Struggling With Student Loan Debt? Credit Karma’s New Payment Relief Experience Could Help

Credit Karma launches a personalized debt relief program for U.S. federal student loan borrowers, addressing financial strain from loan payments. The initiative aims to assist approximately 22 million members holding 53% of the national student loan debt, totaling $850 billion. Borrowers can access income-driven repayment plans potentially reducing monthly payments by an average of $192 and Public Service Loan Forgiveness savings of around $90,699. The program, powered by a partnership with Summer, offers guidance on loan options and application processes through Credit Karma's app.

- Launch of a personalized debt relief program for federal student loan borrowers.

- Potential average monthly payment reduction of $192 through income-driven repayment plans.

- Partnership with Summer to provide resources and support for borrowers.

- Direct access to loan forgiveness qualification through Credit Karma's app.

- None.

Credit Karma seeks to help Americans who are sacrificing necessities to make their federal student loan payments through personalized debt relief options and potential loan forgiveness

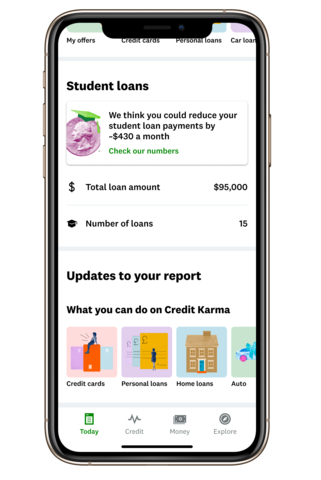

These figures are for display only. (Photo: Business Wire)

Credit Karma found that many borrowers with outstanding student loan debt have had to sacrifice necessities like groceries and making rent payments in order to maintain their student loan payments. Borrowers like these may benefit from extending their loan term and right-sizing their loan payments according to their income, in order to stay on top of their other bills and expenses. Doing so keeps them from slipping backwards and ultimately maintains their ability to be approved for favorable financial products down the line. With unique insight into members’ financial profiles, Credit Karma can help federal student loan borrowers who are struggling financially find a payment plan that enables them to pay down their debt in a more manageable way.

Credit Karma will present eligible borrowers with personalized estimates as to how much they could reduce their monthly payment with a government income-driven repayment (IDR) plan, including potential trade-offs that come with extending a loan term. From there, at no cost and no impact to their credit, borrowers can start the application process, directly from the Credit Karma app, before they are seamlessly handed off to Summer to complete the application process. Credit Karma has partnered with Summer, the digital solution for helping student loan borrowers reduce their debt, to power this new product for its members.

“Around 22 million Credit Karma members hold about

The other form of relief Credit Karma can help connect qualifying federal student loan borrowers to is loan forgiveness. Federal borrowers who visit Credit Karma might qualify for Public Service Loan Forgiveness, and can confirm whether or not they qualify directly through the Credit Karma app before beginning the application process.

On the backend, Credit Karma sorts through members’ student loan types and relief program combinations to determine which plans members qualify for, and which could be most beneficial for their situation, so they can apply with more confidence. Credit Karma’s student loan relief hub also provides educational materials and resources to help borrowers on their journey to paying off their student loans.

“We founded Summer to provide every borrower with the advisory support they need to successfully navigate the complex student loan repayment system,” said

About Credit Karma

Founded in 2007 by

About Summer

Summer partners with organizations to help their populations navigate and reduce student loan debt with proven technologies, policy expertise, and a human touch. Founded in 2017, Summer offers industry-leading tools like digital PSLF enrollment to help all borrowers reach their financial goals.

Summer is a certified B Corporation®.

Learn more about Summer at www.meetsummer.org

View source version on businesswire.com: https://www.businesswire.com/news/home/20220307005972/en/

pr@creditkarma.com

Source: Credit Karma

FAQ

What is Credit Karma's new service for student loan borrowers?

How many members does Credit Karma have in relation to student loans?

What are the average savings from Public Service Loan Forgiveness through Credit Karma?

Which company is Credit Karma partnered with for student loan assistance?