GoDaddy Outlines Key Strategic Growth Initiatives and Outlook at 2022 Investor Day

GoDaddy hosted a virtual investor day on February 11, 2022, highlighting its strategy to empower entrepreneurs by enhancing digital identity and commerce solutions. The company announced a $3 billion share repurchase plan, including a $750 million accelerated buyback in Q1 2022. GoDaddy introduced two new revenue pillars: Applications & Commerce, contributing 30% of 2021 revenue, and Core Platform, comprising 70%. The firm targets a 10% annual revenue growth and aims for $3 billion in unlevered free cash flow through 2024. CEO Aman Bhutani emphasized the importance of supporting customers in a changing business landscape.

- Introduced $3 billion share repurchase program, enhancing shareholder value.

- Projected 10% annual revenue growth, aiming for over $10 billion from existing customers by 2024.

- New revenue pillars expected to drive engagement and Average Revenue Per User (ARPU) growth.

- None.

Insights

Analyzing...

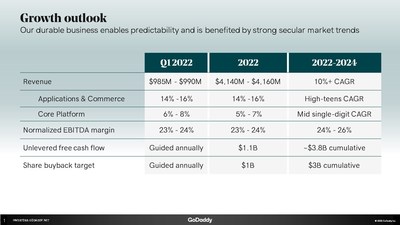

TEMPE, Ariz., Feb. 11, 2022 /PRNewswire/ -- GoDaddy Inc. (NYSE: GDDY) hosted a virtual investor day today providing insights on how its strategy empowers customers to succeed throughout the entrepreneur's journey by creating connections between digital identity, ubiquitous presence and connected commerce products. Within its presentations, GoDaddy provided guidance for the company's revenue, normalized Earnings Before Income Taxes Depreciation and Amortization (EBITDA) and unlevered free cash flow for first quarter 2022, full year 2022 and through full year 2024. The company also outlined multiple ways it expects to grow shareholder value, including a Board-approved multi-year share repurchase target of

For a summary of the guidance provided during the investor day presentations, please click here.

"Our mission to empower entrepreneurs everywhere, making opportunity more inclusive for all, is more relevant today than ever before," said Aman Bhutani, CEO of GoDaddy. "Online presence and omnicommerce are examples of secular trends where entrepreneurs need GoDaddy's help to seamlessly offer their products and services both online and in-store. Our more than 21 million customers count on us for technology supported by sage customer guidance, and our focus will remain on helping them thrive in a changing world."

GoDaddy Investor Day Highlights

Customer and Product Strategy

GoDaddy is an industry leader and intends to create shareholder value by leveraging its unique assets and expanding portfolio to provide a one-stop shop for everyday entrepreneurs. At the core of this strategy is seamlessly connecting customers' digital identity and ubiquitous presence as well as building out the company's connected commerce solution.

GoDaddy continues to attract new customers and believes it can increase engagement with its current loyal base of more than 21 million customers by attaching more products through integrated, industry-leading solutions for small and mid-sized businesses. As more new and current customers use these integrated offerings, GoDaddy expects ARPU (Average Revenue Per User) and lifetime revenue to grow.

Additional details were provided during the presentations on how the company's strong brand awareness, commerce-focused solutions, efficient marketing spend and dedicated Care team provide competitive advantages to accelerate this strategy.

Introducing New Revenue Pillars

To assist the financial community in better understanding and tracking the company's progress for GoDaddy's growth-focused areas, the company introduced two new revenue pillars. These new revenue pillars, along with corresponding financial metrics and financial targets, will be reported on going forward.

The new revenue pillars are:

- Applications & Commerce - includes GoDaddy's create and grow proprietary software, such as websites, list marketing, Managed WordPress and connected commerce solution launched late last year. This pillar also includes productivity applications, such as email. This pillar represented

30% of GoDaddy's total 2021 revenue. - Core Platform - comprises primary domain registration - both on the registry and registrar side – aftermarket, hosting and security solutions. This pillar represented

70% of GoDaddy's total 2021 revenue.

Capital Allocation Strategy

As part of its capital allocation strategy, the company emphasized its balanced approach focused on unlocking meaningful value creation by further investing to grow the business, while returning capital to shareholders. GoDaddy management discussed its authorization to repurchase

Three-year Financial Targets

GoDaddy provided new three-year financial targets to help investors and analysts model its business over the longer term. As part of this guidance through 2024, the company expects:

10% or greater top line revenue compound annual growth rate (CAGR); this includes estimated revenue of more than$10 billion from existing customer cohorts over the next three years24% -26% range for normalized (EBITDA) margin- Approximately

$3.8 billion cumulative unlevered free cash flow $3 billion share buyback target

Investor Day Presentations

Investor Day was webcast, and an archived replay will be available shortly through the Investor Relations section of the company's website at https://investors.godaddy.net/, where the Investor Day presentation materials may also be accessed.

About GoDaddy

GoDaddy is empowering everyday entrepreneurs around the world by providing all of the help and tools to succeed online and in-person. GoDaddy is the place people come to name their idea, build a professional website, attract customers, sell their products and services, and manage their work. GoDaddy's mission is to give its customers the tools, insights and the people to transform their ideas and personal initiative into success. To learn more about the company, visit www.GoDaddy.com.

Forward-Looking Statements and Non-GAAP Financial Measures & Operating Metrics

This press release contains forward-looking statements which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are based on estimates and information available to us at the time of this press release and are not guarantees of future performance. Statements in this press release involve risks, uncertainties and assumptions. If the risks or uncertainties materialize or the assumptions prove incorrect, our results may differ materially from those expressed or implied by such forward-looking statements. All statements other than statements of historical fact could be deemed forward-looking statements, including, but not limited to any statements regarding: launches of new or expansion of existing products or services, any projections of product or service availability, technology developments and innovation, customer growth, or other future events; historical results that may suggest future trends for our business; our plans, strategies or objectives with respect to future operations, including international expansion plans, partner integrations and marketing strategy; future financial results; GoDaddy's ability to integrate its acquisitions and achieve desired synergies and vertical integration; changes to executive leadership; as well as the impact of the COVID-19 pandemic on our business, customers, employees and third-party partners; and assumptions underlying any of the foregoing.

Actual results could differ materially from our current expectations as a result of many factors, including, but not limited to: the unpredictable nature of our rapidly evolving market; fluctuations in our financial and operating results; our rate of growth; interruptions or delays in our service or our web hosting; breaches of our security measures; the impact of any previous or future acquisitions; our ability to continue to release, and gain customer acceptance of, our existing and future products and services; our ability to manage our growth; our ability to hire, retain and motivate employees; the effects of competition; technological, regulatory and legal developments; intellectual property litigation; developments in the economy, financial markets and credit markets, including as a result of COVID-19; and execution of share repurchases.

Additional risks and uncertainties that could affect GoDaddy's business and financial results are included in the filings we make with the SEC from time to time, including those described in "Risk Factors" in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2021 as well as those described in "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our Annual Report on Form 10-K for the year ended December 31, 2020 and in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2021, which are available on GoDaddy's website at https://investors.godaddy.net and on the SEC's website at www.sec.gov. Additional information will also be set forth in other filings that GoDaddy makes with the SEC from time to time. All forward-looking statements in this press release are based on information available to GoDaddy as of the date hereof. Except to the extent required by law, GoDaddy does not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which they were made.

This press release includes certain non-GAAP financial measures and other operating metrics. We believe that these non-GAAP financial measures and other operating metrics are useful as a supplement in evaluating our ongoing operational performance and enhancing an overall understanding of our past financial performance. The non-GAAP financial measures included in this press release should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. A reconciliation between each non-GAAP financial measure and its nearest GAAP equivalent is included in the Investor Day materials available on GoDaddy's website at https://investors.godaddy.net. We use both GAAP and non-GAAP measures to evaluate and manage our operations. GoDaddy does not provide reconciliations from non-GAAP guidance to GAAP, because projections of changes in individual balance sheet amounts are not possible without unreasonable effort, and presentation of such reconciliations would imply an inappropriate degree of precision.

Source: GoDaddy Inc.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/godaddy-outlines-key-strategic-growth-initiatives-and-outlook-at-2022-investor-day-301480901.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/godaddy-outlines-key-strategic-growth-initiatives-and-outlook-at-2022-investor-day-301480901.html

SOURCE GoDaddy Inc.