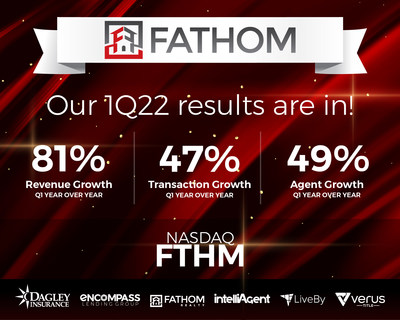

Fathom Holdings Inc. Reports More Than 80% Revenue Growth for 2022 First Quarter

Fathom Holdings Inc. (FTHM) reported a strong first quarter of 2022 with total revenue reaching $90.1 million, an 81.4% increase from the previous year. The real estate agent network grew by 49%, totaling 9,006 agents. The company raised its full-year revenue guidance to $445-$455 million. Despite a GAAP net loss of $6.0 million, Fathom remains optimistic about continued growth, citing investments and operational efficiency. Their cash balance decreased to $30.5 million due to acquisitions and share repurchases, but they expect a rebound in Adjusted EBITDA moving forward.

- Total revenue increased by 81.4% to $90.1 million.

- Real estate transactions rose by 47% to 10,087.

- Real estate agent network expanded by 49% to 9,006 agents.

- Raised full-year revenue guidance to $445-$455 million.

- Acquired iPro Realty and Cornerstone First Financial, expanding operations.

- GAAP net loss increased to $6.0 million from $3.4 million year-over-year.

- General and Administrative expenses rose to $10.8 million, up from $6.1 million.

-- Raises Full Year 2022 Revenue Guidance --

CARY, N.C., May 4, 2022 /PRNewswire/ -- Fathom Holdings Inc. (Nasdaq: FTHM), a national, technology-driven, end-to-end real estate services platform integrating residential brokerage, mortgage, title, insurance, and SaaS offerings for brokerages and agents, today announced financial results for the 2022 first quarter ended March 31, 2022.

First Quarter 2022 Financial Results

Total revenue grew

Segment revenue for the 2022 first quarter was as follows:

Three months ended | |

(Revenue $ in millions) | |

Real Estate Brokerage | |

Mortgage | |

Technology | |

Other* |

*Other primarily includes revenue generated from Fathom's title and insurance businesses. |

"I am very proud of our first quarter results, and believe we can continue to achieve significant growth, even in a challenging real estate market," said Fathom CEO, Joshua Harley. "We are demonstrating the power of our truly disruptive business model quarter-after-quarter through innovation, and by delivering real, long-term value to our agents, employees, and clients.

"We have seen solid growth for over a decade. Over the last four years, we've moved from the 16th spot to the 6th spot on the RealTrends 500 ranking of the largest independent brokerages in the U.S.," Harley said. "I believe we can continue on that growth trajectory while achieving strong profits over time. Our cash position is strong, and we plan to continue to focus on achieving positive operational cash flow."

GAAP net loss for the 2022 first quarter totaled

General and Administrative expense (G&A) totaled

Adjusted EBITDA, a non-GAAP measure, was a loss of

Fathom provides Adjusted EBITDA, a non-GAAP financial measure, because it offers additional information for monitoring the Company's cash flow performance. A table providing a reconciliation of Adjusted EBITDA to its most comparable GAAP measure, as well as an explanation of, and important disclosures about, this non-GAAP measure, is included in the tables at the end of this press release.

Cash and cash equivalents at March 31, 2022 were

During the first quarter of 2022, Fathom purchased 83,881 shares of its common stock under a

"We are continuing to strategically invest capital to enhance our solid foundation for the sustained long-term growth of our newer business lines," said Fathom President and CFO Marco Fregenal. "I believe Fathom remains on track to continue strong revenue, agent, and transaction growth, and with the thoughtful investments we're making in each of our business lines, we look forward to demonstrating sustainable profitability, one of our key priorities."

First Quarter 2022 and Recent Highlights

- Acquired Utah-based iPro Realty Network, a full-service residential real estate brokerage with 435 agents.

- Fathom Holdings subsidiary, Encompass Lending Group, acquired Cornerstone First Financial, a Washington, D.C.-based provider of mortgages for home purchase, debt consolidation and refinancing, as well as home loans for veterans and first-time home buyers.

- Commenced operations in two new states, including Montana and New Hampshire. Fathom now operates in 38 states and the District of Columbia.

- Fathom Holdings' board of directors authorized a

$10 million stock repurchase plan. - Fathom Realty, the Company's real estate brokerage business, moved to the number six spot on The RealTrends 500 ranking of the largest independent brokerages in the U.S., up from the ninth spot for the year prior.

- Fathom subsidiary Verus Title appointed a new Managing Attorney for the state of Maryland.

Guidance/Long-Term Targets

The Company reiterated that it believes it can generate Adjusted EBITDA exceeding

For the second quarter of 2022, Fathom expects total revenue in the range of

For the full year 2022, Fathom is increasing its revenue guidance to a range of

2022 First Quarter Financial Results Conference Call | |

Date: | Wednesday, May 4, 2022 |

Time: | 5:00 p.m. ET/2:00 p.m. PT |

Phone: | 833-685-0908 (domestic); 412-317-5742 (international) |

Replay: | Accessible through May 11, 2022; 877-344-7529 (domestic); 412-317-0088 (international); replay access code 1315876 |

Webcast: | Accessible at www.FathomInc.com; archive available for approximately one year |

About Fathom Holdings Inc.

Fathom Holdings Inc. is a national, technology-driven, real estate services platform integrating residential brokerage, mortgage, title, insurance, and SaaS offerings to brokerages and agents by leveraging its proprietary cloud-based software, intelliAgent. The Company's brands include Fathom Realty, Dagley Insurance, Encompass Lending, intelliAgent, LiveBy, Real Results, and Verus Title. For more information, visit www.FathomInc.com.

Cautionary Note Concerning Forward-Looking Statements

This press release contains "forward-looking statements," including, but not limited to, the ability of the Company to demonstrate solid profitability in the near future. Forward-looking statements are subject to numerous conditions, many of which are beyond the control of the Company, including: risks associated with the Company's ability to continue achieving significant growth; its ability to continue its growth trajectory while achieving strong profits over time; its ability to generate positive operational cash flow; its ability to demonstrate sustainable profitability; others set forth in the Risk Factors section of the Company's most recent Form 10-K as filed with the SEC and supplemented from time to time in other Company filings made with the SEC. Copies of our Form 10-K and other SEC filings are available on the SEC's website, www.sec.gov. The Company undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law.

Investor Relations Contacts: | |

Roger Pondel/Laurie Berman | Marco Fregenal |

PondelWilkinson Inc. | President and CFO |

Fathom Holdings Inc. | |

(310) 279-5980 | |

(888) 455-6040 |

(Financial tables follow)

FATHOM HOLDINGS INC. | ||||

CONSOLIDATED STATEMENTS OF OPERATIONS | ||||

(UNAUDITED) | ||||

(in thousands, except share data) | ||||

Three Months Ended March 31, | ||||

2022 | 2021 | |||

Revenue | ||||

Gross commission income | $ 84,044 | $ 49,156 | ||

Other revenue | 6,038 | 490 | ||

Total revenue | 90,082 | 49,646 | ||

Operating expenses | ||||

Commission and other agent-related costs | 79,479 | 46,400 | ||

Operations and support | 2,175 | - | ||

Technology and development | 1,474 | 149 | ||

General and administrative | 10,854 | 6,123 | ||

Marketing | 1,163 | 402 | ||

Depreciation and amortization | 572 | 21 | ||

Total operating expenses | 95,717 | 53,095 | ||

Loss from operations | (5,635) | (3,449) | ||

Other expense (income), net | ||||

Gain on the extinguishment of debt | - | (51) | ||

Interest expense, net | 1 | 2 | ||

Other expense (income), net | 336 | (5) | ||

Other expense (income), net | 337 | (54) | ||

Loss from operations before income taxes | (5,972) | (3,395) | ||

Income tax expense | 25 | 5 | ||

Net loss | $ (5,997) | $ (3,400) | ||

Net loss per share | ||||

Basic | $ (0.37) | $ (0.25) | ||

Diluted | $ (0.37) | $ (0.25) | ||

Weighted average common shares outstanding | ||||

Basic | 16,323,157 | 13,450,111 | ||

Diluted | 16,323,157 | 13,450,111 | ||

FATHOM HOLDINGS INC. | |||

CONSOLIDATED BALANCE SHEETS | |||

(UNAUDITED) | |||

(in thousands, except share data) | |||

March 31, 2022 | December 31, 2021 | ||

ASSETS | |||

Current assets: | |||

Cash and cash equivalents | $ 30,524 | $ 37,830 | |

Restricted cash | 78 | 91 | |

Accounts receivable | 4,155 | 3,981 | |

Derivative assets | 395 | 53 | |

Mortgage loans held for sale, at fair value | 8,364 | 9,862 | |

Prepaid and other current assets | 2,700 | 2,633 | |

Total current assets | 46,216 | 54,450 | |

Property and equipment, net | 1,537 | 1,250 | |

Lease right of use assets | 4,662 | 4,353 | |

Intangible assets, net | 27,678 | 24,243 | |

Goodwill | 25,412 | 20,541 | |

Other assets | 50 | 93 | |

Total assets | 105,555 | 104,930 | |

LIABILITIES AND STOCKHOLDERS' EQUITY | |||

Current liabilities: | |||

Accounts payable | 4,893 | 5,303 | |

Accrued liabilities and other current liabilities | 5,575 | 4,491 | |

Warehouse lines of credit | 8,162 | 9,577 | |

Long-term debt - current portion | 459 | 831 | |

Lease liability - current portion | 1,099 | 870 | |

Total current liabilities | 20,188 | 21,072 | |

Long-term debt, net of current portion | 151 | 146 | |

Lease liability, net of current portion | 3,688 | 3,562 | |

Total liabilities | 24,027 | 24,780 | |

Stockholders' equity: | |||

Common stock (no par value, shares authorized, 100,000,000; | - | - | |

Additional paid-in capital | 107,504 | 100,129 | |

Accumulated deficit | (25,976) | (19,979) | |

Total stockholders' equity | 81,528 | 80,150 | |

Total liabilities and stockholders' equity | 105,555 | 104,930 | |

FATHOM HOLDINGS INC. | |||

CONSOLIDATED STATEMENTS OF CASH FLOWS | |||

(UNAUDITED) | |||

(in thousands) | |||

Three Months Ended March 31, | |||

2022 | 2021 | ||

CASH FLOWS FROM OPERATING ACTIVITIES: | |||

Net loss | $ (5,997) | $ (3,400) | |

Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | |||

Depreciation and amortization | 1,061 | 102 | |

Non-cash lease expense | - | 29 | |

Gain on extinguishment of debt | - | (51) | |

Gain on sale of mortgages | (1,181) | - | |

Stock-based compensation | 2,407 | 870 | |

Bad debt expense | - | 77 | |

Change in operating assets and liabilities: | |||

Accounts receivable | (154) | 2 | |

Prepaid and other current assets | (29) | 386 | |

Other assets | 80 | (1) | |

Accounts payable | (410) | 571 | |

Accrued and other current liabilities | (65) | 461 | |

Operating lease right of use assets | 271 | - | |

Operating lease liabilities | (225) | (27) | |

Derviative assets | (342) | - | |

Mortgage loans held for sale | (61,488) | - | |

Proceeds from sale and principal payments on mortgage loans held for sale | 67,713 | - | |

Net cash provided by (used in) operating activities | 1,641 | (981) | |

CASH FLOWS FROM INVESTING ACTIVITIES: | |||

Purchase of property and equipment | (317) | (402) | |

Amounts paid for business and asset acquisitions, net of cash acquired | (1,572) | (2,115) | |

Purchase of intangible assets | (763) | (149) | |

Net cash used in investing activities | (2,652) | (2,666) | |

CASH FLOWS FROM FINANCING ACTIVITIES: | |||

Principal payments on long-term debt | (467) | (4) | |

Net borrowing on warehouse lines of credit | (4,852) | - | |

Repurchase of common stock | (989) | - | |

Net cash used in financing activities | (6,308) | (4) | |

Net decrease in cash, cash equivalents, and restricted cash | (7,319) | (3,651) | |

Cash, cash equivalents, and restricted cash at beginning of period | 37,921 | 29,561 | |

Cash, cash equivalents, and restricted cash at end of period | $ 30,602 | $ 25,910 | |

RECONCILIATION OF GAAP to NON-GAAP FINANCIAL MEASURES | ||||

(UNAUDITED) | ||||

(in thousands) | ||||

Three Months Ended March 31, | ||||

2022 | 2021 | |||

Net loss | $ (5,997) | $ (3,400) | ||

Depreciation and amortization | 1,061 | 102 | ||

Other expense (income), net | 337 | (54) | ||

Income tax expense (benefit) | 25 | (5) | ||

Stock based compensation | 2,407 | 870 | ||

Transaction-related costs | 51 | 434 | ||

Adjusted EBITDA | $ (2,116) | $ (2,053) | ||

NON-GAAP FINANCIAL MEASURES

To supplement Fathom's consolidated financial statements, which are prepared and presented in accordance with GAAP, the Company uses Adjusted EBITDA, a non-GAAP financial measure, to understand and evaluate our core operating performance. This non-GAAP financial measure, which may be different than similarly titled measures used by other companies, is presented to enhance investors' overall understanding of our financial performance and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

Fathom defines the non-GAAP financial measure of Adjusted EBITDA as net income (loss), excluding other expense, income taxes, depreciation and amortization, share-based compensation expense, and transaction-related cost.

Fathom believes that Adjusted EBITDA provides useful information about the Company's financial performance, enhances the overall understanding of its past performance and future prospects, and allows for greater transparency with respect to a key metric used by Fathom's management for financial and operational decision-making. Fathom believes that Adjusted EBITDA helps identify underlying trends in its business that otherwise could be masked by the effect of the expenses that the Company excludes in Adjusted EBITDA. In particular, Fathom believes the exclusion of share-based compensation expense related to restricted stock awards and stock options and transaction-related costs associated with the Company's acquisition activity provides a useful supplemental measure in evaluating the performance of its operations and provides better transparency into its results of operations. Adjusted EBITDA also excludes other income and expense, net which primarily includes nonrecurring items, such as, gain on debt extinguishment and severance costs, if applicable.

Fathom is presenting the non-GAAP measure of Adjusted EBITDA to assist investors in seeing its financial performance through the eyes of management, and because the Company believes this measure provides an additional tool for investors to use in comparing Fathom's core financial performance over multiple periods with other companies in its industry.

Adjusted EBITDA should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. There are a number of limitations related to the use of Adjusted EBITDA compared to net income (loss), the closest comparable GAAP measure. Some of these limitations are that:

- Adjusted EBITDA excludes share-based compensation expense related to restricted stock awards and stock options, which have been, and will continue to be for the foreseeable future, significant recurring expenses in Fathom's business and an important part of its compensation strategy;

- Adjusted EBITDA excludes transaction-related costs primarily consisting of professional fees and any other costs incurred directly related to acquisition activity, which is an ongoing part of Fathom's growth strategy and therefore likely to occur; and

- Adjusted EBITDA excludes certain recurring, non-cash charges such as depreciation and amortization of property and equipment and capitalized software costs, however, the assets being depreciated and amortized may have to be replaced in the future.

RECONCILIATION OF GAAP TO NON-GAAP FORWARD LOOKING GUIDANCE | ||||||||

(UNAUDITED) | ||||||||

(in thousands) | ||||||||

Three Months Ended June 30, 2022 | Twelve Months Ended December 31, 2022 | |||||||

Low | High | Low | High | |||||

Net loss | $ (4,350) | $ (3,950) | $ (17,300) | $ (16,500) | ||||

Depreciation and amortization | 1,400 | 1,400 | 6,000 | 6,000 | ||||

Stock based compensation | 2,700 | 2,700 | 10,500 | 10,500 | ||||

Transaction-related costs | 50 | 50 | 300 | 500 | ||||

Adjusted EBITDA | $ (200) | $ 200 | $ (500) | $ 500 | ||||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/fathom-holdings-inc-reports-more-than-80-revenue-growth-for-2022-first-quarter-301539957.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/fathom-holdings-inc-reports-more-than-80-revenue-growth-for-2022-first-quarter-301539957.html

SOURCE Fathom Realty

FAQ

What are the financial results for Fathom Holdings (FTHM) in Q1 2022?

How has Fathom Holdings (FTHM) adjusted its revenue guidance for 2022?

What was the net loss for Fathom Holdings (FTHM) in the first quarter of 2022?

What growth did Fathom Holdings (FTHM) see in its real estate agent network?