NRSInsights’ May 2024 Retail Same-Store Sales Report

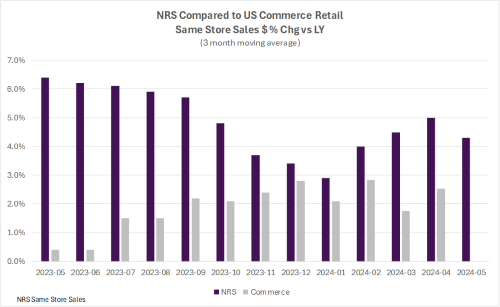

NRSInsights has announced that May 2024 same-store sales rose 4.7% year-over-year. The NRS retail network, consisting of around 30,800 POS terminals, showed an increase in the number of items sold and transactions per store. Price increases for top items were noted. The beverage category saw significant growth except for energy and sports drinks. High-protein food items continue to gain popularity. The NRS POS network outperformed the US Commerce Department’s retail data by 3% over the past 12 months. NRS processed $18.8 billion in sales through 1.3 billion transactions in the past year.

- Same-store sales increased 4.7% year-over-year in May 2024.

- Number of items sold rose by 4.7% year-over-year.

- Average transactions per store increased 2.3% year-over-year.

- Dollar-weighted average prices for top 500 items increased by 1.6% year-over-year.

- NRS outperformed the US Commerce Department’s retail data by 3% over the past 12 months.

- May 2024 saw sequential growth in cold beverage categories such as beer, soft drinks, and coconut water.

- High-protein products showed significant sales growth due to health trends.

- Tobacco and cigarette sales declined modestly from the previous year.

- Vape products saw a decrease in baskets, units, and dollar sales year-over-year.

- Energy drinks and sports drinks did not benefit from seasonal trends and trailed last year’s sales levels.

Insights

May same-store sales increased

NEWARK, N.J., June 07, 2024 (GLOBE NEWSWIRE) -- NRSInsights, a provider of sales data and analytics drawn from retail transactions processed through the National Retail Solutions (NRS) point-of-sale (POS) platform, today announced comparative same-store sales results for May 2024.

As of May 31, 2024, the NRS retail network comprised approximately 30,800 active terminals scanning purchases at independent retailers including bodegas, convenience stores, liquor stores, grocers, tobacco, and sundries sellers nationwide, predominantly serving urban consumers.

May Retail Same-Store Sales Highlights

(Same-store sales, unit sales, transactions, and average price data throughout this release refer to May 2024 unless otherwise noted. All comparisons are provided on a “per calendar day” basis to remove from consideration variability in the number of days per month.)

- Same-store sales increased

4.7% from a year earlier (May 2023). In the previous month (April 2024), average sales had increased2.5% compared to April 2023. - Same-store sales increased

3.4% compared to the previous month (April 2024). Same-store sales in April 2024 had decreased0.9% compared to the previous month (March 2024). - For the three months ended May 31, 2024, same-store sales increased

4.3% compared to the three months ended May 31, 2023. - The number of items sold increased

4.7% from a year earlier (May 2023). In the previous month (April 2024), the number of items sold had increased3.7% compared to April 2023. - The average number of transactions per store increased

2.3% from a year earlier (May 2023). In the previous month (April 2024), the average number of transactions had increased1.7% compared to April 2023. - A dollar-weighted average of prices for the top 500 items purchased increased

1.6% year-over-year, an increase from the0.2% year-over-year increase recorded in April 2024 and the highest rate of price increases reported since November 2023.

Commentary from Suzy Silliman (SVP, Data Strategy and Sales at NRS)

“In May, the NRS point-of-sale network generated solid same-store sales growth versus the year ago and prior month across dollars, baskets, and units scanned.

“Looking at popular categories, Smokeless Tobacco sales continued their upward trajectory propelled by the surging popularity of nicotine pouches, while Tobacco and Cigarette sales declined modestly from year ago levels. Within the Tobacco Alternatives category, Vape scans stood out with continued year-over-year decreases in baskets, units and dollar sales.

“Within Beverages, mid-May marks the start of ‘cold beverage season.’ This May we did indeed see the expected, sequential lift across most cold beverage categories. Beer, NA Beer, FMB/Cider/Seltzer, Soft Drinks, Water (still, value-add, and sparkling), and Coconut Water all grew dollar sales sequentially and year over year. Bucking the trend, Energy Drinks and Sports Drinks saw little seasonal benefit and trailed year-ago sales levels.

“Sales of high-protein offerings, including Performance Nutritional Shakes and Bars, as well as Protein Salty Snacks have increased significantly in recent months. Their market strength closely correlates with broader retail patterns influenced by the increasing popularity of GLP-1 agonist weight loss drugs, which are often paired with high-protein diets for optimal outcomes. Across the retail landscape, health trends, consumer preferences, and product innovation remain key inter-connected drivers of category and brand performance.”

Retail Trade Comparative Data

The table below provides historical comparative data with the U.S. Commerce Department’s Advance Monthly Retail Trade same-store sales data excluding food service:

Over the past twelve months, the NRS network’s three-month moving average same-store sales have outpaced the US Commerce Department’s Advance Monthly Retail Trade data excluding food services by

The NRSInsights data in the chart above have not been adjusted to reflect inflation, demographic distributions, seasonal buying patterns, item substitution, days per month, or other factors that may facilitate comparisons to other periods, to other same-store retail sales data, or to the U.S. Commerce Department’s retail data.

NRSInsights Reports

The NRSInsights monthly Same-Store Retail Sales Reports are intended to provide timely topline data reflective of sales at NRS’ network of independent, predominantly urban, retail stores.

Same-store data comparisons of May 2024 with May 2023 are derived from approximately 187 million transactions processed through the approximately 18,000 stores on the NRS network that scanned transactions in both months. Same-store data comparisons of May 2024 with April 2024 are derived from approximately 238 million transactions processed through approximately 25,700 stores.

Same-store data comparisons for the three months ended May 31, 2024 with the year-ago three months are derived from approximately 516 million scanned transactions processed through the stores that were in the NRS network in both quarters.

NRS POS Network

The NRS network comprises approximately 30,800 active POS terminals operating in approximately 26,800 independent retail stores. Its platform predominantly serves small-format, independent, retail stores including convenience stores, bodegas, liquor stores, grocers, tobacco and sundries sellers. The network includes retailers in all 50 states and in 198 of the 210 designated market areas (DMAs) in the United States. NRS’ POS terminals have processed

About National Retail Solutions (NRS):

National Retail Solutions operates the largest point-of-sale (POS) terminal-based platform and digital payment processing service for independent retailers nationwide. Retailers utilize NRS offerings to process transactions and effectively manage their businesses. Consumer packaged goods (CPG) suppliers, brokers, analytics firms, and advertisers access the terminal’s digital display network to reach these retailers’ predominantly urban, multi-cultural shopper base, and to harness transaction data-based learnings to identify growth opportunities and measure execution and returns on marketing investment. NRS is a subsidiary of IDT Corporation (NYSE: IDT).

All statements above that are not purely about historical facts, including, but not limited to, those in which we use the words “believe,” “anticipate,” “expect,” “plan,” “intend,” “estimate,” “target” and similar expressions, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. While these forward-looking statements represent our current judgment of what may happen in the future, actual results may differ materially from the results expressed or implied by these statements due to numerous important factors. Our filings with the SEC provide detailed information on such statements and risks, and should be consulted along with this release. To the extent permitted under applicable law, IDT assumes no obligation to update any forward-looking statements.

NRSInsights Contact:

Suzy Silliman

SVP, Data Strategy and Sales at NRS

National Retail Solutions

suzy.silliman@nrsplus.com

IDT Corporation Contact:

Bill Ulrey

william.ulrey@idt.net

# # #

Attachment