Fifth Third Momentum® Banking Offers Ease of a Digital Bank with Personal Support When You Need It

Fifth Third Bank launches Fifth Third Momentum Banking, combining digital banking features with local support. This innovative banking solution aims to assist customers in managing cash shortfalls and achieving savings goals. Key features include Early Pay for early payroll access, MyAdvance for fund advances, and tools for setting savings goals. The service incurs no monthly maintenance fees and offers a wide range of customer support options. In addition, customers enjoy fraud protection and cash back rewards, enhancing their banking experience.

- Launch of Fifth Third Momentum Banking, enhancing digital banking experience.

- Features like Early Pay and MyAdvance improve cash flow management.

- $0 monthly maintenance fee attracts new customers.

- Wide range of customer support options including local bankers.

- None.

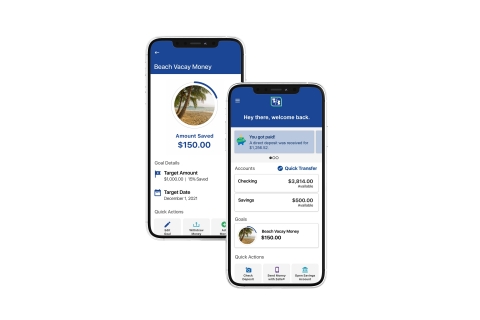

Fifth Third Bank, National Association, is proud to launch Fifth Third Momentum® Banking – a first of its kind, everyday banking solution. It combines the features and innovation of a digital-first bank with the security, reliability and local presence of a 163-year-old institution committed to the communities it serves. Fifth Third Momentum Banking1 is the industry-leading solution to help customers avoid and manage cash shortfalls, get paid and pay others, and reach savings goals, all while knowing their bank helps to protect their identity and finances. In addition, customers have thousands of professionals ready to help them achieve financial well-being.

Fifth Third Momentum® Banking – a first of its kind, everyday banking solution. (Photo: Business Wire)

“Fifth Third Momentum Banking is the latest leap forward in Fifth Third’s digital transformation, enabling customers to manage their finances day-in, day-out, and bank how they want, when they want and where they want,” said Tim Spence, president of Fifth Third Bank. “We’re giving customers the widest possible range of options to gain access to their money faster and avoid fees. When a customer elects to use a short-term liquidity product, it’s a lower cost and more sustainable way to cover a cash-flow shortfall than an overdraft fee.”

Fifth Third Momentum customers will have one of the broadest range of options among all banks to get fast access to their money and address liquidity issues through:

- Early Pay – Free access to payroll up to two days early with direct deposit, rolling out across our retail footprint this summer.2

-

MyAdvance™3 – Ability to advance funds of

$50 or more against future qualified direct deposits, available now, starting the month after direct deposit is established.4 - Immediate Funds – Ability to receive instant availability for check deposits.5

- Extra Time® – Additional time to make a deposit and avoid overdraft fees, available in certain markets today6 and coming soon to our entire retail footprint.

Fifth Third Momentum Banking1 also provides a seamless digital experience and set of tools to help customers save for a vacation, a rainy-day fund or whatever goals they set for themselves. Fifth Third Momentum Savings allows customers to set a goal and schedule money to move from checking to savings to meet their goal.7

Fifth Third Momentum Banking has

Fifth Third Momentum Banking comes in addition to all of the Fifth Third Better offerings: a newly enhanced mobile app, one of the largest U.S. bank networks of fee-free ATMs (more than 50,000),8 digital messaging, and the ability for customers to add products and features such as additional fraud protection services9 and

“Fifth Third Momentum Banking solves our customers’ everyday banking needs,” said Melissa Stevens, chief digital officer for Fifth Third Bank, “helping customers with the security of a bank and the ease of an app, and there always is a human being – a real face and smile, ready to help you.”

1 No minimum deposit required to open a checking or savings account. Account must be funded within 45 days of opening. |

2 Certain conditions apply. Where available, fee-free access to funds for Early Pay are dependent on submission of direct deposit by payer and can currently be up to one day prior to date of scheduled payment for accounts opened in Georgia and, in June, up to two days prior to date of scheduled payment. Eligible direct deposits may include payroll, pension or government benefits (such as Social Security). |

3 MyAdvanceTM is currently known as Fifth Third Early Access®. Early Access will be rebranded MyAdvance in June 2021. |

4 Fifth Third Early Access® (EAX) is an expensive form of credit. We may be able to offer other options that are less expensive and more appropriate for your needs. EAX is a short-term form of credit that allows eligible Fifth Third personal checking customers to take an advance on their next qualified direct deposit. The monthly credit limit calculation for an EAX line of credit opened 90 days or less is based upon qualified direct deposits from the previous 35-day period. The monthly credit limit calculation for an EAX line of credit opened 91 days or more is based upon whichever amount is lowest; The total amount of qualified direct deposits during the previous 35-day period or the average amount of all qualified direct deposits made to the associated account during the past three (3) months. The minimum credit limit amount is |

5 Certain restrictions and fees will apply. Fees are disclosed at the time of deposit. Deposits can be made in a branch or via our mobile app. Mobile deposits are subject to Digital Services User Agreement, including applicable cut-off times. |

6 In order to avoid any overdraft fees with Extra Time you must make a deposit before 11:59:59 PM ET on the business day after your account is overdrawn to bring your account balance to at least |

7 Subject to Digital Services User Agreement. Mobile internet data and text messaging charges may apply. Please contact your mobile service provider for details. To use the mobile app or web you must have previously logged onto internet banking through 53.com. |

8 Fifth Third Bank is part of the Allpoint®, Presto!, and 7-Eleven® network of ATMs, which features more than 50,000 fee-free ATMs nationwide. Customers of Fifth Third Bank can use their Fifth Third debit or prepaid card to withdraw cash fee-free from any domestic Allpoint® ATM in addition to Presto! ATMs located in Publix stores, and 7-Eleven® ATMs listed on our ATM locator on 53.com or on our mobile banking app. Fees will apply when using your credit card at any ATM to perform a cash advance or when using a credit card to withdraw cash at any Presto! ATM. ATM fees may apply to certain 7-Eleven® locations in Oklahoma, Hawaii, and Alaska. Any 7-Eleven® location listed on our ATM locator is fee-free. See the Deposit Account Rules & Regulations for additional information on ATM fees and services. ATM network is fee-free for Fifth Third Bank customers when using their debit or prepaid card to withdraw cash. When you use an ATM not owned by us, you may be charged a fee by the ATM operator or any network used (and you may be charged a fee for a balance inquiry even if you do not complete a fund transfer). Non-Fifth Third ATM transaction: |

9 Fifth Third employs a number of fraud protection measures and offers you fee-free tools, such as alerts, to help protect your account. You may also enroll in Fifth Third Identity Alert®, an optional, non-FDIC insured product, subject to additional fees, provided by Fifth Third’s vendor, Trilegiant. |

10 Subject to credit review and approval. 1.67 Rewards Points ( |

About Fifth Third

Fifth Third Bancorp is a diversified financial services company headquartered in Cincinnati, Ohio, and the indirect parent company of Fifth Third Bank, National Association, a federally chartered institution. As of March 31, 2021, Fifth Third had

View source version on businesswire.com: https://www.businesswire.com/news/home/20210426005675/en/

FAQ

What is Fifth Third Momentum Banking FITB?

When was Fifth Third Momentum Banking launched?

What are the key features of Fifth Third Momentum Banking FITB?

Does Fifth Third Momentum Banking FITB have any monthly fees?