Foremost Clean Energy Completes First Phase of Option Agreement with Denison Mines for Interest in 10 Uranium Properties in the Athabasca Basin

Foremost Clean Energy (NASDAQ: FMST) (CSE: FAT) has completed Phase One of its transaction with Denison Mines Corp., acquiring a 20% interest in 10 uranium exploration properties covering over 330,000 acres in the Athabasca Basin. Denison has become Foremost's largest shareholder at 19.95%, receiving 1,369,810 common shares. The transaction includes:

1. Appointment of David Cates, Denison's President and CEO, to Foremost's board of directors

2. Addition of Andy Yackulic, Denison's VP of Exploration, to Foremost's advisory board

3. Entering into an investor rights agreement with Denison

4. Foremost becoming the operator of the Exploration Properties

The Option Agreement allows Foremost to acquire up to 70% of Denison's interest in the properties through three phases. The Exploration Properties consist of 45 claims in the uranium-rich Athabasca Basin region.

Foremost Clean Energy (NASDAQ: FMST) (CSE: FAT) ha completato la Fase Uno della sua operazione con Denison Mines Corp., acquisendo una partecipazione del 20% in 10 proprietà di esplorazione dell'uranio che coprono oltre 330.000 acri nella regione di Athabasca. Denison è diventata il principale azionista di Foremost con il 19,95%, ricevendo 1.369.810 azioni ordinarie. L'operazione include:

1. Nomina di David Cates, Presidente e CEO di Denison, nel consiglio di amministrazione di Foremost

2. Aggiunta di Andy Yackulic, VP Esplorazione di Denison, nel consiglio consultivo di Foremost

3. Sottoscrizione di un accordo sui diritti degli investitori con Denison

4. Foremost diventa l'operatore delle proprietà di esplorazione

L'Accordo di Opzione consente a Foremost di acquisire fino al 70% dell'interesse di Denison nelle proprietà attraverso tre fasi. Le Proprietà di Esplorazione consistono in 45 rivendicazioni nella ricca regione di uranio di Athabasca.

Foremost Clean Energy (NASDAQ: FMST) (CSE: FAT) ha completado la Fase Uno de su transacción con Denison Mines Corp., adquiriendo un 20% de interés en 10 propiedades de exploración de uranio que cubren más de 330,000 acres en la Cuenca de Athabasca. Denison se ha convertido en el principal accionista de Foremost con un 19.95%, recibiendo 1,369,810 acciones ordinarias. La transacción incluye:

1. Designación de David Cates, Presidente y CEO de Denison, en la junta directiva de Foremost

2. Adición de Andy Yackulic, VP de Exploración de Denison, en el consejo asesor de Foremost

3. Celebración de un acuerdo de derechos de inversionistas con Denison

4. Foremost se convierte en el operador de las Propiedades de Exploración

El Acuerdo de Opción permite a Foremost adquirir hasta el 70% del interés de Denison en las propiedades a través de tres fases. Las Propiedades de Exploración consisten en 45 reclamos en la rica región de uranio de Athabasca.

Foremost Clean Energy (NASDAQ: FMST) (CSE: FAT)는 Denison Mines Corp.와의 거래의 1단계를 완료하고, Athabasca Basin에서 33만 에이커가 넘는 10개의 우라늄 탐사 자산에 대한 20%의 지분을 인수했습니다. Denison은 Foremost의 최대 주주로서 19.95%의 지분을 확보했습니다. 1,369,810주의 보통주를 받았습니다. 거래에는 다음이 포함됩니다:

1. Denison의 사장 겸 CEO인 David Cates를 Foremost의 이사회에 임명

2. Denison의 탐사 담당 부사장인 Andy Yackulic를 Foremost의 자문위원회에 추가

3. Denison과 투자자 권리 계약 체결

4. Foremost가 탐사 자산의 운영자가 됨

옵션 계약은 Foremost가 세 가지 단계를 통해 Denison의 자산에 대한 최대 70%의 지분을 인수할 수 있도록 합니다. 탐사 자산은 우라늄이 풍부한 Athabasca Basin 지역의 45개 청구권으로 구성됩니다.

Foremost Clean Energy (NASDAQ: FMST) (CSE: FAT) a achevé la Phase Un de sa transaction avec Denison Mines Corp., acquérant un intérêt de 20% dans 10 propriétés d'exploration de l'uranium couvrant plus de 330 000 acres dans le bassin d'Athabasca. Denison est devenu le plus grand actionnaire de Foremost avec 19,95%, recevant 1 369 810 actions ordinaires. La transaction comprend :

1. Nommer David Cates, Président et CEO de Denison, au conseil d'administration de Foremost

2. Ajouter Andy Yackulic, VP Exploration de Denison, au conseil consultatif de Foremost

3. Conclusion d'un accord de droits des investisseurs avec Denison

4. Foremost devient l'opérateur des Propriétés d'Exploration

L'Accord d'Option permet à Foremost d'acquérir jusqu'à 70% de l'intérêt de Denison dans les propriétés en trois phases. Les Propriétés d'Exploration consistent en 45 revendications dans la région riche en uranium d'Athabasca.

Foremost Clean Energy (NASDAQ: FMST) (CSE: FAT) hat die erste Phase seiner Transaktion mit Denison Mines Corp. abgeschlossen und eine 20%ige Beteiligung an 10 Uran-Erkundungsprojekten erworben, die über 330.000 Acres im Athabasca-Becken abdecken. Denison ist der größte Aktionär von Foremost mit 19,95% und hat 1.369.810 Stammaktien erhalten. Die Transaktion umfasst:

1. Ernennung von David Cates, Präsident und CEO von Denison, in den Vorstand von Foremost

2. Hinzuzufügung von Andy Yackulic, VP Exploration von Denison, in den Beratungsausschuss von Foremost

3. Abschluss einer Vereinbarung über Investorenrechte mit Denison

4. Foremost wird der Betreiber der Erkundungsprojekte

Die Optionsvereinbarung ermöglicht es Foremost, bis zu 70% des Interesses von Denison an den Eigenschaften in drei Phasen zu erwerben. Die Erkundungsprojekte bestehen aus 45 Ansprüchen in der uranreichen Region Athabasca.

- Acquisition of 20% interest in 10 uranium exploration properties covering 330,000 acres in the Athabasca Basin

- Denison Mines becomes largest shareholder with 19.95% stake

- Option to acquire up to 70% interest in the properties through three phases

- Appointment of experienced industry executives to board and advisory roles

- Foremost becomes operator of the Exploration Properties

- Dilution of existing shareholders due to issuance of new shares to Denison Mines

Insights

Analyzing...

Denison becomes Foremost’s largest shareholder at

VANCOUVER, British Columbia, Oct. 07, 2024 (GLOBE NEWSWIRE) -- Foremost Clean Energy Ltd. (NASDAQ: FMST) (CSE: FAT) (“Foremost Clean Energy”, “Foremost” or the “Company”), an emerging North American uranium and lithium exploration company, is pleased to announce today that, further to its announcement of September 23, 2024, it has now completed Phase One of its transaction (the “Transaction”) with Denison Mines Corp. ("Denison"), acquiring

Jason Barnard President and CEO of Foremost, stated, “We are pleased to officially close the first phase of this transformational transaction, marking a significant milestone for Foremost and its shareholders. The Company is fortunate to acquire an interest in a large portfolio of ten prospective projects situated amongst well-established infrastructure, mills and operating mines. With David Cates joining our Board of Directors, we also have the advantage of Denison’s support and David’s significant experience leading a highly successful advanced uranium developer in the Athabasca Basin.” Barnard continued, “We appreciate that Denison has put its trust and confidence in our Company and are excited to collaborate on the rapid advancement of exploration on these properties at a time when the nuclear energy sector is seeking additional sources of future uranium supplies. With Denison’s additional guidance and support on technical and operating matters, we feel well positioned for future success.”

The acquisition was completed pursuant to an option agreement with Denison dated September 23, 2024 (the “Option Agreement”), which granted Foremost the option to acquire, through three phases, up to

In addition, concurrent with the acquisition of Phase One Interest, Foremost has also:

- Appointed Mr. David Cates, the President and CEO of Denison, to Foremost’s board of directors; Mr. Cates has extensive expertise in the Canadian and international uranium mining industry from over a decade of senior management and financial experience in various roles with Denison;

- Appointed Andy Yackulic, Denison’s Vice President of Exploration, to its advisory board as a technical and geoscientific advisor. Mr. Yackulic has spent the past two decades of exploration focused in the Athabasca Basin region acquiring extensive experience with various geologic models for uranium mineralization, and has been working with Denison since 2020. Previously, he spent 12 years at Cameco Corporation in various roles and led the exploration team that discovered the Fox Lake uranium deposit. Mr. Yackulic holds a Bachelor of Science in Geology from the University of Saskatchewan, is a member of the Association of Professional Engineers & Geoscientists of Saskatchewan (APEGS), and is a Qualified Person in accordance with the requirements of National Instrument 43-101 – Standards of Disclosure for Mineral Projects;

- Entered into an investor rights agreement with Denison; and

- Become the operator of the Exploration Properties.

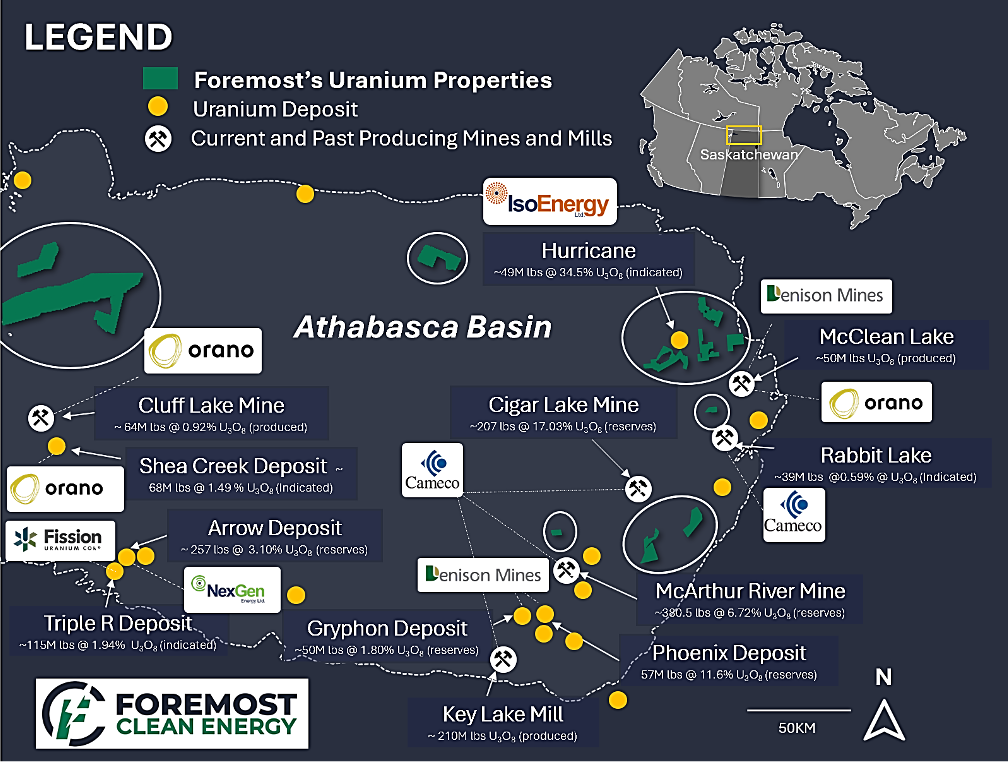

The Exploration Properties are comprised of 45 claims covering an aggregate area of 332,378 acres (134,509 hectares) within the Athabasca Basin region of northern Saskatchewan, which is known for its prolific history of large high-grade uranium discoveries and operating mines—currently producing ~

Fig 1. Map of Foremost’s Uranium Properties With Nearby Mills, Mines and Deposits

Denison Mines is responsible for discovering several high-profile uranium deposits and is currently the operator of the Phoenix and Gryphon deposits at Wheeler River and the THT deposit at Waterbury Lake in the Athabasca Basin. With Denison’s primary focus on development and mining stage projects, this excellent portfolio of uranium exploration properties would otherwise receive limited attention. Many of the properties in the portfolio are proximal to some of the world’s highest-profile uranium operations, such as the McClean Lake mill and Cigar Lake mine and span from grassroots exploration to hosting drill-ready exploration targets. Foremost will now be able to provide the Exploration Properties with increased attention and thus improve the prospect of discovery.

To see full details of the Option Agreement, Investor Rights Agreement, and other related documents in connection with the Transaction, please refer to the Company’s filings under its profile on Sedar+ at www.sedarplus.ca and on Edgar at www.sec.gov. All Common Shares issued to Denison pursuant to the Option Agreement will be subject to a statutory four-month hold period pursuant to applicable Canadian securities laws.

Foremost’s AGSM Record Date Correction

Foremost incorrectly stated the record date (the “Record Date”) on its September 30, 2024 news release for the upcoming Annual General and Special Shareholder’s Meeting (the “AGSM”) being held on December 09, 2024. The correct Record Date is October 24, 2024, and not November 06, 2024. This correction does not change any other information reported in the September 30th news release.

About Foremost

Foremost Clean Energy (NASDAQ: FMST) (CSE: FAT) (WKN: A3DCC8) is an emerging North American uranium and lithium exploration company with an option to earn up to a

Foremost’s uranium projects are at different stages of exploration, from grassroots to those with significant historical exploration and drill-ready targets. Its mission is to create significant discoveries, alongside and in collaboration with Denison Mines (TSX:DML, NYSE American: DNN), through systematic and disciplined exploration programs.

Foremost also has a portfolio of lithium projects at varying stages of development, which are located across 55,000+ acres in Manitoba and Quebec. For further information please visit the company’s website at www.foremostcleanenergy.com.

Contact Information

Company Contact

Jason Barnard

President and CEO

+1 (604) 330-8067

info@foremostcleanenergy.com

Investor Relations

Lucas A. Zimmerman

Managing Director

MZ Group - MZ North America

(949) 259-4987

FMST@mzgroup.us

www.mzgroup.us

Follow us or contact us on social media:

Twitter: @fmstcleanenergy

Linkedin: https://www.linkedin.com/company/foremostcleanenergy/

Facebook: https://www.facebook.com/ForemostCleanEnergy/

Forward-Looking Statements

Except for the statements of historical fact contained herein, the information presented in this news release and oral statements made from time to time by representatives of the Company are or may constitute “forward-looking statements” as such term is used in applicable United States and Canadian laws and including, without limitation, within the meaning of the Private Securities Litigation Reform Act of 1995, for which the Company claims the protection of the safe harbor for forward-looking statements. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Any other statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect,” “is expected,” “anticipates” or “does not anticipate,” “plans,” “estimates” or “intends,” or stating that certain actions, events or results “may,” “could,” “would,” “might” or “will” be taken, occur or be achieved) are not statements of historical fact and should be viewed as forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and other factors include, among others, the availability of capital to fund programs and the resulting dilution caused by the raising of capital through the sale of shares, continuity of agreements with third parties and satisfaction of the conditions to the Transaction, risks and uncertainties associated with the environment, delays in obtaining governmental approvals, permits or financing. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved. Forward-looking information is subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected. Many of these factors are beyond the Company’s ability to control or predict. Important factors that may cause actual results to differ materially and that could impact the Company and the statements contained in this news release can be found in the Company’s filings with the Securities and Exchange Commission. The Company assumes no obligation to update or supplement any forward-looking statements whether as a result of new information, future events or otherwise. Accordingly, readers should not place undue reliance on forward-looking statements contained in this news release and in any document referred to in this news release. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities. and information. Please refer to the Company’s most recent filings under its profile at on Sedar+ at www.sedarplus.ca and on EDGAR at www.sec.gov for further information respecting the risks affecting the Company and its business.

The Canadian Securities Exchange has neither approved nor disapproved the contents of this news release and accepts no responsibility for the adequacy or accuracy hereof.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/61b235eb-1c41-49d5-a551-f3f18e8315c6