Electrovaya Reports Q1 FY2023 Results

Electrovaya Inc. reported a significant increase in Q1 FY2023 revenue, reaching $7.8 million, compared to $1.3 million in Q1 FY2022. The company maintains its revenue guidance of $42 million for FY2023, driven by a robust order backlog and anticipated growth in the retail sector. Adjusted EBITDA for Q1 FY2023 was $(0.4) million due to one-time R&D costs. The company reduced total debt to $9.7 million from $16 million, indicating improved financial health. Electrovaya is advancing plans for a U.S. gigafactory and has secured its first battery order from a Fortune 100 client.

- Q1 FY2023 revenue increased to $7.8 million from $1.3 million in Q1 FY2022.

- Maintained revenue guidance at $42 million for FY2023.

- Total debt reduced to $9.7 million from $16 million.

- Secured first battery order from a Fortune 100 client.

- Plans for a U.S. gigafactory progressing with potential financing.

- Adjusted EBITDA for Q1 FY2023 was $(0.4) million due to one-time R&D expenses.

- Q1 FY2023 revenue impacted by seasonality in the retail sector.

Insights

Analyzing...

Quarterly revenue increases significantly year-over-year to

TORONTO, ON / ACCESSWIRE / February 13, 2023 / Electrovaya Inc. ("Electrovaya" or the "Company") (TSX:EFL)(OTCQB:EFLVF), a leading lithium-ion battery technology and manufacturing company, today reported its financial results for the first quarter ended December 31, 2022 ("Q1 FY2023"). All dollar amounts are in U.S. dollars unless otherwise noted.

Financial Highlights:

- Revenue for Q1 FY2023 was

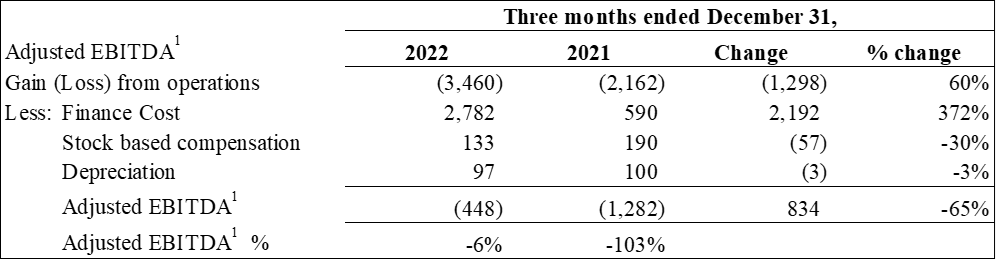

$7.8 million (C$10.7 million ), a significant increase compared to$1.3 million (C$1.7 million ) in the fiscal first quarter ended December 31, 2021 ("Q1 FY2022"). Despite the year-over-year growth, revenue for Q1 FY2023 was impacted by seasonality, as some of Electrovaya's key customers in the retail sector prefer deliveries during other periods of the calendar year since the December quarter represents their peak season. Management anticipates continued strong revenue growth during Fiscal 2023 ("FY 2023") and materially higher revenue in the following quarters of FY 2023 compared to the first quarter. The Company has a strong order backlog, and has also received indications of significant new orders for delivery during the 2023 calendar year. The previously announced revenue guidance of$42 million (C$56.8 million ) for FY 2023 is maintained. - Adjusted EBITDA1 for Q1 FY2023 was

$(0.4) million (C$0.5 million ), which included approximately$0.2 million of one-time costs related to R&D expenses for projects that were completed during the quarter. Management anticipates that the Company will generate positive Adjusted EBITDA1 for the remainder of FY 2023. - On November 9, 2022, Electrovaya completed a private placement of common shares and common share purchase warrants with existing institutional investors, new institutional investors and Company insiders for gross proceeds of approximately C

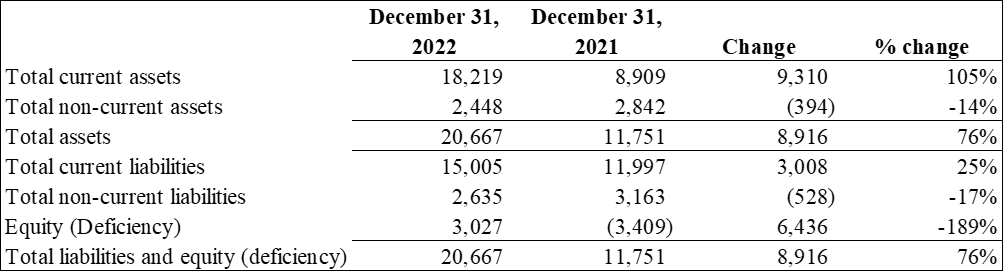

$14.8 million . The proceeds were used to repay C$6.8 million of promissory notes, thus reducing monthly interest costs. - Total debt as at December 31, 2022 was

$9.7 million (C$13.2 million ), compared to$16 million (C$21.7 million ) as at September 30, 2022, Electrovaya's Fiscal 2022 ("FY 2022") year end. The Company is actively managing cash to reduce interest charges. On December 31, 2022, the Company had total cash on hand and availability in its revolving facility of$2.2 million . Management believes that this available liquidity, plus$7.5 million of accounts receivable and$5.8 million of inventory, will provide adequate working capital to support its operating activities and growth targets for FY 2023.

Business Highlights:

- On October 3, 2022, the Company announced that it selected New York State as the location for its first U.S. gigafactory ("the Gigafactory") for the planned production of cells and batteries. The Company is planning to set up operations at a 137,000 square foot plant on a 52-acre campus near Jamestown, NY. The Gigafactory will be located in a former electronics manufacturing facility. This U.S. site will be in addition to Electrovaya's two operating sites in Canada and it is expected to open in phases starting in 2023.

- Electrovaya is in late-stage discussions with two U.S.-based government-owned lending institutions to finance a significant portion of the first phase of the Gigafactory. The Company recently received a term sheet from one of the lenders, and negotiations are ongoing. Despite progress, there are no assurances that either institution will provide funding for the project.

- The Company recently co-bid, alongside a leading energy storage developer, on a large-scale energy storage project in the United States. While the results of this bid are uncertain, it represents Electrovaya's first recent foray into the growing energy storage market using its Infinity Battery Technology Platform.

- On February 9, 2023, the Company announced that it received a first battery purchase order through its OEM sales channel for a new Fortune 100 client. This Fortune 100 retailer has nearly 2000 retail outlets in the USA with many distribution centers. The Electrovaya batteries will be used to power Materials Handling Electric Vehicles ("MHEVs") for a distribution center application in the United States. Deliveries will be made in FY 2023. This represents Electrovaya's first order from this Fortune 100 retailer.

- The Company is developing customized battery systems for robotic, fuel cell hybrid and material handling vehicles for a variety of OEM customers.

- Electrovaya Labs continues to make progress on its research and development on Solid State batteries and to build its intellectual property portfolio.

Positive Financial Outlook:

The Company continues to anticipate revenue of approximately

The revenue forecast takes into consideration the Company's existing purchase order backlog, anticipated pipeline from existing customers, and additional demand from its OEM Strategic Supply Agreement, which includes an exclusivity provision pursuant to which the OEM must make annual purchases in the minimum amount of

Impact of COVID-19 Pandemic:

The impacts of COVID-19 on supply chains continue to exist and could continue to impact the Company. To date, Electrovaya has been adept at combating shortages with long term planning and design changes, while responding to commodity cost increases with sales price adjustments.

1 Non-IFRS Measure: EBITDA does not have a standardized meaning under IFRS. Therefore it is unlikely to be comparable to similar measures presented by other issuers. Management believes that certain investors and analysts use EBITDA to measure the performance of the business.

Selected Annual Financial Information for the Quarters ended December 31, 2022 and 2021

Results of Operations

(Expressed in thousands of U.S. dollars)

*Finance costs for Q1 2023 include a one-time expense of

Adjusted EBITDA1

(Expressed in thousands of U.S. dollars)

Summary Financial Position

(Expressed in thousands of U.S. dollars)

The Company's complete Financial Statements and Management Discussion and Analysis for the fiscal first quarter ended December 31, 2022 are available at www.sedar.com or on the Company's website at www.electrovaya.com.

Conference Call Details:

The Company will hold a conference call on Monday, February 13, 2023 at 5:00 p.m. Eastern Time (ET) to discuss the December 31, 2022 quarter end financial results and to provide a business update.

US and Canada toll free: (877) 407-8291

International: + 1(201) 689-8345

To help ensure that the conference begins in a timely manner, please dial in 10 minutes prior to the start of the call.

For those unable to participate in the conference call, a replay will be available for two weeks beginning on February 13, 2023 through February 27, 2023. To access the replay, the dial-in numbers are (877) 660-6853 and (201) 612-7415. The replay conference ID is 13736251.

For more information, please contact:

Investor and Media Contact:

Jason Roy

Electrovaya Inc.

Telephone: 905-855-4618

Email: jroy@electrovaya.com

About Electrovaya Inc.

Electrovaya Inc. (TSX:EFL) (OTCQB:EFLVF) is a pioneering leader in the global energy transformation, focused on contributing to the prevention of climate change by supplying safe and long-lasting lithium-ion batteries without compromising energy and power. Electrovaya is a technology-focused company with extensive IP, designs, develops, and manufactures proprietary lithium-ion batteries, battery systems, and battery-related products for energy storage, clean electric transportation, and other specialized applications. Headquartered in Ontario, Canada, Electrovaya has production facilities in Canada and NY State, USA, with customers around the globe. To learn more about how Electrovaya is powering mobility and energy storage, please explore www.electrovaya.com.

Forward-Looking Statements

This press release contains forward-looking statements, including statements that relate to, among other things, revenue forecasts and in particular the revenue forecasts for the fiscal year ending September 2023 and the calendar year ending December 31, 2023, continuation of anticipated positive EBITDA, anticipated further sequential revenue growth in fiscal 2023, the ability to satisfy the Company's order backlog, the Company's ability to satisfy its ongoing debt obligations, anticipated increased collaboration with OEMs and OEM channels constituting a source of sales growth for the Company, anticipated continued increase in sales momentum in fiscal 2023 through OEMs and directly to large global companies, including Fortune 500 companies, the future direction of the Company's business and products, the effect of the ongoing global COVID-19 public health emergency on the Company's operations, its employees and other stake holders, including on customer demand, supply chain, and delivery schedule, the Company's ability to source supply to satisfy demand for its products and satisfy current order volume, technology development progress, pre-launch plans, plans for product development, plans for shipment using the Company's technology, production plans, the Company's markets, objectives, goals, strategies, intentions, beliefs, expectations and estimates, and can generally be identified by the use of words such as "may", "will", "could", "should", "would", "likely", "possible", "expect", "intend", "estimate", "anticipate", "believe", "plan", "objective", "seed" and "continue" (or the negative thereof) and words and expressions of similar import. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, such statements involve risks and uncertainties, and undue reliance should not be placed on such statements. Certain material factors and assumptions are applied in making forward-looking statements, and actual results may differ materially from those expressed or implied in such statements. Statements with respect to the Fiscal Year 2023 guidance, to the purchase and deployment of the Company's products by the Company's customers and users, and the timing for delivery thereof, and references to subsequent quarterly revenue and ability to secure funding for the Company's planned Gigafactory in the United States and levels of expected sales and expected further purchases and demand growth are based on an assumption that the Company's customers and users will deploy its products in accordance with communicated intentions, that the Company will be able to deliver the ordered products on a basis consistent with past deliveries, and the anticipation of the Company delivering Infinity Battery Technology Products in FY2023 on the present and anticipated purchase order to meet FY 2023 revenue targets, anticipated revenues in FY 2023, gross margin and ability to increase prices to help maintain gross margins, and ability to have production ramps of the Infinity Battery Technology Products in FY2023 to meet demand, ability to demonstrate viability, and ability to secure customer wins in energy storage and electric bus applications, and performance and manufacturability of its Solid State Platform, are all based on assumptions by the company and its end users. Important factors that could cause actual results to differ materially from expectations include but are not limited to macroeconomic effects on the Company and its business and on the Company's customers, economic conditions generally and their effect on consumer demand, labour shortages, inflation, supply chain constraints, the potential effect of COVID restrictions in Canada and internationally on the Company's ability to produce and deliver products, and on its customers' and end users' demand for and use of products, which effects are not predictable and may be affected by additional regional outbreaks and variants, and other factors which may cause disruptions in the Company's supply chain and Company's capability to deliver the products. Additional information about material factors that could cause actual results to differ materially from expectations and about material factors or assumptions applied in making forward-looking statements may be found in the Company's Annual Information Form for the year ended September 30, 2022 under "Risk Factors", and in the Company's most recent annual Management's Discussion and Analysis under "Qualitative And Quantitative Disclosures about Risk and Uncertainties" as well as in other public disclosure documents filed with Canadian securities regulatory authorities. The Company does not undertake any obligation to update publicly or to revise any of the forward-looking statements contained in this document, whether as a result of new information, future events or otherwise, except as required by law.

The revenue for the periods described herein constitute future‐oriented financial information and financial outlooks (collectively, "FOFI"), and generally, are, without limitation, based on the assumptions and subject to the risks set out above under "Forward‐Looking Statements". Although management believes such assumptions to be reasonable, a number of such assumptions are beyond the Company's control and there can be no assurance that the assumptions made in preparing the FOFI will prove accurate. FOFI is provided for the purpose of providing information about management's current expectations and plans relating to the Company's future performance, and may not be appropriate for other purposes.

The FOFI does not purport to present the Company's financial condition in accordance with IFRS, and it is expected that there may be differences between audited results and preliminary results, and the differences may be material. The inclusion of the FOFI in this news release disclosure should not be regarded as an indication that the Company considers the FOFI to be a reliable prediction of future events, and the FOFI should not be relied upon as such.

SOURCE: Electrovaya, Inc.

View source version on accesswire.com:

https://www.accesswire.com/739184/Electrovaya-Reports-Q1-FY2023-Results