Descartes Study: 74% of Supply Chain Leaders See Technology as Key to Growth Amid Rising Global Trade Complexities

Descartes Systems Group (DSGX) has released a comprehensive study revealing that 74% of supply chain and logistics leaders consider technology fundamental or highly important for organizational growth amid global trade challenges. This percentage increases to 88% for companies projecting over 15% growth in the next two years.

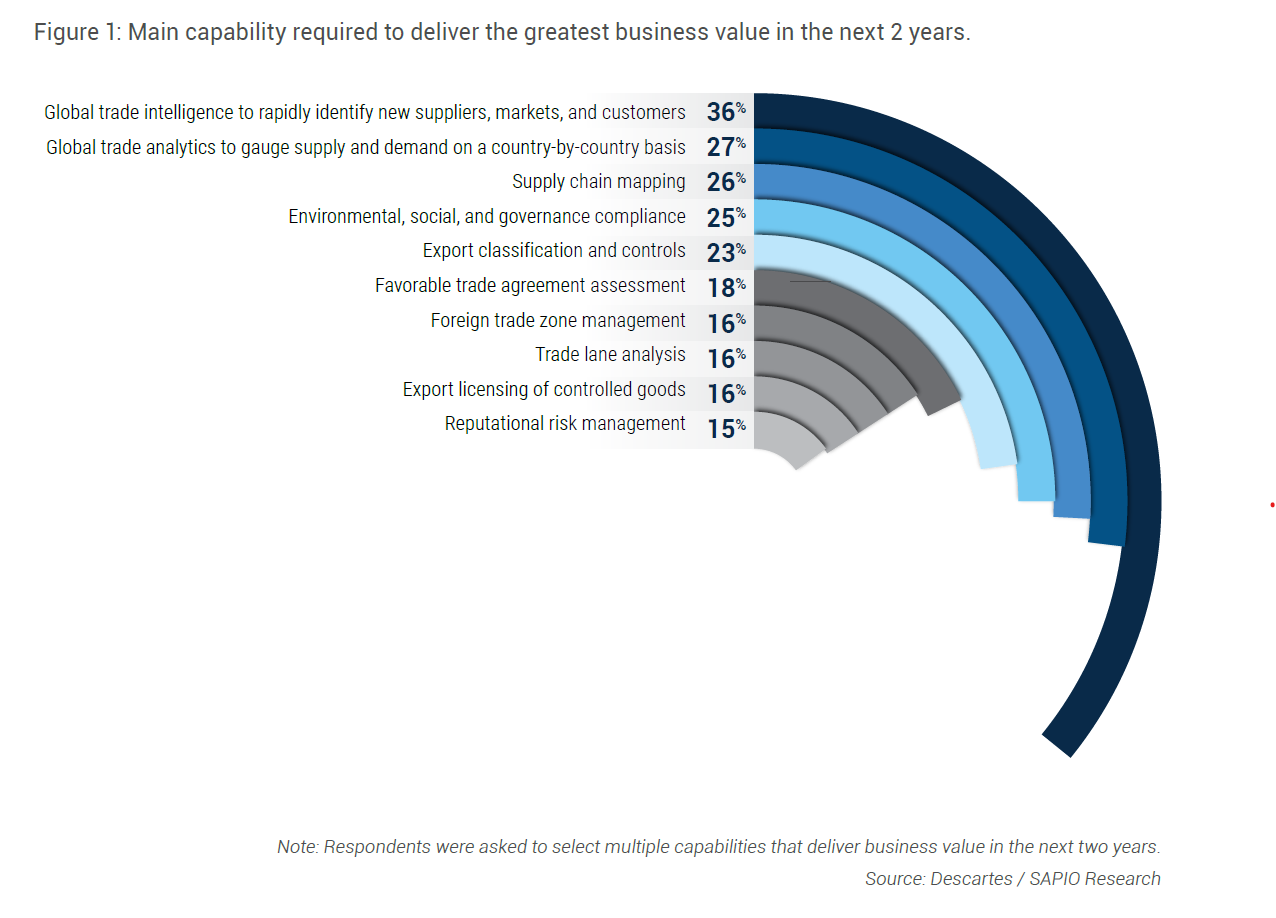

The study, surveying 978 supply chain intelligence leaders globally, found that 59% of respondents view technology as important for competitive advantage in international trade. Global trade intelligence emerged as the top technology capability (36%) expected to deliver the greatest value in the next two years, followed by global trade analytics (27%) and supply chain mapping (26%).

Across industries, global trade intelligence was consistently ranked as the primary technology capability, with wholesale and distribution leading at 44%, manufacturing at 40%, finance and insurance at 38%, and retail at 30%.

Descartes Systems Group (DSGX) ha pubblicato uno studio completo che rivela che il 74% dei leader della supply chain e della logistica considera la tecnologia fondamentale o molto importante per la crescita organizzativa in mezzo alle sfide del commercio globale. Questa percentuale aumenta al 88% per le aziende che prevedono una crescita superiore al 15% nei prossimi due anni.

Lo studio, che ha coinvolto 978 leader nell'intelligence della supply chain a livello globale, ha scoperto che il 59% dei rispondenti vede la tecnologia come importante per il vantaggio competitivo nel commercio internazionale. L'intelligence commerciale globale è emersa come la principale capacità tecnologica (36%) che ci si aspetta generi il maggiore valore nei prossimi due anni, seguita dall'analisi commerciale globale (27%) e dalla mappatura della supply chain (26%).

In tutti i settori, l'intelligence commerciale globale è stata costantemente classificata come la principale capacità tecnologica, con all'ingrosso e distribuzione in testa al 44%, manifatturiero al 40%, finanza e assicurazioni al 38% e retail al 30%.

Descartes Systems Group (DSGX) ha publicado un estudio completo que revela que el 74% de los líderes de la cadena de suministro y la logística consideran la tecnología fundamental o muy importante para el crecimiento organizativo en medio de los desafíos del comercio global. Este porcentaje aumenta al 88% para las empresas que proyectan más del 15% de crecimiento en los próximos dos años.

El estudio, que encuestó a 978 líderes de inteligencia en la cadena de suministro a nivel mundial, encontró que el 59% de los encuestados ve la tecnología como importante para la ventaja competitiva en el comercio internacional. La inteligencia comercial global surgió como la principal capacidad tecnológica (36%) que se espera genere el mayor valor en los próximos dos años, seguida de la analítica comercial global (27%) y la cartografía de la cadena de suministro (26%).

En todos los sectores, la inteligencia comercial global fue constantemente clasificada como la principal capacidad tecnológica, con el comercio mayorista y la distribución liderando con un 44%, la manufactura con un 40%, las finanzas y los seguros con un 38%, y el comercio minorista con un 30%.

Descartes Systems Group (DSGX)는 포괄적인 연구 결과를 발표하여 74%의 공급망 및 물류 리더들이 글로벌 무역의 도전 속에서 조직 성장에 있어 기술이 근본적이거나 매우 중요하다고 고려한다고 밝혔다. 이 비율은 향후 2년 동안 15% 이상의 성장을 예상하는 기업에서는 88%로 증가합니다.

이 연구는 전 세계 978명의 공급망 인텔리전스 리더를 대상으로 진행되었으며, 59%의 응답자가 기술을 국제 무역에서 경쟁 우위를 위한 중요한 요소로 보고있음을 발견했습니다. 글로벌 무역 인텔리전스는 향후 2년 동안 가장 큰 가치를 제공할 것으로 예상되는 주요 기술 역량(36%)으로 나타났으며, 그 다음으로 글로벌 무역 분석(27%)과 공급망 매핑(26%)이 뒤를 이었습니다.

업종에 관계없이 글로벌 무역 인텔리전스는 일관되게 주요 기술 역량으로 평가되었으며, 도매 및 유통은 44%로 선두를 차지하고, 제조업은 40%, 금융 및 보험은 38%, 소매는 30%로 평가되었습니다.

Descartes Systems Group (DSGX) a publié une étude complète révélant que 74% des leaders de la chaîne d'approvisionnement et de la logistique considèrent la technologie comme fondamentale ou très importante pour la croissance organisationnelle face aux défis du commerce mondial. Ce pourcentage passe à 88% pour les entreprises prévoyant une croissance de plus de 15% au cours des deux prochaines années.

L'étude, qui a interrogé 978 leaders en intelligence de la chaîne d'approvisionnement à l'échelle mondiale, a révélé que 59% des répondants estiment que la technologie est importante pour l'avantage concurrentiel dans le commerce international. L'intelligence commerciale mondiale est apparue comme la principale capacité technologique (36%) dont on s'attend à ce qu'elle génère la plus grande valeur dans les deux prochaines années, suivie par l'analyse commerciale mondiale (27%) et la cartographie de la chaîne d'approvisionnement (26%).

Dans tous les secteurs, l'intelligence commerciale mondiale a été constamment classée comme la principale capacité technologique, le commerce de gros et la distribution étant en tête avec 44%, suivi par le secteur manufacturier avec 40%, le secteur financier et les assurances avec 38%, et le commerce de détail avec 30%.

Descartes Systems Group (DSGX) hat eine umfassende Studie veröffentlicht, die zeigt, dass 74% der Führungskräfte in der Lieferkette und Logistik Technologie als grundlegend oder sehr wichtig für das organisatorische Wachstum im Zuge globaler Handelsherausforderungen betrachten. Dieser Prozentsatz steigt auf 88% für Unternehmen, die in den nächsten zwei Jahren mit einem Wachstum von über 15% rechnen.

Die Studie, die 978 Führungskräfte im Bereich Lieferkettenintelligenz weltweit befragte, ergab, dass 59% der Befragten Technologie als wichtig für den Wettbewerbsvorteil im internationalen Handel ansehen. Globale Handelsintelligenz erwies sich als die wichtigste technologische Fähigkeit (36%), die in den nächsten zwei Jahren den größten Wert liefern soll, gefolgt von globaler Handelsanalyse (27%) und Lieferkettenmapping (26%).

In allen Branchen wurde globale Handelsintelligenz konsequent als die Haupttechnologiefähigkeit eingestuft, wobei Großhandel und Distribution mit 44% führend sind, gefolgt von der Fertigungsindustrie mit 40%, Finanzen und Versicherungen mit 38% und dem Einzelhandel mit 30%.

- 74% of supply chain leaders recognize technology as important for growth strategy

- 88% of high-growth companies prioritize technology integration

- Strong cross-industry recognition of global trade intelligence importance

- 59% view technology as key competitive advantage driver

- None.

Insights

The survey findings reveal a critical shift in corporate priorities, with 74% of supply chain leaders recognizing technology as a fundamental growth driver. More telling is the 88% figure among high-growth companies, indicating a strong correlation between technology adoption and business expansion. The focus on global trade intelligence (GTI) as the primary value driver (36%) across multiple sectors suggests a market-wide recognition of the need for sophisticated data analytics in navigating complex international trade landscapes.

The cross-industry consensus on GTI's importance, particularly in manufacturing (40%) and wholesale distribution (44%), points to a significant market opportunity for Descartes' solutions. The timing of this study is strategic, coinciding with heightened global trade tensions and supply chain disruptions. For investors, this validates Descartes' market positioning and suggests potential revenue growth in their GTI segment. The survey's robust sample size of 978 leaders and its geographic diversity adds credibility to these findings.

Looking beyond the surface statistics, the study's emphasis on global trade analytics (27%) and supply chain mapping (26%) as secondary priorities reveals a sophisticated understanding of modern supply chain needs. These technologies form an interconnected ecosystem that enables predictive decision-making and risk mitigation. The high prioritization among finance and insurance sectors (38%) indicates that trade intelligence is evolving from an operational tool to a strategic asset for financial planning and risk management.

What's particularly noteworthy is how this aligns with current market dynamics where companies need real-time visibility and predictive capabilities to navigate supply chain disruptions. For context, imagine these tools as an advanced weather radar system for global trade - they don't just show current conditions but help predict and navigate around potential disruptions before they impact operations. This positions Descartes favorably in the growing market for integrated supply chain intelligence solutions.

Global Trade Intelligence and Global Trade Analytics are Top Technologies Expected to Deliver Business Value

ATLANTA and LONDON, Jan. 21, 2025 (GLOBE NEWSWIRE) -- Descartes Systems Group (Nasdaq:DSGX) (TSX:DSG), the global leader in uniting logistics-intensive businesses in commerce, released findings from its study What Companies are Doing to Tackle Escalating Global Supply Chain Challenges. The study shows that

When considering what technology capabilities are expected to help companies involved in international trade enable business growth and gain a competitive advantage,

Source: Descartes/SAPIO

Results also showed that respondents across all industries agreed that global trade intelligence was the top technology capability expected to deliver the greatest value over the next two years, including, for example, in manufacturing (

“For companies in diverse industries, global trade has become much more complex, with many new challenges to traditional business operations,” said Jackson Wood, Director, Industry Strategy at Descartes. “As businesses contend with tariffs and trade barriers, geopolitical instability, supply chain disruptions and compliance requirements, technology tools can help them build greater agility and resilience into their supply chains to compete more effectively.”

Descartes and SAPIO Research surveyed 978 supply chain intelligence leaders in key trading nations across Europe, North and South America, and Asia-Pacific. The goal was to understand the strategies, tactics and technologies used by companies involved in international trade to help gain a competitive advantage and ensure continued business growth, and to identify if these varied by factors such as country, industry, company size and business growth. Respondents are members of company leadership teams, from management level to Chief Executive Officer or Owner. To learn more, read the study What Companies are Doing to Tackle Escalating Global Supply Chain Challenges.

Learn more about Descartes’ global trade intelligence solutions.

About Descartes

Descartes (Nasdaq:DSGX) (TSX:DSG) is the global leader in providing on-demand, software-as-a-service solutions focused on improving the productivity, security and sustainability of logistics-intensive businesses. Customers use our modular, software-as-a-service solutions to route, track and help improve the safety, performance and compliance of delivery resources; plan, allocate and execute shipments; rate, audit and pay transportation invoices; access global trade data; file customs and security documents for imports and exports; and complete numerous other logistics processes by participating in the world’s largest, collaborative multimodal logistics community. Our headquarters are in Waterloo, Ontario, Canada and we have offices and partners around the world. Learn more at www.descartes.com, and connect with us on LinkedIn and Twitter.

Global Media Contact

Cara Strohack

cstrohack@descartes.com

Cautionary Statement Regarding Forward-Looking Statements

This release contains forward-looking information within the meaning of applicable securities laws (“forward-looking statements”) that relate to Descartes’ global trade intelligence solution offerings and potential benefits derived therefrom; and other matters. Such forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements to differ materially from the anticipated results, performance or achievements or developments expressed or implied by such forward-looking statements. Such factors include, but are not limited to, the factors and assumptions discussed in the section entitled, “Certain Factors That May Affect Future Results” in documents filed with the Securities and Exchange Commission, the Ontario Securities Commission and other securities commissions across Canada including Descartes’ most recently filed management’s discussion and analysis. If any such risks actually occur, they could materially adversely affect our business, financial condition or results of operations. In that case, the trading price of our common shares could decline, perhaps materially. Readers are cautioned not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. Forward-looking statements are provided for the purposes of providing information about management’s current expectations and plans relating to the future. Readers are cautioned that such information may not be appropriate for other purposes. We do not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in our expectations or any change in events, conditions or circumstances on which any such statement is based, except as required by law.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/10c34d00-34d1-44e2-b20e-c04b8e202018