Jiayin Group Inc. Reports Second Quarter 2024 Unaudited Financial Results

Jiayin Group Inc. (NASDAQ: JFIN) reported its Q2 2024 unaudited financial results. Key highlights:

- Loan facilitation volume remained stable at RMB24.0 billion (US$3.3 billion)

- Net revenue increased 15.5% YoY to RMB1,476.3 million (US$203.1 million)

- Income from operations decreased 38.5% YoY to RMB227.1 million (US$31.3 million)

- Net income decreased 27.0% YoY to RMB238.3 million (US$32.8 million)

The company expects Q3 2024 loan facilitation volume to reach approximately RMB25 billion. Jiayin also announced a cash dividend of US$0.50 per ADS and provided updates on its share repurchase plan and ESG initiatives.

Jiayin Group Inc. (NASDAQ: JFIN) ha riportato i risultati finanziari non auditati per il secondo trimestre del 2024. Punti salienti:

- Il volume di facilitazione dei prestiti è rimasto stabile a 24,0 miliardi di RMB (3,3 miliardi di US$)

- I ricavi netti sono aumentati del 15,5% rispetto all'anno precedente, raggiungendo 1.476,3 milioni di RMB (203,1 milioni di US$)

- Il reddito operativo è diminuito del 38,5% rispetto all'anno precedente, scendendo a 227,1 milioni di RMB (31,3 milioni di US$)

- L'utile netto è diminuito del 27,0% rispetto all'anno precedente, raggiungendo 238,3 milioni di RMB (32,8 milioni di US$)

La società prevede che il volume di facilitazione dei prestiti per il terzo trimestre del 2024 raggiunga circa 25 miliardi di RMB. Jiayin ha anche annunciato un dividendo in contante di 0,50 US$ per ADS e ha fornito aggiornamenti sul suo piano di riacquisto di azioni e sulle iniziative ESG.

Jiayin Group Inc. (NASDAQ: JFIN) reportó sus resultados financieros no auditados del segundo trimestre de 2024. Aspectos destacados:

- El volumen de facilitación de préstamos se mantuvo estable en 24,0 mil millones de RMB (3,3 mil millones de US$)

- Los ingresos netos aumentaron un 15,5% interanual hasta 1.476,3 millones de RMB (203,1 millones de US$)

- El ingreso de operaciones disminuyó un 38,5% interanual a 227,1 millones de RMB (31,3 millones de US$)

- La ganancia neta cayó un 27,0% interanual a 238,3 millones de RMB (32,8 millones de US$)

La empresa espera que el volumen de facilitación de préstamos en el tercer trimestre de 2024 alcance aproximadamente 25 mil millones de RMB. Jiayin también anunció un dividendo en efectivo de 0,50 US$ por ADS y proporcionó actualizaciones sobre su plan de recompra de acciones y las iniciativas ESG.

지아이인 그룹 주식회사 (NASDAQ: JFIN)는 2024년 2분기 감사되지 않은 재무 결과를 발표했습니다. 주요 하이라이트:

- 대출 중개량은 240억 위안(33억 달러)으로 안정세를 유지했습니다.

- 순수익은 전년 대비 15.5% 증가하여 14억 7,630만 위안(2억 3,100만 달러)에 도달했습니다.

- 운영 소득은 전년 대비 38.5% 감소하여 2억 2,710만 위안(3,130만 달러)으로 줄었습니다.

- 순이익은 전년 대비 27.0% 감소하여 2억 3,830만 위안(3,280만 달러)으로 줄었습니다.

회사는 2024년 3분기 대출 중개량이 약 250억 위안에 이를 것으로 예상하고 있습니다. 지아이인은 또한 ADS당 0.50달러의 현금 배당금을 발표하고 자사주 매입 계획과 ESG 이니셔티브에 대한 업데이트를 제공했습니다.

La Jiayin Group Inc. (NASDAQ: JFIN) a publié ses résultats financiers non audités pour le deuxième trimestre 2024. Points clés :

- Le volume de facilitation de prêts est resté stable à 24,0 milliards de RMB (3,3 milliards de dollars US)

- Les revenus nets ont augmenté de 15,5 % par rapport à l'année précédente, atteignant 1.476,3 millions de RMB (203,1 millions de dollars US)

- Le revenu d'exploitation a diminué de 38,5 % par rapport à l'année précédente, à 227,1 millions de RMB (31,3 millions de dollars US)

- Le bénéfice net a diminué de 27,0 % par rapport à l'année précédente, atteignant 238,3 millions de RMB (32,8 millions de dollars US)

L'entreprise s'attend à ce que le volume de facilitation de prêts pour le troisième trimestre 2024 atteigne environ 25 milliards de RMB. Jiayin a également annoncé un dividende en espèces de 0,50 $ par ADS et a fourni des mises à jour sur son plan de rachat d'actions et ses initiatives ESG.

Die Jiayin Group Inc. (NASDAQ: JFIN) hat ihre nicht geprüften Finanzergebnisse für das 2. Quartal 2024 veröffentlicht. Wichtige Höhepunkte:

- Das Volumen der Kreditvermittlung blieb mit 24,0 Milliarden RMB (3,3 Milliarden US$) stabil.

- Der Nettoumsatz stieg im Vergleich zum Vorjahr um 15,5 % auf 1.476,3 Millionen RMB (203,1 Millionen US$).

- Der Betriebsertrag sank im Vergleich zum Vorjahr um 38,5 % auf 227,1 Millionen RMB (31,3 Millionen US$).

- Der Nettogewinn ging im Vergleich zum Vorjahr um 27,0 % auf 238,3 Millionen RMB (32,8 Millionen US$) zurück.

Das Unternehmen erwartet, dass das Volumen der Kreditvermittlung im 3. Quartal 2024 etwa 25 Milliarden RMB erreichen wird. Jiayin kündigte außerdem eine Bardividende von 0,50 US$ pro ADS an und gab Updates zu seinem Aktienrückkaufprogramm sowie zu ESG-Initiativen.

- Net revenue increased 15.5% year-over-year to RMB1,476.3 million (US$203.1 million)

- Loan facilitation volume remained stable at RMB24.0 billion (US$3.3 billion)

- Company expects Q3 2024 loan facilitation volume to reach approximately RMB25 billion

- Announced cash dividend of US$0.50 per ADS

- Extended share repurchase plan for 12 months, with remaining balance of approximately US$16.1 million

- Income from operations decreased 38.5% year-over-year to RMB227.1 million (US$31.3 million)

- Net income decreased 27.0% year-over-year to RMB238.3 million (US$32.8 million)

- Average borrowing amount per borrowing decreased 12.4% year-over-year to RMB9,080

- Repeat borrowing rate decreased to 67.1% from 70.1% in the same period of 2023

- Facilitation and servicing expense increased 70.9% year-over-year

Insights

Jiayin Group's Q2 2024 results show mixed performance. While net revenue grew

The increase in facilitation and servicing expenses by

Jiayin's performance reflects broader trends in China's fintech sector. The stable loan volume amid regulatory pressures demonstrates resilience, but also hints at market maturation. The decrease in repeat borrowing rate from

The company's strategic focus on risk management is timely, given the evolving market conditions. However, the substantial increase in guarantee costs indicates heightened perceived risks. The planned dividend distribution of

Jiayin's

The adoption of green technologies for resource efficiency demonstrates forward-thinking in tech implementation. However, the specific nature of these innovations isn't detailed, making it difficult to assess their potential impact. The company's ability to leverage technology for improved risk management and operational efficiency will be key to future growth, especially in balancing regulatory compliance with market expansion. The stability in loan facilitation volume suggests that technological improvements are currently focused on internal processes rather than market expansion.

-- Second Quarter Total Loan Facilitation Volume remained stable at RMB 24.0 billion --

-- Second Quarter Net Revenue Grew

SHANGHAI, Aug. 27, 2024 (GLOBE NEWSWIRE) -- Jiayin Group Inc. (“Jiayin” or the “Company”) (NASDAQ: JFIN), a leading fintech platform in China, today announced its unaudited financial results for the second quarter ended June 30, 2024.

Second Quarter 2024 Operational and Financial Highlights:

- Loan facilitation volume1 was RMB24.0 billion (US

$3.3 billion ), compared with RMB24.0 billion in the same period of 2023. - Average borrowing amount per borrowing was RMB9,080 (US

$1,249) , representing a decrease of12.4% from the same period of 2023. - Repeat borrowing rate2 was

67.1% , compared with70.1% in the same period of 2023. - Net revenue was RMB1,476.3 million (US

$203.1 million ), representing an increase of15.5% from the same period of 2023. - Income from operation was RMB227.1 million (US

$31.3 million ), representing a decrease of38.5% from the same period of 2023. - Net income was RMB238.3 million (US

$32.8 million ), representing a decrease of27.0% from RMB326.3 million in the same period of 2023.

Mr. Yan Dinggui, the Company’s Founder, Director and Chief Executive Officer, commented: “Our second quarter results underscore the strength of our strategic focus and risk management practices, enabling us to sustain fundamental growth while delivering value to our stakeholders. This steady performance amid evolving market conditions highlights the resilience and adaptability built into our business model. After observing several consecutive quarters, we believe that the key risk indicators in the market have stabilized and are improving, which provides a favorable environment for us to accelerate business growth in the coming period. Looking ahead, we remain committed to driving sustainable development through innovation and strategic market expansion.”

_________________

1 “Loan facilitation volume” refers the loan volume facilitated in Mainland China during the period presented.

2 “Repeat borrowing rate” refers to the repeat borrowers as a percentage of all of our borrowers in Mainland China.

“Repeat borrowers” during a certain period refers to borrowers who have borrowed in such period and have borrowed at least twice since such borrowers’ registration on our platform until the end of such period.

Second Quarter 2024 Financial Results

Net revenue was RMB1,476.3 million (US

Revenue from loan facilitation services was RMB951.1 million (US

Revenue from releasing of guarantee liabilities was RMB424.8 million (US

Other revenue was RMB100.4 million (US

Facilitation and servicing expense was RMB608.2 million (US

Reversal of uncollectible receivables, contract assets, loans receivable and others was a reversal of RMB 3.3 million (US

Sales and marketing expense was RMB486.6 million (US

General and administrative expense was RMB65.0 million (US

Research and development expense was RMB92.8 million (US

Income from operation was RMB227.1 million (US

Net income was RMB238.3 million (US

Basic and diluted net income per share were both RMB1.12(US

Cash and cash equivalents were RMB880.2 million (US

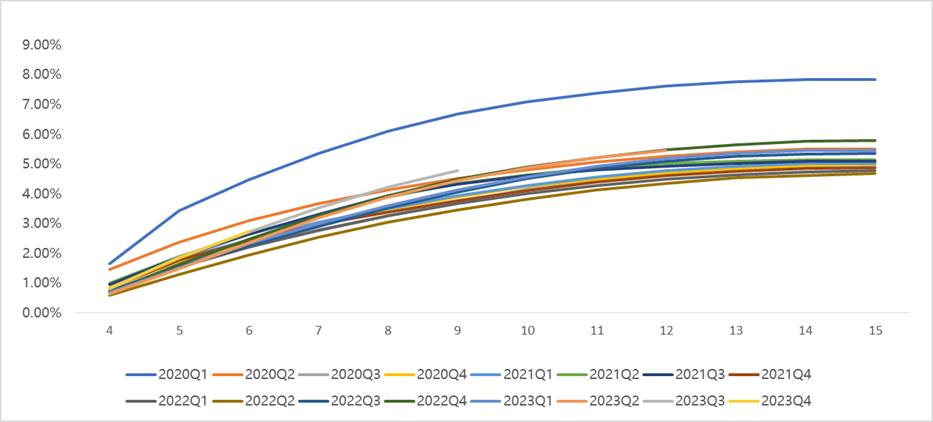

The following table provides the delinquency rates of all outstanding loans on the Company’s platform in Mainland China as of the respective dates indicated.

| Delinquent for | ||||||

| As of | 1-30 days | 31-60 days | 61-90 days | 91 -180 days | More than 180 days | |

| (%) | ||||||

| December 31, 2021 | 1.31 | 0.90 | 0.72 | 1.78 | 2.12 | |

| December 31, 2022 | 1.01 | 0.67 | 0.51 | 1.18 | 2.02 | |

| December 31, 2023 | 1.13 | 0.90 | 0.68 | 1.48 | 2.07 | |

| March 31, 2024 | 0.99 | 0.85 | 0.68 | 1.63 | 2.62 | |

| June 30, 2024 | 0.96 | 0.83 | 0.67 | 1.61 | 2.60 | |

The following chart and table display the historical cumulative M3+ Delinquency Rate by Vintage for loan products facilitated through the Company’s platform in Mainland China.

Business Outlook

The Company expects its loan facilitation volume for the third quarter of 2024 to reach approximately RMB25 billion. This forecast reflects the Company's confidence in the improving economic environment and the company's product and operational capabilities.

Recent Development

Dividend Policy

On August 16, 2024, the Company’s Board of Directors approved the payment of cash dividends of US

Share Repurchase Plan Update

In March 2024, the Company’s Board of Directors approved an adjustment to the existing share repurchase plan, pursuant to which the aggregate value of ordinary shares authorized for repurchase under the plan shall not exceed US

On June 4, 2024, the Company’s Board of Directors approved to extend the share repurchase plan for a period of 12 months, commencing on June 13, 2024 and ending on June 12, 2025. Pursuant to the extended share repurchase plan, the Company may repurchase its ordinary shares through June 12, 2025 with an aggregate value not exceeding the remaining balance under the share repurchase plan.

As of August 27, 2024, the Company had repurchased approximately 3.3 million of its ADSs for approximately US

Environmental, Social and Governance (ESG)

On August 7, 2024, the Company published its 2023 ESG report, marking its third annual ESG publication. The report underscores Jiayin’s steadfast commitment to corporate sustainability, ethical business practices, and transparent governance. In 2023, the Company continued to create societal value and advance its digital transformation initiatives. Key efforts included enhancing service quality, building a responsible supply chain, and promoting low-carbon practices through the adoption of green technologies. These initiatives are designed to minimize environmental impact, boost resource efficiency, and contribute to the development of a circular economy.

The ESG report is prepared in accordance with the Global Reporting Initiative’s Sustainability Reporting Standards (GRI Standards), with reference to Nasdaq’s ESG Reporting Guide 2.0. To download the full report in English or Chinese, please visit the ESG section of the Company's investor relations website at: https://ir.jiayintech.cn/environmental-social-and-governance.

Conference Call

The Company will conduct a conference call to discuss its financial results on Tuesday, August 27, 2024 at 8:00 AM U.S. Eastern Time (8:00 PM Beijing/Hong Kong Time on the same day).

To join the conference call, all participants must use the following link to complete the online registration process in advance. Upon registering, each participant will receive access details for this event including the dial-in numbers, a PIN number, and an e-mail with detailed instructions to join the conference call.

Participant Online Registration:

https://register.vevent.com/register/BIab3d5299bc4c481ca5b0bd145bde23a9.

A live and archived webcast of the conference call will be available on the Company’s investors relations website at http://ir.jiayintech.cn/.

About Jiayin Group Inc.

Jiayin Group Inc. is a leading fintech platform in China committed to facilitating effective, transparent, secure and fast connections between underserved individual borrowers and financial institutions. The origin of the business of the Company can be traced back to 2011. The Company operates a highly secure and open platform with a comprehensive risk management system and a proprietary and effective risk assessment model which employs advanced big data analytics and sophisticated algorithms to accurately assess the risk profiles of potential borrowers. For more information, please visit https://ir.jiayintech.cn/.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars (“US$”) at a specified rates solely for the convenience of the reader. Unless otherwise noted, all translations from RMB to U.S. dollars are made at a rate of RMB7.2672 to US

Safe Harbor / Forward-Looking Statements

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar statements. The Company may also make written or oral forward-looking statements in its periodic reports to the SEC, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about the Company’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties and are based on current expectations, assumptions, estimates and projections about the Company and the industry. Potential risks and uncertainties include, but are not limited to, those relating to the Company’s ability to retain existing investors and borrowers and attract new investors and borrowers in an effective and cost-efficient way, the Company’s ability to increase the investment volume and loan facilitation of loans volume facilitated through its marketplace, effectiveness of the Company’s credit assessment model and risk management system, PRC laws and regulations relating to the online individual finance industry in China, general economic conditions in China, and the Company’s ability to meet the standards necessary to maintain listing of its ADSs on the Nasdaq Stock Market or other stock exchange, including its ability to cure any non-compliance with the continued listing criteria of the Nasdaq Stock Market. All information provided in this press release is as of the date hereof, and the Company undertakes no obligation to update any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that its expectations will turn out to be correct, and investors are cautioned that actual results may differ materially from the anticipated results. Further information regarding risks and uncertainties faced by the Company is included in the Company’s filings with the U.S. Securities and Exchange Commission, including its annual report on Form 20-F.

For investor and media inquiries, please contact:

Jiayin Group

Mr. Shawn Zhang

Email: ir@jiayinfintech.cn

| JIAYIN GROUP INC. UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (Amounts in thousands, except for share and per share data) | |||||||||||

| As of December 31, | As of June 30, | ||||||||||

| 2023 | 2024 | ||||||||||

| RMB | RMB | US$ | |||||||||

| ASSETS | |||||||||||

| Cash and cash equivalents | 370,193 | 880,198 | 121,119 | ||||||||

| Restricted cash | 2,435 | — | — | ||||||||

| Accounts receivable and contract assets, net | 2,103,545 | 2,432,102 | 334,668 | ||||||||

| Financial assets receivables, net | 991,628 | 893,337 | 122,927 | ||||||||

| Prepaid expenses and other current assets, net | 1,922,056 | 1,015,534 | 139,742 | ||||||||

| Deferred tax assets, net | 61,174 | 86,738 | 11,936 | ||||||||

| Property and equipment, net | 40,332 | 44,680 | 6,148 | ||||||||

| Right-of-use assets | 49,659 | 54,857 | 7,549 | ||||||||

| Long-term investment | 101,481 | 127,264 | 17,512 | ||||||||

| Other non-current assets | 2,263 | 1,322 | 182 | ||||||||

| TOTAL ASSETS | 5,644,766 | 5,536,032 | 761,783 | ||||||||

| LIABILITIES AND EQUITY | |||||||||||

| Deferred guarantee income | 886,862 | 505,062 | 69,499 | ||||||||

| Contingent guarantee liabilities | 933,947 | 499,416 | 68,722 | ||||||||

| Payroll and welfare payable | 94,856 | 86,961 | 11,966 | ||||||||

| Tax payables | 568,819 | 553,668 | 76,187 | ||||||||

| Accrued expenses and other current liabilities | 731,863 | 1,088,223 | 149,744 | ||||||||

| Lease liabilities | 47,958 | 54,690 | 7,526 | ||||||||

| TOTAL LIABILITIES | 3,264,305 | 2,788,020 | 383,644 | ||||||||

| TOTAL SHAREHOLDERS' EQUITY | 2,380,461 | 2,748,012 | 378,139 | ||||||||

| TOTAL LIABILITIES AND EQUITY | 5,644,766 | 5,536,032 | 761,783 | ||||||||

| JIAYIN GROUP INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Amounts in thousands, except for share and per share data) | |||||||||||||||||||||||||

| For the Three Months Ended June 30, | For the Six Months Ended June 30, | ||||||||||||||||||||||||

| 2023 | 2024 | 2023 | 2024 | ||||||||||||||||||||||

| RMB | RMB | US$ | RMB | RMB | US$ | ||||||||||||||||||||

| Net revenue | 1,277,824 | 1,476,327 | 203,149 | 2,399,986 | 2,951,667 | 406,163 | |||||||||||||||||||

| Operating costs and expenses: | |||||||||||||||||||||||||

| Facilitation and servicing | (355,815 | ) | (608,158 | ) | (83,685 | ) | (630,054 | ) | (1,275,132 | ) | (175,464 | ) | |||||||||||||

| (Allowance for)/reversal of uncollectible receivables, contract assets, loans receivable and others | (13,815 | ) | 3,262 | 449 | (20,520 | ) | 645 | 89 | |||||||||||||||||

| Sales and marketing | (420,704 | ) | (486,553 | ) | (66,952 | ) | (801,521 | ) | (846,371 | ) | (116,465 | ) | |||||||||||||

| General and administrative | (50,085 | ) | (64,996 | ) | (8,944 | ) | (96,464 | ) | (111,211 | ) | (15,303 | ) | |||||||||||||

| Research and development | (68,102 | ) | (92,819 | ) | (12,772 | ) | (132,868 | ) | (176,089 | ) | (24,231 | ) | |||||||||||||

| Total operating costs and expenses | (908,521 | ) | (1,249,264 | ) | (171,904 | ) | (1,681,427 | ) | (2,408,158 | ) | (331,374 | ) | |||||||||||||

| Income from operation | 369,303 | 227,063 | 31,245 | 718,559 | 543,509 | 74,789 | |||||||||||||||||||

| Interest income, net | 1,623 | 4,318 | 594 | 1,983 | 6,234 | 858 | |||||||||||||||||||

| Other income, net | 3,017 | 65,637 | 9,032 | 11,012 | 66,224 | 9,113 | |||||||||||||||||||

| Income before income taxes and lossfrom investment in affiliates | 373,943 | 297,018 | 40,871 | 731,554 | 615,967 | 84,760 | |||||||||||||||||||

| Income tax expense | (45,573 | ) | (58,750 | ) | (8,084 | ) | (123,249 | ) | (104,632 | ) | (14,398 | ) | |||||||||||||

| Loss from investment in affiliates | (2,029 | ) | — | — | (2,264 | ) | — | — | |||||||||||||||||

| Net income | 326,341 | 238,268 | 32,787 | 606,041 | 511,335 | 70,362 | |||||||||||||||||||

| Less: net loss attributable to non-controlling interest | (10 | ) | (3 | ) | — | (23 | ) | (6 | ) | (1 | ) | ||||||||||||||

| Net income attributable toJiayin Group Inc. | 326,351 | 238,271 | 32,787 | 606,064 | 511,341 | 70,363 | |||||||||||||||||||

| Weighted average shares used incalculating net income per share: | |||||||||||||||||||||||||

| - Basic and diluted | 214,026,210 | 212,332,672 | 212,332,672 | 213,877,632 | 212,231,868 | 212,231,868 | |||||||||||||||||||

| Net income per share: | |||||||||||||||||||||||||

| - Basic and diluted | 1.52 | 1.12 | 0.15 | 2.83 | 2.41 | 0.33 | |||||||||||||||||||

| Net income per ADS: | |||||||||||||||||||||||||

| - Basic and diluted | 6.08 | 4.48 | 0.60 | 11.32 | 9.64 | 1.32 | |||||||||||||||||||

| Net income | 326,341 | 238,268 | 32,787 | 606,041 | 511,335 | 70,362 | |||||||||||||||||||

| Other comprehensive income (loss), net of tax of nil: | |||||||||||||||||||||||||

| Foreign currency translation adjustments | 6,546 | 257 | 36 | 5,970 | (2,883 | ) | (397 | ) | |||||||||||||||||

| Comprehensive income | 332,887 | 238,525 | 32,823 | 612,011 | 508,452 | 69,965 | |||||||||||||||||||

| Comprehensive (loss) income attributable to non-controlling interest | (100 | ) | 42 | 6 | (151 | ) | 56 | 8 | |||||||||||||||||

| Total comprehensive incomeattributable to Jiayin Group Inc. | 332,987 | 238,483 | 32,817 | 612,162 | 508,396 | 69,957 | |||||||||||||||||||

A chart accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/63def440-870f-4232-bbdf-e1388d56a4b4