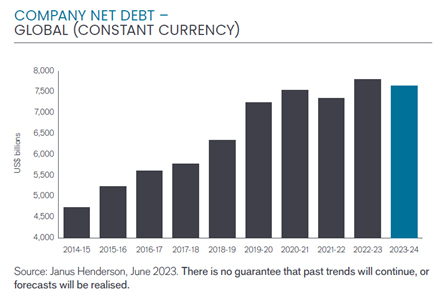

Janus Henderson Corporate Debt Index: Company Debts Reach New Record but Appetite to Borrow Is Waning

(Graphic: Business Wire)

Nevertheless, one fifth of the net-debt increase simply reflected companies such as Alphabet and Meta spending some of their vast cash mountains. Total debt, which excludes cash balances, inched ahead globally by just

Verizon, the US telecoms company, became the most indebted non-financial company in the world in 2022/23 for the first time. Google’s owner Alphabet remained the most cash-rich company.3

Balance sheets remain strong thanks to record profits

Global pre-tax profits (excluding financials) rose

Cash flow declined from record levels

Cash flow, which takes into account factors like investment and working capital, did not follow profits higher in 2022/23, however, dipping by

Higher interest rates are only slowly impacting companies

Many large companies finance their debts with bonds that have fixed interest rates (known as coupons), and this is delaying the impact of higher interest rates – only about one eighth of bonds are refinanced each year. The amount spent on interest only rose

Income is back – corporate bonds are offering exciting opportunities for investors

The median, or typical, yield on investment-grade bonds was

Outlook

The global economy is slowing as higher interest rates exert pressure on demand and on corporate profits. Higher borrowing costs and slower economic activity mean companies will look to repay some of their debts, though there will be significant variation between different sectors and between the strongest and weakest companies. Net debt is likely to fall less than total debt as cash-rich companies continue to reduce their cash piles. Overall Janus Henderson expects net debt to decline by

James Briggs and Michael Keough, Fixed Income Portfolio Managers at Janus Henderson explained:

“The exact path for the global economy and corporate earnings may be very unclear, but the end of the rate-hike cycle and the return of ‘income’ mean there is a lot for corporate bond investors to be happy about.

Debt levels may have risen but they are very well supported, and the global economy has remained remarkably resilient. This resilience and the extraordinarily high levels of profitability companies have enjoyed in the last two years reflect vast sums of government deficit spending and central bank liquidity stimulus during the pandemic. The surge in interest rates needed to quell the resulting inflation is succeeding in most parts of the world, but it is not at all clear when and to what extent the economy will suffer the more painful consequences – higher unemployment and lower profits.

For companies, higher interest costs will gradually increase pressure for the foreseeable future, affecting some more than others depending on their creditworthiness and the structure of their borrowings. All this means exciting times for corporate bond investors. Most obviously, higher interest rates mean ‘income’ is back as a theme. Investors can now lock into meaningful levels of income for the first time in years. Not only that, but when market interest rates fall to reflect lower inflation and a slowing economy, bond prices rise, generating capital gains too. Central banks are likely to start cutting rates in 2024.

A slowing or even shrinking economy will hit the creditworthiness of some borrowers more than others but the extent of this impact and the time lags are very uncertain at present. This phase of the credit cycle is one where sector and security selection are very important. Under these conditions, we prefer to focus on high quality companies with strong balance sheets, steady cash flow and resilient fundamentals.”

Notes to editors

Janus Henderson Group is a leading global active asset manager dedicated to helping clients define and achieve superior financial outcomes through differentiated insights, disciplined investments, and world-class service.

As of March 31, 2023, Janus Henderson had approximately

This press release is solely for the use of members of the media and should not be relied upon by personal investors, financial advisers or institutional investors. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes. All opinions and estimates in this information are subject to change without notice

Issued by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors

Janus Henderson and Knowledge Shared are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc.

1 Adjusted for constant exchange rates.

2 Figures exclude banks and financials

3 See report for more details

4 Adjusted for constant exchange rates.

5 Adjusted for constant exchange rates.

6 Average of last 8 years is

View source version on businesswire.com: https://www.businesswire.com/news/home/20230712749223/en/

Press Enquiries

Janus Henderson Investors

Sarah Johnson

Director of Media Relations & Corporate Communications

T: +1 (303) 336 4219

E: Sarah.Johnson@janushenderson.com

Source: Janus Henderson Group