Genpact and HFS Research Study Finds Majority of Retail and Consumer Goods Execs Overwhelmed by Pace of Change

- None.

- None.

Insights

Analyzing...

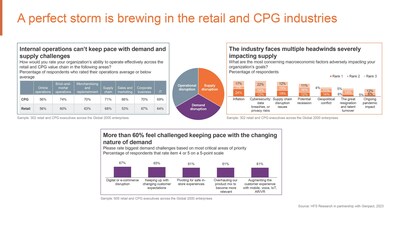

Inflation, cybersecurity, and supply chain disruption top concerns; companies' operations and technology not prepared for future challenges such as explosion of generative artificial intelligence

The study, The consumer goods and retail playbook for balancing the macroeconomic slowdown and race toward innovation, reveals that more than

Growing consumer expectations and e-commerce disruption are also driving new business models and digital modernization initiatives. The report, which includes responses from more 600 global retail and CPG executives, also provides a playbook based upon HFS' Horizons innovation framework. Horizon 1 is digital modernization, Horizon 2 is unmatched consumer experience, and Horizon 3 is driving value through new business models. Companies that invest across all three Horizons of innovation are best positioned to lead in the future, yet most fail to address the full transformation across these areas.

Looking ahead at enterprise challenges, leaders must align priorities and investments across the three Horizons of innovation and value creation to survive, thrive, and lead. Yet, the study shows that only

"Retail and CPG companies struggle to balance the macroeconomic 'slowdown' with the 'big hurry' to innovate," said Saurabh Gupta, President, Research and Advisory Services at HFS Research. "Most companies are not investing across all the areas they need to meet. Beyond survival, they must take a balanced approach to their people, processes, sustainability initiatives, and technology to thrive."

The research also underscores the need for companies to transform processes and operations to meet ever-evolving consumer needs. Most survey respondents cite that their companies' internal operations can't keep pace with demand and supply challenges, and only

Additional insight from the research include:

- Supply chain disruption changing business models – The pandemic shock on supply chains is something with which

70% of retail and CPG executives still grapple, and75% say their companies are responding to by transitioning from traditional linear to autonomous supply networks. - Customer evolving buying patterns also driving new channels – Another pandemic trend with dramatic impact on change is the rapid rise of direct-to-consumer (DTC) sales. Over

70% of consumer-packaged goods executives state that their companies are investing in DTC models for growth. - Sustainability is mission critical, but improvement needed – Only

60% of retail and CPG executives say their companies have appointed a chief sustainability officer, developed frameworks for front-line employees to be more aware of their impact on the planet/sustainability, and are engaged a third-party services provider to help achieve sustainability goals.

"The pace will only pick up, especially with the explosion of generative AI," said BK Kalra, Global Leader of Retail and Consumer Goods at Genpact. "Our research underscores that companies need to transform their operations, invest in AI and data, and develop new business models in a digital-first world."

For more information about the study, see The consumer goods and retail playbook for balancing the macroeconomic slowdown and race toward innovation.

About the Research

Genpact partnered with HFS to survey more than 600 CPG and retail firms across

About Genpact

Genpact (NYSE: G) is a global professional services firm delivering the outcomes that transform our clients' businesses and shape their future. We're guided by our real-world experience redesigning and running thousands of processes for hundreds of global companies. Our clients – including many in the Global Fortune 500 – partner with us for our unique ability to combine deep industry and functional expertise, leading talent, and proven methodologies to drive collaborative innovation that turns insights into action and delivers outcomes at scale. We create lasting competitive advantages for our clients and their customers, running digitally enabled operations and applying our Data-Tech-AI services to design, build, and transform their businesses. And we do it all with purpose. From

Media Contact:

Danielle D'Angelo

Genpact Media Relations

danielle.dangelo@genpact.com

+1 914-336-7951

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/genpact-and-hfs-research-study-finds-majority-of-retail-and-consumer-goods-execs-overwhelmed-by-pace-of-change-301855264.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/genpact-and-hfs-research-study-finds-majority-of-retail-and-consumer-goods-execs-overwhelmed-by-pace-of-change-301855264.html

SOURCE Genpact