GABY Inc. Reports Fiscal Year End 2019 and First Quarter 2020 Financial & Operational Results

GABY Inc. (CSE:GABY, OTCQB:GABLF) reports strong growth with 2019 revenues of $11.9 million, a remarkable 395% increase from 2018. Despite operational challenges, Q1 2020 revenue rose to $1.4 million compared to $0.054 million in Q1 2019. The company underwent a management restructuring and closed its less profitable food segment, yielding $5 million in annual savings. Future goals include achieving cash flow positivity by the end of 2020 through operational efficiencies and high-margin revenue generation.

- 2019 gross revenue increased to $11.9 million, up 395% from 2018.

- Q1 2020 revenue from continuing operations rose to $1.4 million, significantly higher than Q1 2019.

- Management restructuring is expected to enhance operational efficiency.

- Shutting down the food business saves the company almost $2 million annually.

- Total annualized savings from cost-cutting measures amount to $5 million.

- Q1 Adjusted EBITDA was ($3.2 million), worse than ($1.5 million) in Q1 2019 due to high SG&A costs.

- Low gross profit margins on licensed segment revenue due to operational challenges and strategic decisions.

Insights

Analyzing...

- Company reaffirms its commitment to profitability and outlines operational initiatives taken in Q1 -

SANTA ROSA, CA / ACCESSWIRE / August 17, 2020 / GABY Inc. ("GABY" or the "Company") (CSE:GABY) (OTCQB:GABLF), a California-focussed, Cannabis and CBD consumer goods and distribution company, is pleased to provide its fiscal 2019 and first quarter 2020 results (ended March 31, 2020). Selected financial and operational information is outlined below and should be read in conjunction with the Company's annual financial statements for the year ended December 31, 2019, interim financial statements for the three months ended March 31, 2020 and related management's discussion and analysis, which are available on SEDAR at www.sedar.com and the Company's website at www.GABYinc.com.

In 2019, GABY established a strong position in the California cannabis and CBD market as a result of a series of acquisitions, namely:

Sonoma Pacific Distribution Inc;

2Rise Naturals Inc; and

Raw Chocolate Alchemy Inc,

(collectively the "Acquisitions")

Year End 2019 and First Quarter 2020

Year End 2019:

- GABY's gross revenues increased to

$11.9 million in 2019, up (395% ) from$2.4 million in 2018. - Gross profit in the licensed segment was

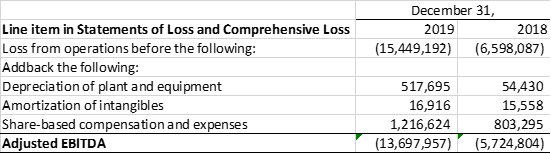

$0.1 million on$9.9 million of revenue. While positive, the margin was low due to inconsistent results and the speculative nature of buying and selling flower in the Company's wholesale division. GABY's wholesale division has since been restructured and is now focusing on high margin revenue. In addition, also contributing to this low margin was the Company's strategy of compressing margin to increase retail penetration, which was effective, in that GABY grew its retail presence from 87 dispensaries at the beginning of the year to over 250 by year end 2019. In keeping with its stated 2020 strategy, the Company is now focusing on generating high margin revenue. - 2019 Adjusted EBITDAi was (

$13.7 million )i compared to ($5.7 million )i in largely as a result of the increase in selling, general and administrative expenses ("SG&A") of$12.8 million compared to$5.0 million in 2018. The$7.8 million increase includes$4.3 million in respect of the Acquisitions. Of this amount,$0.6 million was in respect of bad debt on Sonoma Pac receivables deemed uncollectable due to financial difficulties spurred by the southern California wildfires in the fall of 2019 and later exacerbated by COVID-19. The remaining increase of$3.5 million was in respect of unlicensed and corporate operations including costs to support GABY's acquisition activity and costs to support its public listing.

First Quarter 2020:

- Q1 2020 revenue from continuing operations totalled

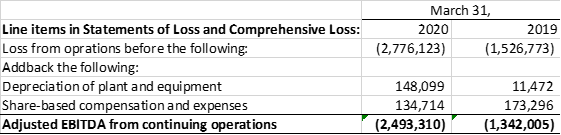

$1.4 million compared to$0.05 4 million for the same period in 2019. While up significantly from 2019, revenue was nonetheless lower than "normal" due in part to the temporary disruption in operations due to the management transition (described below) and the hangover of operational challenges spurred by the California wildfires in Q4 2019, and in late March and beyond, the operational difficulties complicated by COVID-19. - Q1 Adjusted EBITDA from Continuing Operationsi was (

$3.2 million ) i compared to Q1 2019 of ($1.5 million )i due primarily to higher SG&A associated with the Acquisitions as the cost cutting and implementation of operational efficiencies, including the shuttering of its traditional CPG operations, Gabriella's Kitchen (as described below) had just commenced at the end of Q1 2020.

Ongoing Initiatives Through 2020

In early 2020 the Company implemented a management restructuring, which resulted in Margot Micallef, founder and CEO, of GABY re-establishing herself as President, taking on a more hands-on, day-to-day operational role within GABY. Margot's historical expertise and success in turn arounds and consolidations is proving pivotal. Margot and her team embarked on an evaluation of every operating division, and their respective operating procedures, organizational design, work-flow processes and third-party relationships.

Through this evaluation process, management determined that GABY's traditional food business, Gabriella's Kitchen, was not on track to become profitable in the foreseeable future and was no longer aligned with GABY's focus in California. The food business was thus shut down, saving the Company almost

The Company also concluded that several of its third-party distribution relationships were not sufficiently profitable. The Company thus terminated these relationships in favour of more sustainable, higher margin relationships.

Further, this evaluation resulted in a number of operational efficiencies, including:

- Re-designing and streamlining the intake of raw materials;

- Further automating the inventory management process and flow;

- Consolidating the inventory management and transportation logistics role under one better qualified executive (versus two less experienced employees);

- Expediting the time from intake of raw materials to packaging of finished goods and sale;

- Closing down the internal marketing department, consolidating all marketing strategy for the Company under one executive and contracting out the graphic design, social media content creation, and the design and creation of promotional materials and selling tools, resulting in much faster turn around and cost efficiencies;

- Rationalizing its workforce to better align with the needs and size of the organization;

- Revamping of its accounts receivable process and reducing the terms under which and the length of time credit is extended, resulting in faster collections with less risk of non-payment and bad debts; and

- Redesigning its wholesale cannabis brokerage business by contracting out procurement to multiple individuals, purchasing flower only when a sale is assured (ceasing speculative purchasing) and paying commission only on the margin realized upon a sale.

In addition to shutting down the traditional food business, the additional cost cuts, operating efficiencies, organizational redesign and work force rationalization decreases GABY's operating expenses by a further

As a result of the cost cutting measures implemented late in Q1-2020 and effective management of working capital, GABY has not required further funding, after the first quarter.

"It's been very rewarding working through the evaluation process with the team", said Margot Micallef, Founder, President and Chief Executive Officer of GABY. "The team at GABY which has essentially been hand-picked by me personally, has the passion, the commitment and the "can-do" attitude to fuel the engine that will drive us to profitability. We all wish results would be faster coming but building a sustainable company takes time. I know that, because I've done it before!" she concluded.

GABY's shares trade on the Canadian Securities Exchange ("CSE") under the symbol "GABY" and on the OTCQB under the symbol "GABLF". For more information, visit www.GABYinc.com

For further inquiries, please contact:

Margot Micallef, Founder & CEO at Margot@GABYinc.com or Investor Relations at IR@GABYinc.com or 800-674-2239.

Note (i)

NON-GAAP MEASURES

Adjusted EBITDA and Adjusted EBITDA from continuing operations

Adjusted EBITDA and Adjusted EBITDA from continuing operations in respect of Q1-20 does not have any standardized meaning as prescribed by IFRS, and, therefore, is considered a non-GAAP measure and may not be comparable to similar measures presented by other issuers. The non-GAAP measure of Adjusted EBITDA from continuing operations in respect of Q1-20, combined with IFRS measures, such as revenue and net loss, is a useful measure to our investors as management relies on it to provide a measure of operating cash flows before servicing debt, income taxes, capital expenditures and other gains and losses.

Pro forma gross revenue for the year ended December 31, 2019 is calculated as if the April 1, 2019 acquisition of Sonoma Pac and December 31, 2019 acquisitions of Lulu's and 2Rise had all occurred January 1, 2019 and is calculated as follows:

For 2019:

For Q1-2020

Disclaimer and Forward-Looking Information

The CSE does not accept responsibility for the adequacy or accuracy of this release. Certain information set forth in this news release may contain forward-looking statements that involve substantial known and unknown risks and uncertainties, certain of which are beyond the control of the Company. Forward-looking statements are frequently characterized by words such as "plan", "continue", "expect", "project", "intend", "believe", "anticipate", "estimate", "may", "will", "potential", "proposed" and other similar words, or statements that certain events or conditions "may" or "will" occur. These statements are only predictions. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements. Forward looking statements include, but are not limited to, the Company's ability to generate high margin revenue, implement cost cutting and operational efficiencies and become cashflow positive on a run rate basis by the end of 2020 . The Company assumes no obligation to update forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

Each of, Sonoma Pacific Distribution, Inc., is a e subsidiary of GABY. Sonoma Pacific holds a type 11 cannabis license in the State of California. Unlike in Canada which has Federal legislation uniformly governing the cultivation, distribution, sale and possession of medical cannabis under the Cannabis Act (Federal), readers are cautioned that in the United States ("U.S."), cannabis is largely regulated at the State level. Cannabis is legal in the State of California, however cannabis remains illegal under U.S. federal laws. Notwithstanding the permissive regulatory environment of cannabis at the State level, cannabis continues to be categorized as a controlled substance under the Controlled Substances Act in the U.S. and as such, cannabis-related practices or activities, including without limitation, the manufacture, importation, possession, use or distribution of cannabis are illegal under U.S. federal law. To the knowledge of the Company, the businesses operated by Sonoma Pacific is conducted in a manner consistent with the State law of California, as applicable, and it is in compliance with regulatory and licensing requirements applicable in the State of California However, readers should be aware that strict compliance with State laws with respect to cannabis will neither absolve GABY, or its subsidiaries of liability under U.S. federal law, nor will it provide a defense to any federal proceeding in the U.S. which could be brought against any of GABY, or its subsidiaries. Any such proceedings brought against GABY, or its subsidiaries may materially adversely affect the Company's operations and financial performance generally in the U.S. market specifically.

Neither the CSE nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE: GABY Inc.

View source version on accesswire.com:

https://www.accesswire.com/601963/GABY-Inc-Reports-Fiscal-Year-End-2019-and-First-Quarter-2020-Financial-Operational-Results