Granite Creek Copper Completes Acquisition of Copper North Mining and Consolidates Southern Portion of Minto Copper Belt in Yukon, Canada

Granite Creek Copper Ltd. has successfully completed the acquisition of Copper North Mining Corp., combining their significant copper-gold projects in the Yukon. The transaction consolidates a total land position of 176 sq km in the Minto Copper Belt, including the PEA-stage Carmacks Copper-Gold Project with an estimated 23.76 million tonnes grading 0.85% Cu. This merger aims to unlock expansion potential and capitalize on the synergies of the new management teams. Granite Creek now controls 100% of Copper North shares and plans to enhance resource development through targeted drilling.

- Acquisition consolidates a total land position of 176 sq km in the Minto Copper Belt.

- Combines significant resources from Carmacks Copper-Gold Project, estimated at 23.76 million tonnes grading 0.85% Cu.

- Potential for rapid resource expansion from overlapping mineralized zones.

- Strengthened management and technical teams through the merger.

- None.

Insights

Analyzing...

VANCOUVER, BC / ACCESSWIRE / November 27, 2020 / Granite Creek Copper Ltd. (TSXV:GCX)(OTC PINK:GCXXF) ("Granite Creek" or the "Company") and Copper North Mining Corp. (COL) ("Copper North") are pleased to announce that, further to their news release dated August 31, 2020, Granite Creek has completed its acquisition of Copper North. The transaction combines Copper North's PEA-stage Carmacks Copper-Gold Project with Granite Creek's Stu Copper-Gold Project, creating a significant new copper-focused exploration and development company with an existing NI 43-101 mineral resource estimate and exceptional expansion potential.

Highlights of the Transaction

- Consolidation of the second largest land position with a total of 176 sq km (17,580 hectares) in the Yukon's productive and highly prospective Minto Copper Belt;

- Combination of the PEA-stage Carmacks Project with 23.76 million tonnes (oxide and sulfide combined) grading

0.85% Cu, 0.31 g/t Au, 3.14 g/t Ag, containing (446 Mlbs Cu, 237,000 ozs Au and 2.4M ozs Ag) with the blue sky potential of the adjacent Stu Project with multiple kilometer-scale targets including 3,800 meters of historic drilling with several high grade intercepts of over1% Cu[1]; - Ability to quickly expand existing resources on the combined land package, including mineralized zones that potentially overlap claim boundaries between the projects; and

- Synergies in the consolidated management and technical teams, strengthened by resources made available through the Metallic Group.

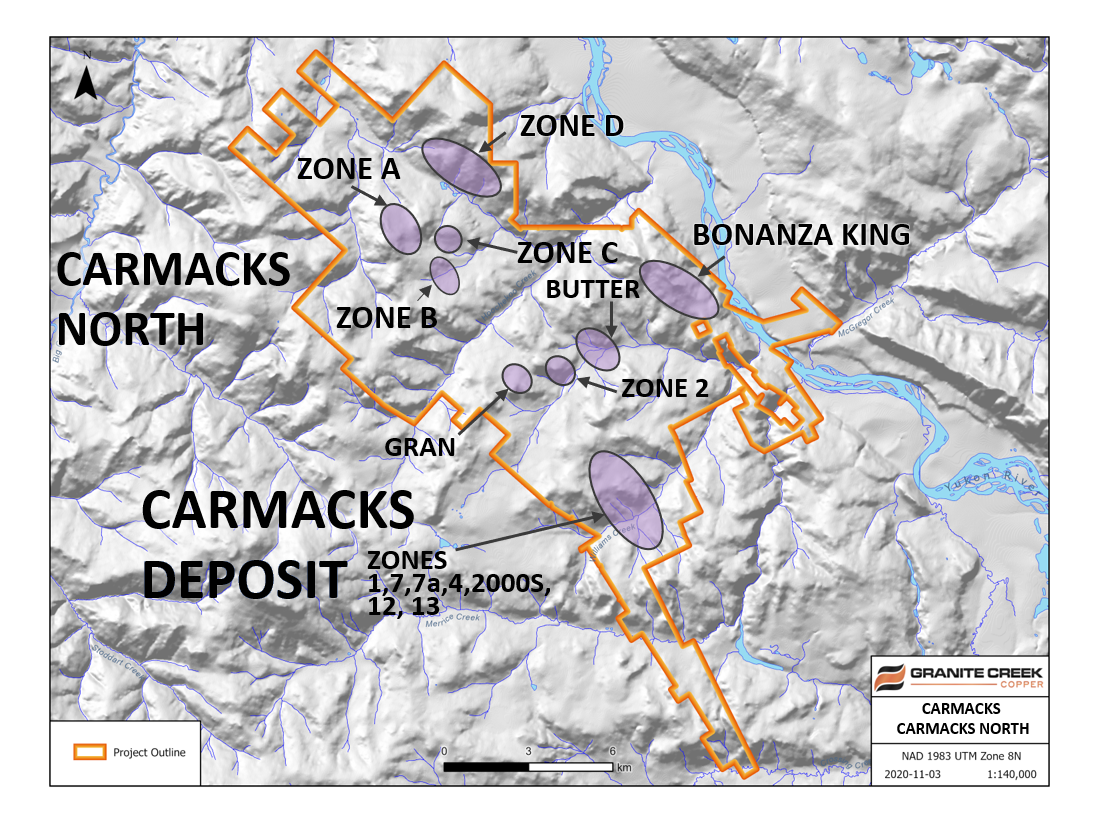

Figure 1: Combined Project Area

Tim Johnson, Granite Creek CEO stated: "Granite Creek management strongly believes that the value of the combined project is significantly greater than the sum of the parts, especially in terms of the potential for expansion of existing high-grade copper-gold resources in this productive yet underexplored district. At Carmacks many zones remain open along trend and at depth especially in the sulfide domain and the work done at Carmacks North has laid the groundwork for resource development. This is a major milestone for the Company, and we look forward to unlocking the potential of the southern half of the high-grade Minto Copper Belt."

Details of the Transaction

The transaction was completed by way of a plan of arrangement. Under the arrangement, Granite Creek acquired all of the outstanding common shares of Copper North (the "Copper North Shares") it did not already own for total consideration of 24,893,984 common shares of Granite Creek. Granite Creek now has 96,536,819 common shares issued, 44,578,555 warrants and 9,143,000 options for 150,258,374 on a fully diluted basis.

John Cumming and Loy Chunpongtong have been appointed as directors of Granite Creek and Dwayne McInnis and Robert Macdonald P.Geo. have joined Granite Creek's Advisory Board.

Carmacks and Carmacks North Project Details

Recognizing the district scale of the newly consolidated project, Granite Creek has renamed the Stu Project as Carmacks North and will reference the projects as one in all future communication.

The Company is actively developing plans to rapidly grow resources through drilling on high priority targets at Carmacks North as well as advancing the underlying sulfide potential at Carmacks. The Company expects to be able to add to the 43-101 resources through exploration of multiple targets it has developed from the substantial project database.

Additional Information

As a result of completion of the arrangement set forth above, Granite Creek acquired ownership and control of

About Granite Creek

Granite Creek is a Canadian exploration company focused on the

About the Minto Copper Belt

The Minto Copper Belt is a 180-kilometer-long by 60-kilometer-wide belt of intrusion-related, high-grade Cu-Au-Ag deposits within the Dawson Range in the central Yukon Territory of Canada. The District is host to Pembridge's operating Minto Mine and Granite Creek's Carmacks and Carmacks North Project. At Carmacks copper mineralization is contained in foliated to gneissic material, generally similar to the Minto mine.

FOR FURTHER INFORMATION PLEASE CONTACT:

Granite Creek Copper Ltd.

Timothy Johnson, President & CEO

Telephone: 1 (604) 235-1982

Toll Free: 1 (888) 361-3494

E-mail: info@gcxcopper.com

Website: www.gcxcopper.com

References

[1] For further information on the Carmacks project, please see the independent technical report dated November 26, 2016 and prepared for Copper North Mining Corp., and for further information on the Stu Project, please see the independent technical report dated November 15, 2018 and prepared for Granite Creek Copper Ltd., both of which are available on SEDAR at www.sedar.com.

Quality Control and Quality Assurance

Ms. Debbie James, P.Geo., a qualified person for the purposes of National Instrument 43-101, has reviewed and approved the technical disclosure contained in this news release.

Forward-Looking Statements

This news release contains forward-looking statements relating to the acquisition of Copper North, including statements regarding the expectations of the Carmacks project. Any statements that are not statements of historical fact (including statements containing the words 'believes,' 'intends', 'plans,' 'anticipates,' 'expects,' 'estimates' or similar expressions) and refer to management's expectations or plans and should be considered to be forward-looking statements. Such forward-looking statements are subject to important risks, uncertainties and assumptions. The results or events predicted in these forward-looking statements may differ materially from actual results or events. As a result, you are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements are based on a number of assumptions which may prove to be incorrect including, but not limited to, that Granite Creek will be able to successfully realize cost and exploration and development synergies and continue the development of the combined Carmacks North (formerly Stu) and Carmacks projects. Readers are cautioned that the foregoing list is not exhaustive. The forward-looking statements contained in this news release are made as of the date of this release and, accordingly, are subject to change after such date. Except as may be required by Canadian securities laws, Copper North and Granite Creek expressly disclaim any intention and assume no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise required by applicable securities legislation. Additionally, Copper North and Granite Creek undertake no obligation to comment on expectations of, or statements made by, third parties in respect of the proposed Arrangement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Granite Creek Copper Ltd.

View source version on accesswire.com:

https://www.accesswire.com/618557/Granite-Creek-Copper-Completes-Acquisition-of-Copper-North-Mining-and-Consolidates-Southern-Portion-of-Minto-Copper-Belt-in-Yukon-Canada