Eventbrite Introduces Instant Payouts and Tap to Pay, a Transformative Duo That Delivers a Win-Win Experience for Event Organizers and Attendees

Eventbrite's two new features, Instant Payouts and Tap to Pay, aim to provide event organizers with enhanced financial flexibility and operational efficiency. (Photo credit: Eventbrite)

"These new tools are a game-changer for event organizers. Beyond simplifying payments, they open up a world of financial flexibility, putting organizers in the driver's seat and streamlining event management. Plus, as digital wallets and credit cards continue to gain popularity, Tap to Pay transforms the event experience, letting attendees breeze through ticket and event purchases with a simple tap on their phone." – Ted Dworkin, Chief Product Officer at Eventbrite.

Instant Payouts: Empowering Organizers with Financial Control

Putting on an event is pricey–from venues to vendors, expenses accumulate well in advance of the event date. A recent Eventbrite survey revealed that

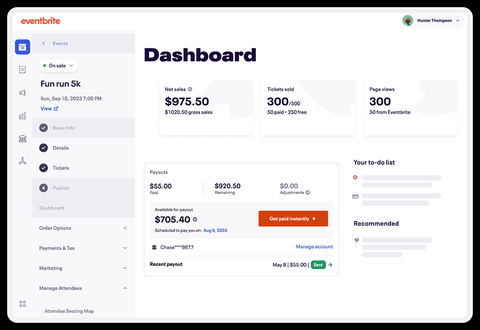

Eventbrite is taking the lead in solving this crucial issue as one of the first in the industry to offer Instant Payouts. This dashboard feature, seamlessly integrated with Stripe, enables organizers to withdraw funds from ticket sales before the event, with deposits arriving within minutes, for a small fee. Instant Payouts provides organizers with unparalleled control over their finances, empowering them to plan even better events with earlier access to sales proceeds.

Key Benefits for Event Organizers:

- More Control: Event organizers have more control over their finances with the ability to decide when and how much to withdraw, enhancing upfront cost management.

- Faster Cash Access: Organizers can cover expenses prior to an event with more ease by no longer having to wait on deposits, with the ability to have their event funds deposited to their bank account in minutes.

-

Ultimate Flexibility: Organizers can select to get instant access to their funds for a simple

3% convenience fee or wait for their scheduled payout dates at no extra cost.

Tap to Pay: A Game-Changer in Contactless Payments

In response to the dynamic shifts in event payments, Eventbrite is launching Tap to Pay, seamlessly integrated with the Eventbrite Organizer app. This innovative feature, included for all users at no cost, allows event organizers to effortlessly accept cashless payments, both at the door and beyond, without any additional costs. Enabling contactless payments directly on their mobile devices not only eliminates the need for dedicated payments hardware, but also opens the door to substantial revenue growth.

Key Advantages for Event Organizers:

- Cashless Convenience: Tap to Pay caters to the preferences of the majority of consumers for cashless transactions, using cards or mobile wallets.

- Efficient Setup: By eliminating the need for clunky card readers, on-site payments just got a lot faster and cheaper. Contactless payments can be accepted at the door securely through Tap to Pay, accessible directly on the Eventbrite Organizer app.

- Integrated Insights: Transaction data seamlessly syncs with the Organizer app, providing a comprehensive view of event sales and attendee interactions.

With the addition of Instant Payouts and Tap to Pay to its toolkit for event organizers, 2024 is shaping up to be all about getting event organizers paid faster and more efficiently. Eventbrite is doubling down on its commitment to providing organizers with essential tools to effectively manage their events and drive exponential growth. These features represent a leap forward, offering tangible benefits from flexible fund withdrawals with Instant Payouts to the cashless convenience and revenue potential of Tap to Pay.

About Eventbrite

Eventbrite is a global events marketplace that serves event creators and event goers in nearly 180 countries. Since inception, Eventbrite has been at the center of the experience economy, transforming the way people organize and attend events. The company was founded by Julia Hartz, Kevin Hartz and Renaud Visage, with a vision to build a self-service platform that would make it possible for anyone to create and sell tickets to live experiences. With over 280 million tickets distributed for over 5 million total events in 2022, Eventbrite is where people all over the world discover new things to do or new ways to do more of what they love. Eventbrite has also earned industry recognition as a top employer with special designations that include a coveted spot on Fast Company’s prestigious The World’s 50 Most Innovative Companies and Fast Company’s Brands That Matter lists, the Great Place to Work® Award in the

View source version on businesswire.com: https://www.businesswire.com/news/home/20240115758990/en/

Source: Eventbrite