Technical Debt Stalls Growth and Transformation for Nearly Half of Global Businesses

DXC Technology reveals new insights from global executives on the impact of tech debt and a four-step plan to pay down today's debt and discourage it in the future.

Tech Debt is the implied cost of rework caused by choosing an "inferior but quick" solution over the "right" technology solution. In other words, while a past investment may have worked in the moment, it could fail to hold up well over time. Tech debt tends to be a series of trade-offs that lead to suboptimization and becomes increasingly hard to undo. While different from obsolescence or depreciation it can be measured in billions for most large enterprises and have far reaching implications costing a business its talent, lower productivity, increase its security risk and ultimately be disruptive to an organization's success and stock price.

In a global survey of 750 C-suite information and technology executives commissioned by DXC Leading Edge, a team of experienced practitioners who create progressive thought leadership focused on business transformation. Embracing modernization: From technical debt to growth research makes the case for reframing tech debt from a problem that needs to be solved to something that needs to be tackled as part of any organization's modernization efforts.

According to the report, there is an accountability crisis when it comes to tech debt. Of the executives interviewed,

Michael Corcoran, Global Lead, Analytics & Engineering, said, "We're at a point in time where technology innovation is rapidly accelerating. The way we build, grow, and enable our teams and customers is changing and with that, our approach to managing the process of modernization must as well. Sometimes the spread of tech debt across the organization makes it hard for leaders to step outside of their team view, and this where a neutral third party can provide a holistic view that lets leaders consider a new perspective. If business leaders don't commit to addressing tech debt now, it will lead to loss of resources, productivity, talent, and have huge security implications."

Lack of awareness amongst business leaders also has a significant impact on their ability to manage technical debt. Executives were clear that there are barriers to progress which hinder modernization efforts in their organizations;

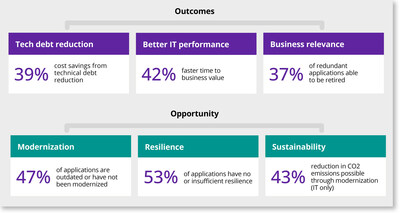

DXC has found that organizations can experience

1. Reframe org debt as modernization

Clearly articulating org debt is a way to ensure clarity of vision on the modernization path. The mind shift toward future focus is essential. This is an appropriate time for candid executive conversations when taking stock of what you have.

2. Define opportunities

The first step in defining modernization opportunities is to expand the circle beyond IT accountability. The CIO and CTO will lead modernization, but the entire executive team is responsible for its success. Coordination between the business side and technical arm of the organization is crucial. CTOs and CIOs are uniquely positioned to communicate org debt effectively to the C-suite and wider business stakeholders, with the CFO's support. Making the case clearly and convincingly to enable effective collaboration is the next step for these leaders.

3. Clear your barriers

Every industry has a unique profile, as would every organization. Therefore, clearing organizational barriers is a matter of defining them in light of your inventory and Wardley Maps. Use your industry profile as a baseline and modify it for your organization's needs.

4. Organize for execution

Having shifted the conversation, defined the barriers and gained alignment, an organization can then focus on the desired objectives and impact of the activities. Modernization is an ongoing collaborative process, involves not just the IT circle but the entire organization. When done properly, the benefits are felt across the whole organization. From cost savings to carbon reduction, to making employees' work lives smoother, there's a business case to be made across every arm of an organization. When org debt is viewed clearly and articulated fully, it can be flattened, understood and managed thoughtfully as part of the balance sheet of a healthy business.

"Technical debt is an enduring topic across the intersection of business and technology, it's long known about yet, often poorly understood. As it continues to accumulate, organizations around the world cite it as a top challenge, inhibiting their ability to transform and serve their customers into the future," said Dave Reid, Research Director of DXC Leading Edge. "Today we're releasing our landmark study to help our customers and partners tackle this issue head on and begin to reap the long-promised but hard-to-realize benefits of modernization and transformation."

In addition to the four ways organisations can clear tech debt, DXC has introduced The Tech Debt Audit business leaders can take immediately to understand the level of tech debt in their organisations and where their barriers to addressing tech debt lie.

For more information, explore:

- DXC Technical Debt page: Reframing Technical Debt

- DXC Leading Edge research report; Embracing modernization: From technical debt to growth

Research Methodology

In 2023, DXC Leading Edge conducted a survey of 750 global IT executives, with a CI (confidence interval) of

About DXC Technology

DXC Technology (NYSE: DXC) helps global companies run their mission-critical systems and operations while modernizing IT, optimizing data architectures, and ensuring security and scalability across public, private and hybrid clouds. The world's largest companies and public sector organizations trust DXC to deploy services to drive new levels of performance, competitiveness, and customer experience across their IT estates. Learn more about how we deliver excellence for our customers and colleagues at DXC.com.

Forward Looking Statements

All statements in this press release that do not directly and exclusively relate to historical facts constitute "forward-looking statements." These statements represent current expectations and beliefs, and no assurance can be given that the results described in such statements will be achieved. Such statements are subject to numerous assumptions, risks, uncertainties, and other factors that could cause actual results to differ materially from those described in such statements, many of which are outside of our control. For a written description of these factors, see the section titled "Risk Factors" in DXC's Annual Report on Form 10-K for the fiscal year ended March 31, 2023, and any updating information in subsequent SEC filings. No assurance can be given that any goal or plan set forth in any forward-looking statement can or will be achieved, and readers are cautioned not to place undue reliance on such statements which speak only as of the date they are made. We do not undertake any obligation to update or release any revisions to any forward-looking statement or to report any events or circumstances after the date of this report or to reflect the occurrence of unanticipated events except as required by law.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/technical-debt-stalls-growth-and-transformation-for-nearly-half-of-global-businesses-301957970.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/technical-debt-stalls-growth-and-transformation-for-nearly-half-of-global-businesses-301957970.html

SOURCE DXC Technology Company