Duluth Holdings Inc. Announces Second Quarter 2024 Financial Results

Rhea-AI Summary

Duluth Holdings Inc. (NASDAQ: DLTH) announced its Q2 2024 financial results, reporting net sales growth of 1.8% to $141.6 million. The company's gross margin expanded by 90 basis points to 52.3%, benefiting from product and sourcing initiatives. Duluth Trading reported a net loss of $3.7 million and an adjusted net loss of $0.6 million, excluding restructuring expenses and a non-recurring sales tax expense accrual.

Key highlights include:

- EPS per diluted share of ($0.11); Adjusted EPS of ($0.02)

- Adjusted EBITDA increased by $2.0 million to $10.6 million

- Strong financial position with no debt and approximately $210 million of liquidity

The company reaffirmed its Fiscal 2024 outlook, excluding restructuring expense and sales tax expense accrual, projecting net sales of approximately $640 million and Adjusted EPS of ($0.22) per diluted share.

Positive

- Net sales increased 1.8% to $141.6 million

- Gross margin expanded by 90 basis points to 52.3%

- Direct-to-consumer net sales increased by 5.6% to $91.7 million

- Adjusted EBITDA increased $2.0 million to $10.6 million

- Strong financial position with no debt and $209.8 million of liquidity

- Successful implementation of automated fulfillment center in Adairsville, processing 58% of total company volume

Negative

- Net loss of $3.7 million compared to $2.0 million in the prior year quarter

- Retail store net sales decreased by 4.4% to $49.9 million due to slower store traffic

- Selling, general and administrative expenses increased 4.6% to $76.3 million

- Restructuring expenses of $1.6 million recognized in Q2, with total expected expenses of $7.4 million

- Forecasted Adjusted EPS of ($0.22) per diluted share for Fiscal 2024

News Market Reaction

On the day this news was published, DLTH gained 18.89%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Year-over-year net sales growth of

Benefiting from our product and sourcing initiatives, gross margin expands 90 basis points to

Strong financial position with no debt and approximately

Reaffirmed Fiscal 2024 outlook excluding restructuring expense and sales tax expense accrual

MOUNT HOREB, Wis., Aug. 29, 2024 (GLOBE NEWSWIRE) -- Duluth Holdings Inc. (dba, Duluth Trading Company) (“Duluth Trading” or the “Company”) (NASDAQ: DLTH), a lifestyle brand of men’s and women’s workwear, casual wear, outdoor apparel and accessories, today announced its financial results for the fiscal second quarter ended July 28, 2024.

Summary of the Second Quarter Ended July 28, 2024

- Net sales of 141.6 million increased

1.8% compared to the prior year second quarter - Net loss of

$3.7 million and adjusted net loss1 of$0.6 million , compared to net loss of$2.0 million in the prior year second quarter. Adjusted net loss of$0.6 million excludes$1.6 million of restructuring expense and a$2.4 million non-recurring estimated sales tax expense accrual that is reflected in Selling, general and administrative expenses - EPS per diluted share of (

$0.11) ; Adjusted EPS1 of ($0.02) - Adjusted EBITDA2 increased

$2.0 million from the prior year to$10.6 million , representing7.5% of net sales

1See Reconciliation of net loss to adjusted net loss and adjusted net loss to adjusted EPS in the accompanying financial tables.

2See Reconciliation of net loss to EBITDA and EBITDA to Adjusted EBITDA in the accompanying financial tables.

Management Commentary

President and CEO, Sam Sato commented, “We are pleased to have returned to top-line growth in the second quarter, while also expanding our gross margin as we begin to see the benefits of our product development and sourcing initiatives. During the quarter we saw a trend line improvement in both traffic and transactions with healthy shopper conversion, fueling

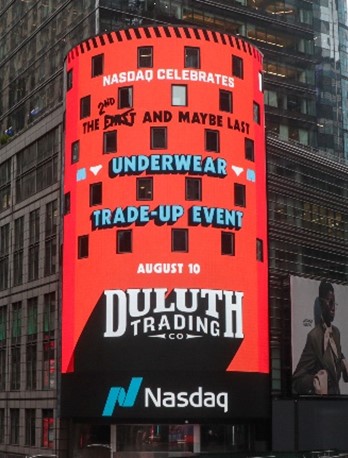

“We entered the third quarter with a strong lineup of newness such as Duluth Reserve, Bullpen 3D and Souped up Sweats and we expanded our Plus size assortment including our successful Adjustabust, a bonded

zip-front bra with a sleek silhouette and criss-crossed back offering extra support and security. On August 10th we successfully hosted our second underwear trade-up event engaging with existing and new customers throughout our local store markets. The event generated a lot of buzz and resulted in a jump in traffic, higher overall sales, and

Sato concluded, “From a longer-term structural update, we have successfully moved into phase two of our fulfillment center network plan to maximize productivity and capacity. The tremendous success we are seeing with our near fully automated fulfillment center in Adairsville, Georgia, which processed

Operating Results for the Second Quarter Ended July 28, 2024

Net sales increased

Gross profit increased to

Selling, general and administrative expenses increased

As part of the Company’s in-depth review of the retail portfolio strategy, fulfillment center network, and benchmarking to identify structural opportunities to improve operating margin, working capital, and asset efficiency, in the second quarter of 2024, the Company began phase two of the fulfillment center network plan to maximize productivity and capacity. As a result, the Company initiated a lease amendment for one of its legacy fulfillment centers to accelerate the lease expiration date from September 2030 to October 2024.

The Company expects to incur total restructuring expenses related to the lease amendment of

Exiting the legacy facility is projected to reduce overhead expenses by approximately

As previously mentioned, during the third quarter last year, the Company went live with a highly automated fulfillment center in Adairsville, Georgia which now processes

Balance Sheet and Liquidity

The Company ended the quarter with

Fiscal 2024 Outlook

The Company reaffirmed its fiscal 2024 outlook, excluding restructuring expense and sales tax expense accrual:

- Net sales of approximately

$640 million - Adjusted EPS1 of approximately (

$0.22) per diluted share - Adjusted EBITDA2 of approximately

$39 million - Capital expenditures, inclusive of software hosting implementation costs, of approximately

$25 million

1See Reconciliation of forecasted net loss to forecasted adjusted net loss and forecasted adjusted net loss to forecasted adjusted EPS in the accompanying financial tables.

2See Reconciliation of forecasted net loss to forecasted EBITDA and forecasted EBITDA to forecasted Adjusted EBITDA in the accompanying financial tables.

Conference Call Information

A conference call and audio webcast with analysts and investors will be held on Thursday, August 29, 2024 at 9:30 am Eastern Time, to discuss the results and answer questions.

- Live conference call: 844-875-6915 (domestic) or 412-317-6711 (international)

- Conference call replay available through September 5, 2024: 877-344-7529 (domestic) or 412-317-0088 (international)

- Replay access code: 5705373

- Live and archived webcast: ir.duluthtrading.com

Investors can pre-register for the earnings conference call to expedite their entry into the call and avoid waiting for a live operator. To pre-register for the call, please visit https://dpregister.com/sreg/10191086/fd20abea22 and enter your contact information. You will then be issued a personalized phone number and pin to dial into the live conference call. Investors can pre-register any time prior to the start of the conference call.

About Duluth Trading

Duluth Trading is a lifestyle brand for the Modern, Self-Reliant American. Based in Mount Horeb, Wisconsin, we offer high quality, solution-based casual wear, workwear and accessories for men and women who lead a hands-on lifestyle and who value a job well-done. We provide our customers an engaging and entertaining experience. Our marketing incorporates humor and storytelling that conveys the uniqueness of our products in a distinctive, fun way, and are available through our content-rich website, catalogs, and “store like no other” retail locations. We are committed to outstanding customer service backed by our “No Bull Guarantee” - if it’s not right, we’ll fix it. Visit our website at http://www.duluthtrading.com.

Non-GAAP Measurements

Management believes that non-GAAP financial measures may be useful in certain instances to provide additional meaningful comparisons between current results and results in prior operating periods. Within this release, including the tables attached hereto, reference is made to adjusted earnings before interest, taxes, depreciation and amortization (EBITDA), adjusted net loss and adjusted earnings per share (EPS). See attached table “Reconciliation of Net Loss to EBITDA and EBITDA to Adjusted EBITDA,” for a reconciliation of net loss to EBITDA and EBITDA to Adjusted EBITDA for the three and six months ended July 28, 2024, versus the three and six months ended July 30, 2023 and attached table “Reconciliation of Net Loss to Adjusted Net Loss and Adjusted Net Loss to Adjusted EPS,” for a reconciliation of net loss to adjusted net loss and adjusted net loss to adjusted EPS for the three and six months ended July 28, 2024.

Adjusted EBITDA is a metric used by management and frequently used by the financial community, which provides insight into an organization’s operating trends and facilitates comparisons between peer companies, since interest, taxes, depreciation and amortization can differ greatly between organizations as a result of differing capital structures and tax strategies. Adjusted EBITDA excludes certain items that are unusual in nature or not comparable from period to period.

Adjusted Net Loss and Adjusted EPS is a metric used by management and frequently used by the financial community, which provides insight into the effectiveness of our business strategies and to compare our performance against that of peer companies. Adjusted Net Loss and Adjusted EPS excludes restructuring expenses and a one-time estimated sales tax accrual that are not comparable from period to period.

The Company provides this information to investors to assist in comparisons of past, present and future operating results and to assist in highlighting the results of on-going operations. While the Company’s management believes that non-GAAP measurements are useful supplemental information, such adjusted results are not intended to replace the Company’s GAAP financial results and should be read in conjunction with those GAAP results.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts included in this press release, including statements concerning Duluth Trading's plans, objectives, goals, beliefs, business strategies, future events, business conditions, its results of operations, financial position and its business outlook, business trends and certain other information herein, including statements under the heading “Fiscal 2024 Outlook” are forward-looking statements. You can identify forward-looking statements by the use of words such as “may,” ”might,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “believe,” “estimate,” “project,” “target,” “predict,” “intend,” “future,” “budget,” “goals,” “potential,” “continue,” “design,” “objective,” “forecasted,” “would” and other similar expressions. The forward-looking statements are not historical facts, and are based upon Duluth Trading's current expectations, beliefs, estimates, and projections, and various assumptions, many of which, by their nature, are inherently uncertain and beyond Duluth Trading's control. Duluth Trading's expectations, beliefs and projections are expressed in good faith, and Duluth Trading believes there is a reasonable basis for them. However, there can be no assurance that management's expectations, beliefs, estimates, and projections will be achieved and actual results may vary materially from what is expressed in or indicated by the forward-looking statements. Forward-looking statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the forward-looking statements, including, among others, the risks, uncertainties, and factors set forth under Part 1, Item 1A “Risk Factors” in the Company’s Annual Report on Form 10-K filed with the SEC on March 22, 2024 and other factors as may be periodically described in Duluth Trading’s subsequent filings with the SEC. These risks and uncertainties include, but are not limited to, the following: the impact of inflation and measures to control inflation on our results of operations; the prolonged effects of economic uncertainties on store and website traffic and disruptions to our distribution network, supply chains and operations; our ability to maintain and enhance a strong brand and sub-brand image; adapting to declines in consumer confidence, inflation and decreases in consumer spending; disruptions in our e-commerce platform; effectively adapting to new challenges associated with our expansion into new geographic markets; our ability to meet customer delivery time expectations; natural disasters, unusually adverse weather conditions, boycotts, prolonged public health crises, epidemics or pandemics and unanticipated events; generating adequate cash from our existing stores and direct sales to support our growth; the impact of changes in corporate tax regulations and sales tax; identifying and responding to new and changing customer preferences; the success of the locations in which our stores are located; effectively relying on sources for merchandise located in foreign markets; transportation delays and interruptions, including port congestion; inability to timely and effectively obtain shipments of products from our suppliers and deliver merchandise to our customers; the inability to maintain the performance of a maturing store portfolio; our inability to deploy marketing tactics to strengthen brand awareness and attract new customers in a cost effective manner; our ability to successfully open new stores; competing effectively in an environment of intense competition; our ability to adapt to significant changes in sales due to the seasonality of our business; price reductions or inventory shortages resulting from failure to purchase the appropriate amount of inventory in advance of the season in which it will be sold; the potential for further increases in price and availability of raw materials; our dependence on third-party vendors to provide us with sufficient quantities of merchandise at acceptable prices; the susceptibility of the price and availability of our merchandise to international trade conditions; failure of our vendors and their manufacturing sources to use acceptable labor or other practices; our dependence upon key executive management or our inability to hire or retain the talent required for our business; increases in costs of fuel or other energy, transportation or utility costs and in the costs of labor and employment; failure of our information technology systems to support our current and growing business, before and after our planned upgrades; disruptions in our supply chain and fulfillment centers; our inability to protect our trademarks or other intellectual property rights; infringement on the intellectual property of third parties; acts of war, terrorism or civil unrest; the impact of governmental laws and regulations and the outcomes of legal proceedings; changes in U.S. and non-U.S. laws affecting the importation and taxation of goods, including imposition of unilateral tariffs on imported goods; our ability to secure the personal and/or financial information of our customers and employees; our ability to comply with the security standards for the credit card industry; our failure to maintain adequate internal controls over our financial and management systems; acquisition, disposition, and development risks; and other factors that may be disclosed in our SEC filings or otherwise. Forward-looking statements speak only as of the date the statements are made. Duluth Trading assumes no obligation to update forward-looking statements to reflect actual results, subsequent events or circumstances or other changes affecting forward-looking information except to the extent required by applicable securities laws.

(Tables Follow)

***

| DULUTH HOLDINGS INC. Condensed Consolidated Balance Sheets (Unaudited) (Amounts in thousands) | ||||||||||||

| July 28, 2024 | January 28, 2024 | July 30, 2023 | ||||||||||

| ASSETS | ||||||||||||

| Current Assets: | ||||||||||||

| Cash and cash equivalents | $ | 9,787 | $ | 32,157 | $ | 11,148 | ||||||

| Receivables | 8,318 | 5,955 | 5,758 | |||||||||

| Income tax receivable | 313 | 617 | 140 | |||||||||

| Inventory, net | 168,718 | 125,757 | 157,126 | |||||||||

| Prepaid expenses & other current assets | 19,722 | 16,488 | 17,665 | |||||||||

| Total current assets | 206,858 | 180,974 | 191,837 | |||||||||

| Property and equipment, net | 121,148 | 132,718 | 125,970 | |||||||||

| Operating lease right-of-use assets | 107,799 | 121,430 | 126,132 | |||||||||

| Finance lease right-of-use assets, net | 34,646 | 40,315 | 45,742 | |||||||||

| Available-for-sale security | 4,877 | 4,986 | 5,254 | |||||||||

| Other assets, net | 8,961 | 9,020 | 7,853 | |||||||||

| Deferred tax assets | 4,306 | 1,010 | 353 | |||||||||

| Total assets | $ | 488,595 | $ | 490,453 | $ | 503,141 | ||||||

| LIABILITIES AND SHAREHOLDERS' EQUITY | ||||||||||||

| Current liabilities: | ||||||||||||

| Trade accounts payable | $ | 77,600 | $ | 51,122 | $ | 59,259 | ||||||

| Accrued expenses and other current liabilities | 30,069 | 30,930 | 28,215 | |||||||||

| Current portion of operating lease liabilities | 16,027 | 16,401 | 15,993 | |||||||||

| Current portion of finance lease liabilities | 2,450 | 3,149 | 2,964 | |||||||||

| Current maturities of TRI long-term debt1 | 888 | 847 | 807 | |||||||||

| Total current liabilities | 127,034 | 102,449 | 107,238 | |||||||||

| Operating lease liabilities, less current maturities | 92,275 | 106,413 | 110,999 | |||||||||

| Finance lease liabilities, less current maturities | 31,911 | 34,276 | 35,906 | |||||||||

| TRI long-term debt, less current maturities1 | 24,723 | 25,141 | 25,538 | |||||||||

| Total liabilities | 275,943 | 268,279 | 279,681 | |||||||||

| Shareholders' equity: | ||||||||||||

| Treasury stock | (2,243 | ) | (1,738 | ) | (1,733 | ) | ||||||

| Capital stock | 106,169 | 103,579 | 101,415 | |||||||||

| Retained earnings | 112,199 | 123,816 | 127,299 | |||||||||

| Accumulated other comprehensive loss, net | (436 | ) | (427 | ) | (295 | ) | ||||||

| Total shareholders' equity of Duluth Holdings Inc. | 215,689 | 225,230 | 226,686 | |||||||||

| Noncontrolling interest | (3,037 | ) | (3,056 | ) | (3,226 | ) | ||||||

| Total shareholders' equity | 212,652 | 222,174 | 223,460 | |||||||||

| Total liabilities and shareholders' equity | $ | 488,595 | $ | 490,453 | $ | 503,141 | ||||||

1Represents debt of the variable interest entity, TRI Holdings, LLC, that is consolidated in accordance with ASC 810, Consolidation. Duluth Holdings Inc. is not the guarantor nor the obligor of this debt.

| DULUTH HOLDING INC. Consolidated Statements of Operations (Unaudited) (Amounts in thousands, except per share figures) | ||||||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||

| July 28, 2024 | July 30, 2023 | July 28, 2024 | July 30, 2023 | |||||||||||||

| Net sales | $ | 141,619 | $ | 139,099 | $ | 258,303 | $ | 262,858 | ||||||||

| Cost of goods sold (excluding depreciation and amortization) | 67,623 | 67,616 | 122,683 | 125,724 | ||||||||||||

| Gross profit | 73,996 | 71,483 | 135,620 | 137,134 | ||||||||||||

| Selling, general and administrative expenses1 | 76,286 | 72,926 | 146,881 | 143,126 | ||||||||||||

| Restructuring expense | 1,596 | — | 1,596 | — | ||||||||||||

| Operating loss | (3,886 | ) | (1,443 | ) | (12,857 | ) | (5,992 | ) | ||||||||

| Interest expense | 988 | 880 | 1,981 | 1,814 | ||||||||||||

| Other income, net | 145 | 109 | 161 | 257 | ||||||||||||

| Loss before income taxes | (4,729 | ) | (2,214 | ) | (14,677 | ) | (7,549 | ) | ||||||||

| Income tax benefit | (996 | ) | (202 | ) | (3,079 | ) | (1,660 | ) | ||||||||

| Net loss | (3,733 | ) | (2,012 | ) | (11,598 | ) | (5,889 | ) | ||||||||

| Less: Net income (loss) attributable to noncontrolling interest | 11 | (8 | ) | 19 | (16 | ) | ||||||||||

| Net loss attributable to controlling interest | $ | (3,744 | ) | $ | (2,004 | ) | $ | (11,617 | ) | $ | (5,873 | ) | ||||

| Basic earnings per share (Class A and Class B): | ||||||||||||||||

| Weighted average shares of common stock outstanding | 33,367 | 32,952 | 33,247 | 32,912 | ||||||||||||

| Net loss per share attributable to controlling interest | $ | (0.11 | ) | $ | (0.06 | ) | $ | (0.35 | ) | $ | (0.18 | ) | ||||

| Diluted earnings per share (Class A and Class B): | ||||||||||||||||

| Weighted average shares and equivalents outstanding | 33,367 | 32,952 | 33,247 | 32,912 | ||||||||||||

| Net loss per share attributable to controlling interest | $ | (0.11 | ) | $ | (0.06 | ) | $ | (0.35 | ) | $ | (0.18 | ) | ||||

1In conjunction with ongoing state sales tax audits the Company began a review of its sales tax positions. As a result of the review, the Company recorded an estimated sales tax expense accrual of

| DULUTH HOLDINGS INC. Consolidated Statements of Cash Flows (Unaudited) (Amounts in thousands) | ||||||||

| Six Months Ended | ||||||||

| July 28, 2024 | July 30, 2023 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (11,598 | ) | $ | (5,889 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation and amortization | 16,297 | 14,868 | ||||||

| Stock based compensation | 2,383 | 2,284 | ||||||

| Deferred income taxes | (3,293 | ) | (1,553 | ) | ||||

| Loss on disposal of property and equipment | 77 | 16 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Receivables | (2,363 | ) | 283 | |||||

| Income taxes receivable | 304 | (140 | ) | |||||

| Inventory | (42,961 | ) | (2,204 | ) | ||||

| Prepaid expense & other current assets | 130 | (1,351 | ) | |||||

| Software hosting implementation costs, net | (3,406 | ) | (370 | ) | ||||

| Trade accounts payable | 26,623 | 2,716 | ||||||

| Income taxes payable | — | (1,761 | ) | |||||

| Accrued expenses and deferred rent obligations | (591 | ) | (7,343 | ) | ||||

| Other assets | (2 | ) | (20 | ) | ||||

| Noncash lease impacts | 1,348 | (785 | ) | |||||

| Net cash used in operating activities | (17,052 | ) | (1,249 | ) | ||||

| Cash flows from investing activities: | ||||||||

| Purchases of property and equipment | (3,183 | ) | (31,483 | ) | ||||

| Principal receipts from available-for-sale security | 97 | 88 | ||||||

| Net cash used in investing activities | (3,086 | ) | (31,395 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Proceeds from line of credit | 40,500 | 10,000 | ||||||

| Payments on line of credit | (40,500 | ) | (10,000 | ) | ||||

| Payments on TRI long term debt | (412 | ) | (373 | ) | ||||

| Payments on finance lease obligations | (1,521 | ) | (1,397 | ) | ||||

| Payments of tax withholding on vested restricted shares | (505 | ) | (274 | ) | ||||

| Other | 206 | 288 | ||||||

| Net cash used in financing activities | (2,232 | ) | (1,756 | ) | ||||

| Decrease in cash and cash equivalents | (22,370 | ) | (34,400 | ) | ||||

| Cash and cash equivalents at beginning of period | 32,157 | 45,548 | ||||||

| Cash and cash equivalents at end of period | $ | 9,787 | $ | 11,148 | ||||

| Supplemental disclosure of cash flow information: | ||||||||

| Interest paid | $ | 1,981 | $ | 1,814 | ||||

| Income taxes paid | $ | 125 | $ | 1,795 | ||||

| Supplemental disclosure of non-cash information: | ||||||||

| Unpaid liability to acquire property and equipment | $ | 1,459 | $ | 1,336 | ||||

| DULUTH HOLDINGS INC. Reconciliation of Net Loss to EBITDA and EBITDA to Adjusted EBITDA For the Fiscal Quarter and Six Months Ended July 28, 2024 and July 30, 2023 (Unaudited) (Amounts in thousands) | ||||||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||

| July 28, 2024 | July 30, 2023 | July 28, 2024 | July 30, 2023 | |||||||||||||

| (in thousands) | ||||||||||||||||

| Net loss | $ | (3,733 | ) | $ | (2,012 | ) | $ | (11,598 | ) | $ | (5,889 | ) | ||||

| Depreciation and amortization | 8,046 | 7,455 | 16,297 | 14,868 | ||||||||||||

| Amortization of internal-use software hosting | ||||||||||||||||

| subscription implementation costs | 1,292 | 1,150 | 2,462 | 2,420 | ||||||||||||

| Interest expense | 988 | 880 | 1,981 | 1,814 | ||||||||||||

| Income tax benefit | (996 | ) | (202 | ) | (3,079 | ) | (1,660 | ) | ||||||||

| EBITDA | $ | 5,597 | $ | 7,271 | $ | 6,063 | $ | 11,553 | ||||||||

| Stock based compensation | 1,011 | 1,294 | 2,383 | 2,284 | ||||||||||||

| Restructuring expense | 1,596 | — | 1,596 | — | ||||||||||||

| Sales tax expense accrual | 2,406 | — | 2,406 | — | ||||||||||||

| Adjusted EBITDA | $ | 10,610 | $ | 8,565 | $ | 12,448 | $ | 13,837 | ||||||||

| DULUTH HOLDINGS INC. Reconciliation of Forecasted Net Loss to Forecasted EBITDA and Forecasted EBITDA to Forecasted Adjusted EBITDA For the Fiscal Year Ending February 2, 2025 (Unaudited) (Amounts in thousands) | ||||

| Forecasted | ||||

| Net loss | $ | (14,800 | ) | |

| Depreciation and amortization | 33,200 | |||

| Amortization of internal-use software hosting subscription implementation costs | 5,000 | |||

| Interest expense | 5,450 | |||

| Income tax benefit | (4,350 | ) | ||

| EBITDA | $ | 24,500 | ||

| Stock based compensation | 4,694 | |||

| Restructuring expense | 7,400 | |||

| Sales tax expense accrual | 2,406 | |||

| Adjusted EBITDA | $ | 39,000 | ||

| DULUTH HOLDINGS INC. Reconciliation of Forecasted Net Loss to Forecasted Adjusted Net Loss and Forecasted Adjusted Net Loss to Forecasted Adjusted EPS For the Fiscal Year Ending February 2, 2025 (Unaudited) (Amounts in thousands) | ||||||||

| Forecasted | ||||||||

| (in thousands, except per share amounts) | Amount | Per share | ||||||

| Forecasted Net Loss | $ | (14,800 | ) | $ | (0.45 | ) | ||

| Plus: Forecasted income tax benefit | (4,350 | ) | (0.13 | ) | ||||

| Forecasted Net loss before income taxes | $ | (19,150 | ) | $ | (0.58 | ) | ||

| Plus: Forecasted restructuring expenses | 7,400 | 0.22 | ||||||

| Plus: Sales tax expense accrual | 2,406 | 0.07 | ||||||

| Forecasted Adjusted loss before income taxes | $ | (9,344 | ) | $ | (0.28 | ) | ||

| Forecasted Adjusted estimated income tax benefit | (1,944 | ) | (0.06 | ) | ||||

| Forecasted Adjusted net loss | $ | (7,400 | ) | $ | (0.22 | ) | ||

| DULUTH HOLDINGS INC. Reconciliation of Net Loss to Adjusted Net Loss and Adjusted Net Loss to Adjusted EPS For the Fiscal Quarter and Six Months Ended July 28, 2024 (Unaudited) (Amounts in thousands) | ||||||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||

| July 28, 2024 | July 28, 2024 | |||||||||||||||

| (in thousands, except per share amounts) | Amount | Per share | Amount | Per share | ||||||||||||

| Net Loss | $ | (3,733 | ) | $ | (0.11 | ) | $ | (11,598 | ) | $ | (0.35 | ) | ||||

| Plus: Income tax benefit | (996 | ) | (0.03 | ) | (3,079 | ) | (0.09 | ) | ||||||||

| Net loss before income taxes | $ | (4,729 | ) | $ | (0.14 | ) | $ | (14,677 | ) | $ | (0.44 | ) | ||||

| Plus: Restructuring expenses | 1,596 | 0.05 | 1,596 | 0.05 | ||||||||||||

| Plus: Sales tax expense accrual | 2,406 | 0.07 | 2,406 | 0.07 | ||||||||||||

| Adjusted loss before income taxes | $ | (727 | ) | $ | (0.02 | ) | $ | (10,675 | ) | $ | (0.32 | ) | ||||

| Adjusted estimated income tax benefit | (159 | ) | (0.00 | ) | (2,242 | ) | (0.07 | ) | ||||||||

| Adjusted net loss | $ | (568 | ) | $ | (0.02 | ) | $ | (8,433 | ) | $ | (0.25 | ) | ||||

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/258f8294-62c0-412d-b897-efc33dd32268