Electrovaya Reports Fiscal Year 2024 Results

Electrovaya (NASDAQ:ELVA) reported its FY2024 financial results with revenue of $44.6 million, slightly up from $44.1 million in FY2023. The company achieved significant milestones including improved gross margins of 30.7%, six consecutive quarters of positive Adjusted EBITDA totaling $4.1 million, and positive operating cash flow of $1.0 million.

Key developments include securing a $50.8 million direct loan from the Export-Import Bank of the United States for battery manufacturing in Jamestown, NY, adding a new global construction equipment OEM customer, and receiving follow-on orders from existing customers. The company provided FY2025 guidance expecting revenues to exceed $60 million.

Electrovaya (NASDAQ:ELVA) ha riportato i risultati finanziari per l'anno fiscale 2024 con un fatturato di 44,6 milioni di dollari, leggermente in aumento rispetto ai 44,1 milioni di dollari dell'anno fiscale 2023. L'azienda ha raggiunto traguardi significativi, tra cui un miglioramento dei margini lordi al 30,7%, sei trimestri consecutivi di EBITDA rettificato positivo per un totale di 4,1 milioni di dollari e un flusso di cassa operativo positivo di 1,0 milione di dollari.

Sviluppi chiave includono l'acquisizione di un prestito diretto di 50,8 milioni di dollari dalla Export-Import Bank degli Stati Uniti per la produzione di batterie a Jamestown, NY, l'aggiunta di un nuovo cliente OEM globale nel settore delle attrezzature da costruzione e la ricezione di ordini di follow-up da clienti esistenti. L'azienda ha fornito indicazioni per l'anno fiscale 2025 prevedendo che i ricavi supereranno 60 milioni di dollari.

Electrovaya (NASDAQ:ELVA) informó sus resultados financieros del año fiscal 2024 con ingresos de 44,6 millones de dólares, ligeramente por encima de los 44,1 millones de dólares del año fiscal 2023. La empresa logró hitos significativos, incluyendo un margen bruto mejorado del 30,7%, seis trimestres consecutivos de EBITDA ajustado positivo que totalizan 4,1 millones de dólares, y un flujo de caja operativo positivo de 1,0 millón de dólares.

Los desarrollos clave incluyen la obtención de un préstamo directo de 50,8 millones de dólares del Export-Import Bank de los Estados Unidos para la fabricación de baterías en Jamestown, NY, la adición de un nuevo cliente OEM global en el sector de equipos de construcción y la recepción de pedidos de seguimiento de clientes existentes. La empresa proporcionó orientación para el año fiscal 2025, esperando que los ingresos superen 60 millones de dólares.

Electrovaya (NASDAQ:ELVA)는 2024 회계연도의 재무 실적을 발표하며 매출이 4460만 달러에 달해 2023 회계연도의 4410만 달러에서 소폭 증가했다고 밝혔습니다. 이 회사는 30.7%의 개선된 총 마진, 410만 달러의 긍정적인 조정 EBITDA를 기록한 6분기 연속 성과, 그리고 100만 달러의 긍정적인 운영 현금 흐름을 달성하는 등 중요한 이정표를 세웠습니다.

주요 발전 사항으로는 미국 수출입은행으로부터 뉴욕주 잼스타운에서의 배터리 제조를 위한 5080만 달러의 직접 대출을 확보한 것, 새로운 글로벌 건설 장비 OEM 고객 추가, 기존 고객으로부터 후속 주문을 수신한 것이 포함됩니다. 이 회사는 2025 회계연도에 대한 가이던스를 제공하며 매출이 6000만 달러를 초과할 것으로 예상하고 있습니다.

Electrovaya (NASDAQ:ELVA) a annoncé ses résultats financiers pour l'exercice 2024 avec un chiffre d'affaires de 44,6 millions de dollars, légèrement en hausse par rapport aux 44,1 millions de dollars de l'exercice 2023. L'entreprise a atteint des jalons significatifs, notamment une amélioration de la marge brute à 30,7%, six trimestres consécutifs d'EBITDA ajusté positif totalisant 4,1 millions de dollars, et un flux de trésorerie opérationnel positif de 1,0 million de dollars.

Les développements clés incluent l'obtention d'un prêt direct de 50,8 millions de dollars de la Export-Import Bank des États-Unis pour la fabrication de batteries à Jamestown, NY, l'ajout d'un nouveau client OEM mondial dans le secteur de l'équipement de construction, et la réception de commandes de suivi de clients existants. L'entreprise a fourni des prévisions pour l'exercice 2025, s'attendant à ce que les revenus dépassent 60 millions de dollars.

Electrovaya (NASDAQ:ELVA) hat seine finanziellen Ergebnisse für das Geschäftsjahr 2024 mit Einnahmen von 44,6 Millionen Dollar veröffentlicht, was einen leichten Anstieg gegenüber den 44,1 Millionen Dollar im Geschäftsjahr 2023 bedeutet. Das Unternehmen hat bedeutende Meilensteine erreicht, darunter verbesserte Bruttomargen von 30,7%, sechs aufeinanderfolgende Quartale mit positivem bereinigtem EBITDA in Höhe von 4,1 Millionen Dollar und positiven operativen Cashflow von 1,0 Million Dollar.

Wichtige Entwicklungen umfassen die Sicherstellung eines direkten Darlehens über 50,8 Millionen Dollar von der Export-Import-Bank der Vereinigten Staaten für die Batterieherstellung in Jamestown, NY, die Hinzufügung eines neuen globalen OEM-Kunden im Bereich Baugeräte sowie den Erhalt von Folgeaufträgen von bestehenden Kunden. Das Unternehmen gab eine Prognose für das Geschäftsjahr 2025 heraus und erwartet, dass die Einnahmen 60 Millionen Dollar überschreiten werden.

- Revenue increased to $44.6M from $44.1M YoY

- Gross margin improved by 377 basis points to 30.7%

- Achieved $4.1M in Adjusted EBITDA, up from $3.3M

- Generated positive operating cash flow of $1.0M vs -$5.2M in FY2023

- Secured $50.8M EXIM Bank loan for manufacturing expansion

- Removal of going concern note from financial statements

- Added new global construction equipment OEM customer

- Received follow-on orders from existing major customers

- Revenue growth was minimal at 1.1% YoY

Insights

The fiscal 2024 results demonstrate significant operational improvements and financial strengthening. Revenue reached $44.6M with a notable gross margin expansion of

The secured

The strategic expansion into domestic lithium-ion cell manufacturing in Jamestown, NY, backed by the EXIM loan, positions Electrovaya for vertical integration and enhanced supply chain control. The company's ability to secure orders from a Japanese construction equipment OEM and a global aerospace & defense company validates their technology's competitive advantages in high-performance applications.

The

Revenue of

Historic Positive Cash Flow from Operations and Improved Gross Margins

Approval of

Removal of Going Concern note in the financial statements due to improved financial performance

TORONTO, ONTARIO / ACCESSWIRE / December 12, 2024 / Electrovaya Inc. ("Electrovaya" or the "Company") (Nasdaq:ELVA)(TSX:ELVA), a leading lithium-ion battery technology and manufacturing company, today reported its financial results for the fourth quarter and fiscal year ended September 30, 2024 ("Q4 2024" & "FY 2024", respectively). All dollar amounts are in U.S. dollars unless otherwise noted.

Financial Highlights:

Revenue for FY 2024 was

$44.6 million , compared to$44.1 million in the fiscal year ended September 30, 2023 ("FY 2023"). Gross margin was30.7% in FY 2024, an improvement of 377 basis points compared to FY 2023. Battery system margins remained strong at31.3% for the fiscal year.Adjusted EBITDA1 was

$4.1 million , a significant improvement of$0.8 million compared to$3.3 million in FY 2023. Q4 2024 was the Company's sixth consecutive quarter of positive Adjusted EBITDA1.The Company generated positive cash from operating activities of

$1.0 million for FY 2024, compared to cash used in operating activities of$5.2 million in FY2023, a significant improvement in operating cash flow of$6.2 million .Given the improved financial performance of the Company, management and the Company's auditors concluded that the going concern note in the company's financial statements is no longer required.

Key Operational and Strategic Highlights - Q4 FY 2024 & Subsequent Events:

Added New Global Construction Equipment OEM customer: The Company announced the receipt of its first purchase orders from a global Japanese-headquartered manufacturer of construction equipment. Electrovaya will be powering an electric excavator product line with an estimated scaled production start in 2026. The initial shipments are expected to be delivered in Q2 FY2025 to a manufacturing site in Japan. Sumitomo Corporation Power and Mobility is the trading company partner.

Received Follow-On Orders from Global Aerospace & Defense Company: The Company announced repeat orders following significant validation testing for its high voltage battery systems from a Global Aerospace and Defense company. The Company believes that its products and technologies provide mission critical sectors, including defense applications, key competitive advantages due to inherent safety and performance benefits.

Received Direct Loan Approval from Export-Import Bank of the United States: On November 14, 2024, the Company announced that it had secured approval for a direct loan in the amount of US

$50.8 million from the Export-Import Bank of the United States ("EXIM") under the bank's "Make More in America" initiative. This financing is expected to fund Electrovaya's battery manufacturing buildout in Jamestown, New York including equipment, engineering and setup costs for the facility. Electrovaya is currently in the process of finalizing loan documentation and terms with an anticipated funding date in CY Q1 2025.Continued Growth from Leading End-Customers: The Company recently announced new orders from its two largest end customers, including a Fortune 100 e-commerce company and a leading Fortune 500 retailer. These orders are significant due to both the renewed demand and in the case of the Fortune 500 retailer, an intention to revamp its significant existing warehouse infrastructure.

Management Commentary:

"Electrovaya, with its core technology advantages and proven performance, is poised to lead mission-critical and heavy-duty energy storage solutions," said Dr. Raj DasGupta, Electrovya's CEO. "With growing demand from existing and new customers, we expect robust growth in 2025 and onwards. This includes increasing revenue, enhancing profitability, and expanding domestic lithium-ion cell manufacturing in the U.S."

"Reaching record revenue, achieving six consecutive quarters of positive adjusted EBITDA1, generating positive cash flow from operations, and removing the going concern note are pivotal milestones for Electrovaya," stated John Gibson, Electrovaya's CFO. "These achievements solidify our financial position and set the stage for anticipated revenue growth exceeding

Positive Financial Outlook & Fiscal 2025 Guidance:

The Company anticipates strong growth into FY2025 with estimated revenues to exceed

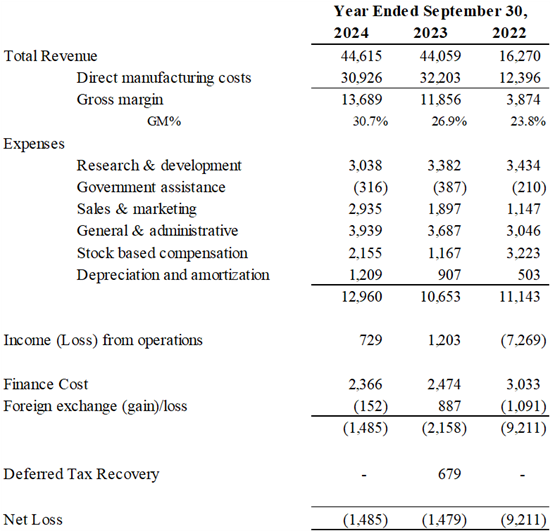

Selected Annual Financial Information for the Years ended September 30, 2024, 2023 and 2022:

Results of Operations

(Expressed in thousands of U.S. dollars)

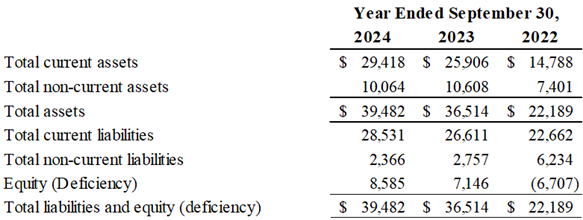

Summary Financial Position

(Expressed in thousands of U.S. dollars)

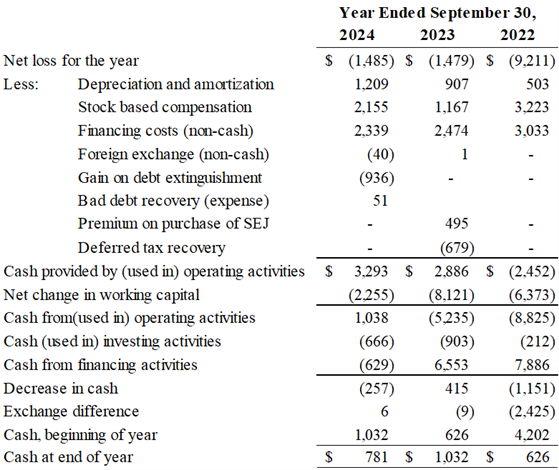

Cash flow statement

(Expressed in thousands of U.S. dollars)

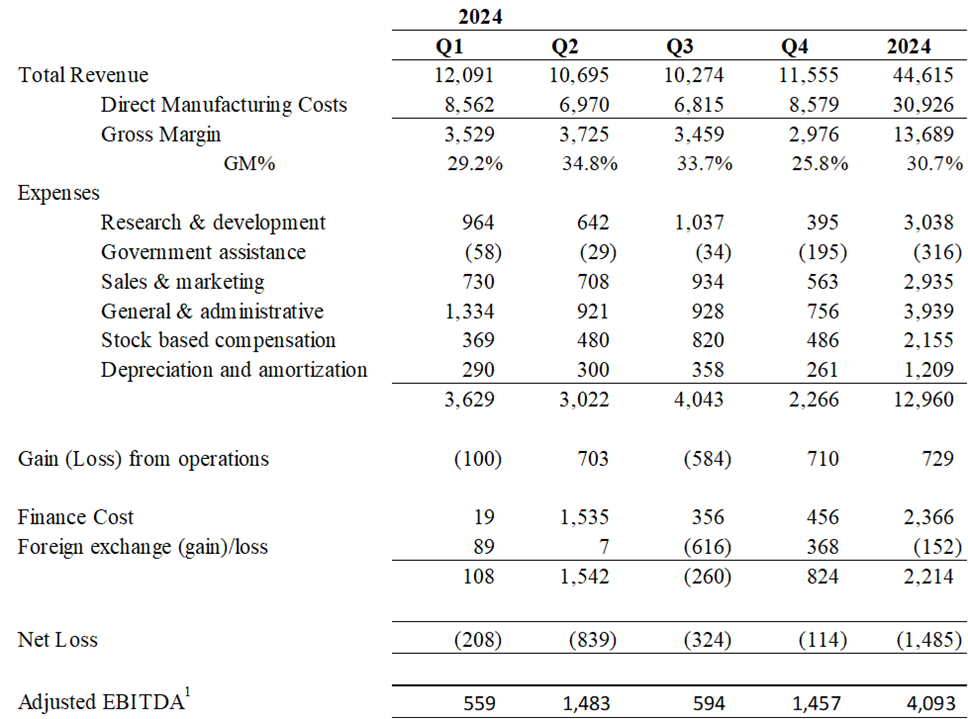

Quarterly Results of Operations

(Expressed in thousands of U.S. dollars)

1 Non-IFRS Measure: Adjusted EBITDA is defined as income/(loss) from operations, plus stock-based compensation costs and depreciation and amortization costs. Adjusted EBITDA does not have a standardized meaning under IFRS. Therefore it is unlikely to be comparable to similar measures presented by other issuers. Management believes that certain investors and analysts use adjusted EBITDA to measure the performance of the business and is an accepted measure of financial performance in our industry. It is not a measure of financial performance under IFRS, and may not be defined and calculated in the same manner by other companies and should not be considered in isolation or as an alternative to IFRS measures. The most directly comparable measure to Adjusted EBITDA calculated in accordance with IFRS is income (loss) from operations.

The Company's complete Financial Statements and Management Discussion and Analysis for the fourth quarter and fiscal year ended September 30, 2024 are available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov, as well as on the Company's website at www.electrovaya.com.

Conference Call & Webcast details:

Date: Thursday, December 12, 2024

Time: 5:00 pm. Eastern Standard Time (EST)

Toll Free: 888-506-0062

International: 973-528-0011

Participant Access Code: 193374

To help ensure that the conference begins in a timely manner, please dial in 10 minutes prior to the start of the call.

For those unable to participate in the conference call, a replay will be available for two weeks beginning on December 13, 2024 through December 27, 2024. To access the replay, the dial-in number is 877-481-4010 and 919-882-2331. The replay access ID is 49582.

Investor and Media Contact:

Jason Roy

Director, Corporate Development and Investor Relations

Electrovaya Inc.

jroy@electrovaya.com

905-855-4618

Brett Maas

Hayden IR

elva@haydenir.com

646-536-7331

About Electrovaya Inc.

Electrovaya Inc. (NASDAQ:ELVA)(TSX:ELVA) is a pioneering leader in the global energy transformation, focused on contributing to the prevention of climate change by supplying safe and long-lasting lithium-ion batteries without compromising energy and power. The Company has extensive IP and designs, develops and manufactures proprietary lithium-ion batteries, battery systems, and battery-related products for energy storage, clean electric transportation, and other specialized applications.Electrovaya has two operating sites in Canada and a 52-acre site with a 135,000 square foot manufacturing facility in Jamestown New York state for its planned gigafactory. To learn more about how Electrovaya is powering mobility and energy storage, please explore www.electrovaya.com.

Forward-Looking Statements

This press release contains forward-looking statements, including statements that relate to, among other things, revenue growth and revenue guidance of approximately

Revenue guidance for FY2025 described herein constitute future‐oriented financial information and financial outlooks (collectively, "FOFI"), and generally, is, without limitation, based on the assumptions and subject to the risks set out above under "Forward‐Looking Statements". Although management believes such assumption to be reasonable, a number of such assumptions are beyond the Company's control and there can be no assurance that the assumptions made in preparing the FOFI will prove accurate. FOFI is provided for the purpose of providing information about management's current expectations and plans relating to the Company's future performance, and may not be appropriate for other purposes.

The FOFI does not purport to present the Company's financial condition in accordance with IFRS, and it is expected that there may be differences between audited results and preliminary results, and the differences may be material. The inclusion of the FOFI in this news release disclosure should not be regarded as an indication that the Company considers the FOFI to be a reliable prediction of future events, and the FOFI should not be relied upon as such.

SOURCE: Electrovaya Inc.

View the original press release on accesswire.com