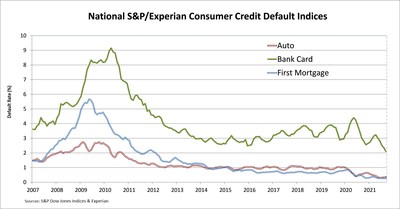

S&P/Experian Consumer Credit Default Indices Show Composite Rate Stable In September 2021

The S&P Dow Jones Indices and Experian released data for the S&P/Experian Consumer Credit Default Indices as of September 2021, showing the composite rate remained steady at 0.39%. The bank card default rate decreased by 24 basis points to 2.11%, while the auto loan default rate increased by one basis point to 0.35%. Regional analysis revealed Miami's default rate dropped to 0.80%, New York to 0.40%, and Los Angeles to 0.31%. The release highlights trends in consumer credit defaults across various loan categories and metropolitan areas.

- Bank card default rate decreased by 24 basis points to 2.11%.

- Miami showed the largest decline in default rates, down eight basis points to 0.80%.

- New York declined four basis points to 0.40%.

- Auto loan default rate increased by one basis point to 0.35%.

- Chicago and Dallas default rates remained unchanged at 0.43%.

NEW YORK, Oct. 19, 2021 /PRNewswire/ -- S&P Dow Jones Indices and Experian released today data through September 2021 for the S&P/Experian Consumer Credit Default Indices. The indices represent a comprehensive measure of changes in consumer credit defaults and show that the composite rate was unchanged at

Three of the five major metropolitan statistical areas ("MSAs") showed lower default rates compared to last month. Miami had the largest decline, down eight basis points to

The table below summarizes the September 2021 results for the S&P/Experian Consumer Credit Default Indices. These data are not seasonally adjusted and are not subject to revision.

Index Levels – National Indices | |||

Index | September 2021 | August 2021 | September 2020 |

Composite | 0.39 | 0.39 | 0.63 |

First Mortgage | 0.27 | 0.27 | 0.46 |

Bank Card | 2.11 | 2.35 | 3.00 |

Auto Loans | 0.35 | 0.34 | 0.56 |

Source: S&P/Experian Consumer Credit Default Indices | |||

Data through September 2021 | |||

The table below provides the index levels for the five major MSAs tracked by the S&P/Experian Consumer Credit Default Indices.

Index Levels – Major MSAs | |||

MSA | September 2021 | August 2021 | September 2020 |

New York | 0.40 | 0.44 | 0.88 |

Chicago | 0.43 | 0.43 | 0.65 |

Dallas | 0.43 | 0.41 | 0.62 |

Los Angeles | 0.31 | 0.34 | 0.71 |

Miami | 0.80 | 0.88 | 1.80 |

Source: S&P/Experian Consumer Credit Default Indices | |||

Data through September 2021 | |||

For more information about S&P Dow Jones Indices, please visit www.spdji.com.

ABOUT THE S&P/EXPERIAN CONSUMER CREDIT DEFAULT INDICES

Jointly developed by S&P Dow Jones Indices LLC and Experian, the S&P/Experian Consumer Credit Default Indices are published on the third Tuesday of each month at 9:00 am ET. They are constructed to track the default experience of consumer balances in four key loan categories: auto, bankcard, first mortgage lien and second mortgage lien. The Indices are calculated based on data extracted from Experian's consumer credit database. This database is populated with individual consumer loan and payment data submitted by lenders to Experian every month. Experian's base of data contributors includes leading banks and mortgage companies, and covers approximately

For more information, please visit: www.spindices.com/indices/indicators/sp-experian-consumer-credit-default-composite-index.

ABOUT S&P DOW JONES INDICES

S&P Dow Jones Indices is the largest global resource for essential index-based concepts, data and research, and home to iconic financial market indicators, such as the S&P 500® and the Dow Jones Industrial Average®. More assets are invested in products based on our indices than products based on indices from any other provider in the world. Since Charles Dow invented the first index in 1884, S&P DJI has been innovating and developing across the spectrum of asset classes helping to define the way investors measure and trade the markets.

S&P Dow Jones Indices is a division of S&P Global (NYSE: SPGI), which provides essential intelligence for individuals, companies and governments to make decisions with confidence. For more information, visit www.spdji.com.

ABOUT EXPERIAN

Experian is the world's leading global information services company. During life's big moments – from buying a home or a car, to sending a child to college, to growing a business by connecting with new customers – we empower consumers and our clients to manage their data with confidence. We help individuals to take financial control and access financial services, businesses to make smarter decisions and thrive, lenders to lend more responsibly, and organizations to prevent identity fraud and crime.

We have 17,800 people operating across 45 countries and every day we're investing in new technologies, talented people and innovation to help all our clients maximize every opportunity. We are listed on the London Stock Exchange (EXPN) and are a constituent of the FTSE 100 Index.

Learn more at www.experianplc.com or visit our global content hub at our global news blog for the latest news and insights from the Group.

FOR MORE INFORMATION:

Ray McConville

North America Communications

New York, USA

(+1) 212 438 1678

raymond.mcconville@spglobal.com

Annie Russell

Experian Public Relations

(+1) 714 830 7927

annie.russell@experian.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/spexperian-consumer-credit-default-indices-show-composite-rate-stable-in-september-2021-301403612.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/spexperian-consumer-credit-default-indices-show-composite-rate-stable-in-september-2021-301403612.html

SOURCE S&P Dow Jones Indices

FAQ

What is the S&P/Experian Consumer Credit Default Indices data for September 2021?

What does the bank card default rate indicate for EXPGY and SPGI?

How did the default rates change in major MSAs for September 2021?