Descartes’ Study Shows 40% of Shippers and Logistics Services Providers Plan to Invest in Transportation Technology to Address Industry Changes

Descartes Systems Group (Nasdaq: DSGX) announced results from its 8th Annual Global Transportation Management Benchmark Survey. The study, covering over 630 companies, reveals that 40% of shippers and logistics service providers plan to invest in transportation technology to address industry changes. Top financially performing companies show a 44% investment rate, while poorer performers stand at 32%. Real-time transportation visibility remains the top IT investment priority for the seventh consecutive year, cited by 36% of respondents. Order management and fleet routing follow, with 35% and 29% of respondents respectively. Carrier sourcing investments continue to decline.

- 40% of shippers and logistics providers plan to invest in transportation technology.

- Top-performing companies show a 44% investment rate in transportation technology.

- Real-time transportation visibility is the top investment priority for 36% of respondents.

- Order management and fleet routing are also key investment areas, with 35% and 29% respectively.

- Top performers take aggressive actions to grow and expand delivery options.

- Poorer financial performers only show a 32% investment rate in transportation technology.

- Carrier sourcing investments have been declining for the third year in a row, cited by only 20% of respondents.

Insights

Investing in transportation technology reflects a strategic alignment with industry growth and regulatory adaptation. The emphasis on real-time transportation visibility, order management and fleet routing suggests an industry pivot towards optimizing logistics efficiency and enhancing supply chain transparency. For investors, this trend signifies potential for higher operational efficiency and cost reduction, which can lead to improved profit margins in the long run.

Companies prioritizing these technologies could be positioning themselves to outperform competitors, indicated by the correlation between transportation investment and financial success. This focus on technology investments aligns with broader market trends where digital transformation is key to maintaining a competitive edge.

However, the disparity in focus between top performers and poorer performers highlights the risk: companies that fail to invest may fall behind, impacting their market position and financial health. Investors should watch for companies that lag in these key investment areas, as they may struggle against more tech-forward rivals.

The survey results showcase industry-wide shifts towards enhanced logistical capabilities, underlining the increasing importance of transportation technology. Real-time transportation visibility being a top investment priority for seven consecutive years underscores its critical role in ensuring efficient supply chain operations. This technology enhances the ability to track shipments, anticipate delays and manage logistics dynamically, driving customer satisfaction and operational resilience.

Order management and fleet routing rising in priority indicate a broader trend towards integrated logistics solutions that streamline processes from order intake to final delivery. This integration can lead to faster turnaround times and better resource utilization, directly benefiting companies' bottom lines.

Investors should note the declining interest in carrier sourcing, suggesting a possible shift from external carrier reliance towards in-house fleet management or more comprehensive logistics solutions. This shift can offer better control over transportation variables and costs.

The logistics sector's inclination towards investing in technology for transportation management is a clear indicator of evolving industry standards. Real-time visibility and fleet routing are critical in today's context where timely deliveries and route optimization are pivotal. Companies investing in these areas are likely to see improvements in delivery accuracy and fuel efficiency, addressing both operational costs and sustainability concerns.

The rise in order management systems reflects the need for better end-to-end process integration, enhancing everything from inventory control to customer communication. This holistic approach is essential for maintaining a competitive edge in a rapidly evolving market.

Overall, these technology investments are strategic moves to stay relevant and efficient. Companies that adopt these technologies are likely to provide better service at lower costs, thus attracting more business and improving their financial performance.

ATLANTA and AMERSFOORT, The Netherlands, June 11, 2024 (GLOBE NEWSWIRE) -- Descartes Systems Group (Nasdaq:DSGX) (TSX:DSG), the global leader in uniting logistics-intensive businesses in commerce, released the results of its 8th Annual Global Transportation Management Benchmark Survey of over 630 companies. The study shows that

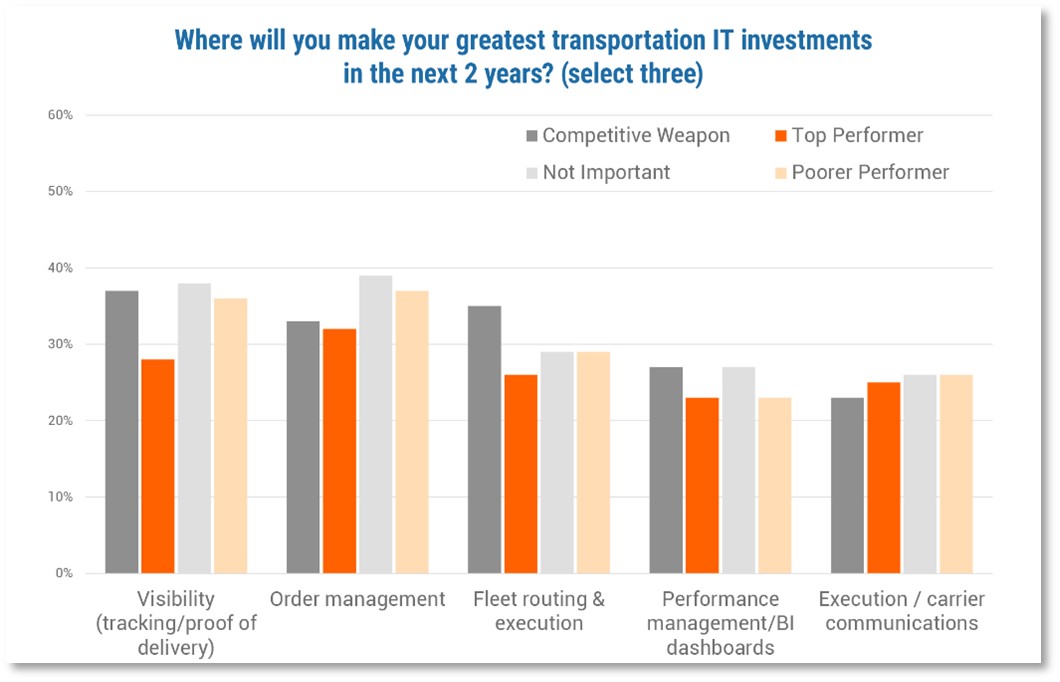

In terms of areas of focus, for the 7th consecutive year, real-time transportation visibility held the top spot for greatest transportation IT investment. Visibility was cited as the priority technology investment by

Figure 1. Transportation Management Technology Investments

Source: Descartes

“This year’s study once again shows a correlation between business performance and management’s perception of the importance of transportation, as companies that place a higher strategic value on transportation realize stronger financial performance and growth,” said Mike Hane, Director, Product Marketing, Transportation Management at Descartes. “Top performers continue to take more aggressive actions to grow and expand delivery options for customers, which requires increasing technology investments such as visibility and order management. By contrast, poorer performers are more focused on cost cutting and are 10X less likely to expect growth greater than

Descartes and SAPIO Research surveyed 630 participants representing the logistics community (i.e., brokers, forwarders and third-party logistics providers) and shippers (i.e., manufacturers, distributors and retailers) from a wide variety of industries. The goal was to understand how companies view the role of transportation management; uncover which capabilities, technologies and competitive strategies/tactics are having the greatest impact on transportation operations; and provide an outlook on future transportation IT investment.

Respondents were based in the United States, Canada and in Western Europe.

To learn more, read the full report: Descartes’ 8th Annual Global Transportation Management Benchmark Survey.

About Descartes

Descartes (Nasdaq:DSGX) (TSX:DSG) is the global leader in providing on-demand, software-as-a-service solutions focused on improving the productivity, security and sustainability of logistics-intensive businesses. Customers use our modular, software-as-a-service solutions to route, track and help improve the safety, performance and compliance of delivery resources; plan, allocate and execute shipments; rate, audit and pay transportation invoices; access global trade data; file customs and security documents for imports and exports; and complete numerous other logistics processes by participating in the world’s largest, collaborative multimodal logistics community. Our headquarters are in Waterloo, Ontario, Canada and we have offices and partners around the world. Learn more at www.descartes.com, and connect with us on LinkedIn and Twitter.

Global Media Contact

Cara Strohack

Tel: +1(800) 419-8495 ext. 202025

cstrohack@descartes.com

Cautionary Statement Regarding Forward-Looking Statements

This release contains forward-looking information within the meaning of applicable securities laws (“forward-looking statements”) that relate to Descartes’ transportation management solution offerings and potential benefits derived therefrom; and other matters. Such forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements to differ materially from the anticipated results, performance or achievements or developments expressed or implied by such forward-looking statements. Such factors include, but are not limited to, the factors and assumptions discussed in the section entitled, “Certain Factors That May Affect Future Results” in documents filed with the Securities and Exchange Commission, the Ontario Securities Commission and other securities commissions across Canada including Descartes’ most recently filed management’s discussion and analysis. If any such risks actually occur, they could materially adversely affect our business, financial condition or results of operations. In that case, the trading price of our common shares could decline, perhaps materially. Readers are cautioned not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. Forward-looking statements are provided for the purposes of providing information about management’s current expectations and plans relating to the future. Readers are cautioned that such information may not be appropriate for other purposes. We do not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in our expectations or any change in events, conditions or circumstances on which any such statement is based, except as required by law.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/f9af155d-5fe2-45b1-8166-b796f7553f45