GigaCloud Technology Inc Responds to Short-Seller Report

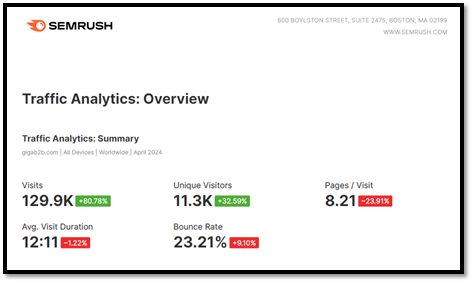

GigaCloud Technology (Nasdaq: GCT) issued a response to a short-seller report by Grizzly Research , refuting claims of misleading web traffic data and undisclosed related party transactions. The report, which GigaCloud deems defamatory and inaccurate, misinterprets the company's B2B marketplace model and web traffic metrics. GigaCloud clarified that it had about 130,000 visits and 11,000 unique visitors in April 2024, aligning with its 5,010 active buyers in 2023. The company confirmed compliance with SEC disclosure rules and emphasized the legitimacy of its transactions. GigaCloud is evaluating the short-seller's claims and may take legal action to protect its shareholders.

- GigaCloud reported around 130,000 total visits and 11,000 unique visitors in April 2024.

- The company had 5,010 active buyers in its marketplace during 2023.

- GigaCloud confirmed compliance with SEC disclosure rules for related party transactions.

- Company transactions are validated through delivery records and significant logistical expenses.

- The short-seller report by Grizzly Research has raised market concerns.

- Potential market manipulation claims could damage investor confidence.

Insights

Regarding the allegations of related party transactions, GigaCloud's insistence on adherence to SEC filing requirements and accounting standards is crucial. It's important for investors to understand that related party transactions, while often scrutinized, are not inherently problematic if disclosed transparently and managed according to regulations.

Investors should also consider the context of the short-seller's motivations. Short-sellers benefit from a decline in stock prices, which can sometimes lead to biased or exaggerated claims. It remains essential for investors to independently verify any claims and rely on official filings.

However, the Company's defensive posture and lack of independent verification on some points prompt a cautious stance in the short term. The stock may experience volatility as market perceptions adjust based on these ongoing communications and investigations.

Moreover, highlighting the 5,010 active buyers during 2023 provides a clearer picture of the marketplace's user base. This figure is more relevant to assessing the platform's health and growth potential than raw search traffic. Investors should appreciate the distinct dynamics of B2B marketplaces where fewer, high-value transactions are typical compared to B2C models.

This situation also brings into focus the competitive landscape and the potential for misinformation to influence investor sentiment. The clear distinction between B2B and B2C models is a critical takeaway that should inform investor strategies, emphasizing the need for tailored analysis rather than generalized interpretations.

GigaCloud's response, emphasizing transparency and regulatory adherence, helps maintain investor confidence, but the ongoing scrutiny and potential legal actions suggest a need for vigilance in the near term.

EL MONTE, Calif., May 23, 2024 (GLOBE NEWSWIRE) -- GigaCloud Technology Inc (Nasdaq: GCT) (“GigaCloud” or the “Company”), a pioneer of global end-to-end B2B technology solutions for large parcel merchandise, today issued the following statement in response to the claims made in a report by Grizzly Research LLC, a short-seller, issued on May 22, 2024.

The short-seller report lacks merit and contains numerous defamatory, selective, inaccurate, incomplete and misleading statements, speculation, and innuendo. The report demonstrates a fundamental lack of understanding of the Company’s business particularly with respect to the types of buyers who use our marketplace and the services we provide them.

- Web Traffic

The first allegation in the short-seller report is that the Company’s “web traffic does not square with its growth story.” The report misleadingly cites third-party data search traffic – but this does not reflect overall visitor traffic to the Company’s website. Indeed, as explained by the third-party cited in the short-seller report, the “Domain Overview” and “Organic Traffic” data provide data regarding search engine performance.1

This third-party also explains that “[e]stimates of total website traffic” are found in their “Traffic Analytics” tool.2 The report omits this data, which shows significant web traffic measured by visits to the Company’s website of roughly 130,000 total visits and 11,000 unique visitors during April 2024, according to this third-party’s estimates.

The Company’s marketplace is a business-to-business (B2B) platform, not a consumer-direct business. As previously disclosed, buyers in the Company’s marketplace are typically resellers (rather than end consumers) and this level of website traffic is fully consistent with the Company’s disclosures that it had approximately 5,010 active buyers on its marketplace during 2023.

In other words, the Company’s business model is to sell in volume to a smaller number of customers than if it operated a consumer-direct business. In focusing only on search activity, the short-seller report misapprehends the nature of the Company’s business and misstates the overall traffic to the Company’s marketplace.

- Related Party Transactions

The short-seller report claims that the purported lack of website activity is explained by allegedly undisclosed transactions with related parties. This claim is false and misleading for the reasons noted above: GigaCloud’s B2B marketplace has substantial monthly traffic. There is also no merit to the claims the short-seller makes about purported related party transactions. Following similar unsubstantiated allegations made in September 2023 by another short-seller, the Company carefully evaluated its customer relationships and has disclosed in its filings made with the U.S. Securities and Exchange Commission all related party transactions required by the applicable rules and accounting standards.

There is also no basis in the short-seller’s unsupported suggestion that sales made through certain entities are not legitimate. As the Company previously disclosed, buyers in its marketplace can list products for sale to consumers on their own stores or other ecommerce websites and GigaCloud will handle fulfilment directly to their end customer. These transactions represent legitimate sales that can be validated through the records of deliveries to end customers and are corroborated by the substantial expenses the Company has previously reported for delivery and logistics services.

The balance of the short-seller report consists of malicious personal attacks and unsupported innuendo. Investors are cautioned that the claims come from a short-seller who admits on its website that: (1) its views are “not statements of fact,” (2) it makes “no representation” as to the accuracy of information in its report, and (3) it “will realize significant gains in the event the prices of [the Company’s stock] declines.” Investors are encouraged to review materials filed by the Company with the SEC and available on the Company’s investor relations website.

The Company is continuing to consider the claims in the short-seller report and reserves all rights to take appropriate measures to defend itself against attempts to manipulate the market for its stock and to safeguard the interests of its shareholders.

About GigaCloud Technology Inc

GigaCloud Technology Inc is a pioneer of global end-to-end B2B technology solutions for large parcel merchandise. The Company’s B2B ecommerce platform, which it refers to as the “GigaCloud Marketplace,” integrates everything from discovery, payments and logistics tools into one easy-to-use platform. The Company’s global marketplace seamlessly connects manufacturers, primarily in Asia, with resellers, primarily in the U.S., Asia and Europe, to execute cross-border transactions with confidence, speed and efficiency. The Company offers a truly comprehensive solution that transports products from the manufacturer’s warehouse to the end customer’s doorstep, all at one fixed price. The Company first launched its marketplace in January 2019 by focusing on the global furniture market and has since expanded into additional categories such as home appliances and fitness equipment. For more information, please visit the Company’s website: https://investors.gigacloudtech.com/.

Safe Harbor Statement

This press release contains statements that may constitute “forward-looking statements” pursuant to the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements reflect our current view about future events. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can identify these forward-looking statements by words or phrases such as “may,” “will,” “could,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “propose,” “potential,” “continue” or similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s annual report and other filings with the SEC. This press release also contains publicly available data compiled a third-party not affiliated with the Company. We have not independently verified this data, are not privy to the precise methodology by which it was compiled, and have presented it solely for purpose of comparison to other data made available by this third-party.

For investor and media inquiries, please contact:

GigaCloud Technology Inc

Investor Relations

Email: ir@gigacloudtech.com

PondelWilkinson, Inc.

Laurie Berman (Investors) – lberman@pondel.com

George Medici (Media) – gmedici@pondel.com

A photo accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/7611ef1b-17fb-4941-ac90-890ecb8a57f0

______________________________

1 https://www.semrush.com/kb/254-domain-overview; https://www.semrush.com/kb/296-organic-traffic-insights

2 https://www.semrush.com/kb/26-traffic-analytics