Gold Royalty Acquires Near-Term and Long-Life Royalty on IAMGOLD's Canadian Côté Gold Project

Gold Royalty Corp. (NYSE American: GROY) announced an agreement to acquire a 0.75% net smelter return royalty on IAMGOLD's Côté Gold Project in Ontario for US$15.875 million. This acquisition is expected to enhance Gold Royalty's portfolio of 28 producing and developing royalties in Tier one jurisdictions. The Côté Gold Project is projected to produce 489,000 oz Au annually in its first five years, with commercial production expected in H2 2023. The transaction, funded through cash and common shares, is expected to close by early March 2022.

- Acquisition of a 0.75% NSR royalty enhances portfolio with significant gold production potential.

- Addition of royalties on two of Canada's largest gold mines improves growth profile.

- Expected cash flow from Côté Gold Project in 2023 contributes to long-term revenue.

- Transaction increases trading liquidity and positions the company for higher valuations.

- None.

VANCOUVER, BC, Feb. 22, 2022 /PRNewswire/ - Gold Royalty Corp. ("Gold Royalty" or the "Company") (NYSE American: GROY) is pleased to announce that it has entered into an agreement (the "Agreement") to acquire an existing

David Garofalo, Chairman and CEO of Gold Royalty commented: "Together with our royalty on Canadian Malartic's Odyssey Project, Gold Royalty will own royalties on what is expected to be two of Canada's largest and longest-life gold mines. With first cash flow expected in 2023, the acquisition of the royalty on the Côté Gold Project will further enhance our sector-leading growth profile and expand our portfolio to include 28 producing and developing royalties anchored in Tier one jurisdictions."

"This transaction represents the fifth major acquisition undertaken by Gold Royalty since our IPO last year, representing an unprecedented pace of growth and resulting in a diverse and well-balanced portfolio of 192 high-quality precious metal royalty assets. This enhanced scale drives increased trading liquidity, lower cost of capital and, ultimately, higher valuations", added Mr. Garofalo.

The Acquisition

Pursuant to the Agreement, Gold Royalty will acquire the Royalty for total consideration of US

The Côté Gold Project

The Côté Gold Project is located in the Chester and Yeo Townships, District of Sudbury, in northeastern Ontario, Canada, approximately 125 km southwest of Timmins and 175 km northwest of Sudbury.

IAMGOLD completed an updated feasibility study on the project in 2021, as set out in a technical report titled " Technical Report on the Côté Gold Project, Ontario, Canada" with an effective date of November 26, 2021 (the "Côté Technical Report"). The report describes a 36,000 tpd open pit operation with estimated average annual production of 489,000 oz Au over the first 5 years of operation, and average annual production of 367,000 oz Au at an AISC of US

In July 2020, IAMGOLD announced a construction decision at the Côté Gold Project. On January 12, 2022, IAMGOLD disclosed that construction is well underway (detailed engineering at

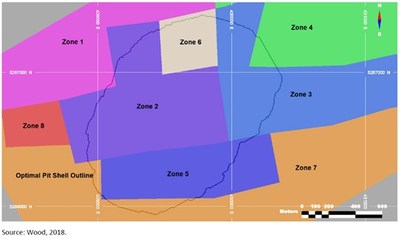

The Côté Gold Project open pit is being mined in four phases, with the approximate ultimate open pit outline shown in the figure below:

The Royalty covers the southern portion of the proposed open pit identified as Zone 5 and Zone 7 as illustrated in Figure 1. Based on the geometry of the deposit, the Royalty coverage is coincident with the higher-grade mineralization and is expected to be scheduled during the initial phases of production.

Since a prior feasibility study completed by IAMGOLD in 2018, further optimizations of the mine plan now include the re-design of mine phases to target higher grade mineralized material in years 1 to 3, a reduction in stockpile rehandling by simplifying ore stockpile management, and usage of an autonomous haulage system to improve overall project economics while reducing capital expenditures over the life-of-mine.

The following table sets forth the Mineral Reserve and Mineral Resource Estimates as described in the Côté Technical Report.

Côté Gold Project Mineral Reserve and Mineral Resource Estimate1 (Dec. 19, 2019)

Classification | Tonnage | Grade | Metal |

Proven | 130.5 | 1.02 | 4,262 |

Probable | 102.5 | 0.89 | 2,932 |

Proven & Probable | 233.0 | 0.96 | 7,194 |

Measured | 152.1 | 0.97 | 4,720 |

Indicated | 213.4 | 0.80 | 5,480 |

Measured & Indicated | 365.5 | 0.87 | 10,200 |

Inferred | 189.6 | 0.63 | 3,820 |

Notes:

- 2014 CIM Definition Standards were followed for the definition of Mineral Resources

- Mineral Resources are inclusive of Mineral Reserves

- Mineral Reserves were estimated using the following assumptions:

- Gold price of US

$1,200 /oz - Fixed process gold recovery of

91.8% - Treatment and refining costs, including transport and selling costs of

$1.75 /oz Au - Variable royalty percentages by zone: 0.0

-1.5% - Overall pit slope angles varying by sector with a range of 45.8° to 56.4°

- Mineral Reserves are constrained by the 233 million tonne tailings management facility capacity

- Mineral Reserves are estimated at a cut-off grade of 0.35 g/t Au

- Mineral Resources are reported within optimized constraining pit shells

- Gold price of US

$1,500 /oz - USD:CAD exchange rate of 1.00:1.30

- Mineral Resources are estimated at a cut-off grade of 0.30 g/t Au

- Mineral Resources are constrained by a Whittle optimized pit shell using economic parameters consistent with those used for mineral resources estimate in the Côté Gold Project, Ontario, NI 43-101 Technical Report on Feasibility Study" effective November 1, 2018, prepared in accordance with NI 43-101.

- Bulk density values range from 2.69 t/m3 to 2.85 t/m3

- Quantities reported on

100% basis - Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability

- All figures have been rounded to reflect the relative accuracy of the estimates

Readers should refer to the Côté Technical Report for further information regarding the Côté Gold Project, IAMGOLD's feasibility study and the above estimates of Mineral Reserves and Mineral Resources.

Qualified Person

Alastair Still, P.Geo., Director of Technical Services of the Company, is a "qualified person" as such term is defined under National Instrument 43-101, and has reviewed and approved the technical information disclosed in this news release.

About Gold Royalty Corp.

Gold Royalty Corp. is a gold-focused royalty company offering creative financing solutions to the metals and mining industry. Its mission is to acquire royalties, streams and similar interests at varying stages of the mine life cycle to build a balanced portfolio offering near, medium and longer-term attractive returns for its investors. Gold Royalty's diversified portfolio currently consists primarily of net smelter return royalties on gold properties located in the Americas.

Technical and Third-Party Information

Except where otherwise stated, the disclosure in this press release relating to the Côté Gold Project has been derived from the Côté Technical Report and other public information disclosed by the operator and has not been independently verified by the Company. Specifically, Gold Royalty has limited, if any, access to the property subject to the royalty. Although Gold Royalty does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate. The Royalty does not cover the entire project area for the Côté Gold Project, or the areas covered by existing Mineral Reserve and Mineral Resource estimates.

Unless otherwise indicated, the technical and scientific disclosure contained or referenced in this press release, including any references to Mineral Resources or Mineral Reserves, was prepared by the operator in accordance with Canadian National Instrument 43-101, which differs significantly from the requirements of the U.S. Securities and Exchange Commission (the "SEC") applicable to U.S. domestic issuers. Accordingly, the scientific and technical information contained or referenced in this press release may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

Cautionary Statement on Forward-Looking Information:

Certain of the information contained in this news release constitutes 'forward-looking information' and 'forward-looking statements' within the meaning of applicable Canadian and U.S. securities laws ("forward-looking statements"), including but not limited to statements regarding: expected production disclosed by the operator of the Côté Gold Project; such operator's expectations regarding the timeline for construction and achieving production at the project; and expected costs and other estimates contained in the operator's feasibility study and Mineral Reserve and Mineral Resource estimates; and the Company's future growth plans. Such statements can be generally identified by the use of terms such as "may", "will", "expect", "intend", "believe", "plans", "anticipate" or similar terms. Forward-looking statements are based upon certain assumptions and other important factors, including assumptions of management regarding the accuracy of the disclosure of the operators of the projects underlying the Company's projects, their ability to achieve disclosed plans and targets, macroeconomic conditions and commodity prices. Forward-looking statements are subject to a number of risks, uncertainties and other factors which may cause the actual results to be materially different from those expressed or implied by such forward-looking statements including, among others, any inability of the operators to execute proposed plans, risks related to exploration, development, permitting, infrastructure, operating or technical difficulties on any such projects, the influence of macroeconomic developments, the impact of, and response of relevant governments to, COVID-19 and the effectiveness of such responses, the ability of the Company to carry out its growth plans and other factors set forth in the Company's publicly filed documents under its profiles at www.sedar.com and www.sec.gov, including its Annual Report on Form 20-F for the year ended September 30, 2021. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements, except in accordance with applicable securities laws.

___________________________________________ |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/gold-royalty-acquires-near-term-and-long-life-royalty-on-iamgolds-canadian-cote-gold-project-301487141.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/gold-royalty-acquires-near-term-and-long-life-royalty-on-iamgolds-canadian-cote-gold-project-301487141.html

SOURCE Gold Royalty Corp.

FAQ

What is the significance of Gold Royalty's acquisition of the Côté Gold Project?

How much is Gold Royalty paying for the Côté Gold Project royalty?

What are the expected production metrics for the Côté Gold Project?