dam to impound the sulphide concentrate.

Capital Expenditure

The total initial construction capital is forecasted at

Within the construction capital, the site development, water treatment and infrastructure area includes the truck shop, admin facilities, and camp. It also includes state of the art water treatment including ultra-filtration and a robust site-wide water management strategy to ensure the highest environmental standards.

Additionally, the capital estimate includes indirect and contingency costs, where indirect and owner costs are

The Project’s capital requirements are expected to be manageable for Kinross and are forecasted within the Company’s planned annual capex profile in the range of

| Great Bear capital cost estimates (US$ millions) | |||

| Direct Capital Costs | |||

| Mine equipment | |||

| Site development, water treatment and infrastructure | |||

| UG Infrastructure | |||

| Processing | |||

| Power | |||

| Tailings management facility | |||

| Total Direct Costs | $689 | ||

| Indirect | |||

| Contingency | |||

| Total Initial Construction Capital Cost | $1,181 | ||

| Capitalized open pit mining | |||

| Capitalized underground development | |||

| Total Capitalized Mine Development | $248 | ||

| Total Initial Project Capital | $1,429 | ||

| Life of Mine Sustaining Capital | $1,034 | ||

| Total Growth Capital | $9711 | ||

Next Steps and Permitting

Kinross is continuing to progress work in several areas across the Project, for both the advanced exploration program (AEX) and the Main Project. Both the AEX and Main Project remain subject to permitting, which continues to advance. The AEX permitting is a provincial process and Kinross is working closely with the authorities on finalizing the permits. The Main Project’s permitting is mainly a federal permitting review process driven by the Impact Assessment Agency of Canada (IAAC), with some provincial permitting components. Kinross was pleased to recently receive the Tailored Impact Statement Guidelines from IAAC, which will assist with completing the draft Impact Statement.

For the AEX, detailed engineering, execution planning, and procurement continues to progress well. The Company is targeting to commence surface works in 2024, subject to receiving provincial permits.

For the Main Project, Kinross expects to advance engineering definition and execution planning following the selection of design partners later this year. Work on permitting of the Main Project is ongoing and will require federal review under the Impact Assessment Act. An Impact Statement is currently in process and is expected to be submitted to the IAAC next year.

Kinross has actively engaged and consulted with Indigenous communities and organizations and has commenced negotiations of a Project Agreement with its First Nations partners, Lac Seul and Wabauskang, on whose traditional territories the Great Bear project is located.

________________________

11 The long-term power supply strategy for the Project is to obtain enough power supply from the Ontario power grid to avoid self-generation and the use of natural gas. To secure the necessary grid power supply, Kinross estimates it will need to make a capital contribution of approximately

Resource update and exploration

The Mineral Resources12 at the property have been estimated for three zones: LP, Hinge, and Limb. As of April 2, 2024, approximately 568,000 ounces of inferred resources have been added from the LP zone to the total resource compared to year end 2023, bringing the total inferred resource to 3.9 Moz., in addition to 2.7 Moz. of M&I resources.

Mineral resources have been calculated at a gold price of

| Great Bear Summary of project mineral resources13,14,15,16,17,18 (as at April 2, 2024) | |||||

| Classification | Tonnes | Grade | Gold Ounces | ||

| (000) | (g/t Au) | (000) | |||

| Measured | 1,556 | 3.04 | 152 | ||

| Indicated | 28,711 | 2.80 | 2,586 | ||

| TOTAL M&I | 30,267 | 2.81 | 2,738 | ||

| Inferred | 25,480 | 4.74 | 3,884 | ||

Given the Company’s current understanding of the orogenic system, and the significant high-grade extensions realized at the main LP zone, Kinross expects the strong grades to continue as drilling extends deeper. To date, Kinross has completed more than 420 kilometres of drilling on the property and results have been very strong, supporting the Company’s view that high-grade mineralization extends at depth and indicating the potential for resource growth over time.

Kinross’ 2023 and 2024 exploration program resulted in the addition of significant ounces at improved grades compared with the initial project mineral resource declared at year end 2022, with the bulk of additions in the high-grade underground between 500 metres and 1 kilometre.

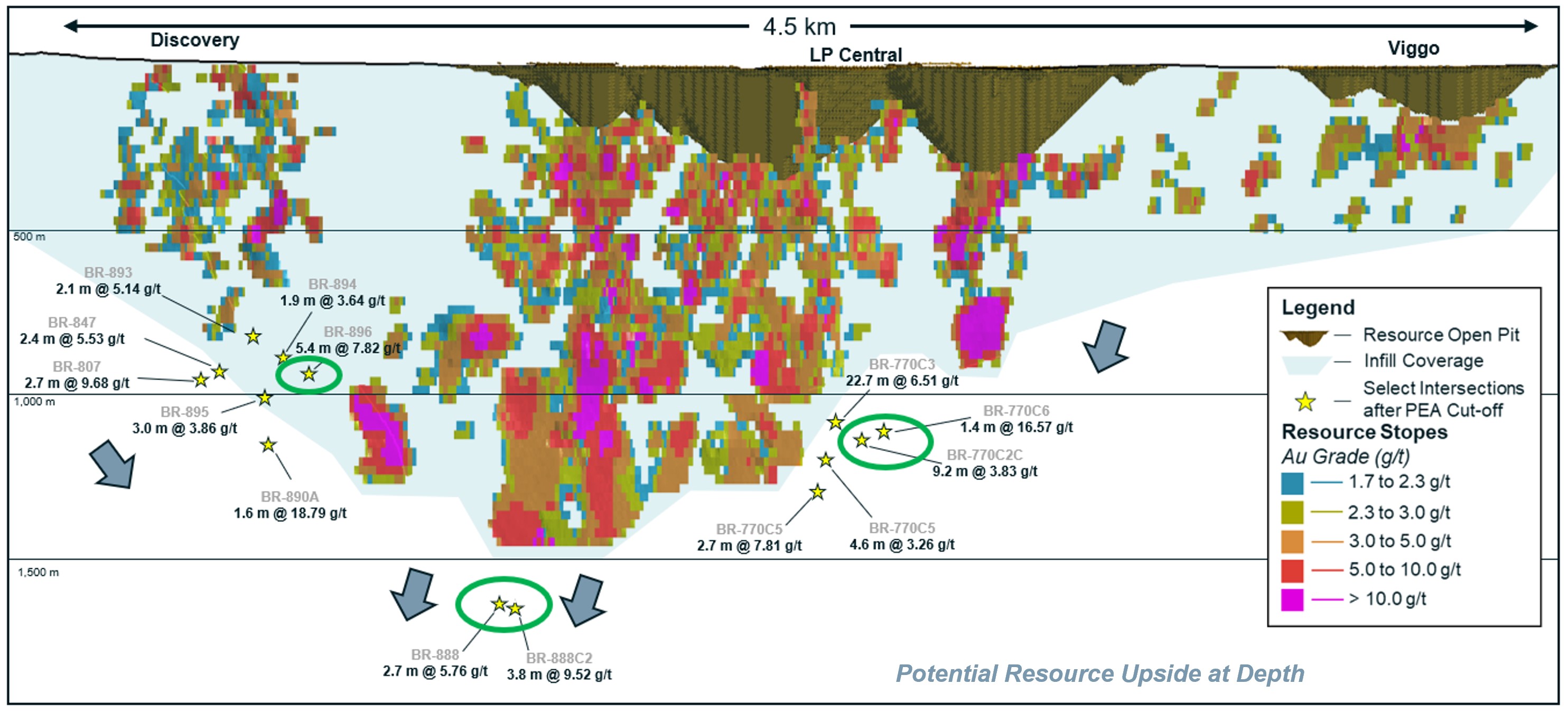

This recent drilling, highlighted by the deepest hole drilled on the property to date, which returned 3.8 metres at a grade of 9.5 g/t at nearly 1.6 kilometres vertical depth at the LP zone, demonstrates the impressive continuity of this system. Exploration drilling at Great Bear continues to see success beyond the PEA inventory. Drill holes BR-888 and BR-888C2 are the deepest drill holes on the property to date and have intersected high grade mineralization 1,600 metre vertically below surface.

Furthermore, exploration drilling at both the Discovery and Yauro zones have also intersected mineralization beyond the PEA inventory. Drill hole BR-770C3 intersected 22.7 metres at 6.51 g/t at Yauro and BR-896 intersected 5.4 metres at 7.82 g/t at Discovery. These drill holes demonstrate the successful expansion of mineralization through drilling, not just at depth, but along strike and linking zones.

________________________

12 Mineral Resources are stated in accordance with CIM (2014) Definitions as incorporated by reference into NI 43-101. Mineral Resources are estimated for the LP zone and satellite Hinge and Limb zones and have an effective date of April 2, 2024.

13 Mineral resources estimated according to CIM (2014) Definitions.

14 Mineral resources estimated at a gold price of

15 Open pit mineral resources are reported within optimized pit shells at a cut-off grade of 0.55 g/t Au.

16 Underground mineral resources are reported within underground reporting shapes at cut-off grades of 2.3 g/t Au for the LP zone, 2.5 g/t Au for the Limb zone, and 2.4 g/t for the Hinge zone. An incremental cut-off grade of 1.7 g/t Au was used at the LP zone for areas that do not require additional development.

17 Mineral resources that are not mineral reserves do not have demonstrated economic viability.

18 Numbers may not add due to rounding.

Figure 5: Resource Growth - continuing to see high-grade intercepts outside of the PEA inventory

A figure accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b9aaeb87-b9e5-4fdd-989a-1c6282633600

The PEA represents a point in time estimate and is only a window into the long-term potential of the asset given the indications of continued mineralization at depth. As a result, the Company is focused on progressing the AEX to begin drilling underground to continue unlocking the full potential of the asset.

In 2024, the Company will continue to focus drilling to link zones at depth at LP and further directional work at Hinge and Limb. Exploration will also focus resources on brownfield exploration work on the newly expanded ~120 square kilometre land package to look for additional open pit and underground opportunities.

Great Bear Technical Presentation details

In connection with this news release, Kinross will hold a conference call and audio webcast on Tuesday, September 10, 2024, at 9:00 a.m. EDT, followed by a question-and-answer session. To access the call, please dial:

To access the call:

Webcast Link: https://meetings.lumiconnect.com/400-478-546-594

Canada & US toll-free: 1-866-613-0812

Outside of Canada & US: 647-694-2812

Replay (available 30 days after the call):

Canada & US toll-free: 1 (877) 454-9859

Outside of Canada & US: (647) 483-1416

Passcode: 4887947

You may also access the conference call on a listen-only basis via webcast at our website www.kinross.com. The audio webcast will be archived on www.kinross.com.

About Kinross Gold Corporation

Kinross is a Canadian-based global senior gold mining company with operations and projects in the United States, Brazil, Mauritania, Chile and Canada. Our focus is on delivering value based on the core principles of responsible mining, operational excellence, disciplined growth, and balance sheet strength. Kinross maintains listings on the Toronto Stock Exchange (symbol: K) and the New York Stock Exchange (symbol: KGC).

Media Contact

Victoria Barrington

Senior Director, Corporate Communications

phone: 647-788-4153

victoria.barrington@kinross.com

Investor Relations Contact

David Shaver

Senior Vice-President

phone: 416-365-2761

david.shaver@kinross.com

APPENDIX A

Non-GAAP financial measures

The Company has included certain non-GAAP financial measures in this document. These financial measures are not defined under IFRS and should not be considered in isolation. The Company believes that these financial measures, together with financial measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. The inclusion of these financial measures is meant to provide additional information and should not be used as a substitute for performance measures prepared in accordance with IFRS. These financial measures are not necessarily standard and therefore may not be comparable to other issuers.

All-in sustaining cost

All in sustaining cost is a non-GAAP financial measure calculated based on guidance published by the World Gold Council (“WGC”). The WGC is a market development organization for the gold industry and is an association whose membership comprises leading gold mining companies including Kinross. Although the WGC is not a mining industry regulatory organization, it worked closely with its member companies to develop these metrics. Adoption of the all-in sustaining cost metric is voluntary and not necessarily standard, and therefore, this measure presented by the Company may not be comparable to similar measures presented by other issuers. The Company believes that the all-in sustaining cost measure complements existing measures and ratios reported by Kinross.

All-in sustaining cost includes both operating and capital costs required to sustain gold production on an ongoing basis. Sustaining operating costs represent expenditures expected to be incurred at Great Bear that are considered necessary to maintain production. Sustaining capital represents expected capital expenditures comprising mine development costs, including capitalized waste, and ongoing replacement of mine equipment and other capital facilities, and does not include expected capital expenditures for major growth projects or enhancement capital for significant infrastructure improvements.

APPENDIX B

Proposed Site Layout

A figure accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/a13ccfc5-3edf-4be5-85ed-f1c17ae69f9c

APPENDIX C

Cautionary statement on forward-looking information

All statements, other than statements of historical fact, contained or incorporated by reference in this news release including, but not limited to, any information as to the future financial or operating performance of Kinross, constitute “forward-looking information” or “forward-looking statements” within the meaning of certain securities laws, including the provisions of the Securities Act (Ontario) and the provisions for “safe harbor” under the United States Private Securities Litigation Reform Act of 1995 and are based on expectations, estimates and projections as of the date of this news release. Forward-looking statements contained in this news release include, without limitation, statements with respect to: the calculation of mineral resources at the project and the possibility of eventual economic extraction of minerals from the project; the identification of future mineral resources at the project; the Company’s ability to convert existing mineral resources into categories of mineral resources or mineral reserves of increased geological confidence; the projected yearly gold production profile from both open pit and underground operations, all-in sustaining costs, mill throughput and average grades; future plans for exploration drilling; the projected economics of the project, including total gold sales, margins, taxes, average annual production, the net present value of the project, the internal rate of return on the project, project payback period, average yearly free cash flow, life of mine unit costs, projected mine life, the total initial capital and sustaining capital required; the project design, including the location of the tailings management facility, process plant, infrastructure area, stockpile areas, the anticipated advanced exploration site and the proposed open pit and underground mine plans; the project development timeline to production including the Company’s work relating to its Impact Statement and permitting future phases of the project and development and construction of and production at the project, including the possibility of constructing either or both of an open pit and underground mines; the timing of and future prospects for exploration and any expansion of the project, including upside associated with the project’s land package and via exploration at depth beneath the proposed underground mine; the potential for expanding the initial mineral resource and the potential for identifying additional mineralization in areas of intercepts and conceptual areas for extension and expansion; potential recovery rates or processing techniques; and the Company’s plans to construct an exploration decline. The words “believe”, “conceptual”, “expect”, “future”, “plan”, “potential”, “progress”, “prospective”, “target”, “view” and “upside” or variations of or similar such words and phrases or statements that certain actions, events or results “may”, “could”, “will” or “would” occur, and similar expressions identify forward-looking statements. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by Kinross as of the date of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. The estimates, models and assumptions of Kinross referenced, contained or incorporated by reference in this news release, which may prove to be incorrect, include, but are not limited to, the various assumptions set forth herein and in our Annual Information Form dated March 27, 2024 and our full-year 2023 Management’s Discussion and Analysis as well as: (1) there being no significant disruptions affecting the activities of the Company whether due to extreme weather events and other or related natural disasters, labour disruptions, supply disruptions, power disruptions, damage to equipment or otherwise; (2) permitting and development of the project being consistent with the Company’s expectations; (3) political and legal developments in Ontario and Canada being consistent with its current expectations; (4) the accuracy of the current mineral resource estimates of the Company (including but not limited to ore tonnage and ore grade estimates); (5) certain price assumptions for gold and silver and foreign exchange rates; (6) Kinross’ future relationship with the Wabauskang and Lac Seul First Nations and other Indigenous groups being consistent with the Company’s expectations; and (7) inflation and prices for diesel, natural gas, fuel oil, electricity and other key supplies being approximately consistent with anticipated levels. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are provided for the purpose of providing information about management’s expectations and plans relating to the future. All of the forward-looking statements made in this news release are qualified by these cautionary statements and those made in our other filings with the securities regulators of Canada and the United States including, but not limited to, the cautionary statements made in the “Risk Factors” section of our Annual Information Form dated March 27, 2024, and the “Risk Analysis” section of our full year 2023 Management’s Discussion & Analysis. These factors are not intended to represent a complete list of the factors that could affect Kinross. Kinross disclaims any intention or obligation to update or revise any forward-looking statements or to explain any material difference between subsequent actual events and such forward looking statements, except to the extent required by applicable law.

Certain forward-looking statements in this press release may also constitute a “financial outlook” within the meaning of applicable securities laws. A financial outlook involves statements about the Company’s prospective financial performance, financial position or cash flows and is based on and subject to the assumptions about future economic conditions and courses of action and the risk factors described above in respect of forward-looking information generally, as well as any other specific assumptions and risk factors in relation to such financial outlook noted in this press release. Such assumptions are based on management’s assessment of the relevant information currently available, and any financial outlook included in this press release is provided for the purpose of helping viewers understand the Company’s current expectations and plans for the future. Viewers are cautioned that reliance on any financial outlook may not be appropriate for other purposes or in other circumstances and that the risk factors described above, or other factors may cause actual results to differ materially from any financial outlook. The actual results of the Company’s operations will likely vary from the amounts set forth in any financial outlook and such variances may be material.

Other information

Where we say “we”, “us”, “our”, the “Company”, or “Kinross” in this news release, we mean Kinross Gold Corporation and/or one or more or all of its subsidiaries, as may be applicable.

The technical information about the Company’s mineral properties contained in this news release has been prepared under the supervision of Mr. Nicos Pfeiffer who is a “qualified person” within the meaning of National Instrument 43-101.

Source: Kinross Gold Corporation