E3 Lithium Provides Overview of Saskatchewan Lithium Assets

- Recent positive advancements in lithium exploration

- Project valuations between $40 million to $70 million

- None.

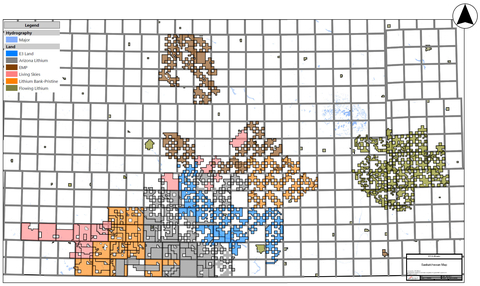

Saskatchewan Map (Graphic: Business Wire)

Saskatchewan Assets Overview

E3 Lithium owns mineral permits to approximately 258 sections, or 66,800 hectares, in southeast

E3 Lithium’s lands sit strategically in the center of the

While E3 Lithium continues to prioritize the development of its Clearwater Project in

“Securing mineral permits in

E3 Lithium Engages Meadowbank Strategic Partners to provide investor relations services

Subject to regulatory approval, effective September 15, 2023, E3 Lithium has engaged Meadowbank Strategic Partners Inc. (Meadowbank) to provide investor relations support services in accordance with TSX Venture Exchange TSXV policies. Meadowbank will assist with expanding investor awareness of E3 Lithium’s business and actively communicating with the investment community.

Under the agreement, Meadowbank will receive compensation of

ON BEHALF OF THE BOARD OF DIRECTORS

Chris Doornbos, President & CEO

E3 Lithium Ltd.

About E3 Lithium

E3 Lithium is a development company with a total of 16.0 million tonnes of lithium carbonate equivalent (LCE) Measured and Indicated and 0.9 million tonnes LCE Inferred mineral resources1 in

1: The Preliminary Economic Assessment (PEA) for the Clearwater Lithium Project NI 43-101 technical report is amended Sept 17, 2021. The mineral resource NI 43-101 Technical Report for the North Rocky Property, effective October 27, 2017, identified 0.9Mt LCE (inferred). The mineral resource NI 43-101 Technical Report for the Bashaw District Project, effective March 21, 2023, identified 16.0Mt LCE (measured & indicated). All reports are available on the E3 Lithium’s website (e3lithium.ca/technical-reports) and SEDAR+ (www.sedarplus.ca).

Forward-Looking and Cautionary Statements

This news release includes certain forward-looking statements as well as management’s objectives, strategies, beliefs and intentions. Forward looking statements are frequently identified by such words as “may”, “will”, “plan”, “expect”, “anticipate”, “estimate”, “intend” and similar words referring to future events and results. Forward-looking statements are based on the current opinions and expectations of management. All forward-looking information is inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including the speculative nature of mineral exploration and development, fluctuating commodity prices, the effectiveness and feasibility of emerging lithium extraction technologies which have not yet been tested or proven on a commercial scale or on the Company’s brine, competitive risks and the availability of financing, as described in more detail in our recent securities filings available at www.sedarplus.ca. Actual events or results may differ materially from those projected in the forward-looking statements and we caution against placing undue reliance thereon. We assume no obligation to revise or update these forward-looking statements except as required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230912308244/en/

E3 Lithium - Investor and Media Relations

Greg Foofat

Manager, Investor Relations

investor@e3lithium.ca

587-324-2775

Source: E3 LITHIUM LTD.