John Marshall Bancorp, Inc. Reports 10th Consecutive Quarter of Record Earnings

John Marshall Bancorp, Inc. (OTCQB: JMSB) reported strong financial results for Q2 2021, marking its tenth consecutive quarter of record earnings. Net income rose 33.3% to $6.1 million, with EPS reaching $0.44. For the first half of 2021, net income was $11.2 million, a 23.1% increase. Total assets grew 14.6% year-over-year, totaling $2.07 billion, while gross loans increased by 3.3%. The bank maintained a pristine asset quality with no non-performing loans. The net interest margin increased to 3.31%.

- Net income increased 33.3% to $6.1 million for Q2 2021.

- Earnings per share rose to $0.44, a 33.3% year-over-year increase.

- Total assets grew 14.6% to $2.07 billion year-over-year.

- Gross loans increased 3.3% from last year.

- No non-performing loans for seven consecutive quarters.

- Gross loans net of unearned income decreased $38.7 million during Q2 2021.

- Noninterest expense increased 23.1% to $9.1 million for Q2 2021.

Insights

Analyzing...

John Marshall Bancorp, Inc. (OTCQB: JMSB) (the “Company”), parent company of John Marshall Bank (the “Bank”), reported its financial results for the three and six months ended June 30, 2021.

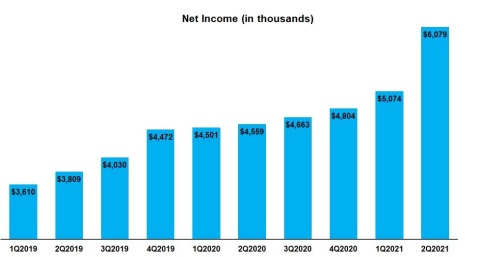

Net Income (in thousands) (Graphic: Business Wire)

Selected Highlights

-

Tenth Consecutive Quarter of Record Earnings – The Company reported net income of

$6.1 million for the three months ended June 30, 2021, a33.3% increase over the$4.6 million reported for the three months ended June 30, 2020. The Company reported net income of$11.2 million for the six months ended June 30, 2021, a23.1% increase over the$9.1 million reported for the six months ended June 30, 2020. Earnings per diluted share for the three months ended June 30, 2021 were$0.44 , a33.3% increase over the$0.33 reported for the three months ended June 30, 2020. Earnings per diluted share for the six months ended June 30, 2021 were$0.80 , a21.2% increase over the$0.66 reported for the six months ended June 30, 2020. Return on average assets was1.20% and return on average equity was12.64% for the three months ended June 30, 2021. Return on average assets was1.13% and return on average equity was11.78% for the six months ended June 30, 2021.

-

Strong Growth – Year-over-year total assets increased

14.6% or$263.3 million to$2.07 billion at June 30, 2021. Gross loans net of unearned income increased$49.5 million or3.3% from June 30, 2020 to June 30, 2021. Gross loans net of unearned income and Paycheck Protection Program (“PPP”) loans grew$115.4 million or8.4% from June 30, 2020 to June 30, 2021. Total deposits grew$253.4 million or16.2% from June 30, 2020 to June 30, 2021. Non-interest bearing demand deposits grew20.1% or$80.0 million from June 30, 2020 to June 30, 2021.

-

Asset Quality Remains Pristine – For the seventh consecutive quarter, the Company had no non-performing loans and no other real estate owned at quarter-end June 30, 2021. As of June 30, 2021, the Company had no loans more than 15 days past due. The Company had

$90 thousand and$91 thousand in charge-offs during the three months and six months ended June 30, 2021, respectively, compared to no charge-offs during the same periods in 2020. Troubled debt restructurings were$473 thousand at June 30, 2021, a decrease of$160 thousand , from$633 thousand at June 30, 2020. The Company had no COVID modifications as of June 30, 2021. The Company believes its allowance for loan losses is appropriate for the inherent risks and uncertainties associated with the portfolio.

-

Net Interest Margin Increased from 2Q 2020 and 1Q 2021 – The net interest margin was

3.31% for the three months ended June 30, 2021, an increase of 4 basis points from the three months ended June 30, 2020. On a linked quarterly basis, net interest margin, excluding PPP loans, increased 7 basis points from3.25% for the quarter ended March 31, 2021 to3.32% for the quarter ended June 30, 2021.

Chris Bergstrom, President and Chief Executive Officer, commented, “Despite the economic headwinds we have faced over the course of the past year, John Marshall continues to produce record earnings while investing for our future growth. We have a well-capitalized balance sheet, ample liquidity, excellent asset quality and a strong loan pipeline. Our net interest margin has been stable and our ratio of overhead expense to average assets compares favorably to the industry. We are well-positioned as the economic outlook continues to improve.”

Balance Sheet Review

Assets

Total assets were

Loans

Gross loans were

Excluding the impact of PPP loans, gross loans net of unearned income grew

Investment Securities

The Company’s portfolio of investments in fixed income securities was

Interest-Bearing Deposits in Banks

Interest-bearing deposits in banks were

Deposits

Total deposits were

Non-interest bearing demand deposits were

Core customer funding (which includes reciprocal IntraFi Demand®, IntraFi Money Market® and IntraFi CD® deposits maintained by customers) was

IntraFi CD® certificates of deposits (formerly known as Certificate of Deposit Account Registry Service [CDARS]) were

Certificates of deposits were

Borrowings

Borrowings, consisting of Federal Home Loan Bank of Atlanta (“FHLB”) advances were

The Company had subordinated notes with a balance of

Shareholders’ Equity and Capital Levels

Total shareholders’ equity was

Total common shares outstanding increased from 13,573,601, including 47,403 shares relating to unvested stock awards, at June 30, 2020, to 13,639,173, including 60,995 shares relating to unvested stock awards, at June 30, 2021. The year-over-year increase in shares outstanding was the result of exercises of share options and additional grants of unvested stock awards.

The Bank’s capital ratios remain well above regulatory minimums for well-capitalized banks. As of June 30, 2021, the Bank’s total risk-based capital ratio was

Asset Quality

As of June 30, 2021, the Company had no non-accrual loans, no loans more than 15 days past due and no other real estate owned.

Troubled debt restructurings were

The Company did not have any loans with COVID loan modifications as of June 30, 2021.

Income Statement Review

Net Interest Income

Net interest income was

Average loans net of unearned income increased

The average cost of interest-bearing liabilities declined 81 basis points or

Net interest margin, excluding PPP loans, was

Net interest income was

Average loans net of unearned income increased

The average cost of interest-bearing liabilities declined 92 basis points or

Net interest margin, excluding PPP loans, was

On a linked quarterly basis, net interest margin, excluding PPP loans, increased from

Provision for Loan Losses

The Company had a

The Company had a

The allowance for loan losses as a percentage of total loans increased from

The Company continues to monitor and evaluate additional information as it becomes available concerning COVID and a number of economic performance metrics, including those related to the overall economy as well as specific industry sectors. The Company believes the allowance for loan losses was adequate to absorb probable losses inherent in the loan portfolio as of June 30, 2021. The continued evolution of COVID and the intensity of its socioeconomic effects, which are inherently uncertain, may positively or negatively impact the level of the allowance and provision in future periods.

Noninterest Income

The Company’s recurring sources of noninterest income consist primarily of bank owned life insurance income, service charges on deposit accounts and insurance commissions. Generally speaking, loan fees are included in interest income on the loan portfolio and not reported as noninterest income.

For the three and six months ended June 30, 2021, the Company reported total noninterest income of

Noninterest Expense

For the three months ended June 30, 2021, noninterest expense increased

For the six months ended June 30, 2021, noninterest expense increased

For both the three and six months ended June 30, 2021, the increase in salaries and employee benefits was primarily related to increases in headcount within the Bank and incentive compensation tied to performance. The headcount increases are investments in the Bank’s future growth. As in the past, management expects these staffing additions will lead to subsequent increases in revenues. Incentive compensation expense accruals can fluctuate significantly from quarter to quarter, based upon the Company’s financial performance and condition measured against, among other evaluation criteria, our strategic plan and budget. Increases in occupancy expense were primarily related to additional cleaning expenses related to COVID and general increase in rent expenses. Furniture and equipment expense declined due to renegotiation of software and equipment contracts during the past year. The increase in other operating expense for the three and six months ended June 30, 2021 when compared to the same periods in 2020 was primarily due to increases in legal expenses (including contemplated registration of the Company’s shares with the Securities and Exchange Commission), consulting expenses, marketing expenses, state bank franchise taxes, and expense associated with higher Federal Deposit Insurance Corporation deposit insurance that correlates directly to the Bank’s increase of insured deposit balances.

About John Marshall Bancorp, Inc.

John Marshall Bancorp, Inc. is the bank holding company for John Marshall Bank. John Marshall Bank is headquartered in Reston, Virginia with eight full-service branches located in Alexandria, Arlington, Loudoun, Prince William, Reston, Rockville, Tysons, and Washington, D.C. and one loan production office in Arlington, Virginia. The Company is dedicated to providing an exceptional customer experience and value to local businesses, business owners and consumers in the Washington D.C. Metro area. The Bank offers a comprehensive line of sophisticated banking products, services and a digital platform that rival those of the largest banks. Dedicated relationship managers serving as direct point-of-contact along with an experienced staff help achieve customer’s financial goals. Learn more at www.johnmarshallbank.com.

In addition to historical information, this press release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 which are based on certain assumptions and describe future plans, strategies and expectations of the Company. These forward-looking statements are generally identified by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “will,” “should,” “may,” “view,” “opportunity,” “potential,” or similar expressions or expressions of confidence. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations of the Company and its subsidiary include, but are not limited to the following: changes in interest rates, general economic conditions, public health crises (such as the governmental, social and economic effects of COVID), levels of unemployment in the Bank’s lending area, real estate market values in the Bank’s lending area, future natural disasters, the level of prepayments on loans and mortgage-backed securities, legislative/regulatory changes, monetary and fiscal policies of the U.S. Government including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System, the quality or composition of the loan or investment portfolios, demand for loan products, deposit flows, competition, demand for financial services in the Company’s market area, accounting principles and guidelines, and other conditions which by their nature are not susceptible to accurate forecast, and are subject to significant uncertainty. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

| John Marshall Bancorp, Inc. | |||||||||||||||

| Financial Highlights (Unaudited) | |||||||||||||||

| (Dollar amounts in thousands, except per share data) | |||||||||||||||

| At or For the Three Months Ended | At or For the Six Months Ended | ||||||||||||||

| June 30, | June 30, | ||||||||||||||

|

2021 |

|

|

2020 |

|

|

|

2021 |

|

|

2020 |

|

|||

| Selected Balance Sheet Data | |||||||||||||||

| Cash and cash equivalents | $ |

168,004 |

|

$ |

120,106 |

|

|

168,004 |

|

|

120,106 |

|

|||

| Total investment securities |

|

306,030 |

|

|

134,304 |

|

|

306,030 |

|

|

134,304 |

|

|||

| Loans, net of unearned income |

|

1,567,112 |

|

|

1,517,631 |

|

|

1,567,112 |

|

|

1,517,631 |

|

|||

| Allowance for loan losses |

|

19,381 |

|

|

12,725 |

|

|

19,381 |

|

|

12,725 |

|

|||

| Total assets |

|

2,065,895 |

|

|

1,802,573 |

|

|

2,065,895 |

|

|

1,802,573 |

|

|||

| Non-interest bearing demand deposits |

|

478,705 |

|

|

398,670 |

|

|

478,705 |

|

|

398,670 |

|

|||

| Interest bearing deposits |

|

1,336,327 |

|

|

1,162,921 |

|

|

1,336,327 |

|

|

1,162,921 |

|

|||

| Total deposits |

|

1,815,032 |

|

|

1,561,591 |

|

|

1,815,032 |

|

|

1,561,591 |

|

|||

| Shareholders' equity |

|

195,246 |

|

|

176,326 |

|

|

195,246 |

|

|

176,326 |

|

|||

| Summary Results of Operations | |||||||||||||||

| Interest income | $ |

18,627 |

|

$ |

18,055 |

|

$ |

37,374 |

|

$ |

35,873 |

|

|||

| Interest expense |

|

2,136 |

|

|

4,182 |

|

|

4,601 |

|

|

9,173 |

|

|||

| Net interest income |

|

16,491 |

|

|

13,873 |

|

|

32,773 |

|

|

26,700 |

|

|||

| Provision for loan losses |

|

90 |

|

|

1,507 |

|

|

2,455 |

|

|

1,926 |

|

|||

| Net interest income after provision for loan losses |

|

16,401 |

|

|

12,366 |

|

|

30,318 |

|

|

24,774 |

|

|||

| Noninterest income |

|

417 |

|

|

638 |

|

|

881 |

|

|

882 |

|

|||

| Noninterest expense |

|

9,067 |

|

|

7,366 |

|

|

16,960 |

|

|

14,506 |

|

|||

| Income before income taxes |

|

7,751 |

|

|

5,638 |

|

|

14,239 |

|

|

11,150 |

|

|||

| Net income |

|

6,079 |

|

|

4,559 |

|

|

11,153 |

|

|

9,060 |

|

|||

| Per Share Data and Shares Outstanding | |||||||||||||||

| Earnings per share - basic | $ |

0.45 |

|

$ |

0.34 |

|

$ |

0.82 |

|

$ |

0.67 |

|

|||

| Earnings per share - diluted | $ |

0.44 |

|

$ |

0.33 |

|

$ |

0.80 |

|

$ |

0.66 |

|

|||

| Tangible book value per share | $ |

14.32 |

|

$ |

12.99 |

|

$ |

14.32 |

|

$ |

12.99 |

|

|||

| Weighted average common shares (basic) |

|

13,572,779 |

|

|

13,504,858 |

|

|

13,565,320 |

|

|

13,393,546 |

|

|||

| Weighted average common shares (diluted) |

|

13,868,147 |

|

|

13,635,927 |

|

|

13,852,936 |

|

|

13,664,108 |

|

|||

| Common shares outstanding at end of period |

|

13,639,173 |

|

|

13,573,601 |

|

|

13,639,173 |

|

|

13,573,601 |

|

|||

| Performance Ratios | |||||||||||||||

| Return on average assets (annualized) |

|

1.20 |

% |

|

1.05 |

% |

|

1.13 |

% |

|

1.09 |

% |

|||

| Return on average equity (annualized) |

|

12.64 |

% |

|

10.51 |

% |

|

11.78 |

% |

|

10.68 |

% |

|||

| Net interest margin |

|

3.31 |

% |

|

3.27 |

% |

|

3.37 |

% |

|

3.30 |

% |

|||

| Noninterest income as a percentage of average assets (annualized) |

|

0.08 |

% |

|

0.15 |

% |

|

0.09 |

% |

|

0.11 |

% |

|||

| Noninterest expense to average assets (annualized) |

|

1.79 |

% |

|

1.70 |

% |

|

1.72 |

% |

|

1.75 |

% |

|||

| Efficiency ratio |

|

53.6 |

% |

|

50.8 |

% |

|

50.4 |

% |

|

52.6 |

% |

|||

| Asset Quality | |||||||||||||||

| Non-performing assets to total assets |

|

0.00 |

% |

|

0.00 |

% |

|

0.00 |

% |

|

0.00 |

% |

|||

| Non-performing loans to total loans |

|

0.00 |

% |

|

0.00 |

% |

|

0.00 |

% |

|

0.00 |

% |

|||

| Allowance for loan losses to non-performing loans |

|

N/M |

|

|

N/M |

|

|

N/M |

|

|

N/M |

|

|||

| Allowance for loan losses to total loans (1) |

|

1.24 |

% |

|

0.84 |

% |

|

1.24 |

% |

|

0.84 |

% |

|||

| Net charge-offs (recoveries) to average loans (annualized) |

|

0.02 |

% |

|

(0.01 |

)% |

|

0.01 |

% |

|

(0.01 |

)% |

|||

| Loans 30-89 days past due and accruing interest | $ |

- - |

|

$ |

- - |

|

$ |

- - |

|

$ |

- - |

|

|||

| Non-accrual loans | $ |

- - |

|

$ |

- - |

|

$ |

- - |

|

$ |

- - |

|

|||

| Other real estate owned | $ |

- - |

|

$ |

- - |

|

$ |

- - |

|

$ |

- - |

|

|||

| Non-performing assets (2) | $ |

- - |

|

$ |

- - |

|

$ |

- - |

|

$ |

- - |

|

|||

| Troubled debt restructurings (total) | $ |

473 |

|

$ |

633 |

|

$ |

473 |

|

$ |

633 |

|

|||

| Performing in accordance with modified terms | $ |

473 |

|

$ |

633 |

|

$ |

473 |

|

$ |

633 |

|

|||

| Not performing in accordance with modified terms | $ |

- - |

|

$ |

- - |

|

$ |

- - |

|

$ |

- - |

|

|||

| Capital Ratios | |||||||||||||||

| Tangible equity / tangible assets |

|

9.5 |

% |

|

9.8 |

% |

|

9.5 |

% |

|

9.8 |

% |

|||

| Total risk-based capital ratio |

|

15.0 |

% |

|

14.4 |

% |

|

15.0 |

% |

|

14.4 |

% |

|||

| Tier 1 risk-based capital ratio |

|

13.9 |

% |

|

11.9 |

% |

|

13.9 |

% |

|

11.9 |

% |

|||

| Leverage ratio |

|

10.7 |

% |

|

9.9 |

% |

|

10.7 |

% |

|

9.9 |

% |

|||

| Common equity tier 1 ratio |

|

12.3 |

% |

|

11.9 |

% |

|

12.3 |

% |

|

11.9 |

% |

|||

| Other Information | |||||||||||||||

| Number of full time equivalent employees |

|

143 |

|

|

133 |

|

|

143 |

|

|

133 |

|

|||

| # Full service branch offices |

|

8 |

|

|

8 |

|

|

8 |

|

|

8 |

|

|||

| # Loan production or limited service branch offices |

|

1 |

|

|

1 |

|

|

1 |

|

|

1 |

|

|||

(1) The allowance for loan losses to total loans, excluding PPP loans of |

(2) Non-performing assets consist of non-accrual loans, loans 90 days or more past due and still accruing interest, and other real estate owned. Does not include troubled debt restructurings which were accruing interest at the date indicated. |

| John Marshall Bancorp, Inc. | ||||||||||||||||||

| Consolidated Balance Sheets | ||||||||||||||||||

| (Dollar amounts in thousands, except per share data) | ||||||||||||||||||

| % Change | ||||||||||||||||||

| June 30, | December 31, | June 30, | Last Six | Year Over | ||||||||||||||

|

2021 |

|

|

|

2020 |

|

|

|

2020 |

|

Months | Year | ||||||

Assets |

(Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||||

| Cash and due from banks | $ |

9,341 |

|

$ |

8,228 |

|

$ |

10,214 |

|

13.5 |

% |

-8.5 |

% |

|||||

| Interest-bearing deposits in banks |

|

158,663 |

|

|

130,229 |

|

|

109,892 |

|

21.8 |

% |

44.4 |

% |

|||||

| Securities available-for-sale, at fair value |

|

299,485 |

|

|

151,900 |

|

|

127,724 |

|

97.2 |

% |

134.5 |

% |

|||||

| Restricted securities, at cost |

|

4,939 |

|

|

5,676 |

|

|

5,839 |

|

-13.0 |

% |

-15.4 |

% |

|||||

| Equity securities, at fair value |

|

1,606 |

|

|

967 |

|

|

741 |

|

66.1 |

% |

116.7 |

% |

|||||

| Loans, net of unearned income |

|

1,567,112 |

|

|

1,562,524 |

|

|

1,517,631 |

|

0.3 |

% |

3.3 |

% |

|||||

| Allowance for loan losses |

|

(19,381 |

) |

|

(17,017 |

) |

|

(12,725 |

) |

13.9 |

% |

52.3 |

% |

|||||

| Net loans |

|

1,547,731 |

|

|

1,545,507 |

|

|

1,504,906 |

|

0.1 |

% |

2.8 |

% |

|||||

| Bank premises and equipment, net |

|

1,955 |

|

|

2,422 |

|

|

2,213 |

|

-19.3 |

% |

-11.7 |

% |

|||||

| Accrued interest receivable |

|

4,513 |

|

|

5,308 |

|

|

5,469 |

|

-15.0 |

% |

-17.5 |

% |

|||||

| Bank owned life insurance |

|

20,794 |

|

|

20,587 |

|

|

20,353 |

|

1.0 |

% |

2.2 |

% |

|||||

| Right of use assets |

|

5,608 |

|

|

5,944 |

|

|

6,603 |

|

-5.7 |

% |

-15.1 |

% |

|||||

| Other assets |

|

11,260 |

|

|

8,728 |

|

|

8,619 |

|

29.0 |

% |

30.6 |

% |

|||||

| Total assets | $ |

2,065,895 |

|

$ |

1,885,496 |

|

$ |

1,802,573 |

|

9.6 |

% |

14.6 |

% |

|||||

| Liabilities and Shareholders' Equity | ||||||||||||||||||

Liabilities |

||||||||||||||||||

| Deposits: | ||||||||||||||||||

| Non-interest bearing demand deposits | $ |

478,705 |

|

$ |

362,582 |

|

$ |

398,670 |

|

32.0 |

% |

20.1 |

% |

|||||

| Interest bearing demand deposits |

|

587,878 |

|

|

563,956 |

|

|

510,936 |

|

4.2 |

% |

15.1 |

% |

|||||

| Savings deposits |

|

79,119 |

|

|

62,138 |

|

|

49,896 |

|

27.3 |

% |

58.6 |

% |

|||||

| Time deposits |

|

669,330 |

|

|

651,444 |

|

|

602,089 |

|

2.7 |

% |

11.2 |

% |

|||||

| Total deposits |

|

1,815,032 |

|

|

1,640,120 |

|

|

1,561,591 |

|

10.7 |

% |

16.2 |

% |

|||||

| Federal Home Loan Bank advances |

|

18,000 |

|

|

22,000 |

|

|

26,000 |

|

-18.2 |

% |

-30.8 |

% |

|||||

| Subordinated debt |

|

24,704 |

|

|

24,679 |

|

|

24,655 |

|

0.1 |

% |

0.2 |

% |

|||||

| Accrued interest payable |

|

884 |

|

|

877 |

|

|

958 |

|

0.8 |

% |

-7.7 |

% |

|||||

| Lease liabilities |

|

5,873 |

|

|

6,208 |

|

|

6,853 |

|

-5.4 |

% |

-14.3 |

% |

|||||

| Other liabilities |

|

6,156 |

|

|

5,531 |

|

|

6,190 |

|

11.3 |

% |

-0.5 |

% |

|||||

| Total liabilities |

|

1,870,649 |

|

|

1,699,415 |

|

|

1,626,247 |

|

10.1 |

% |

15.0 |

% |

|||||

| Shareholders' Equity | ||||||||||||||||||

| Preferred stock, par value |

||||||||||||||||||

| 1,000,000 shares; none issued |

|

- - |

|

|

- - |

|

|

- - |

|

- - |

|

- - |

|

|||||

| Common stock, nonvoting, par value |

||||||||||||||||||

| 1,000,000 shares; none issued |

|

- - |

|

|

- - |

|

|

- - |

|

- - |

|

- - |

|

|||||

| Common stock, voting, par value |

||||||||||||||||||

| 30,000,000 shares; issued and outstanding, 13,639,173 | ||||||||||||||||||

| at 6/30/2021 including 60,995 unvested shares, 13,606,558 | ||||||||||||||||||

| shares at 12/31/2020 including 74,000 unvested shares | ||||||||||||||||||

| and 13,573,601 at 6/30/2020, including 47,403 unvested shares |

|

136 |

|

|

135 |

|

|

135 |

|

0.6 |

% |

0.6 |

% |

|||||

| Additional paid-in capital |

|

90,448 |

|

|

89,995 |

|

|

89,718 |

|

0.5 |

% |

0.8 |

% |

|||||

| Retained earnings |

|

103,318 |

|

|

92,165 |

|

|

82,700 |

|

12.1 |

% |

24.9 |

% |

|||||

| Accumulated other comprehensive income |

|

1,344 |

|

|

3,786 |

|

|

3,773 |

|

64.5 |

% |

64.4 |

% |

|||||

| Total shareholders' equity |

|

195,246 |

|

|

186,081 |

|

|

176,326 |

|

4.9 |

% |

10.7 |

% |

|||||

| Total liabilities and shareholders' equity | $ |

2,065,895 |

|

$ |

1,885,496 |

|

$ |

1,802,573 |

|

9.6 |

% |

14.6 |

% |

|||||

| John Marshall Bancorp, Inc. | ||||||||||||||||||

| Consolidated Statements of Income | ||||||||||||||||||

| (Dollar amounts in thousands, except per share data) | ||||||||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||||

| June 30, | June 30, | |||||||||||||||||

|

2021 |

|

2020 |

% Change |

|

2021 |

|

2020 |

% Change | |||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||||

| Interest and Dividend Income | ||||||||||||||||||

| Interest and fees on loans | $ |

17,499 |

$ |

17,165 |

1.9 |

% |

$ |

35,338 |

$ |

33,790 |

4.6 |

% |

||||||

| Interest on investment securities, taxable |

|

993 |

|

744 |

33.5 |

% |

|

1,762 |

|

1,516 |

16.2 |

% |

||||||

| Interest on investment securities, tax-exempt |

|

30 |

|

26 |

15.4 |

% |

|

60 |

|

52 |

15.4 |

% |

||||||

| Dividends |

|

66 |

|

87 |

-24.1 |

% |

|

131 |

|

182 |

-28.0 |

% |

||||||

| Interest on deposits in banks |

|

39 |

|

33 |

18.2 |

% |

|

83 |

|

333 |

-75.1 |

% |

||||||

| Total interest and dividend income |

|

18,627 |

|

18,055 |

3.2 |

% |

|

37,374 |

|

35,873 |

4.2 |

% |

||||||

| Interest Expense | ||||||||||||||||||

| Deposits |

|

1,735 |

|

3,699 |

-53.1 |

% |

|

3,795 |

|

8,157 |

-53.5 |

% |

||||||

| Federal Home Loan Bank advances |

|

30 |

|

112 |

-73.2 |

% |

|

63 |

|

272 |

-76.8 |

% |

||||||

| Subordinated debt |

|

371 |

|

371 |

0.0 |

% |

|

743 |

|

743 |

0.0 |

% |

||||||

| Other short-term borrowings |

|

- - |

|

- - |

N/M |

|

|

- - |

|

1 |

-100.0 |

% |

||||||

| Total interest expense |

|

2,136 |

|

4,182 |

-48.9 |

% |

|

4,601 |

|

9,173 |

-49.8 |

% |

||||||

| Net interest income |

|

16,491 |

|

13,873 |

18.9 |

% |

|

32,773 |

|

26,700 |

22.7 |

% |

||||||

| Provision for loan losses |

|

90 |

|

1,507 |

-94.0 |

% |

|

2,455 |

|

1,926 |

27.5 |

% |

||||||

| Net interest income after provision for loan losses |

|

16,401 |

|

12,366 |

32.6 |

% |

|

30,318 |

|

24,774 |

22.4 |

% |

||||||

| Noninterest Income | ||||||||||||||||||

| Service charges on deposit accounts |

|

131 |

|

102 |

28.4 |

% |

|

252 |

|

236 |

6.8 |

% |

||||||

| Bank owned life insurance |

|

100 |

|

115 |

-13.0 |

% |

|

207 |

|

234 |

-11.5 |

% |

||||||

| Other service charges and fees |

|

44 |

|

35 |

25.7 |

% |

|

85 |

|

82 |

3.7 |

% |

||||||

| Gain on sale of securities |

|

- - |

|

297 |

-100.0 |

% |

|

10 |

|

309 |

-96.8 |

% |

||||||

| Other operating income |

|

142 |

|

89 |

59.6 |

% |

|

327 |

|

21 |

1457.1 |

% |

||||||

| Total noninterest income |

|

417 |

|

638 |

-34.6 |

% |

|

881 |

|

882 |

-0.1 |

% |

||||||

| Noninterest Expenses | ||||||||||||||||||

| Salaries and employee benefits |

|

5,680 |

|

4,442 |

27.9 |

% |

|

10,669 |

|

8,928 |

19.5 |

% |

||||||

| Occupancy expense of premises |

|

514 |

|

489 |

5.1 |

% |

|

1,021 |

|

976 |

4.6 |

% |

||||||

| Furniture and equipment expenses |

|

378 |

|

557 |

-32.1 |

% |

|

700 |

|

926 |

-24.4 |

% |

||||||

| Other operating expenses |

|

2,495 |

|

1,878 |

32.9 |

% |

|

4,570 |

|

3,676 |

24.3 |

% |

||||||

| Total noninterest expenses |

|

9,067 |

|

7,366 |

23.1 |

% |

|

16,960 |

|

14,506 |

16.9 |

% |

||||||

| Income before income taxes |

|

7,751 |

|

5,638 |

37.5 |

% |

|

14,239 |

|

11,150 |

27.7 |

% |

||||||

| Income tax expense |

|

1,672 |

|

1,079 |

55.0 |

% |

|

3,086 |

|

2,090 |

47.7 |

% |

||||||

| Net income | $ |

6,079 |

$ |

4,559 |

33.3 |

% |

$ |

11,153 |

$ |

9,060 |

23.1 |

% |

||||||

| Earnings Per Share | ||||||||||||||||||

| Basic | $ |

0.45 |

$ |

0.34 |

32.4 |

% |

$ |

0.82 |

$ |

0.67 |

22.4 |

% |

||||||

| Diluted | $ |

0.44 |

$ |

0.33 |

33.3 |

% |

$ |

0.80 |

$ |

0.66 |

21.2 |

% |

||||||

| John Marshall Bancorp, Inc. | |||||||||||||||||||||||||||||||||||

| Loan, Deposit and Borrowing Detail (Unaudited) | |||||||||||||||||||||||||||||||||||

| (Dollar amounts in thousands) | |||||||||||||||||||||||||||||||||||

2021 |

2020 |

||||||||||||||||||||||||||||||||||

Loans |

2Q | 1Q | Q4 | Q3 | Q2 | Q1 | |||||||||||||||||||||||||||||

| $ Amount | % of Total | $ Amount | % of Total | $ Amount | % of Total | $ Amount | % of Total | $ Amount | % of Total | $ Amount | % of Total | ||||||||||||||||||||||||

| Commercial business loans | $ |

55,375 |

|

3.5 |

% |

$ |

60,637 |

|

3.8 |

% |

$ |

67,549 |

|

4.4 |

% |

$ |

77,709 |

|

5.1 |

% |

$ |

77,987 |

|

5.1 |

% |

$ |

81,553 |

|

6.1 |

% |

|||||

| Commercial PPP loans |

|

82,190 |

|

5.2 |

% |

|

117,796 |

|

7.3 |

% |

|

114,411 |

|

7.3 |

% |

|

148,156 |

|

9.6 |

% |

|

148,156 |

|

9.7 |

% |

|

- - |

|

0.0 |

% |

|||||

| Commercial owner-occupied real estate loans |

|

320,519 |

|

20.4 |

% |

|

307,918 |

|

19.2 |

% |

|

290,802 |

|

18.6 |

% |

|

260,575 |

|

17.0 |

% |

|

267,032 |

|

17.6 |

% |

|

255,010 |

|

19.1 |

% |

|||||

| Total business loans |

|

458,084 |

|

29.2 |

% |

|

486,351 |

|

30.3 |

% |

|

472,762 |

|

30.3 |

% |

|

486,440 |

|

31.7 |

% |

|

493,175 |

|

32.4 |

% |

|

336,563 |

|

25.2 |

% |

|||||

| Investor real estate loans |

|

505,605 |

|

32.3 |

% |

|

502,940 |

|

31.3 |

% |

|

497,087 |

|

31.8 |

% |

|

498,352 |

|

32.5 |

% |

|

480,220 |

|

31.6 |

% |

|

470,163 |

|

35.2 |

% |

|||||

| Construction & development loans |

|

219,175 |

|

14.0 |

% |

|

250,208 |

|

15.6 |

% |

|

243,741 |

|

15.6 |

% |

|

237,195 |

|

15.4 |

% |

|

236,927 |

|

15.6 |

% |

|

243,023 |

|

18.2 |

% |

|||||

| Multi-family loans |

|

92,203 |

|

5.9 |

% |

|

84,689 |

|

5.3 |

% |

|

69,367 |

|

4.4 |

% |

|

49,277 |

|

3.2 |

% |

|

55,797 |

|

3.7 |

% |

|

58,362 |

|

4.3 |

% |

|||||

| Total commercial real estate loans |

|

816,983 |

|

52.1 |

% |

|

837,837 |

|

52.2 |

% |

|

810,195 |

|

51.8 |

% |

|

784,824 |

|

51.1 |

% |

|

772,944 |

|

50.9 |

% |

|

771,548 |

|

57.7 |

% |

|||||

| Residential mortgage loans |

|

291,615 |

|

18.6 |

% |

|

281,964 |

|

17.5 |

% |

|

278,763 |

|

17.8 |

% |

|

262,049 |

|

17.1 |

% |

|

252,494 |

|

16.6 |

% |

|

227,172 |

|

17.0 |

% |

|||||

| Consumer loans |

|

916 |

|

0.1 |

% |

|

793 |

|

0.0 |

% |

|

1,000 |

|

0.1 |

% |

|

1,208 |

|

0.1 |

% |

|

1,448 |

|

0.1 |

% |

|

1,099 |

|

0.1 |

% |

|||||

| Total loans | $ |

1,567,598 |

|

100.0 |

% |

$ |

1,606,945 |

|

100.0 |

% |

$ |

1,562,720 |

|

100.0 |

% |

$ |

1,534,521 |

|

100.0 |

% |

$ |

1,520,061 |

|

100.0 |

% |

$ |

1,336,382 |

|

100.0 |

% |

|||||

| Less: Allowance for loan losses |

|

(19,381 |

) |

|

(19,381 |

) |

|

(17,017 |

) |

|

(14,441 |

) |

|

(12,725 |

) |

|

(11,176 |

) |

|||||||||||||||||

| Net deferred loan costs (fees) |

|

(486 |

) |

|

(1,162 |

) |

|

(196 |

) |

|

(1,808 |

) |

|

(2,430 |

) |

|

439 |

|

|||||||||||||||||

| Net loans | $ |

1,547,731 |

|

$ |

1,586,402 |

|

$ |

1,545,507 |

|

$ |

1,518,272 |

|

$ |

1,504,906 |

|

$ |

1,325,645 |

|

|||||||||||||||||

2021 |

2020 |

||||||||||||||||||||||||||||||||||

| 2Q | 1Q | Q4 | Q3 | Q2 | Q1 | ||||||||||||||||||||||||||||||

Deposits |

$ Amount | % of Total | $ Amount | % of Total | $ Amount | % of Total | $ Amount | % of Total | $ Amount | % of Total | $ Amount | % of Total | |||||||||||||||||||||||

| Noninterest-bearing demand deposits | $ |

478,705 |

|

26.4 |

% |

$ |

419,796 |

|

23.8 |

% |

$ |

362,582 |

|

22.1 |

% |

$ |

385,885 |

|

23.8 |

% |

$ |

398,670 |

|

25.5 |

% |

$ |

274,878 |

|

19.9 |

% |

|||||

| Interest-bearing demand deposits: | |||||||||||||||||||||||||||||||||||

| NOW accounts(1) |

|

254,060 |

|

14.0 |

% |

|

245,274 |

|

13.9 |

% |

|

233,993 |

|

14.3 |

% |

|

227,816 |

|

14.1 |

% |

|

207,558 |

|

13.3 |

% |

|

179,197 |

|

13.0 |

% |

|||||

| Money market accounts(1) |

|

333,818 |

|

18.4 |

% |

|

344,807 |

|

19.6 |

% |

|

329,960 |

|

20.1 |

% |

|

321,760 |

|

19.8 |

% |

|

303,378 |

|

19.4 |

% |

|

289,131 |

|

21.0 |

% |

|||||

| Savings accounts |

|

79,119 |

|

4.4 |

% |

|

72,102 |

|

4.1 |

% |

|

62,138 |

|

3.8 |

% |

|

60,418 |

|

3.7 |

% |

|

49,896 |

|

3.2 |

% |

|

32,745 |

|

2.4 |

% |

|||||

| Certificates of deposit | |||||||||||||||||||||||||||||||||||

|

243,662 |

|

13.4 |

% |

|

265,772 |

|

15.1 |

% |

|

258,744 |

|

15.8 |

% |

|

281,302 |

|

17.4 |

% |

|

250,779 |

|

16.1 |

% |

|

249,802 |

|

18.1 |

% |

||||||

| Less than |

|

112,991 |

|

6.2 |

% |

|

119,828 |

|

6.8 |

% |

|

115,634 |

|

7.0 |

% |

|

117,171 |

|

7.2 |

% |

|

121,600 |

|

7.8 |

% |

|

128,176 |

|

9.3 |

% |

|||||

| QwickRate® certificates of deposit |

|

31,481 |

|

1.7 |

% |

|

38,565 |

|

2.2 |

% |

|

29,765 |

|

1.8 |

% |

|

29,781 |

|

1.8 |

% |

|

31,764 |

|

2.0 |

% |

|

20,011 |

|

1.4 |

% |

|||||

| IntraFi® certificates of deposit |

|

60,761 |

|

3.3 |

% |

|

38,284 |

|

2.2 |

% |

|

39,725 |

|

2.4 |

% |

|

36,909 |

|

2.3 |

% |

|

37,320 |

|

2.4 |

% |

|

57,398 |

|

4.2 |

% |

|||||

| Brokered deposits |

|

220,435 |

|

12.1 |

% |

|

216,962 |

|

12.3 |

% |

|

207,579 |

|

12.7 |

% |

|

161,104 |

|

9.9 |

% |

|

160,626 |

|

10.3 |

% |

|

148,104 |

|

10.7 |

% |

|||||

| Total deposits | $ |

1,815,032 |

|

100.0 |

% |

$ |

1,761,390 |

|

100.0 |

% |

$ |

1,640,120 |

|

100.0 |

% |

$ |

1,622,146 |

|

100.0 |

% |

$ |

1,561,591 |

|

100.0 |

% |

$ |

1,379,442 |

|

100.0 |

% |

|||||

Borrowings |

|||||||||||||||||||||||||||||||||||

| Federal Home Loan Bank advances | $ |

18,000 |

|

42.2 |

% |

$ |

22,000 |

|

47.1 |

% |

$ |

22,000 |

|

47.1 |

% |

$ |

22,000 |

|

47.1 |

% |

$ |

26,000 |

|

51.3 |

% |

$ |

37,000 |

|

60.0 |

% |

|||||

| Subordinated debt |

|

24,704 |

|

57.8 |

% |

|

24,692 |

|

52.9 |

% |

|

24,679 |

|

52.9 |

% |

|

24,667 |

|

52.9 |

% |

|

24,655 |

|

48.7 |

% |

|

24,642 |

|

40.0 |

% |

|||||

| Total borrowings | $ |

42,704 |

|

100.0 |

% |

$ |

46,692 |

|

100.0 |

% |

$ |

46,679 |

|

100.0 |

% |

$ |

46,667 |

|

100.0 |

% |

$ |

50,655 |

|

100.0 |

% |

$ |

61,642 |

|

100.0 |

% |

|||||

| Total deposits and borrowings | $ |

1,857,736 |

|

$ |

1,808,082 |

|

$ |

1,686,799 |

|

$ |

1,668,813 |

|

$ |

1,612,246 |

|

$ |

1,441,084 |

|

|||||||||||||||||

| Core customer funding sources (2) | $ |

1,563,116 |

|

85.3 |

% |

$ |

1,505,863 |

|

84.4 |

% |

$ |

1,402,776 |

|

84.4 |

% |

$ |

1,431,261 |

|

87.1 |

% |

$ |

1,369,201 |

|

86.2 |

% |

$ |

1,211,327 |

|

85.5 |

% |

|||||

| Wholesale funding sources (3) |

|

269,916 |

|

14.7 |

% |

|

277,527 |

|

15.6 |

% |

|

259,344 |

|

15.6 |

% |

|

212,885 |

|

12.9 |

% |

|

218,390 |

|

13.8 |

% |

|

205,115 |

|

14.5 |

% |

|||||

| Total funding sources | $ |

1,833,032 |

|

100.0 |

% |

$ |

1,783,390 |

|

100.0 |

% |

$ |

1,662,120 |

|

100.0 |

% |

$ |

1,644,146 |

|

100.0 |

% |

$ |

1,587,591 |

|

100.0 |

% |

$ |

1,416,442 |

|

100.0 |

% |

|||||

| (1) Includes IntraFi® accounts. |

| (2) Includes reciprocal IntraFi Demand®, IntraFi Money Market® and IntraFi CD® deposits, which are maintained by customers. |

| (3) Consists of QwickRate® certificates of deposit, brokered deposits, federal funds purchased and Federal Home Loan Bank advances. |

| John Marshall Bancorp, Inc. | |||||||||||||||||

| Average Balance Sheets, Interest and Rates (unaudited) | |||||||||||||||||

| (Dollar amounts in thousands) | |||||||||||||||||

| Three Months Ended June 30, 2021 | Three Months Ended June 30, 2020 | ||||||||||||||||

| Interest | Average | Interest | Average | ||||||||||||||

| Average | Income- | Yields | Average | Income- | Yields | ||||||||||||

| Balance | Expense | /Rates | Balance | Expense | /Rates | ||||||||||||

| Assets | |||||||||||||||||

| Securities | $ |

256,671 |

$ |

1,089 |

1.70 |

% |

$ |

138,350 |

$ |

857 |

2.49 |

% |

|||||

| Loans, net of unearned income |

|

1,602,125 |

|

17,499 |

4.38 |

% |

|

1,467,631 |

|

17,165 |

4.70 |

% |

|||||

| Interest-bearing deposits in other banks |

|

137,759 |

|

39 |

0.11 |

% |

|

102,625 |

|

33 |

0.13 |

% |

|||||

| Total interest-earning assets | $ |

1,996,555 |

$ |

18,627 |

3.74 |

% |

$ |

1,708,606 |

$ |

18,055 |

4.25 |

% |

|||||

| Other assets |

|

30,809 |

|

36,417 |

|||||||||||||

| Total assets | $ |

2,027,364 |

$ |

1,745,023 |

|||||||||||||

| Liabilities & Shareholders' equity | |||||||||||||||||

| Interest-bearing deposits | |||||||||||||||||

| NOW accounts | $ |

250,845 |

$ |

194 |

0.31 |

% |

$ |

192,375 |

$ |

282 |

0.59 |

% |

|||||

| Money market accounts |

|

337,752 |

|

314 |

0.37 |

% |

|

300,554 |

|

553 |

0.74 |

% |

|||||

| Savings accounts |

|

75,321 |

|

70 |

0.37 |

% |

|

39,121 |

|

90 |

0.93 |

% |

|||||

| Time deposits |

|

674,969 |

|

1,157 |

0.69 |

% |

|

582,820 |

|

2,774 |

1.91 |

% |

|||||

| Total interest-bearing deposits | $ |

1,338,887 |

$ |

1,735 |

0.52 |

% |

$ |

1,114,870 |

$ |

3,699 |

1.33 |

% |

|||||

| Federal funds purchased | $ |

- - |

$ |

- - |

0.00 |

% |

$ |

605 |

$ |

- - |

0.00 |

% |

|||||

| Subordinated debt |

|

24,696 |

|

371 |

6.03 |

% |

|

24,647 |

|

371 |

6.05 |

% |

|||||

| Other borrowed funds |

|

18,000 |

|

30 |

0.67 |

% |

|

35,538 |

|

112 |

1.27 |

% |

|||||

| Total interest-bearing liabilities | $ |

1,381,583 |

$ |

2,136 |

0.62 |

% |

$ |

1,175,660 |

$ |

4,182 |

1.43 |

% |

|||||

| Demand deposits |

|

439,356 |

|

382,581 |

|||||||||||||

| Other liabilities |

|

13,507 |

|

12,293 |

|||||||||||||

| Total liabilities | $ |

1,834,446 |

$ |

1,570,534 |

|||||||||||||

| Shareholders' equity |

|

192,918 |

|

174,489 |

|||||||||||||

| Total liabilities and shareholders' equity | $ |

2,027,364 |

$ |

1,745,023 |

|||||||||||||

| Interest rate spread | 3.12 |

% |

2.82 |

% |

|||||||||||||

| Net interest income and margin | $ |

16,491 |

3.31 |

% |

$ |

13,873 |

3.27 |

% |

|||||||||

| Six Months Ended June 30, 2021 | Six Months Ended June 30, 2020 | ||||||||||||||||

| Interest | Average | Interest | Average | ||||||||||||||

| Average | Income- | Yields | Average | Income- | Yields | ||||||||||||

| Balance | Expense | /Rates | Balance | Expense | /Rates | ||||||||||||

| Assets | |||||||||||||||||

| Securities | $ |

218,637 |

$ |

1,953 |

1.80 |

% |

$ |

137,204 |

$ |

1,750 |

2.56 |

% |

|||||

| Loans, net of unearned income |

|

1,589,059 |

|

35,338 |

4.48 |

% |

|

1,394,039 |

|

33,790 |

4.87 |

% |

|||||

| Interest-bearing deposits in other banks |

|

152,203 |

|

83 |

0.11 |

% |

|

98,049 |

|

333 |

0.68 |

% |

|||||

| Total interest-earning assets | $ |

1,959,899 |

$ |

37,374 |

3.85 |

% |

$ |

1,629,292 |

$ |

35,873 |

4.43 |

% |

|||||

| Other assets |

|

31,029 |

|

38,005 |

|||||||||||||

| Total assets | $ |

1,990,928 |

$ |

1,667,297 |

|||||||||||||

| Liabilities & Shareholders' equity | |||||||||||||||||

| Interest-bearing deposits | |||||||||||||||||

| NOW accounts | $ |

244,952 |

$ |

392 |

0.32 |

% |

$ |

170,726 |

$ |

627 |

0.74 |

% |

|||||

| Money market accounts |

|

336,528 |

|

630 |

0.38 |

% |

|

296,720 |

|

1,456 |

0.99 |

% |

|||||

| Savings accounts |

|

71,307 |

|

135 |

0.38 |

% |

|

34,959 |

|

191 |

1.10 |

% |

|||||

| Time deposits |

|

670,014 |

|

2,638 |

0.79 |

% |

|

587,855 |

|

5,883 |

2.01 |

% |

|||||

| Total interest-bearing deposits | $ |

1,322,801 |

$ |

3,795 |

0.58 |

% |

$ |

1,090,260 |

$ |

8,157 |

1.50 |

% |

|||||

| Federal funds purchased | $ |

- - |

$ |

- - |

0.00 |

% |

$ |

368 |

$ |

1 |

0.55 |

% |

|||||

| Subordinated debt |

|

24,690 |

|

743 |

6.07 |

% |

|

24,641 |

|

743 |

6.06 |

% |

|||||

| Other borrowed funds |

|

18,757 |

|

63 |

0.68 |

% |

|

40,121 |

|

272 |

1.36 |

% |

|||||

| Total interest-bearing liabilities | $ |

1,366,248 |

$ |

4,601 |

0.68 |

% |

$ |

1,155,390 |

$ |

9,173 |

1.60 |

% |

|||||

| Demand deposits |

|

421,349 |

|

329,395 |

|||||||||||||

| Other liabilities |

|

12,364 |

|

11,966 |

|||||||||||||

| Total liabilities | $ |

1,799,961 |

$ |

1,496,751 |

|||||||||||||

| Shareholders' equity |

|

190,967 |

|

170,546 |

|||||||||||||

| Total liabilities and shareholders' equity | $ |

1,990,928 |

$ |

1,667,297 |

|||||||||||||

| Interest rate spread | 3.17 |

% |

2.83 |

% |

|||||||||||||

| Net interest income and margin | $ |

32,773 |

3.37 |

% |

$ |

26,700 |

3.30 |

% |

|||||||||

View source version on businesswire.com: https://www.businesswire.com/news/home/20210721005578/en/