Voss Encourages Griffon Investors to Vote for its BLUE Proxy Card

Voss Capital, a major shareholder of Griffon Corp. (GFF), emphasizes the need for shareholders to vote their proxies ahead of the Annual Meeting on February 17. Voss argues that under the current management, Griffon has consistently underperformed with a Total Shareholder Return lagging behind peer companies by 61% over five years. They highlight inefficiencies in the conglomerate structure costing shareholders nearly $50 million annually and question the independence of the Board. Voss advocates for the election of independent candidate Charlie Diao to drive meaningful changes and improve shareholder value.

- Charlie Diao is recognized by proxy advisory firms as an independent candidate capable of driving meaningful change.

- Diao has extensive experience in corporate governance and financial expertise, which could benefit the Board.

- Griffon's Total Shareholder Return has underperformed peers by 61% over the last five years.

- Inefficient corporate structure costs shareholders about $50 million annually, primarily due to high executive compensation.

- The Board lacks independence, with CEO Ron Kramer involved in recommending Board members, raising concerns about responsiveness to shareholder feedback.

Insights

Analyzing...

HOUSTON, Feb. 14, 2022 /PRNewswire/ -- Voss Capital, LLC ("Voss"), a significant shareholder of Griffon Corp. (NYSE: GFF) ("Griffon" or the "Company"), reiterates key facts Griffon shareholder should consider when voting their proxies before Griffon's Annual Meeting on February 17th and corrects misperceptions dispersed by the Company.

We believe the key facts below answer the most important question of this proxy contest: Can the current Board be trusted to protect shareholder interests, hold management accountable and maximize value?

VOTE THE BLUE PROXY CARD TO ELECT A TRULY INDEPENDENT CANDIDATE AND REJECT THE STATUS QUO

Under management's tenure, GFF has underperformed peers and destroyed shareholder value.

- Griffon's Total Shareholder Return trailed its self-selected proxy peer group median(1) by

61% over the past five years and by132% over the past ten years. - Griffon's ROIC has been below

6% in each of the past eight years and never exceeded its cost of capital under Mr. Kramer's tenure.

Griffon's conglomerate corporate structure is inefficient and provides no discernable value to shareholders.

- Griffon's conglomerate structure shrouds the value of its underlying businesses and costs shareholders nearly

$50 million a year in unallocated corporate expense. Over60% of this expense can be attributed to the compensation of Griffon's top four NEOs alone. - Each business segment operates independently of the others, has its own executive team and operates with seemingly little input from the corporate level. This level of managerial redundancy is one reason the Company has struggled to create any discernible value for shareholders over the years.

The Board lacks true independence and has been continuously unresponsive to shareholder feedback.

- CEO Ron Kramer has personally recommended at least half of the past six Board additions, calling into question the true independence of these candidates and the Board at large.

- It was only after Griffon was faced with the possibility of a proxy contest that the Board decided to make minor changes to the Company's governance in a seemingly defensive move. These perfunctory changes do not go nearly far enough to address the extent of shareholder concerns.

Charlie Diao is independent and is dedicated to representing all Griffon shareholders. He has the necessary experience to help enact meaningful change in the Boardroom.

- While Voss has nominated Charlie Diao, if he is elected to Griffon's Board, he will be a fiduciary and will be representative for all Griffon shareholders' interests. Mr. Diao understands a Board's duty is to its shareholders, along with the mandate that their voices have spoken, and will be independent of management's undue influence.

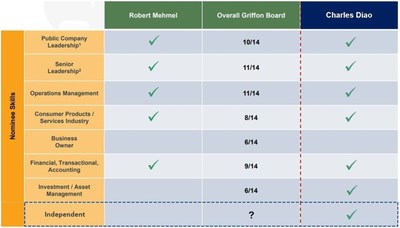

- In their most recent presentation, Griffon included a skills matrix ranking our candidate Charlie Diao based on his experience. Unfortunately, it appears the Company did not take the time to read Mr. Diao's bio – which we provided to the Company's Nomination and Governance Committee and is available on our website here. To correct this apparent oversight, we have completed Mr. Diao's section for them as well as adding perhaps the most important qualification lacking on this Board – independence.

[please refer to the Skills Matrix slide image at the beginning of the release]

- Mr. Diao has served on the Board of directors at 2 public companies, including Board leadership positions such as currently in role of Chairman of the Audit Committee and previously in role as Chairman of the Nomination and Governance Committee on another public company Board. After a 25-yr career on Wall Street in investment banking, merchant banking, M&A, and asset management, Mr. Diao was a senior financial executive at a large multinational corporation.

- Each of Institutional Shareowner Services and Glass Lewis, the two leading proxy advisory firms, have separately determined that Mr. Diao has the relevant experience and professional demeanor to be a capable director, and BOTH have recommended that Griffon shareholders vote for Mr. Diao as an independent director at Griffon.

We believe the election of Charlie Diao to Griffon's Board represents the best opportunity for a voice among the Board of directors to pursue significant value creation at the Company. Without the addition of a fresh and independent perspective attuned to shareholders' concerns, we are concerned that the Board will continue to oversee poor shareholder returns, while permitting subpar governance and excessive executive compensation. Furthermore, the Board has historically struggled to select truly independent directors who are willing and able to be the voice of shareholders in the Boardroom and, if needed, challenge Mr. Kramer.

We urge any shareholders who have not yet voted to vote as soon as possible; Griffon's Annual Meeting Is Thursday, February 17. Follow the directions on your BLUE proxy card to vote online, over the phone or by mail. If you have already voted Griffon's white proxy card, a later-dated vote on Voss' BLUE proxy card will revoke your previously cast vote.

VOTE THE BLUE PROXY CARD TO ELECT CHARLIE DIAO TO THE BOARD BEFORE THE COMPANY'S ANNUAL MEETING ON THURSDAY, FEBRUARY 17TH.

(1) Peer group indicates the same companies that Griffon identified as peers in its December 2020 Definitive Proxy Statement

Media Contact:

Serena Koontz

Head of Investor Relations

Voss Capital, LLC

serena@vosscap.com

Investor Contact:

John Ferguson

Saratoga Proxy Consulting LLC

jferguson@saratogaproxy.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/voss-encourages-griffon-investors-to-vote-for-its-blue-proxy-card-301481560.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/voss-encourages-griffon-investors-to-vote-for-its-blue-proxy-card-301481560.html

SOURCE Voss Capital