Janover Reports Profitability and Over 700% Monthly Increase in Operating Margins for Groundbreaker Platform in May 2024

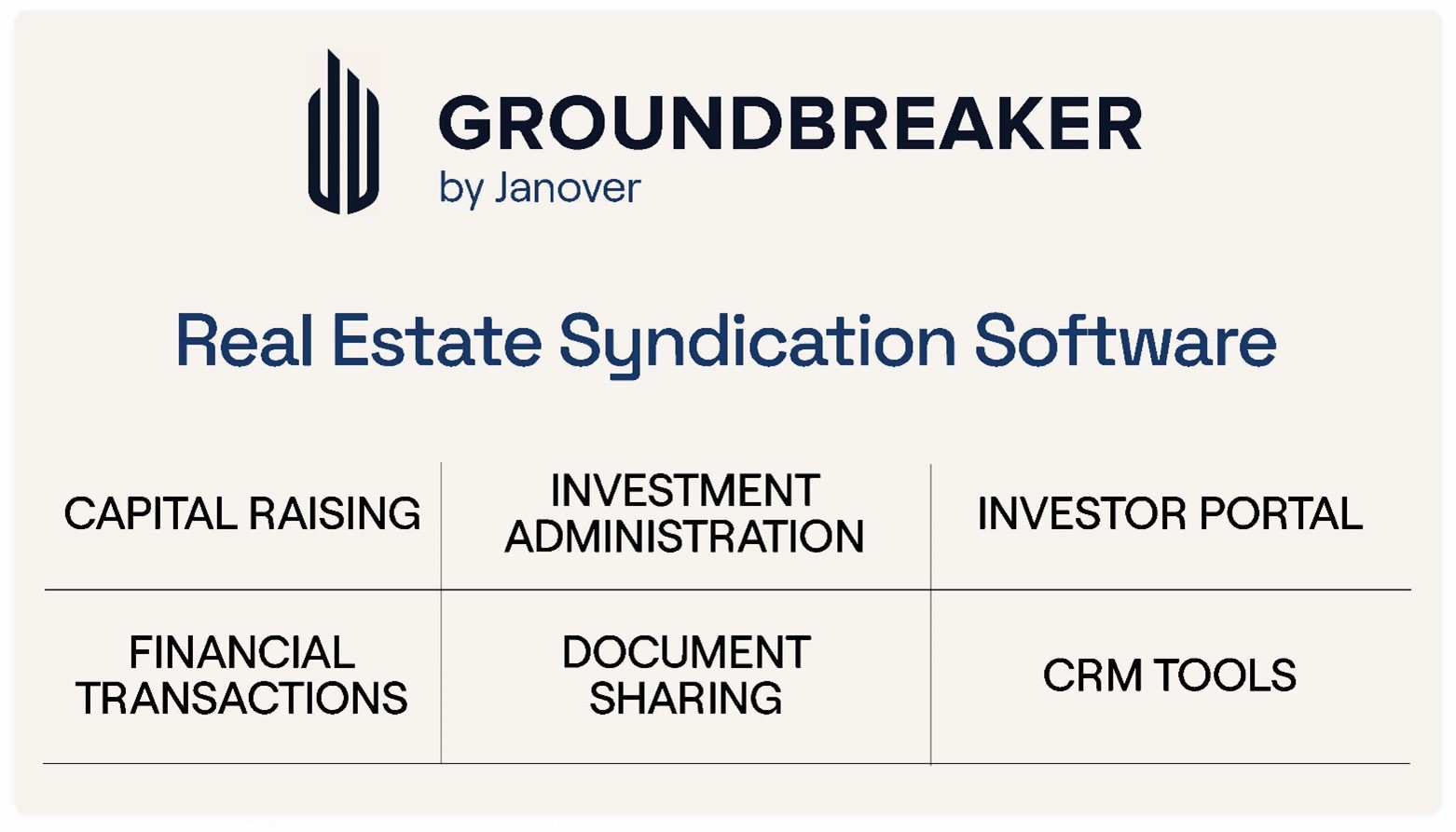

Janover's subsidiary, Groundbreaker, reached profitability in May 2024 with a 700% increase in operating margins, climbing to approximately 30% from -4% in April 2024. Acquired in November 2023, Groundbreaker is a SaaS platform that simplifies capital raising and investment administration in the commercial real estate sector. The platform supports secure financial transactions, investor relations, and document sharing, driving enhanced transparency and engagement. CEO Blake Janover expects continued improvement in operating margins due to the integration of Groundbreaker into Janover's AI-enhanced sales and marketing ecosystem, aiming for high-margin, recurring revenue.

- Groundbreaker achieved profitability in May 2024.

- Operating margins increased by over 700% from April to May 2024, reaching approximately 30%.

- The integration of Groundbreaker into Janover's ecosystem is expected to further improve operating margins.

- High-margin, recurring revenue stream from Groundbreaker.

- None.

Insights

The announcement by Janover Inc. that its subsidiary Groundbreaker achieved profitability and improved operating margins by over

The uptick in margins implies effective cost control and increased revenue generation through Groundbreaker's SaaS model, which typically benefits from high margins once the customer base scales. For retail investors, this is a positive indicator, as the performance suggests potential for sustained profitability. However, it's wise to be cautious and monitor whether these improvements are sustainable long-term or merely short-term gains.

Groundbreaker's success lies in its ability to leverage technology to simplify capital raising and investment administration. The platform’s features, such as secure financial transactions and robust customer relationship management tools, are important for enhancing transparency and engagement between property developers and investors. The integration of Groundbreaker into Janover’s AI-enhanced sales and marketing funnel likely contributed to its profitability.

For investors, this technological synergy means that Groundbreaker can offer differentiated and superior services, which can lead to higher customer retention and satisfaction. The use of AI and automation in their operations supports scalability, making the platform more appealing to a broader range of commercial real estate professionals.

The commercial real estate industry is known for its complexity and Groundbreaker’s SaaS platform addresses key pain points by simplifying equity capital management and investor relations. This market is ripe for disruption through technology and Groundbreaker seems well-positioned to capture a significant share by providing these streamlined services.

Janover’s strategic move to acquire Groundbreaker and its subsequent rapid profitability underscores a strong market demand for such solutions. For investors, this indicates that Janover is tapping into a growing niche, which could translate into strong recurring revenue streams in the future. The emphasis on a high-margin subscription model is particularly attractive, as it suggests predictable and steady revenue growth.

BOCA RATON, Fla., July 11, 2024 (GLOBE NEWSWIRE) -- Janover Inc. (Nasdaq: JNVR) (“Janover” or the “Company”), an AI-enabled platform for commercial real estate transactions, today provided an update on its wholly-owned subsidiary Groundbreaker Tech Inc. (“Groundbreaker”), its recurring revenue B2B Software-as-a-Service (“SaaS”) platform for multifamily and commercial property professionals. Janover recently acquired Groundbreaker in November 2023, and reports that this new business line achieved profitability for the first time in May 2024 since the acquisition, reflecting a sequential monthly increase in its operating margins by more than

Groundbreaker is a specialized SaaS platform designed to simplify capital raising and investment administration in the commercial real estate industry. By offering an intuitive portal at groundbreaker.co, it enables real estate professionals to efficiently manage equity capital, investor relations, and document sharing, fostering a seamless and professional investment experience. The platform also facilitates secure financial transactions and offers robust customer relationship management tools, aiming to enhance transparency and engagement between property developers and investors.

Blake Janover, CEO of Janover, stated, “We are pleased to report that Groundbreaker achieved profitability in May, reflecting an increase in our operating margins due to the hard work and strict financial discipline of our team. We expect this positive trend to continue to improve in June and throughout the rest of the year. Since acquiring Groundbreaker, we have integrated it into Janover’s ecosystem, leveraging our highly automated, AI-enhanced sales and marketing funnel and our suite of services. The synergies from the Groundbreaker acquisition we believe will result in stickier, happier clients. We are focused on generating high-quality, high-margin subscription and recurring revenue as we develop the premier tech-enabled platform for commercial real estate owners and beyond.”

About Janover Inc.

Janover is an AI-enabled platform for commercial real estate transactions. The Company seeks to revolutionize the commercial real estate lending market by making it hyper-efficient, transparent, and accessible to all rather than the few. Through the Company’s online platform, it provides technology that connects commercial mortgage borrowers looking for capital to refinance, build, or purchase commercial property, including, but not limited to, apartment buildings, to commercial property lenders. Borrowers include, but are not limited to, owners, operators, and developers of commercial real estate including multifamily properties and most recently, a growing segment of small business owners, which Janover believes represents a significant growth opportunity. Lenders include small banks, credit unions, REITs, Fannie Mae® and Freddie Mac® multifamily lenders, FHA® multifamily lenders, debt funds, CMBS lenders, SBA lenders, and more. Additional information about the Company is available at: https://janover.co/.

To view the latest investor presentation, please visit https://ir.janover.co/.

Forward-Looking Statements

This release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “believe,” “project,” “estimate,” “expect,” strategy,” “future,” “likely,” “may,”, “should,” “will” and similar references to future periods. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: (i) the effect of and uncertainties related the ongoing volatility in interest rates; (ii) our ability to achieve and maintain profitability in the future; (iii) the impact on our business of the regulatory environment and complexities with compliance related to such environment; (iv) our ability to respond to general economic conditions; (v) our ability to manage our growth effectively and our expectations regarding the development and expansion of our business; (vi) our ability to access sources of capital, including debt financing and other sources of capital to finance operations and growth and other risks and uncertainties more fully in the section captioned "Risk Factors" in the Company’s Registration Statement on Form S-1 related to the public offering (SEC File No. File No. 333-267907) and other reports we file with the SEC. As a result of these matters, changes in facts, assumptions not being realized or other circumstances, the Company's actual results may differ materially from the expected results discussed in the forward-looking statements contained in this press release. Forward-looking statements contained in this announcement are made as of this date, and the Company undertakes no duty to update such information except as required under applicable law.

The financial information presented herein is not a comprehensive statement of our financial results for this period, and our actual results may differ materially from these estimates due to the completion of our financial closing procedures, final adjustments, and other developments that may arise between now and the time the closing procedures for the fiscal quarter are completed.

Contact:

Crescendo Communications, LLC

Tel: 212-671-1020

Email: jnvr@crescendo-ir.com

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/c16e569a-5a05-43c4-97fb-a13e624d95a3

https://www.globenewswire.com/NewsRoom/AttachmentNg/f5f4ea72-cb5f-41bd-80cc-97d7992b8bab