GoldMining Confirms Additional Mineralization at the São Jorge Project, Brazil, Including 19 Metres Grading 1.24 g/t Gold

GoldMining announced positive assay results from its São Jorge Project in Brazil. The completed diamond core drilling program, spanning 1,077 meters, revealed significant findings from two holes: SJD-122-24, which showed 19 meters grading 1.24 g/t gold, including 7 meters at 2.98 g/t gold, and SJD-121-24, which showed 18 meters grading 0.70 g/t gold, including 8 meters at 1.14 g/t gold. The drilling aims to confirm and explore new mineralization zones, bolstering resource confidence and potentially leading to new gold discoveries. São Jorge, located in the Tapajós gold district, benefits from its proximity to infrastructure and historical gold production.

- Completion of 1,077 meters of diamond core drilling at São Jorge Project.

- Significant assay results: 19 meters at 1.24 g/t gold in SJD-122-24.

- Significant assay results: 18 meters at 0.70 g/t gold in SJD-121-24.

- Potential for new gold discoveries in unexplored zones.

- Proximity to infrastructure like Hwy BR-163 and a new 138 kV powerline corridor.

- None.

Insights

The reported drill results at the São Jorge Project in Brazil indicate significant mineralization. Specifically, hole SJD-122-24 shows 19 meters grading at 1.24 g/t gold from 61 meters depth, with a more concentrated 7 meters at 2.98 g/t gold from 68 meters. These results suggest a high-grade zone within the broader mineralized corridor, potentially boosting the project's feasibility.

For a retail investor, these findings could signal increased future production capacity. However, it is important to note that these results represent just a portion of the deposit. Consistency in future drill outcomes and successful conversion of these findings into mineable reserves are critical factors to watch.

From a financial viewpoint, the assay results are promising but should be interpreted with caution. While the grades and intervals are favorable, translating these into economic value involves several steps, including resource modeling, reserve estimation and feasibility studies. Investors should await these comprehensive evaluations.

Moreover, the company’s drilling success could enhance its appeal, potentially leading to improved stock performance. Yet, investors should consider the associated costs and the timeline required to bring these resources into production.

Short-term, the market may react positively to the news, but long-term value depends on several variables, such as gold prices, operational efficiency and further drilling results.

Assay results for two additional diamond drill holes (SJD-121-24 and SJD-122-24) have been received, which combined with the previously released hole, SJD-120-24 (see news release dated June 18, 2024), have successfully completed the confirmatory component of drilling within and near the margins of the Deposit.

Highlights include:

- SJD-122-24:

- 19 m at 1.24 grams per tonne (g/t) gold (Au) from 61 m depth, including:

- 7 m at 2.98 g/t Au from 68 m depth.

- 7 m at 2.98 g/t Au from 68 m depth.

- 19 m at 1.24 grams per tonne (g/t) gold (Au) from 61 m depth, including:

- SJD-121-24:

- 18 m at 0.70 g/t Au from 86 m depth, including:

- 8 m at 1.14 g/t Au from 88 m

- 18 m at 0.70 g/t Au from 86 m depth, including:

Tim Smith, Vice President of Exploration, commented: "We are pleased to announce additional results from the recently completed drilling at São Jorge. The results from these two drill holes near the western known extents of the main São Jorge deposit further help to delineate the corridor of mineralization consisting of multiple intercepts of gold mineralization and indicating a possible en echelon array of mineralized veins within the broader São Jorge high-strain corridor. Further oriented diamond core drilling will help to model these zones and improve resource confidence. Additionally, our auger drilling program is proceeding to map bedrock lithology and collect geochemical samples of the in situ saprolite located beneath broad surface soil anomalies, and it is anticipated this will help define vectors towards possible new zones of bedrock-hosted mineralization. We look forward to providing further updates from the São Jorge drilling program."

Drill Program Details and Geological Description

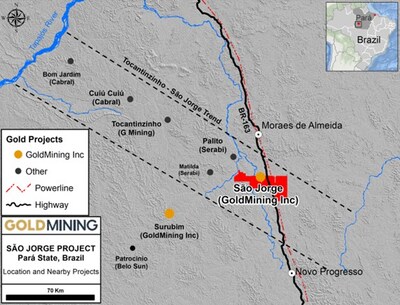

São Jorge lies within the active and rapidly developing Tapajós Gold District (see Figure 1), which is estimated to have produced over 20 million ounces of gold historically from artisanal mining of surface deposits, according to the Brazil National Mining Agency. The Tapajós is home to Serabi Gold Plc.'s producing high-grade underground Palito Mine and G Mining Ventures Corp.'s ("G Mining") brand new Tocantinzinho open pit mine, which recently commenced commissioning of its processing facility (see G Mining news release June 11, 2024).

São Jorge is located immediately adjacent to paved Hwy BR-163 and a new 138 kV powerline corridor, which ties into the district electrical grid recently constructed for Tocantinzinho. Exploration activities at São Jorge are operated from a permanent camp near the existing Deposit and just 3 kilometres from the highway.

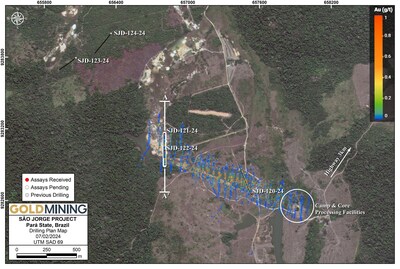

The Company commenced drilling at São Jorge in May 2024 (see news release dated May 29, 2024) and released results of the first confirmatory drill hole SJD-120-24 (see news release dated June 18, 2024) with an interval of 163 m at 1.02 g/t Au, including 37 m at 2.26 g/t Au (see Figure 2).

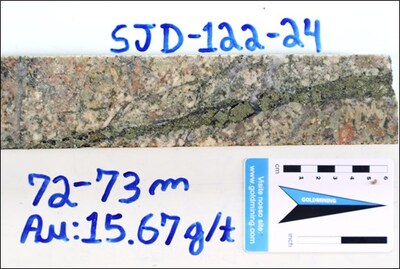

Mineralization comprises fracture-controlled sulphide ± quartz veins, with the sulphides consisting of dominant pyrite with lesser chalcopyrite, along metre-scale northwest-southeast striking shear zones hosted within monzogranite and along a sheared footwall contact between monzogranite and syenogranite, which cumulatively defines the São Jorge high-strain corridor. Pyrite occurs as hairline stringers, disseminated grains and semi-massive pyrite in 3 – 5 cm thick veins. Higher gold grades are related to a higher abundance of sulphide minerals, particularly thicker veins, and/or a higher density of semi-massive to massive pyrite veins (see Figure 3).

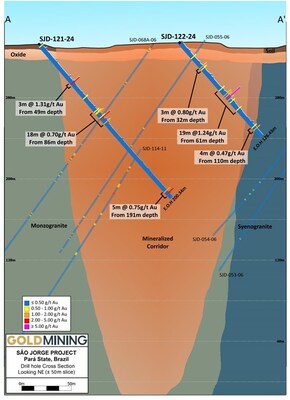

SJD-121-24 and SJD-122-24 provided additional infill drilling in the western portion of the Deposit to support potential future resource interpolation and classification (see Figure 4). Drilling intersected multiple zones of mineralization hosted within the São Jorge high-strain corridor. SJD-122-24 demonstrated strong mineralization directly along strike of the main Deposit. SJD-121-24 intersected several zones of mineralization north of the established Deposit strike direction, representing possible en echelon northwest stepping of mineralized structures within a large low-grade envelope associated with the broader São Jorge high-strain corridor. See Tables 1 and 2 below for further information regarding the drilling.

For additional information regarding the São Jorge Project, including existing resource estimates and historical work at the project, please refer to the technical report titled "São Jorge Gold Project, Pará State,

Table 1 – São Jorge assay intercepts from the first three holes of the 2024 drilling program, received as of July 9, 2024.

Hole Number | Interval From | Interval To | Core Length1 | Au Grade (g/t) |

SJD-120-24 | 44.00 | 207.00 | 163.00 | 1.02 |

SJD-120-24 | 44.00 | 64.00 | 20.00 | 1.37 |

Including | 45.00 | 50.00 | 5.00 | 2.82 |

Including | 45.00 | 46.00 | 1.00 | 7.25 |

SJD-120-24 | 69.00 | 70.00 | 1.00 | 3.03 |

SJD-120-24 | 74.00 | 75.00 | 1.00 | 5.05 |

SJD-120-24 | 95.00 | 132.00 | 37.00 | 2.26 |

Including | 97.00 | 98.00 | 1.00 | 11.47 |

Including | 102.00 | 104.00 | 2.00 | 12.22 |

SJD-120-24 | 148.00 | 159.00 | 11.00 | 1.00 |

Including | 152.00 | 155.00 | 3.00 | 2.31 |

SJD-120-24 | 166.00 | 179.00 | 13.00 | 1.35 |

SJD-120-24 | 195.0 | 207.0 | 12.00 | 1.15 |

including | 201.00 | 206.00 | 5.00 | 2.24 |

Including | 205.00 | 206.00 | 1.00 | 7.29 |

SJD-120-24 | 249.00 | 250.00 | 1.00 | 1.07 |

SJD-120-24 | 259.00 | 260.00 | 1.00 | 1.27 |

SJD-120-24 | 265.00 | 266.00 | 1.00 | 3.74 |

SJD-121-24 | 49.00 | 52.00 | 3.00 | 1.31 |

SJD-121-24 | 86.00 | 104.00 | 18.00 | 0.70 |

Including | 88.00 | 96.00 | 8.00 | 1.14 |

SJD-121-24 | 191.00 | 196.00 | 5.00 | 0.75 |

SJD-122-24 | 32.00 | 35.00 | 3.00 | 0.80 |

SJD-122-24 | 61.00 | 80.00 | 19.00 | 1.24 |

Including | 68.00 | 75.00 | 7.00 | 2.98 |

Including | 72.00 | 73.00 | 1.00 | 15.67 |

SJD-122-24 | 110.00 | 114.00 | 4.00 | 0.47 |

Notes: |

1. True widths are estimated to be approximately |

Table 2 – São Jorge 2024 drill hole collar location coordinates.

Hole Number | Easting Metres | Northing Metres | Elevation | Depth | Azimuth (Degrees) | Dip | Status |

SJD 120-24 | 657535 | 9282655 | 209.45 | 271.84 | 335 | -50 | All assays |

SJD 121-24 | 656807 | 9283159 | 211.50 | 200.34 | 180 | -50 | All assays |

SJD 122-24 | 656810 | 9283020 | 214.90 | 126.43 | 180 | -50 | All assays |

SJD 123-24 | 656065 | 9283800 | 203.10 | 251.39 | 230 | -50 | Pending |

SJD 124-24 | 656360 | 9284004 | 223.29 | 226.51 | 215 | -50 | Pending |

Qualified Person

Paulo Pereira, P. Geo., President of GoldMining, has supervised the preparation of, and verified and approved, the scientific and technical information herein this news release. Mr. Pereira is a Qualified Person as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101").

Data Verification

For this drill core sampling program, samples were taken from the NQ/HQ core by sawing the drill core in half, with one-half sent to SGS Geosol Laboratórios Ltda. ("SGS") in

About GoldMining Inc.

GoldMining Inc. is a public mineral exploration company focused on acquiring and developing gold assets in the

Notice to Readers

Technical disclosure regarding São Jorge has been prepared by the Company in accordance with NI 43-101. NI 43-101 is a rule of the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ from the requirements of the

Cautionary Statement on Forward-looking Statements

Certain of the information contained in this news release constitutes "forward-looking information" and "forward-looking statements" within the meaning of applicable Canadian and

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/goldmining-confirms-additional-mineralization-at-the-sao-jorge-project-brazil-including-19-metres-grading-1-24-gt-gold-302191408.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/goldmining-confirms-additional-mineralization-at-the-sao-jorge-project-brazil-including-19-metres-grading-1-24-gt-gold-302191408.html

SOURCE GoldMining Inc.