Hecla Reports Exploration Results and Reserves

- Hecla Mining Company (HL) reported the second highest silver reserves in its 133-year history at 238 million ounces, just 1% less than the all-time highest reserve from the previous year.

- The gold resource is the largest in Hecla's history.

- The 2023 exploration program expanded reserves at Keno Hill and Lucky Friday and increased mineralization at Greens Creek.

- Keno Hill's reserves saw an 11% increase, now 45% higher since acquisition.

- Drilling results at Keno Hill included high-grade intercepts such as 54 ounces per ton silver over 39 feet.

- Greens Creek's exploration efforts have consistently yielded remarkable results in silver, gold, zinc, and lead.

- With the acquisition of ATAC, Hecla now has 20 district-sized properties with excellent exploration potential.

- Hecla produces almost half of the silver in the U.S. and expects to be Canada's largest silver producer in 2024.

- Hecla plays a key role in mining silver for solar energy production.

- The year-end 2023 reserves and resources show a replacement of 11 million ounces of silver produced during the year.

- Greens Creek saw a drop in silver reserves of 10% due to depletion and other changes.

- The proven and probable gold reserves declined by 16% due to a strategic shift at Casa Berardi.

- Measured and indicated gold reserves increased by 21% following the acquisition of ATAC.

- Inferred gold resources increased by 11%.

- Resource metal price assumptions for 2023 remained unchanged from the previous year.

- Exploration programs at Keno Hill and Greens Creek focused on extending mineralization and resource conversion.

- Significant assay highlights were reported from drilling programs at Keno Hill and Greens Creek.

- None.

Insights

The reported exploration results from Hecla Mining Company indicating the second highest silver reserves and the largest gold resource in the company's history are significant indicators of the company's potential growth and sustainability. The discovery of high-grade and wide intercepts, particularly the 54 ounces per ton silver over 39 feet, suggests an increase in the intrinsic value of the company's mining assets. This could lead to a positive reassessment of the company's stock by investors and analysts, as reserve expansions often correlate with increased production capacity and potential revenue growth.

Furthermore, the strategic acquisition of ATAC and its extensive land package may provide long-term growth opportunities for Hecla. The company's positioning as a leading silver producer in the U.S. and its expected rise to Canada's largest silver producer by 2024 could be leveraged in the context of the growing demand for silver in the solar industry. This strategic alignment with the renewable energy sector could enhance investor sentiment, especially within the ESG investing community.

Hecla Mining's exploration update and reserves report have vital implications for financial forecasting and valuation. The company's ability to replace 11 million ounces of silver production and the increase in measured and indicated gold reserves by 21% post-acquisition of ATAC Resources Ltd. are important for projecting future cash flows. The unchanged metal price assumptions for silver, with a slight increase for gold, indicate a stable pricing environment that the company is using for its reserve calculations, which is an important factor for investors to consider when evaluating the company's future profitability.

However, the 16% decrease in gold reserves due to the transition at Casa Berardi to a surface operation only is a noteworthy development. It reflects a strategic shift that could impact the cost structure and operational efficiency of the company. Investors should closely monitor how these changes affect the company's margins and overall financial health.

The technical aspects of Hecla's exploration results, such as the reported high-grade mineralization at depths greater than 1,000 feet and the expansion of mineralization at Greens Creek, indicate a robust exploration methodology and potential for resource longevity. The reported grades and widths from Keno Hill and Greens Creek are substantial and the use of terms like 'proven and probable reserves' and 'measured and indicated resources' are industry standards for reporting mineral assets, reflecting the level of confidence in the economic extraction of these minerals.

It is also important to note the company's strategic focus on district-sized properties, which typically offer economies of scale and can lead to lower production costs per ounce of metal. This strategy, combined with the company's significant landholdings in politically stable regions such as the U.S. and Canada, can be seen as a risk mitigation factor that might appeal to risk-averse investors.

Second highest silver reserve and largest gold resource in company history

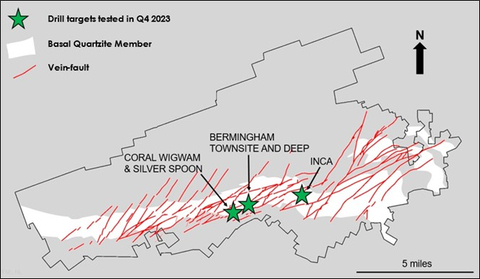

Figure 1: District geology with 2023 drill target locations. (Graphic: Business Wire)

“Hecla’s silver reserves are the second highest in our 133-year history at 238 million silver ounces and only

Baker continued, “Keno Hill’s 2023 exploration provided an

Baker concluded, “With the recent acquisition of ATAC and its massive 700 square mile land package, we now have 20 district-sized properties with excellent exploration potential to explore and grow our resource base, primarily in the

EXPLORATION HIGHLIGHTS

Select drill highlights from the company’s exploration programs include the following drill holes, additional drill holes and details are included later in this release.

KENO HILL

-

Footwall Vein: 54.0 oz/ton silver,

4.8% lead, and2.5% zinc over 39.5 feet-

Includes: 77.1 oz/ton silver,

8.1% lead, and3.2% zinc over 11.4 feet; and -

Includes: 122.1 oz/ton silver,

8.0% lead, and6.5% zinc over 8.9 feet

-

Includes: 77.1 oz/ton silver,

-

Footwall Vein: 58.6 oz/ton silver,

3.6% lead, and4.3% zinc over 10.1 feet -

Main Vein: 32.7 oz/ton silver,

1.7% lead, and1.7% zinc over 15.2 feet-

Includes: 78.9 oz/ton silver,

3.9% lead, and2.3% zinc over 5.8 feet

-

Includes: 78.9 oz/ton silver,

-

Main Vein: 32.4 oz/ton silver,

8.3% lead, and4.1% zinc over 9.2 feet-

Includes: 114.9 oz/ton silver,

41.5% lead, and8.4% zinc over 1.5 feet

-

Includes: 114.9 oz/ton silver,

GREENS CREEK

West Zone

-

63.4 oz/ton silver, 0.64 oz/ton gold,

8.3% zinc, and4.3% lead over 26.04 feet -

28.3 oz/ton silver, 0.08 oz/ton gold,

8.3% zinc, and4.7% lead over 12.8 feet -

35.2 oz/ton silver, 0.08 oz/ton gold,

10.0% zinc, and6.3% lead over 27.3 feet

Upper Plate Zone

-

19.6 oz/ton silver, 0.05 oz/ton gold,

10.9% zinc and5.4% lead over 27.9 feet -

28.3 oz/ton silver, 0.01 oz/ton gold,

2.6% zinc and1.3% lead over 23.9 feet

5250 Zone

-

18.7 oz/ton silver, 0.05 oz/ton gold,

11.4% zinc, and3.6% lead over 26.8 feet

RESERVES & RESOURCES HIGHLIGHTS

- Silver reserves at 238 million ounces with additions at Keno Hill and Lucky Friday after depletion.

-

Keno Hill reserves increased

10% to 55 million ounces, an increase of45% since acquisition. -

Gold reserves decreased by

16% due to the strategic change to transition to a surface operation only at Casa Berardi. -

Measured and indicated gold reserves increased

21% and inferred gold resources increased11% following the acquisition of ATAC Resources Ltd (“ATAC”).

YEAR-END 2023 RESERVES AND RESOURCES

On a consolidated basis, the Company replaced 11 million ounces of silver produced during the year. At the Lucky Friday and Keno Hill, production was replaced, and additional silver reserves were defined. Greens Creek saw a drop in silver reserves of

Reserve metal price assumptions for 2023 were

Measured and indicated silver ounces are unchanged with increases at Greens Creek and Keno Hill which offset the decrease at Lucky Friday due to conversion to reserves. Measured and indicated gold ounces also increased

Inferred silver resources decreased less than

Resource metal price assumptions for 2023 were

A breakdown of the Company’s reserves and resources is set out in Table A at the end of this news release.

EXPLORATION AND PRE-DEVELOPMENT UPDATE

Keno Hill,

At Keno Hill, the underground definition and surface exploration drilling programs continued to be focused on extending mineralization, resource conversion in the high-grade Bermingham Bear Zone Veins (Bear, Footwall, and Main Vein Zones), and discovering and defining new mineral resources. During the fourth quarter, two underground drills completed over 12,800 feet of definition and geotechnical drilling, and two surface core drills completed over 14,400 feet of exploration drilling targeting the Deep Bermingham, Bermingham Townsite, Inca, and Coral Wigwam target areas (Figure 1).

Bermingham underground definition and exploration drilling in the three Bear Zone veins (Bear, Footwall, Main veins) continues to extend mineralization to the northeast, southeast, and down dip outside of the current reserve shapes (Figures 2, 3 and 4). Drilling in the Bear Vein identified strong vein mineralization between the Ursa and Splay faults where testing at higher elevations had no significant mineralization; this new drilling expands higher-grade mineralization between the faults and to the southwest near the Arctic fault zone. Drilling in the Footwall Vein intersected substantially wider and higher-grade mineralization than modeled to the southwest internal to the reserve shape. Drilling in the Main Vein intercepted strong mineralization at depth and along strike significantly increasing the strike and depth of high grade in this zone. Assay highlights include (reported widths are estimates of true width):

-

Bear Vein: 21.4 oz/ton silver,

2.8% lead, and0.5% zinc over 11.7 feet-

Includes: 129.9 oz/ton silver,

14.8% lead, and3.1% zinc over 1.6 feet

-

Includes: 129.9 oz/ton silver,

-

Bear Vein: 25.5 oz/ton silver,

3.6% lead, and1.2% zinc over 5.0 feet -

Footwall Vein: 54.0 oz/ton silver,

4.8% lead, and2.5% zinc over 39.5 feet-

Includes: 77.1 oz/ton silver,

8.1% lead, and3.2% zinc over 11.4 feet; and -

Includes: 122.1 oz/ton silver,

8.0% lead, and6.5% zinc over 8.9 feet

-

Includes: 77.1 oz/ton silver,

-

Footwall Vein: 58.6 oz/ton silver,

3.6% lead, and4.3% zinc over 10.1 feet -

Main Vein: 32.7 oz/ton silver,

1.7% lead, and1.7% zinc over 15.2 feet-

Includes: 78.9 oz/ton silver,

3.9% lead, and2.3% zinc over 5.8 feet

-

Includes: 78.9 oz/ton silver,

-

Main Vein: 32.4 oz/ton silver,

8.3% lead, and4.1% zinc over 9.2 feet-

Includes: 114.9 oz/ton silver,

41.5% lead, and8.4% zinc over 1.5 feet

-

Includes: 114.9 oz/ton silver,

Initial surface exploration drilling tested for continuity of the Bermingham vein system at depth intersected strong mineralization (87.2 oz/ton silver over 0.6 feet) 1,050 feet below the existing Deep Bermingham resource. This mineralized intercept resets and expands exploration potential in the district where previously high-grade silver mineralization was thought to occur only in the upper parts of the favorable Basil Quartzite host stratigraphy.

Surface exploration drilling continued targeting the Bermingham Townsite Vein and Townsite Vein Splay system intersected strong mineralization which continues to be open for expansion at depth. Assay highlights include (reported widths are estimates of true width):

-

Townsite Vein Splay: 73.5 oz/ton silver,

1.4% lead, and0.2% zinc over 4.6 feet

Surface exploration drilling targeting the Inca Vein located east of the Hector Calumet area testing for continuity from historic drillhole intercepts intersected strong silver mineralization with significant intercepts associated indium and zinc mineralization. Limited drilling to date has outlined a mineralized zone of over 800 feet of strike length and is open for expansion to the northeast and southwest along strike and up and down dip.

-

Inca Vein 2: 4.7 oz/ton silver,

0.5% lead,2.7% zinc, and 1.6 oz/ton indium over 22.6 feet-

Includes: 42.9 oz/ton silver, 3.6 oz/ton lead,

21.9% zinc, and 14.9 oz/ton indium over 2.1 feet

-

Includes: 42.9 oz/ton silver, 3.6 oz/ton lead,

-

Inca Vein 2: 5.8 oz/ton silver,

0.2% lead,1.6% zinc, and 0.9 oz/ton indium over 7.4 feet-

Includes: 107.3 oz/ton silver, 4.6 oz/ton lead,

15.7% zinc, and 10.5 oz/ton indium over 0.4 feet

-

Includes: 107.3 oz/ton silver, 4.6 oz/ton lead,

Greens Creek,

At Greens Creek, four underground drills completed over 38,000 feet of drilling in 79 drillholes focused on resource conversion and exploration that extends mineralization of known resources. Drilling was focused in the 9a, 200 South, East, West, Gallagher, and Gallagher Fault Block zones while assay results were received from drilling in the 200 South, 5250, East, Upper Plate, West, and 9a zones (Figure 5).

Underground drilling completed 25 drillholes in the 200 South Zone targeting the upper orebody and the deeper mine contact portions of the zone covering a strike length of 1,050 feet. Unexpected zones of mineralized ore lithologies were intersected early in a few of the drillholes before the targeted contact expanding mineralization in those areas. Highlights from this drilling include:

-

17.4 oz/ton silver, 0.02 oz/ton gold,

4.1% zinc, and3.0% lead over 21.1 feet -

11.4 oz/ton silver, 0.06 oz/ton gold,

3.1% zinc, and1.5% lead over 7.0 feet

Drilling in the 5250 Zone targeted 150 feet of strike length in the upper portion of the resources intersected thick sequences of white baritic and massive sulfide ore lithologies above the modeled resources expanding mineralization in that area of the zone. Highlights from this drilling include:

-

18.7 oz/ton silver, 0.05 oz/ton gold,

11.4% zinc, and3.6% lead over 26.8 feet

Additional assay results have been received from underground drilling in the northern, central, and eastern portion of the Upper Plate zone, targeting mineralization for upgrading and expanding resources over 900 feet of strike length. Results to date indicate that drilling is upgrading and expanding mineralization in the Upper Plate Zone. Highlights from this drilling include:

-

19.6 oz/ton silver, 0.05 oz/ton gold,

10.9% zinc and5.4% lead over 27.9 feet -

28.3 oz/ton silver, 0.01 oz/ton gold,

2.6% zinc and1.3% lead over 23.9 feet

Strong assay results received from underground drilling in the West Zone extend mineralization at the lower mine contact over 400 feet to the west of previous intercepts and infills a 200-foot gap in drilling in the central ore band (Figure 6). Highlights from this drilling include:

-

63.4 oz/ton silver, 0.64 oz/ton gold,

8.3% zinc, and4.3% lead over 26.04 feet -

28.3 oz/ton silver, 0.08 oz/ton gold,

8.3% zinc, and4.7% lead over 12.8 feet -

35.2 oz/ton silver, 0.08 oz/ton gold,

10.0% zinc, and6.3% lead over 27.3 feet

Detailed complete drill assay highlights can be found in Table B at the end of the release.

ABOUT HECLA

Founded in 1891, Hecla Mining Company (NYSE: HL) is the largest silver producer in

Cautionary Statements Regarding Estimates and Forward-Looking Statements, Including 2024 Outlook

Statements made or information provided in this news release that are not historical facts are "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbor created by such sections and other applicable laws, and "forward-looking information" within the meaning of Canadian securities laws. When a forward-looking statement expresses or implies an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, such statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by the forward-looking statements. Forward-looking statements often address our expected future business and financial performance and financial condition and often contain words such as “anticipate,” “intend,” “plan,” “will,” “could,” “would,” “estimate,” “should,” “expect,” “believe,” “project,” “target,” “indicative,” “preliminary,” “potential” and similar expressions. Forward-looking statements in this news release may include, without limitation: (i) the Company expects fourth quarter 2023 exploration drilling should grow the reserves at Keno Hill; (ii) the Company expects to grow its resource base, primarily in the

In addition, material risks that could cause actual results to differ from forward-looking statements include, but are not limited to: (i) gold, silver and other metals price volatility; (ii) operating risks; (iii) currency fluctuations; (iv) increased production costs and variances in ore grade or recovery rates from those assumed in mining plans; (v) community relations; (vi) conflict resolution and outcome of projects or oppositions; (vii) litigation, political, regulatory, labor and environmental risks; (viii) exploration risks and results, including that mineral resources are not mineral reserves, they do not have demonstrated economic viability and there is no certainty that they can be upgraded to mineral reserves through continued exploration; (ix) the failure of counterparties to perform their obligations under hedging instruments; (x) we take a material impairment charge on any of our assets; and (xi) inflation causes our costs to rise more than we currently expect. For a more detailed discussion of such risks and other factors, see the Company’s 2023 Annual Report on Form 10-K, to be filed with the Securities and Exchange Commission (“SEC”) on February 15, 2024. The Company does not undertake any obligation to release publicly, revisions to any “forward-looking statement,” including, without limitation, outlook, to reflect events or circumstances after the date of this presentation, or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws. Investors should not assume that any lack of update to a previously issued “forward-looking statement” constitutes a reaffirmation of that statement. Continued reliance on “forward-looking statements” is at investors’ own risk.

Cautionary Statements to Investors on Reserves and Resources

This news release uses the terms “mineral resources”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. Mineral resources that are not mineral reserves do not have demonstrated economic viability. You should not assume that all or any part of measured or indicated mineral resources will ever be converted into mineral reserves. Further, inferred mineral resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically, and an inferred mineral resource may not be considered when assessing the economic viability of a mining project, and may not be converted to a mineral reserve. We report reserves and resources under the SEC’s mining disclosure rules (“S-K 1300”) and Canada’s National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) because we are a “reporting issuer” under Canadian securities laws. Unless otherwise indicated, all resource and reserve estimates contained in this press release have been prepared in accordance with S-K 1300 as well as NI 43-101.

Qualified Person (QP)

Kurt D. Allen, MSc., CPG, VP - Exploration of Hecla Mining Company and Keith Blair, MSc., CPG, Chief Geologist of Hecla Limited, who serve as a Qualified Person under S-K 1300 and NI 43-101, supervised the preparation of the scientific and technical information concerning Hecla’s mineral projects in this news release. Technical Report Summaries (each a “TRS”) for each of the Company’s Greens Creek and Lucky Friday properties are filed as exhibits 96.1 and 96.2 respectively, to the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and are available at www.sec.gov. A TRS for each of the Company’s Casa Berardi and Keno Hill properties will be filed as exhibits 96.3 and 96.4, respectively, to the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 to be filed on February 15, 2024 and will then be available at www.sec.gov. Information regarding data verification, surveys and investigations, quality assurance program and quality control measures and a summary of analytical or testing procedures for (i) the Greens Creek Mine are contained in its TRS and in a NI 43-101 technical report titled “Technical Report for the Greens Creek Mine” effective date December 31, 2018, (ii) the Lucky Friday Mine are contained in its TRS and in its technical report titled “Technical Report for the Lucky Friday Mine

Table A

Mineral Reserves – 12/31/2023 (1)

Proven Reserves (1) |

|||||||||||

Asset |

Location |

Ownership |

Tons (000) |

Silver

|

Gold

|

Lead

|

Zinc

|

Silver

|

Gold

|

Lead Tons |

Zinc Tons |

Greens Creek (2,3) |

|

|

9 |

11.3 |

0.08 |

3.5 |

8.4 |

100 |

1 |

310 |

740 |

Lucky Friday (2,4) |

|

|

5,299 |

12.8 |

- |

8.0 |

3.8 |

67,595 |

- |

424,080 |

201,280 |

Casa Berardi Underground (2,5) |

|

|

55 |

- |

0.12 |

- |

- |

- |

7 |

- |

- |

Casa Berardi Open Pit (2,5) |

|

|

4,240 |

- |

0.09 |

- |

- |

- |

379 |

- |

- |

Keno Hill (2,6) |

|

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

Total |

|

|

9,603 |

|

|

|

|

67,695 |

387 |

424,390 |

202,020 |

Probable Reserves (7) |

|||||||||||

Asset |

Location |

Ownership |

Tons (000) |

Silver

|

Gold

|

Lead

|

Zinc

|

Silver

|

Gold

|

Lead

|

Zinc

|

Greens Creek (2,3) |

|

|

10,009 |

10.5 |

0.09 |

2.5 |

6.6 |

105,122 |

880 |

250,270 |

657,990 |

Lucky Friday (2,4) |

|

|

966 |

10.8 |

- |

7.1 |

2.9 |

10,411 |

- |

68,320 |

28,100 |

Casa Berardi Underground (2,5) |

|

|

175 |

- |

0.15 |

- |

- |

- |

26 |

- |

- |

Casa Berardi Open Pit (2,5) |

|

|

11,384 |

- |

0.08 |

- |

- |

- |

859 |

- |

- |

Keno Hill (2,6) |

|

|

2,069 |

26.6 |

0.01 |

2.8 |

2.5 |

55,068 |

13 |

58,170 |

52,380 |

Total |

|

|

24,603 |

|

|

|

|

170,601 |

1,778 |

376,760 |

738,470 |

Proven and Probable Reserves |

|||||||||||

Asset |

Location |

Ownership |

Tons (000) |

Silver

|

Gold

|

Lead

|

Zinc

|

Silver

|

Gold

|

Lead

|

Zinc

|

Greens Creek (2,3) |

|

|

10,018 |

10.5 |

0.09 |

2.5 |

6.6 |

105,222 |

881 |

250,580 |

658,730 |

Lucky Friday (2,4) |

|

|

6,265 |

12.5 |

- |

7.9 |

3.7 |

78,006 |

- |

492,400 |

229,380 |

Casa Berardi Underground (2,5) |

|

|

230 |

- |

0.14 |

- |

- |

- |

33 |

- |

- |

Casa Berardi Open Pit (2,5) |

|

|

15,624 |

- |

0.08 |

- |

- |

- |

1,238 |

- |

- |

Keno Hill (2,6) |

|

|

2,069 |

26.6 |

0.01 |

2.8 |

2.5 |

55,068 |

13 |

58,170 |

52,380 |

Total |

34,206 |

|

|

|

238,296 |

2,165 |

801,150 |

940,490 |

|||

(1) |

The term “reserve” means an estimate of tonnage and grade or quality of indicated and measured mineral resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a measured or indicated mineral resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted. The term “proven reserves” means the economically mineable part of a measured mineral resource and can only result from conversion of a measured mineral resource. See footnotes 8 and 9 below. |

|

(2) |

Mineral reserves are based on |

|

(3) |

The reserve NSR cut-off values for Greens Creek are |

|

(4) |

The reserve NSR cut-off values for Lucky Friday are |

|

(5) |

The average reserve cut-off grades at Casa Berardi are 0.11 oz/ton gold underground and 0.03 oz/ton gold for open pit. Metallurgical recovery (actual 2023): |

|

(6) |

The reserve NSR cut-off value at Keno Hill is |

|

(7) |

The term “probable reserves” means the economically mineable part of an indicated and, in some cases, a measured mineral resource. See footnotes 9 and 10 below. |

|

| Totals may not represent the sum of parts due to rounding | ||

Mineral Resources - 12/31/2023 (8)

Measured Resources (9) |

|||||||||||||

Asset |

Location |

Ownership |

Tons (000) |

Silver

|

Gold

|

Lead

|

Zinc

|

Copper

|

Silver

|

Gold

|

Lead

|

Zinc

|

Copper

|

Greens Creek (12,13) |

|

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Lucky Friday (12,14) |

|

|

5,326 |

8.6 |

- |

5.6 |

2.7 |

- |

45,785 |

- |

299,360 |

146,420 |

- |

Casa Berardi Underground(12,15) |

|

|

1,099 |

- |

0.21 |

- |

- |

- |

- |

234 |

- |

- |

- |

Casa Berardi Open Pit (12,15) |

|

|

67 |

- |

0.03 |

- |

- |

- |

- |

2 |

- |

- |

- |

Keno Hill (12,16) |

|

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Fire Creek (18,19) |

|

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

|

18 |

4.9 |

0.59 |

- |

- |

- |

87 |

10 |

- |

- |

- |

Midas (18,21) |

|

|

2 |

7.6 |

0.68 |

- |

- |

- |

14 |

1 |

- |

- |

- |

Heva (22) |

|

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Hosco (22) |

|

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Star (12,23) |

|

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Rackla - Tiger Underground (29) |

|

|

881 |

- |

0.09 |

- |

- |

- |

- |

75 |

- |

- |

- |

Rackla - Tiger Open Pit (29) |

|

|

32 |

- |

0.06 |

- |

- |

- |

- |

2 |

- |

- |

- |

Rackla - Osiris Underground (30) |

|

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Rackla - Osiris Open Pit (30) |

|

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Total |

|

|

7,425 |

|

|

|

|

|

45,886 |

324 |

299,360 |

146,420 |

- |

Indicated Resources (10) |

|||||||||||||

Asset |

Location |

Ownership |

Tons (000) |

Silver

|

Gold

|

Lead

|

Zinc

|

Copper

|

Silver

|

Gold

|

Lead

|

Zinc

|

Copper

|

Greens Creek (12,13) |

|

|

8,040 |

13.9 |

0.10 |

3.0 |

8.0 |

- |

111,526 |

800 |

239,250 |

643,950 |

- |

Lucky Friday (12,14) |

|

|

1,011 |

8.0 |

- |

6.0 |

2.7 |

- |

8,136 |

- |

60,200 |

26,910 |

- |

Casa Berardi Underground (12,15) |

|

|

3,154 |

- |

0.19 |

- |

- |

- |

- |

603 |

- |

- |

- |

Casa Berardi Open Pit (12,15) |

|

|

205 |

- |

0.03 |

- |

- |

- |

- |

5 |

- |

- |

- |

Keno Hill (12,16) |

|

|

4,504 |

7.5 |

0.006 |

0.9 |

3.5 |

- |

33,926 |

26 |

41,120 |

157,350 |

- |

|

|

|

1,453 |

6.5 |

0.09 |

- |

- |

- |

9,430 |

135 |

- |

- |

- |

|

|

|

1,187 |

5.5 |

0.01 |

1.9 |

2.9 |

1.2 |

6,579 |

16 |

22,420 |

34,100 |

14,650 |

Fire Creek (18,19) |

|

|

114 |

1.0 |

0.46 |

- |

- |

- |

113 |

53 |

- |

- |

- |

|

|

|

70 |

1.9 |

0.58 |

- |

- |

- |

130 |

40 |

- |

- |

- |

Midas (18,21) |

|

|

76 |

5.7 |

0.42 |

- |

- |

- |

430 |

32 |

- |

- |

- |

Heva (22) |

|

|

1,266 |

- |

0.06 |

- |

- |

- |

- |

76 |

- |

- |

- |

Hosco (22) |

|

|

29,287 |

- |

0.04 |

- |

- |

- |

- |

1,202 |

- |

- |

- |

Star (12,23) |

|

|

1,068 |

3.0 |

- |

6.4 |

7.7 |

- |

3,177 |

- |

67,970 |

82,040 |

- |

Rackla - Tiger Underground (29) |

|

|

3,116 |

- |

0.10 |

- |

- |

- |

- |

311 |

- |

- |

- |

Rackla - Tiger Open Pit (29) |

|

|

960 |

- |

0.08 |

- |

- |

- |

- |

76 |

- |

- |

- |

Rackla - Osiris Underground (30) |

|

|

5,135 |

- |

0.12 |

- |

- |

- |

- |

604 |

- |

- |

- |

Rackla - Osiris Open Pit (30) |

|

|

960 |

- |

0.13 |

- |

- |

- |

- |

128 |

- |

- |

- |

Total |

|

|

61,606 |

|

|

|

|

|

173,447 |

4,107 |

430,960 |

944,350 |

14,650 |

Measured & Indicated Resources |

|||||||||||||

Asset |

Location |

Ownership |

Tons (000) |

Silver

|

Gold

|

Lead

|

Zinc

|

Copper

|

Silver

|

Gold

|

Lead

|

Zinc

|

Copper

|

Greens Creek (12,13) |

|

|

8,040 |

13.9 |

0.10 |

3.0 |

8.0 |

- |

111,526 |

800 |

239,250 |

643,950 |

- |

Lucky Friday (12,14) |

|

|

6,337 |

8.3 |

- |

5.8 |

2.7 |

- |

53,921 |

- |

359,560 |

173,330 |

- |

Casa Berardi Underground (12,15) |

|

|

4,253 |

- |

0.20 |

- |

- |

- |

- |

837 |

- |

- |

- |

Casa Berardi Open Pit (12,15) |

|

|

272 |

- |

0.03 |

- |

- |

- |

- |

7 |

- |

- |

- |

Keno Hill (12,16) |

|

|

4,504 |

7.5 |

0.006 |

0.9 |

3.5 |

- |

33,926 |

26 |

41,120 |

157,350 |

- |

|

|

|

1,453 |

6.5 |

0.09 |

- |

- |

- |

9,430 |

135 |

- |

- |

- |

|

|

|

1,187 |

5.5 |

0.01 |

1.9 |

2.9 |

1.2 |

6,579 |

16 |

22,420 |

34,100 |

14,650 |

Fire Creek (18,19) |

|

|

114 |

1.0 |

0.46 |

- |

- |

- |

113 |

53 |

- |

- |

- |

|

|

|

88 |

2.5 |

0.58 |

- |

- |

- |

217 |

50 |

- |

- |

- |

Midas (18,21) |

|

|

78 |

5.7 |

0.43 |

- |

- |

- |

444 |

33 |

- |

- |

- |

Heva (22) |

|

|

1,266 |

- |

0.06 |

- |

- |

- |

- |

76 |

- |

- |

- |

Hosco (22) |

|

|

29,287 |

- |

0.04 |

- |

- |

- |

- |

1,202 |

- |

- |

- |

Star (12,23) |

|

|

1,068 |

3.0 |

- |

6.4 |

7.7 |

- |

3,177 |

- |

67,970 |

82,040 |

- |

Rackla - Tiger Underground (29) |

|

|

3,997 |

- |

0.10 |

- |

- |

- |

- |

386 |

- |

- |

- |

Rackla - Tiger Open Pit (29) |

|

|

992 |

- |

0.08 |

- |

- |

- |

- |

78 |

- |

- |

- |

Rackla - Osiris Underground (30) |

|

|

5,135 |

- |

0.12 |

- |

- |

- |

- |

604 |

- |

- |

- |

Rackla - Osiris Open Pit (30) |

|

|

960 |

- |

0.13 |

- |

- |

- |

- |

128 |

- |

- |

- |

Total |

|

|

69,031 |

|

|

|

|

|

219,333 |

4,431 |

730,320 |

1,090,770 |

14,650 |

Inferred Resources (11) |

|||||||||||||

Asset |

Location |

Ownership |

Tons (000) |

Silver

|

Gold

|

Lead

|

Zinc

|

Copper

|

Silver

|

Gold

|

Lead

|

Zinc

|

Copper

|

Greens Creek (12,13) |

|

|

1,930 |

13.4 |

0.08 |

2.9 |

6.9 |

- |

25,891 |

154 |

55,890 |

133,260 |

- |

Lucky Friday (12,14) |

|

|

3,600 |

7.8 |

- |

5.9 |

2.8 |

- |

27,934 |

- |

211,340 |

100,630 |

- |

Casa Berardi Underground (12,15) |

|

|

1,475 |

- |

0.22 |

- |

- |

- |

- |

332 |

- |

- |

- |

Casa Berardi Open Pit (12,15) |

|

|

828 |

- |

0.08 |

- |

- |

- |

- |

64 |

- |

- |

- |

Keno Hill (12,16) |

|

|

2,836 |

11.2 |

0.003 |

1.1 |

1.8 |

- |

31,791 |

9 |

32,040 |

51,870 |

- |

|

|

|

3,490 |

6.4 |

0.05 |

- |

- |

- |

22,353 |

182 |

- |

- |

- |

|

|

|

385 |

4.2 |

0.01 |

1.6 |

2.3 |

0.9 |

1,606 |

5 |

6,070 |

8,830 |

3,330 |

Fire Creek (18,19) |

|

|

764 |

0.5 |

0.51 |

- |

- |

- |

393 |

392 |

- |

- |

- |

Fire Creek - Open Pit (24) |

|

|

74,584 |

0.1 |

0.03 |

- |

- |

- |

5,232 |

2,178 |

- |

- |

- |

|

|

|

642 |

3.0 |

0.42 |

- |

- |

- |

1,916 |

273 |

- |

- |

- |

Midas (18,21) |

|

|

1,232 |

6.3 |

0.50 |

- |

- |

- |

7,723 |

615 |

- |

- |

- |

Heva (22) |

|

|

2,787 |

- |

0.08 |

- |

- |

- |

- |

216 |

- |

- |

- |

Hosco (22) |

|

|

17,726 |

- |

0.04 |

- |

- |

- |

- |

663 |

- |

- |

- |

Star (12,23) |

|

|

2,851 |

3.1 |

- |

5.9 |

5.9 |

- |

8,795 |

- |

168,180 |

166,930 |

- |

San Juan Silver (12,25) |

|

|

2,570 |

14.9 |

0.01 |

1.4 |

1.1 |

- |

38,203 |

34 |

49,400 |

39,850 |

- |

|

|

|

913 |

0.3 |

0.14 |

- |

- |

- |

271 |

131 |

- |

- |

- |

|

|

|

100,086 |

1.5 |

- |

- |

- |

0.7 |

148,736 |

- |

- |

- |

658,680 |

Libby Exploration Project (12,28) |

|

|

112,185 |

1.6 |

- |

- |

- |

0.7 |

183,346 |

- |

- |

- |

759,420 |

Rackla - Tiger Underground (29) |

|

|

30 |

- |

0.05 |

- |

- |

- |

- |

2 |

- |

- |

- |

Rackla - Tiger Open Pit (29) |

|

|

152 |

- |

0.07 |

- |

- |

- |

- |

10 |

- |

- |

- |

Rackla - Osiris Underground (30) |

|

|

5,919 |

- |

0.09 |

- |

- |

- |

- |

530 |

- |

- |

- |

Rackla - Osiris Open Pit (30) |

|

|

4,398 |

- |

0.12 |

- |

- |

- |

- |

514 |

- |

- |

- |

Total |

|

|

341,383 |

|

|

|

|

|

504,190 |

6,304 |

522,920 |

501,370 |

1,421,430 |

| Note: All estimates are in-situ except for the proven reserves at Greens Creek which are in surface stockpiles. Mineral resources are exclusive of reserves. | ||

(8) |

The term "mineral resources" means a concentration or occurrence of material of economic interest in or on the Earth's crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A mineral resource is a reasonable estimate of mineralization, taking into account relevant factors such as cut-off grade, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralization drilled or sampled. |

|

(9) |

The term "measured resources" means that part of a mineral resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. The level of geological certainty associated with a measured mineral resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit. Because a measured mineral resource has a higher level of confidence than the level of confidence of either an indicated mineral resource or an inferred mineral resource, a measured mineral resource may be converted to a proven mineral reserve or to a probable mineral reserve. |

|

(10) |

The term "indicated resources" means that part of a mineral resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an indicated mineral resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an indicated mineral resource has a lower level of confidence than the level of confidence of a measured mineral resource, an indicated mineral resource may only be converted to a probable mineral reserve. |

|

(11) |

The term "inferred resources" means that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an inferred mineral resource has the lowest level of geological confidence of all mineral resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability, an inferred mineral resource may not be considered when assessing the economic viability of a mining project, and may not be converted to a mineral reserve. |

|

(12) |

Mineral resources for operating properties are based on |

|

(13) |

The resource NSR cut-off values for Greens Creek are |

|

(14) |

The resource NSR cut-off values for Lucky Friday are |

|

(15) |

The average resource cut-off grades at Casa Berardi are 0.12 oz/ton gold for underground and 0.03 oz/ton gold for open pit; metallurgical recovery (actual 2023): |

|

(16) |

The resource NSR cut-off value at Keno Hill is |

|

(17) |

Indicated resources for most zones at |

|

(18) |

Mineral resources for Fire Creek, |

|

(19) |

Fire Creek mineral resources are reported at a gold equivalent cut-off grade of 0.283 oz/ton. Metallurgical recoveries: |

|

(20) |

|

|

(21) |

Midas mineral resources are reported at a gold equivalent cut-off grade of 0.237 oz/ton. Metallurgical recoveries: |

|

(22) |

Measured, indicated and inferred resources at Heva and Hosco are based on |

|

(23) |

Indicated and Inferred resources at the Star property are reported using a minimum mining width of 4.3 feet and an NSR cut-off value of |

|

(24) |

Inferred open-pit resources for Fire Creek calculated November 30, 2017 using gold and silver recoveries of |

|

(25) |

Inferred resources reported at a minimum mining width of 6.0 feet for Bulldog and an NSR cut-off value of |

|

(26) |

Inferred resource at |

|

(27) |

Inferred resource at |

|

(28) |

Inferred resource at the Libby Exploration Project reported at a minimum thickness of 15 feet and an NSR cut-off value of |

|

(29) |

Mineral resources at the Rackla-Tiger Project are based on a gold price of |

|

(30) |

Mineral resources at the Rackla-Osiris Project are based on a gold price of |

|

| Totals may not represent the sum of parts due to rounding | ||

Table B

Assay Results – Q4 2022

Keno Hill |

Zone |

Drillhole Number |

Drillhole Azm/Dip |

Sample From (feet) |

Sample To (feet) |

True Width (feet) |

Silver (oz/ton) |

Gold (oz/ton) |

Lead (%) |

Zinc (%) |

Indium (oz/ton) |

Depth From Surface (feet) |

Underground |

Bermingham Bear Vein |

BMUG23-086 |

153/-13 |

268.7 |

272.7 |

2.6 |

49.7 |

0.01 |

12.8 |

4.3 |

|

897 |

Bermingham Bear Vein |

BMUG23-087 |

153/-20 |

304.8 |

308.2 |

1.4 |

50.0 |

0.01 |

0.9 |

1.0 |

|

948 |

|

Bermingham Bear Vein |

BMUG23-088 |

145/-17 |

255.4 |

255.9 |

0.3 |

39.7 |

0.00 |

18.5 |

0.1 |

|

910 |

|

Bermingham Bear Vein |

BMUG23-089 |

145/-25 |

338.7 |

345.6 |

3.9 |

0.1 |

0.00 |

0.0 |

0.0 |

|

991 |

|

Bermingham Bear Vein |

BMUG23-090 |

136/-14 |

228.1 |

240.1 |

9.0 |

10.8 |

0.00 |

0.4 |

0.4 |

|

886 |

|

Bermingham Bear Vein |

Including |

230.2 |

231.3 |

0.8 |

83.7 |

0.01 |

1.4 |

1.4 |

|

887 |

||

Bermingham Bear Vein |

BMUG23-091 |

136/-21 |

278.9 |

279.5 |

0.3 |

0.4 |

0.00 |

0.0 |

0.0 |

|

932 |

|

Bermingham Bear Vein |

BMUG23-092 |

136/-26 |

347.9 |

350.7 |

1.0 |

0.1 |

0.00 |

0.0 |

0.0 |

|

1001 |

|

Bermingham Bear Vein |

BMUG23-093 |

130/-14 |

221.1 |

225.1 |

2.8 |

82.5 |

0.01 |

7.2 |

1.5 |

|

889 |

|

Bermingham Bear Vein |

Including |

222.0 |

223.1 |

0.8 |

278.5 |

0.00 |

25.0 |

5.0 |

|

889 |

||

Bermingham Bear Vein |

BMUG23-094 |

130/-20 |

254.0 |

259.5 |

3.7 |

2.7 |

0.00 |

0.1 |

0.5 |

|

925 |

|

Bermingham Bear Vein |

BMUG23-095 |

115/-7 |

351.5 |

354.6 |

2.7 |

10.8 |

0.00 |

1.6 |

0.4 |

|

925 |

|

Bermingham Bear Vein |

BMUG23-096 |

130/-26 |

352.0 |

355.6 |

1.3 |

0.1 |

0.00 |

0.0 |

0.0 |

|

1007 |

|

Bermingham Bear Vein |

BMUG23-097 |

145/06 |

373.1 |

379.7 |

5.0 |

25.5 |

0.02 |

3.6 |

1.2 |

|

847 |

|

Bermingham Bear Vein |

BMUG23-098A |

120/-15 |

212.9 |

213.9 |

0.7 |

0.6 |

0.00 |

0.3 |

0.5 |

|

877 |

|

Bermingham Bear Vein |

BMUG23-105 |

140/-08 |

388.8 |

404.6 |

11.7 |

21.4 |

0.00 |

2.8 |

0.5 |

|

947 |

|

Bermingham Bear Vein |

Including |

396.6 |

398.8 |

1.6 |

129.9 |

0.01 |

14.8 |

3.1 |

|

949 |

||

Bermingham Bear Vein |

Including |

404.3 |

404.6 |

0.2 |

84.3 |

0.01 |

22.8 |

3.0 |

|

950 |

||

Bermingham Bear Vein |

BMUG23-106 |

110/-22 |

249.5 |

252.1 |

1.4 |

0.1 |

0.00 |

0.0 |

0.0 |

|

926 |

|

Bermingham Bear Vein |

BMUG23-107 |

100/-16 |

348.9 |

357.0 |

3.4 |

0.2 |

0.00 |

0.0 |

0.0 |

|

928 |

|

Bermingham Footwall Vein |

BMUG23-087 |

153/-20 |

611.4 |

614.3 |

2.2 |

8.8 |

0.01 |

0.7 |

0.9 |

|

1096 |

|

Bermingham Footwall Vein |

BMUG23-088 |

145/-17 |

548.9 |

561.5 |

10.1 |

58.6 |

0.01 |

3.6 |

4.3 |

|

1010 |

|

Bermingham Footwall Vein |

BMUG23-090 |

136/-14 |

497.7 |

509.2 |

10.1 |

13.9 |

0.00 |

0.9 |

2.9 |

|

966 |

|

Bermingham Footwall Vein |

Including |

497.7 |

498.8 |

1.0 |

121.0 |

0.02 |

6.4 |

24.4 |

|

965 |

||

Bermingham Footwall Vein |

BMUG23-093 |

130/-14 |

483.9 |

487.4 |

3.0 |

17.7 |

0.00 |

0.2 |

1.8 |

|

968 |

|

Bermingham Footwall Vein |

Including |

483.9 |

485.8 |

1.7 |

31.4 |

0.00 |

0.3 |

2.9 |

|

968 |

||

Bermingham Footwall Vein |

BMUG23-094 |

130/-20 |

510.7 |

513.0 |

2.0 |

6.9 |

0.00 |

0.2 |

1.8 |

|

1001 |

|

Bermingham Footwall Vein |

BMUG23-098A |

120/-15 |

471.5 |

485.9 |

12.2 |

8.3 |

0.01 |

1.1 |

3.1 |

|

958 |

|

Bermingham Footwall Vein |

Including |

473.4 |

474.3 |

0.8 |

21.8 |

0.01 |

7.3 |

13.1 |

|

958 |

||

Bermingham Footwall Vein |

Including |

484.6 |

485.9 |

1.1 |

47.7 |

0.02 |

4.7 |

1.4 |

|

961 |

||

Bermingham Footwall Vein |

BMUG23-105 |

140/-08 |

553.9 |

598.2 |

39.5 |

54.0 |

0.01 |

4.8 |

2.5 |

|

980 |

|

Bermingham Footwall Vein |

Including |

554.7 |

567.4 |

11.4 |

77.1 |

0.02 |

8.1 |

3.2 |

|

981 |

||

Bermingham Footwall Vein |

Including |

574.5 |

575.1 |

0.6 |

137.7 |

0.01 |

44.5 |

6.2 |

|

984 |

||

Bermingham Footwall Vein |

Including |

583.3 |

593.3 |

8.9 |

122.1 |

0.01 |

8.0 |

6.5 |

|

985 |

||

Bermingham Main Vein |

BMUG23-086 |

153/-13 |

615.8 |

631.1 |

10.3 |

28.3 |

0.00 |

0.9 |

0.1 |

|

974 |

|

Bermingham Main Vein |

Including |

615.8 |

617.8 |

1.4 |

117.0 |

0.01 |

2.0 |

0.1 |

|

974 |

||

Bermingham Main Vein |

Including |

628.5 |

631.1 |

1.8 |

47.6 |

0.01 |

2.1 |

0.4 |

|

974 |

||

Bermingham Main Vein |

BMUG23-087 |

153/-20 |

766.1 |

783.9 |

9.2 |

32.4 |

0.01 |

8.3 |

4.1 |

|

1152 |

|

Bermingham Main Vein |

Including |

770.0 |

772.9 |

1.5 |

114.9 |

0.02 |

41.5 |

8.4 |

|

1152 |

||

Bermingham Main Vein |

Including |

779.8 |

783.9 |

2.1 |

35.7 |

0.01 |

1.6 |

3.5 |

|

1152 |

||

Bermingham Main Vein |

BMUG23-088 |

145/-17 |

604.2 |

608.1 |

2.8 |

1.2 |

0.00 |

0.1 |

0.0 |

|

1028 |

|

Bermingham Main Vein |

BMUG23-090 |

136/-14 |

528.2 |

547.3 |

15.2 |

32.7 |

0.01 |

1.7 |

1.7 |

|

978 |

|

Bermingham Main Vein |

Including |

531.8 |

539.1 |

5.8 |

78.9 |

0.01 |

3.9 |

2.3 |

|

978 |

||

Bermingham Main Vein |

BMUG23-093 |

130/-14 |

494.1 |

507.5 |

10.1 |

19.8 |

0.01 |

1.0 |

3.9 |

|

971 |

|

Bermingham Main Vein |

Including |

494.1 |

499.5 |

4.1 |

46.3 |

0.02 |

2.2 |

9.2 |

|

971 |

||

Bermingham Main Vein |

BMUG23-094 |

130/-20 |

535.1 |

539.0 |

3.0 |

15.4 |

0.01 |

0.9 |

1.1 |

|

1014 |

|

Bermingham Main Vein |

Including |

535.1 |

535.9 |

0.6 |

70.6 |

0.01 |

3.2 |

3.6 |

|

1014 |

||

Bermingham Main Vein |

BMUG23-105 |

140/-08 |

674.0 |

680.1 |

4.4 |

0.2 |

0.00 |

0.0 |

0.1 |

|

1001 |

|

Stockwork Mineralization |

BMUG23-086 |

153/-13 |

137.2 |

137.8 |

0.4 |

12.6 |

0.00 |

5.7 |

6.7 |

|

863 |

|

Stockwork Mineralization |

BMUG23-087 |

153/-20 |

635.2 |

636.2 |

0.7 |

89.5 |

0.02 |

1.7 |

4.6 |

|

1096 |

|

Stockwork Mineralization |

BMUG23-092 |

136/-26 |

407.4 |

417.3 |

3.6 |

0.9 |

0.00 |

0.4 |

0.2 |

|

1024 |

|

Stockwork Mineralization |

BMUG23-104 |

110/-15 |

403.9 |

407.3 |

2.4 |

5.4 |

0.00 |

0.0 |

3.7 |

|

944 |

|

Stockwork Mineralization |

Including |

403.9 |

404.6 |

0.5 |

22.7 |

0.00 |

0.1 |

15.4 |

|

944 |

||

Surface Exploration |

Bermingham Footwall Vein |

K-23-0855 |

278/-63 |

3138.9 |

3139.8 |

0.6 |

87.2 |

0.03 |

0.0 |

0.0 |

|

2719 |

Bermingham Footwall Vein |

K-23-0869 |

285/-54 |

2632.0 |

2634.1 |

1.8 |

0.2 |

0.00 |

0.0 |

0.0 |

|

1995 |

|

Bermingham Main Vein |

K-23-0855 |

278/-63 |

2438.9 |

2457.7 |

16.9 |

0.1 |

0.00 |

0.0 |

0.0 |

|

2186 |

|

Bermingham Main Vein |

K-23-0869 |

285/-54 |

2223.7 |

2224.6 |

0.9 |

2.7 |

0.00 |

1.0 |

0.4 |

|

1729 |

|

Bermingham Main Vein |

K-23-0869 |

285/-54 |

2317.6 |

2318.4 |

0.8 |

1.1 |

0.00 |

0.5 |

1.4 |

|

1831 |

|

Bermingham Ruby Vein |

K-23-0860 |

330/-60 |

540.0 |

543.1 |

2.8 |

0.4 |

0.00 |

0.0 |

0.1 |

|

394 |

|

Bermingham Ruby Vein |

K-23-0870 |

300/-66.5 |

757.9 |

762.3 |

3.5 |

33.2 |

0.00 |

0.0 |

0.0 |

|

636 |

|

Bermingham Townsite Vein |

K-23-0860 |

330/-60 |

1013.6 |

1014.3 |

0.6 |

0.4 |

0.00 |

0.0 |

0.0 |

|

720 |

|

Bermingham Townsite Vein |

K-23-0860 |

330/-60 |

1073.1 |

1075.9 |

2.4 |

0.1 |

0.00 |

0.0 |

0.4 |

|

762 |

|

Bermingham Townsite Vein |

TSUG23-001 |

030/-55 |

451.7 |

455.9 |

2.7 |

0.3 |

0.00 |

0.0 |

0.0 |

|

1031 |

|

Bermingham Townsite Vein |

K-23-0861 |

315/-60 |

1018.4 |

1023.1 |

4.3 |

1.7 |

0.00 |

0.4 |

0.7 |

|

770 |

|

Bermingham Townsite Vein |

K-23-0862 |

309/-65 |

1082.2 |

1084.5 |

2.0 |

6.1 |

0.00 |

0.5 |

0.1 |

|

969 |

|

Bermingham Townsite Vein |

K-23-0863 |

338/-53 |

596.1 |

609.5 |

12.5 |

3.2 |

0.00 |

0.1 |

1.6 |

|

427 |

|

Bermingham Townsite Vein |

K-23-0864 |

308/-59 |

592.8 |

594.7 |

1.7 |

0.2 |

0.01 |

0.0 |

0.2 |

|

463 |

|

Bermingham Townsite Vein |

K-23-0865 |

308/-70 |

665.5 |

667.5 |

1.7 |

1.2 |

0.00 |

0.1 |

0.7 |

|

587 |

|

Bermingham Townsite Vein |

K-23-0867 |

305/-67 |

1070.5 |

1079.6 |

8.0 |

5.4 |

0.00 |

0.3 |

0.1 |

|

889 |

|

Bermingham Townsite Vein |

Including |

1070.5 |

1070.9 |

0.3 |

30.6 |

0.01 |

4.2 |

1.5 |

|

889 |

||

Bermingham Townsite Vein |

Including |

1078.8 |

1079.6 |

0.6 |

51.6 |

0.01 |

2.1 |

0.1 |

|

889 |

||

Bermingham Townsite Vein |

K-23-0868 |

271/-75 |

803.5 |

804.5 |

0.7 |

0.1 |

0.00 |

0.0 |

0.1 |

|

755 |

|

Bermingham Townsite Vein |

K-23-0870 |

300/-66.5 |

1166.5 |

1168.8 |

2.0 |

8.1 |

0.00 |

0.0 |

3.6 |

|

997 |

|

Bermingham Townsite Vein |

TSUG23-002 |

023/-74 |

487.0 |

489.6 |

1.8 |

0.2 |

0.00 |

0.0 |

0.0 |

|

1159 |

|

Bermingham Townsite Vein splay |

K-23-0862 |

309/-65 |

1195.0 |

1200.5 |

4.6 |

73.5 |

0.01 |

1.4 |

0.2 |

|

1029 |

|

Bermingham Townsite Vein splay |

Including |

1195.8 |

1200.5 |

3.9 |

85.7 |

0.02 |

1.6 |

0.2 |

|

1029 |

||

Bermingham Townsite Vein splay |

K-23-0865 |

308/-70 |

693.9 |

698.7 |

4.0 |

0.3 |

0.00 |

0.2 |

0.4 |

|

612 |

|

Bermingham Townsite Vein splay |

K-23-0870 |

300/-66.5 |

1186.9 |

1196.7 |

8.4 |

2.4 |

0.00 |

0.5 |

0.1 |

|

1007 |

|

Bermingham Townsite Vein Stockwork |

K-23-0867 |

305/-67 |

1053.6 |

1054.0 |

0.4 |

7.7 |

0.01 |

0.8 |

4.8 |

|

840 |

|

Coral Wigwam Walleye Vein |

K-23-0857 |

260/-73 |

1603.0 |

1608.7 |

3.2 |

0.1 |

0.00 |

0.1 |

0.0 |

|

1512 |

|

Coral Wigwam Walleye Vein |

K-23-0858 |

297/-73 |

1488.7 |

1492.1 |

2.3 |

24.9 |

0.00 |

0.0 |

0.1 |

|

1353 |

|

Inca Vein 1 |

K-23-0871 |

314/-65 |

585.4 |

595.2 |

8.6 |

6.9 |

0.00 |

0.3 |

2.7 |

0.3 |

571 |

|

Inca Vein 1 |

K-23-0872 |

336/-58 |

610.2 |

612.5 |

1.9 |

6.4 |

0.00 |

0.2 |

8.6 |

4.5 |

548 |

|

Inca Vein 1 |

K-23-0873 |

355/-56 |

587.2 |

590.1 |

2.5 |

14.6 |

0.00 |

1.0 |

4.3 |

1.7 |

467 |

|

Inca Vein 1 |

K-23-0874 |

007/-67 |

713.4 |

714.2 |

0.6 |

1.4 |

0.00 |

0.0 |

3.0 |

1.7 |

605 |

|

Inca Vein 2 |

K-23-0873 |

355/-56 |

671.4 |

702.1 |

22.6 |

4.7 |

0.00 |

0.5 |

2.7 |

1.6 |

545 |

|

Inca Vein 2 |

Including |

696.0 |

698.8 |

2.1 |

42.9 |

0.02 |

3.6 |

21.9 |

14.9 |

567 |

||

Inca Vein 2 |

K-23-0874 |

007/-67 |

757.1 |

759.0 |

1.3 |

4.2 |

0.02 |

0.9 |

13.8 |

9.6 |

646 |

|

Inca Vein 2 |

K-23-0874 |

007/-67 |

767.7 |

778.5 |

7.4 |

5.8 |

0.00 |

0.2 |

1.6 |

0.9 |

656 |

|

Inca Vein 2 |

Including |

767.7 |

768.2 |

0.4 |

107.3 |

0.03 |

4.6 |

15.7 |

10.5 |

656 |

||

Inca Vein 2 |

K-23-0874 |

007/-67 |

800.4 |

806.9 |

4.4 |

3.0 |

0.01 |

3.5 |

12.1 |

10.1 |

687 |

|

Greens Creek ( |

Zone |

Drill Hole Number |

Drill Hole Azm/Dip |

Sample From (feet) |

Sample To (feet) |

Est. True Width (feet) |

Silver (oz/ton) |

Gold (oz/ton) |

Zinc (%) |

Lead (%) |

Depth From Mine Portal (feet) |

Underground |

200 South |

GC6069 |

216.7/-81.4 |

603.0 |

604.7 |

1.2 |

10.8 |

0.07 |

5.9 |

3.3 |

-1907 |

200 South |

GC6120 |

131.8/-83.5 |

301.5 |

306.5 |

2.5 |

20.0 |

0.01 |

1.9 |

1.1 |

-1620 |

|

200 South |

GC6120 |

131.8/-83.5 |

589.4 |

592.4 |

2.8 |

8.6 |

0.13 |

0.2 |

0.1 |

-1909 |

|

200 South |

GC6120 |

131.8/-83.5 |

638.6 |

641.6 |

1.8 |

12.2 |

0.05 |

1.0 |

0.4 |

-1959 |

|

200 South |

GC6162 |

243.4/63.7 |

13.5 |

14.5 |

0.9 |

11.5 |

0.05 |

6.0 |

4.4 |

-1266 |

|

200 South |

GC6162 |

243.4/63.7 |

32.0 |

41.0 |

8.1 |

6.1 |

0.04 |

6.8 |

3.3 |

-1244 |

|

200 South |

GC6162 |

243.4/63.7 |

64.0 |

65.7 |

1.5 |

5.3 |

0.02 |

12.0 |

4.2 |

-1219 |

|

200 South |

GC6170 |

63.4/52.9 |

104.0 |

106.9 |

2.4 |

8.1 |

0.09 |

2.3 |

1.8 |

-1195 |

|

200 South |

GC6192 |

243.4/-44.1 |

65.5 |

67.0 |

1.4 |

10.6 |

0.02 |

4.8 |

2.2 |

-1344 |

|

200 South |

GC6192 |

243.4/-44.1 |

71.0 |

73.0 |

1.9 |

8.9 |

0.02 |

6.6 |

3.3 |

-1347 |

|

200 South |

GC6192 |

243.4/-44.1 |

81.0 |

83.6 |

2.4 |

9.1 |

0.03 |

4.3 |

2.3 |

-1353 |

|

200 South |

GC6192 |

243.4/-44.1 |

120.0 |

160.0 |

21.1 |

17.4 |

0.02 |

4.1 |

3.0 |

-1389 |

|

200 South |

GC6195 |

243.4/-23.6 |

37.5 |

45.3 |

7.0 |

11.4 |

0.06 |

3.1 |

1.5 |

-1313 |

|

200 South |

GC6196 |

243.4/-13.1 |

36.1 |

40.8 |

3.2 |

4.2 |

0.01 |

9.0 |

4.4 |

-1299 |

|

200 South |

GC6200 |

63.4/47.5 |

49.0 |

57.6 |

3.7 |

5.7 |

0.03 |

6.1 |

3.2 |

-1243 |

|

200 South |

GC6200 |

63.4/47.5 |

87.6 |

93.0 |

4.4 |

3.6 |

0.06 |

2.7 |

1.2 |

-1216 |

|

200 South |

GC6200 |

63.4/47.5 |

104.4 |

105.6 |

0.8 |

6.9 |

0.05 |

6.5 |

3.1 |

-1205 |

|

5250 |

GC6151 |

36.5/27 |

0.0 |

30.5 |

10.6 |

20.0 |

0.14 |

11.8 |

3.9 |

266 |

|

5250 |

GC6151 |

36.5/27 |

61.8 |

92.0 |

30.0 |

14.2 |

0.07 |

8.4 |

2.4 |

287 |

|

5250 |

GC6151 |

36.5/27 |

104.0 |

131.6 |

26.8 |

18.7 |

0.05 |

11.4 |

3.6 |

310 |

|

East |

GC6152 |

23.1/59.6 |

188.6 |

189.7 |

1.0 |

8.4 |

0.01 |

9.2 |

6.7 |

76 |

|

East |

GC6160 |

63.4/48.6 |

204.0 |

205.6 |

1.5 |

6.5 |

0.01 |

10.1 |

6.1 |

68 |

|

East |

GC6165 |

63.4/31.6 |

247.8 |

259.0 |

7.4 |

12.7 |

0.02 |

5.8 |

3.3 |

44 |

|

East |

GC6165 |

63.4/31.6 |

267.0 |

271.0 |

2.7 |

9.7 |

0.07 |

2.3 |

1.4 |

38 |

|

East |

GC6207 |

63.4/50.7 |

164.5 |

176.0 |

11.0 |

14.3 |

0.04 |

2.4 |

2.0 |

45 |

|

East |

GC6207 |

63.4/50.7 |

193.4 |

194.7 |

1.1 |

4.0 |

0.02 |

9.5 |

4.5 |

50 |

|

East |

GC6207 |

63.4/50.7 |

203.3 |

204.6 |

0.7 |

21.5 |

0.01 |

3.7 |

2.0 |

75 |

|

Upper Plate |

GC6127 |

351.2/76 |

77.9 |

106.2 |

27.9 |

19.6 |

0.05 |

10.9 |

5.4 |

93 |

|

Upper Plate |

GC6127 |

351.2/76 |

130.7 |

132.3 |

1.6 |

16.3 |

0.05 |

15.1 |

7.5 |

113 |

|

Upper Plate |

GC6127 |

351.2/76 |

141.8 |

143.3 |

1.5 |

2.2 |

0.01 |

14.0 |

6.3 |

142 |

|

Upper Plate |

GC6127 |

351.2/76 |

167.0 |

183.0 |

15.0 |

15.0 |

0.07 |

12.9 |

4.8 |

246 |

|

Upper Plate |

GC6141 |

222.3/56.3 |

222.4 |

227.0 |

3.9 |

17.9 |

0.01 |

6.6 |

3.4 |

200 |

|

Upper Plate |

GC6149 |

14/70.2 |

465.5 |

466.7 |

1.1 |

11.7 |

0.01 |

1.9 |

1.1 |

288 |

|

Upper Plate |

GC6164 |

54.5/73.6 |

348.0 |

372.0 |

23.9 |

28.3 |

0.01 |

2.6 |

1.3 |

198 |

|

Upper Plate |

GC6164 |

54.5/73.6 |

461.5 |

466.2 |

4.6 |

13.9 |

0.01 |

1.9 |

0.7 |

299 |

|

Upper Plate |

GC6191 |

253.9/74.1 |

506.9 |

526.4 |

14.9 |

13.0 |

0.02 |

2.7 |

1.1 |

352 |

|

Upper Plate |

GC6191 |

253.9/74.1 |

557.6 |

561.7 |

3.5 |

11.4 |

0.01 |

10.1 |

3.7 |

388 |

|

Upper Plate |

GC6201 |

254.8/48.6 |

726.2 |

732.9 |

4.8 |

24.3 |

0.02 |

18.5 |

8.5 |

380 |

|

Upper Plate |

GC6206 |

5.3/73.9 |

226.0 |

247.0 |

18.4 |

11.1 |

0.04 |

5.3 |

3.3 |

288 |

|

Upper Plate |

GC6209 |

15.3/69.4 |

146.0 |

159.0 |

7.4 |

12.3 |

0.01 |

1.4 |

0.7 |

223 |

|

Upper Plate |

GC6209 |

15.3/69.4 |

242.0 |

250.0 |

7.9 |

14.2 |

0.05 |

5.7 |

3.9 |

313 |

|

Upper Plate |

GC6219 |

225.9/64.8 |

154.0 |

161.2 |

6.8 |

38.3 |

0.03 |

9.3 |

4.4 |

223 |

|

Upper Plate |

GC6219 |

225.9/64.8 |

178.5 |

194.0 |

14.0 |

8.7 |

0.02 |

7.6 |

3.4 |

249 |

|

Upper Plate |

GC6219 |

225.9/64.8 |

241.0 |

244.0 |

3.0 |

16.0 |

0.06 |

0.2 |

0.1 |

298 |

|

Upper Plate |

GC6220 |

259.2/76.2 |

124.1 |

129.2 |

5.1 |

13.1 |

0.01 |

5.1 |

2.0 |

205 |

|

Upper Plate |

GC6220 |

259.2/76.2 |

239.5 |

259.4 |

19.9 |

21.5 |

0.03 |

12.9 |

6.4 |

326 |

|

West |

GC6179 |

16.1/-40.8 |

21.4 |

28.1 |

6.4 |

8.8 |

0.01 |

5.4 |

2.4 |

-116 |

|

West |

GC6179 |

16.1/-40.8 |

50.0 |

59.4 |

9.0 |

7.3 |

0.04 |

11.5 |

4.6 |

-134 |

|

West |

GC6179 |

16.1/-40.8 |

63.0 |

66.2 |

3.1 |

3.5 |

0.05 |

15.2 |

7.5 |

-139 |

|

West |

GC6179 |

16.1/-40.8 |

92.5 |

107.0 |

12.7 |

8.4 |

0.02 |

19.6 |

9.6 |

-164 |

|

West |

GC6183 |

243.4/-82.6 |

120.3 |

128.8 |

8.5 |

10.4 |

0.07 |

20.0 |

8.9 |

-221 |

|

West |

GC6212 |

63.4/-9.5 |

110.5 |

112.4 |

0.9 |

0.6 |

0.01 |

10.3 |

8.9 |

-111 |

|

West |

GC6212 |

63.4/-9.5 |

126.3 |

136.2 |

4.8 |

8.2 |

0.00 |

8.0 |

4.0 |

-113 |

|

West |

GC6214 |

63.4/-35.9 |

57.0 |

90.5 |

26.0 |

63.4 |

0.64 |

8.3 |

4.3 |

-147 |

|

West |

GC6214 |

63.4/-35.9 |

282.0 |

307.6 |

12.8 |

28.3 |

0.08 |

8.3 |

4.7 |

-273 |

|

West |

GC6221 |

63.4/-71.2 |

48.1 |

59.0 |

10.8 |

40.6 |

0.07 |

8.4 |

5.0 |

-148 |

|

West |

GC6221 |

63.4/-71.2 |

102.0 |

110.2 |

8.0 |

7.7 |

0.03 |

12.4 |

5.1 |

-202 |

|

West |

GC6221 |

63.4/-71.2 |

116.0 |

125.0 |

9.0 |

6.3 |

0.02 |

9.3 |

3.7 |

-215 |

|

West |

GC6223 |

10.5/-49.7 |

49.6 |

53.8 |

3.3 |

7.8 |

0.02 |

9.5 |

5.5 |

-140 |

|

West |

GC6223 |

10.5/-49.7 |

90.1 |

92.4 |

2.1 |

2.0 |

0.01 |

26.4 |

7.8 |

-167 |

|

West |

GC6223 |

10.5/-49.7 |

116.0 |

121.4 |

5.4 |

77.5 |

0.42 |

9.6 |

4.3 |

-189 |

|

West |

GC6226 |

243.4/-63.6 |

72.9 |

74.5 |

1.6 |

4.2 |

0.02 |

9.0 |

6.9 |

-162 |

|

West |

GC6226 |

243.4/-63.6 |

83.7 |

88.7 |

4.3 |

2.5 |

0.01 |

11.0 |

5.9 |

-175 |

|

West |

GC6226 |

243.4/-63.6 |

196.5 |

199.0 |

1.9 |

15.1 |

0.01 |

10.4 |

5.0 |

-274 |

|

West |

GC6228 |

243.4/-81.6 |

62.6 |

73.0 |

10.3 |

2.2 |

0.01 |

10.4 |

8.6 |

-255 |

|

West |

GC6228 |

243.4/-81.6 |

150.6 |

158.0 |

7.4 |

9.5 |

0.02 |

13.8 |

7.2 |

-170 |

|

West |

GC6232 |

95.6/-26.3 |

145.3 |

159.1 |

9.3 |

6.7 |

0.01 |

9.6 |

4.3 |

-166 |

|

West |

GC6232 |

95.6/-26.3 |

145.3 |

159.1 |

9.3 |

6.7 |

0.01 |

9.6 |

4.3 |

-166 |

|

West |

GC6233 |

63.4/-41.5 |

52.7 |

83.6 |

27.3 |

35.2 |

0.08 |

10.0 |

6.3 |

-140 |

|

West |

GC6233 |

63.4/-41.5 |

234.4 |

260.0 |

15.8 |

11.0 |

0.02 |

5.7 |

2.8 |

-269 |

|

9a |

GC6242 |

239.7/37 |

133.3 |

135.2 |

1.9 |

29.7 |

0.02 |

21.0 |

15.5 |

-8 |

|

9a |

GC6242 |

239.7/37 |

152.2 |

155.5 |

3.3 |

10.7 |

0.01 |

8.4 |

3.2 |

3 |

View source version on businesswire.com: https://www.businesswire.com/news/home/20240213785221/en/

Anvita M. Patil

Vice President - Investor Relations and Treasurer

Cheryl Turner

Communications Coordinator

800-HECLA91 (800-432-5291)

Investor Relations

Email: hmc-info@hecla.com

Website: http://www.hecla.com

Source: Hecla Mining Company