Intuit Introduces QuickBooks Solopreneur, an Easy-to-Use Financial Tool Built for One-Person Businesses

- None.

- None.

Insights

The introduction of QuickBooks Solopreneur by Intuit Inc. is a strategic move to capture a growing market segment of one-person businesses. The number of solopreneurs is on the rise, as indicated by Intuit's own Entrepreneurship Report, which aligns with broader labor market trends towards gig economy and self-employment. This product expansion caters to a niche yet expanding customer base, which could lead to increased user adoption and recurring revenue streams for Intuit.

From a market perspective, the decision to target solopreneurs is astute, considering the lower market penetration of comprehensive financial tools in this segment compared to larger enterprises. The ease of use and the integration of business and tax management in one platform could reduce barriers to entry for new entrepreneurs, potentially leading to higher market demand.

However, the success of QuickBooks Solopreneur hinges on user experience, pricing strategy and the effectiveness of its features in truly simplifying financial management for solopreneurs. Competitors are likely to respond with similar offerings, so Intuit's first-mover advantage and brand reputation will be critical in maintaining market share.

Intuit's launch of QuickBooks Solopreneur may have a positive impact on its financial performance. The tool's ability to streamline financial operations and tax preparation for solopreneurs addresses a significant pain point, potentially leading to increased customer loyalty and a lower churn rate. By simplifying the transition from bookkeeping to tax filing, Intuit is also leveraging its existing TurboTax platform, which could lead to cross-selling opportunities and enhanced customer lifetime value.

The financial implications for Intuit will depend on the product's adoption rate and the ability to upsell additional services. If the tool gains traction, it could contribute to Intuit's top-line growth and further diversify its revenue sources. Investors should monitor user growth metrics and engagement levels post-launch to gauge the product's impact on Intuit's financial health.

It's important to note that while this product may not immediately contribute a significant portion to Intuit's overall revenue, it represents an investment in capturing a growing demographic, which could be accretive to earnings over the long term.

The integration of tax preparation features within QuickBooks Solopreneur is a significant development for solopreneurs who often struggle with tax compliance and management. The ability to track mileage, categorize business expenses and prepare tax returns within the same platform can save time and reduce errors, which are common challenges faced by individuals running their own business.

For tax professionals, this tool could facilitate smoother collaboration with clients, as financial data would be more organized and accessible. However, the extent to which QuickBooks Solopreneur can replace professional tax advice remains to be seen, as complex tax scenarios may still require expert intervention.

The tool's effectiveness in ensuring tax readiness and its adoption by solopreneurs could influence tax preparation practices within this demographic, potentially reducing the stress associated with tax season and improving overall tax compliance.

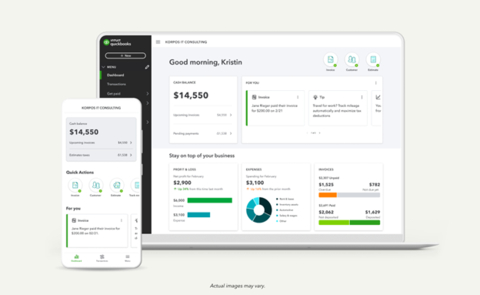

New QuickBooks product tailored to the needs of solopreneurs, featuring intuitive tools to manage business transactions, stay tax-ready, and set financial goals

QuickBooks Solopreneur, an Easy-to-Use Financial Tool Built for One-Person Businesses (Photo: Business Wire)

According to the Intuit QuickBooks Entrepreneurship in 2024 Report, solopreneurs are increasing in numbers as more people take the leap to work for themselves. Nearly a quarter of

“Many solopreneurs are at that critical phase where they need to better understand their business to chart a path to financial stability,” said Michael Hitchcock, vice president, Accounting and Tax, QuickBooks. “QuickBooks Solopreneur is designed specifically for one-person businesses who crave simplicity and don’t yet require an advanced accounting solution. It enables them to get a holistic view of their finances, manage daily operations, and be ready for tax time so they can grow on their own terms.”

QuickBooks Solopreneur includes a suite of intuitive tools and features. With QuickBooks Solopreneur, business owners can:

- Manage books, all in one place: Access transaction management tools that automatically separate business and personal transactions into categories for easy review, and connect bank accounts* and import spreadsheet data for a full view of operations. Plus, customers can seamlessly track mileage, create and send customized invoices and estimates, view reports, and more.

- Utilize tools and insights to drive business decisions: Easily view income, expenses, and profit with simple reports and dashboards to stay in control of cash flow in real time. Customers can also set up trackable goals, view insights, and see recommended actions to help them to make smarter business decisions and achieve goals.

- Make tax time less taxing: Stay tax-ready year-round with tools that auto-track miles on-the-go through the QuickBooks mobile app**, and easily categorize business trips for accurate tax time deductions for business expenses. Customers can also move seamlessly from books to taxes to easily prepare and file tax year returns directly in QuickBooks, and access expert help through QuickBooks Live Assisted Tax, powered by TurboTax, to help them file with confidence.***

Adding to the growing solopreneur community are side-giggers, who currently run their own business in addition to working a day job. These individuals have set clear financial goals before they plan to commit to solopreneurship full–time. More than half of America’s side-giggers said they won’t quit their day job until their side business earns

“Being able to seamlessly navigate the features has made a tremendous impact on the financial health of my business,” said Dr. Brenda Sacino PT DPT, owner of Playful Progress in

Built on the expertise gained from serving self-employed business owners with QuickBooks Self-Employed, which launched in 2015, QuickBooks Solopreneur provides an elevated experience with added flexibility and productivity tools designed for the needs of one-person businesses, to help them set financial goals and further grow. Additionally, QuickBooks Solopreneur will soon offer a more seamless experience across the QuickBooks ecosystem to meet a solopreneur's growing needs, including upgrading to QuickBooks Online and accessing other QuickBooks tools and services.

QuickBooks Solopreneur is available to customers in the

About Intuit

Intuit is the global financial technology platform that powers prosperity for the people and communities we serve. With 100 million customers worldwide using TurboTax, Credit Karma, QuickBooks, and Mailchimp, we believe that everyone should have the opportunity to prosper. We never stop working to find new, innovative ways to make that possible. Please visit us at Intuit.com and find us on social for the latest information about Intuit and our products and services.

*Online services vary by participating financial institutions or other parties and may be subject to application approval, additional terms, conditions, and fees.

**Requires QuickBooks Online mobile (“QBM”) application. QBM app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

***QuickBooks Live Tax, powered by TurboTax, is an integrated service available to one-person businesses/sole proprietors who file Schedule C (form 1040). Additional terms and eligibility apply; fees may apply. Some tax situations may not be supported. For guarantee information, see https://turbotax.intuit.com/guarantees/

This information is intended to outline our general product direction, but represents no obligation and should not be relied on in making a purchasing decision. Additional terms, conditions and fees may apply with certain features and functionality. Eligibility criteria may apply. Product offers, features, functionality are subject to change without notice.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240221724297/en/

Intuit QuickBooks:

Jaymie Sinlao

Jaymie_Sinlao@intuit.com

Jen Garcia

Jeng@accesstheagency.com

Source: Intuit Inc.