Descartes’ Study Reveals Tariffs and Trade Barriers as Top Concern of 48% of Supply Chain Leaders

Descartes Systems Group released its 2024 Supply Chain Intelligence Report revealing that 48% of supply chain leaders consider rising tariffs and trade barriers their top concern, followed by supply chain disruptions (45%) and geopolitical instability (41%). The study, surveying 978 supply chain intelligence leaders globally, found that tariffs and trade barriers remained the primary concern across all company sizes. Companies expecting over 15% growth showed higher concern (51%) about tariffs compared to those with /no growth (43%). The findings emphasize the need for organizations to strengthen their supply chain analytics and adopt technology-enabled insights to manage tariff updates, identify new markets, and secure better supply sources.

Il Gruppo Descartes Systems ha pubblicato il suo rapporto sulla Supply Chain Intelligence 2024, rivelando che il 48% dei leader della supply chain considera l'aumento dei dazi e delle barriere commerciali la propria principale preoccupazione, seguita dalle interruzioni della supply chain (45%) e dall'instabilità geopolitica (41%). Lo studio, che ha coinvolto 978 leader dell'intelligence della supply chain a livello globale, ha scoperto che dazi e barriere commerciali rimangono la principale preoccupazione per tutte le dimensioni aziendali. Le aziende che prevedono una crescita superiore al 15% mostrano una preoccupazione più elevata (51%) riguardo ai dazi rispetto a quelle senza crescita (43%). I risultati sottolineano la necessità per le organizzazioni di rafforzare le proprie analisi della supply chain e adottare intuizioni supportate dalla tecnologia per gestire gli aggiornamenti sui dazi, identificare nuovi mercati e garantire forniture migliori.

Descartes Systems Group publicó su Informe sobre Inteligencia de la Cadena de Suministro 2024, revelando que el 48% de los líderes de la cadena de suministro consideran que el aumento de tarifas y barreras comerciales es su principal preocupación, seguido de las interrupciones en la cadena de suministro (45%) y la inestabilidad geopolítica (41%). El estudio, que encuestó a 978 líderes de inteligencia de la cadena de suministro a nivel mundial, encontró que las tarifas y barreras comerciales siguen siendo la principal preocupación en todas las empresas, independientemente de su tamaño. Las compañías que esperan un crecimiento superior al 15% mostraron una mayor preocupación (51%) por las tarifas en comparación con aquellas sin crecimiento (43%). Los hallazgos enfatizan la necesidad de que las organizaciones fortalezcan su análisis de cadena de suministro y adopten conocimientos habilitados por tecnología para gestionar actualizaciones de tarifas, identificar nuevos mercados y asegurar mejores fuentes de suministro.

Descartes Systems Group는 2024년 공급망 인텔리전스 보고서를 발표하며 48%의 공급망 리더들이 상승하는 관세와 무역 장벽을 가장 큰 우려 사항으로 간주하고, 다음으로 공급망 중단(45%)과 지정학적 불안정성(41%)이 있음을 밝혔습니다. 이 연구는 전 세계의 978명의 공급망 인텔리전스 리더를 대상으로 조사하였으며, 모든 회사 규모에서 관세와 무역 장벽이 주요 우려 사항으로 남아 있다는 사실을 발견했습니다. 15% 이상의 성장을 예상하는 기업들은 성장 없는 기업들(43%)에 비해 관세에 대한 우려가 더 높았습니다(51%). 이 결과는 조직들이 공급망 분석을 강화하고 기술 기반의 통찰력을 채택하여 관세 업데이트를 관리하고, 새로운 시장을 식별하며, 더 나은 공급원을 확보해야 할 필요성을 강조합니다.

Descartes Systems Group a publié son Rapport sur l'Intelligence de la Chaîne d'Approvisionnement 2024, révélant que 48% des responsables de la chaîne d'approvisionnement considèrent que la hausse des tarifs douaniers et des barrières commerciales est leur principale préoccupation, suivie par les perturbations de la chaîne d'approvisionnement (45%) et l'instabilité géopolitique (41%). L'étude, qui a interrogé 978 leaders de l'intelligence de la chaîne d'approvisionnement à l'échelle mondiale, a constaté que les tarifs douaniers et les barrières commerciales restent la préoccupation principale pour toutes les tailles d'entreprises. Les entreprises s'attendant à une croissance de plus de 15% ont montré une préoccupation plus élevée (51%) concernant les tarifs par rapport à celles sans croissance (43%). Les résultats soulignent la nécessité pour les organisations de renforcer leur analyse de la chaîne d'approvisionnement et d'adopter des insights basés sur la technologie pour gérer les mises à jour tarifaires, identifier de nouveaux marchés et sécuriser de meilleures sources d'approvisionnement.

Descartes Systems Group hat seinen Bericht über die Supply Chain Intelligence 2024 veröffentlicht, der zeigt, dass 48% der Führungskräfte in der Lieferkette steigende Zölle und Handelsbarrieren als ihr größtes Anliegen ansehen, gefolgt von Unterbrechungen in der Lieferkette (45%) und geopolitischer Instabilität (41%). Die Studie, die 978 Führungskräfte im Bereich der Lieferkettenintelligenz weltweit befragte, ergab, dass Zölle und Handelsbarrieren in allen Unternehmensgrößen das Hauptanliegen blieben. Unternehmen, die mit über 15% Wachstum rechnen, zeigen eine größere Besorgnis (51%) gegenüber Zöllen im Vergleich zu denen ohne Wachstum (43%). Die Ergebnisse betonen die Notwendigkeit für Organisationen, ihre Analytik der Lieferkette zu stärken und technologiegestützte Erkenntnisse zu nutzen, um Zollerhöhungen zu verwalten, neue Märkte zu identifizieren und bessere Lieferquellen zu sichern.

- Comprehensive survey covering 978 global supply chain leaders

- Strong market position in supply chain intelligence solutions

- Increasing tariffs and trade barriers affecting business operations

- Significant supply chain disruptions impacting 45% of respondents

- Geopolitical instability affecting 41% of surveyed companies

Insights

The survey findings reveal critical insights for supply chain-dependent companies and their investors. With

The broad consensus across company sizes indicates this isn't just a big business or small business problem - it's an industry-wide challenge that could reshape competitive dynamics. For investors, companies with robust supply chain analytics capabilities and geographical diversification in their supplier base may be better positioned to navigate these headwinds.

The timing is particularly relevant given potential new U.S. tariffs on the horizon. Companies without the technology infrastructure to quickly analyze and adapt their sourcing strategies could face material cost increases and competitive disadvantages.

ATLANTA and LONDON, Dec. 02, 2024 (GLOBE NEWSWIRE) -- Descartes Systems Group (Nasdaq:DSGX) (TSX:DSG), the global leader in uniting logistics-intensive businesses in commerce, released findings from its 2024 Supply Chain Intelligence Report: Escalating Challenges for Global Supply Chain Leaders survey, which examined the most significant global trade challenges facing logistics and supply chain leaders today. The study showed that

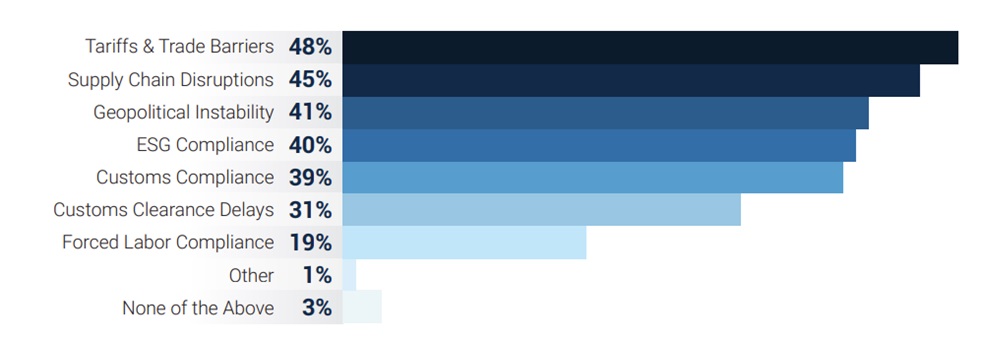

These challenges and others (see Figure 1) highlight the need among organizations involved in international trade to sharpen their supply chain analytics practices to help build more resilient supply chain networks, including having robust, technology-enabled insights to keep pace with frequent and complex tariff updates, quickly find new markets, secure better sources of supply and acquire timely and high quality competitive intelligence.

Figure 1: Respondents’ top challenges in international trade operations

Source: Descartes/SAPIO

Results also showed that the impact of top global trade challenges on organizations can potentially vary by factors other than company size, including business growth, country and industry. For example, tariffs and trade barriers were more concerning for companies expecting greater than

“Evolving tariffs and trade policies are one of a number of complex issues requiring organizations to build more resilience into their supply chains through compliance, technology and strategic planning,” said Jackson Wood, Director, Industry Strategy at Descartes. “With the potential for the incoming U.S. administration to impose new and additional tariffs on a wide variety of goods and countries of origin, U.S. importers may need to significantly re-engineer their sourcing strategies to mitigate potentially higher costs.”

Descartes and SAPIO Research surveyed 978 supply chain intelligence leaders in key trading nations across Europe, North and South America, and Asia-Pacific. The goal was to understand the nature of the global trade challenges they were facing and to identify if concerns varied by factors such as country, industry, company size and business growth. Respondents are members of company leadership teams, from management level to Chief Executive Officer or Owner. To learn more, read the 2024 Supply Chain Intelligence Report: Escalating Challenges for Global Supply Chain Leaders report.

Learn more about Descartes’ global trade intelligence solutions.

About Descartes

Descartes (Nasdaq:DSGX) (TSX:DSG) is the global leader in providing on-demand, software-as-a-service solutions focused on improving the productivity, security and sustainability of logistics-intensive businesses. Customers use our modular, software-as-a-service solutions to route, track and help improve the safety, performance and compliance of delivery resources; plan, allocate and execute shipments; rate, audit and pay transportation invoices; access global trade data; file customs and security documents for imports and exports; and complete numerous other logistics processes by participating in the world’s largest, collaborative multimodal logistics community. Our headquarters are in Waterloo, Ontario, Canada and we have offices and partners around the world. Learn more at www.descartes.com, and connect with us on LinkedIn and Twitter.

Global Media Contact

Cara Strohack

Tel: +1(800) 419-8495 ext. 202025

cstrohack@descartes.com

Cautionary Statement Regarding Forward-Looking Statements

This release contains forward-looking information within the meaning of applicable securities laws (“forward-looking statements”) that relate to Descartes’ global trade intelligence solution offerings and potential benefits derived therefrom; and other matters. Such forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements to differ materially from the anticipated results, performance or achievements or developments expressed or implied by such forward-looking statements. Such factors include, but are not limited to, the factors and assumptions discussed in the section entitled, “Certain Factors That May Affect Future Results” in documents filed with the Securities and Exchange Commission, the Ontario Securities Commission and other securities commissions across Canada including Descartes’ most recently filed management’s discussion and analysis. If any such risks actually occur, they could materially adversely affect our business, financial condition or results of operations. In that case, the trading price of our common shares could decline, perhaps materially. Readers are cautioned not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. Forward-looking statements are provided for the purposes of providing information about management’s current expectations and plans relating to the future. Readers are cautioned that such information may not be appropriate for other purposes. We do not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in our expectations or any change in events, conditions or circumstances on which any such statement is based, except as required by law.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/52ccb611-13b6-436a-934d-c5d3eb1fb001