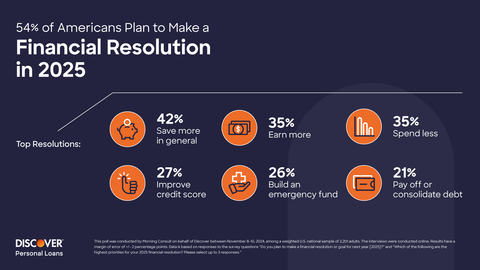

Discover Survey: Save More, Earn More and Spend Less Are Top 2025 Financial Resolutions for American Consumers

Discover's national survey reveals that 54% of U.S. consumers plan to make financial resolutions for 2025. The top financial goals include saving more (42%), earning more (35%), and spending less (35%). However, 94% of Americans anticipate challenges, with inflation (47%), unexpected expenses (39%), and economic conditions (38%) being primary concerns.

While 52% plan to budget in 2025, only 36% created a budget in 2024. Among those who budgeted in 2024, 22% stuck to it, reporting feelings of accomplishment (46%) and preparedness (38%). Looking ahead, most Americans are cautiously optimistic about their finances, with 45% expecting their situation to remain stable and 36% anticipating improvement. Younger generations show higher optimism, with 44% of Gen Zers and 45% of Millennials expecting better financial situations in 2025.

Il sondaggio nazionale di Discover rivela che il 54% dei consumatori statunitensi prevede di fare risoluzioni finanziarie per il 2025. Gli obiettivi finanziari principali includono risparmiare di più (42%), guadagnare di più (35%) e spendere meno (35%). Tuttavia, il 94% degli americani si aspetta delle difficoltà, con l'inflazione (47%), spese inattese (39%) e le condizioni economiche (38%) che rappresentano le principali preoccupazioni.

Mentre il 52% prevede di fare un bilancio nel 2025, solo il 36% ha creato un bilancio nel 2024. Tra coloro che hanno fatto un bilancio nel 2024, il 22% lo ha rispettato, riportando sentimenti di realizzazione (46%) e preparazione (38%). Guardando al futuro, la maggior parte degli americani è cautamente ottimista riguardo alle proprie finanze, con il 45% che si aspetta che la propria situazione rimanga stabile e il 36% che prevede un miglioramento. Le generazioni più giovani mostrano un ottimismo maggiore, con il 44% dei membri della Gen Z e il 45% dei Millennials che si aspettano situazioni finanziarie migliori nel 2025.

La encuesta nacional de Discover revela que el 54% de los consumidores de EE. UU. planean hacer resoluciones financieras para 2025. Los principales objetivos financieros incluyen ahorrar más (42%), ganar más (35%) y gastar menos (35%). Sin embargo, el 94% de los estadounidenses anticipa desafíos, siendo la inflación (47%), los gastos inesperados (39%) y las condiciones económicas (38%) las principales preocupaciones.

Mientras que el 52% planea hacer un presupuesto en 2025, solo el 36% creó un presupuesto en 2024. Entre aquellos que hicieron un presupuesto en 2024, el 22% se adhirió a él, reportando sentimientos de logro (46%) y preparación (38%). Mirando hacia adelante, la mayoría de los estadounidenses son cautelosamente optimistas acerca de sus finanzas, con el 45% que espera que su situación se mantenga estable y el 36% anticipando mejoras. Las generaciones más jóvenes muestran un mayor optimismo, con el 44% de la Generación Z y el 45% de los Millennials que esperan mejores situaciones financieras en 2025.

디스커버의 전국 설문조사에 따르면, 미국 소비자의 54%가 2025년을 위한 재정 결심을 세울 계획이라고 합니다. 주요 재정 목표로는 더 많이 저축하기 (42%), 더 많이 벌기 (35%), 덜 쓰기 (35%)가 있습니다. 그러나 94%의 미국인이 인플레이션 (47%), 예상치 못한 비용 (39%), 경제적 상황 (38%)과 같은 문제에 대해 우려하고 있습니다.

2025년에는 52%가 예산을 세울 계획이지만, 2024년에 예산을 세운 사람은 36%에 불과합니다. 2024년에 예산을 세운 사람 중 22%가 이를 지켰으며, 성취감 (46%)과 준비성 (38%)을 느꼈다고 보고했습니다. 앞으로를 내다보면, 대부분의 미국인은 재정에 대해 조심스러운 낙관론을 보이고 있으며, 45%는 자신의 상황이 안정적일 것으로 예상하고, 36%는 개선될 것으로 기대하고 있습니다. 젊은 세대는 더 높은 낙관론을 보입니다, 2025년에 더 나은 재정 상황을 기대하는 Z세대는 44%, 밀레니얼 세대는 45%입니다.

L'enquête nationale de Discover révèle que 54% des consommateurs américains prévoient de faire des résolutions financières pour 2025. Les principaux objectifs financiers incluent épargner davantage (42%), gagner plus (35%) et dépenser moins (35%). Cependant, 94% des Américains anticipent des défis, l'inflation (47%), les dépenses imprévues (39%) et les conditions économiques (38%) étant les principales préoccupations.

Alors que 52% prévoient de budgétiser en 2025, seulement 36% ont créé un budget en 2024. Parmi ceux qui ont élaboré un budget en 2024, 22% s'y sont tenus, rapportant des sentiments d'accomplissement (46%) et de préparation (38%). En regardant vers l'avenir, la plupart des Américains sont prudemment optimistes quant à leurs finances, avec 45% s'attendant à ce que leur situation reste stable et 36% anticipant une amélioration. Les jeunes générations affichent un optimisme plus élevé, 44% des membres de la génération Z et 45% des Millennials s'attendant à des situations financières meilleures en 2025.

Die nationale Umfrage von Discover zeigt, dass 54% der Verbraucher in den USA planen, finanzielle Vorsätze für 2025 zu fassen. Die wichtigsten finanziellen Ziele sind mehr sparen (42%), mehr verdienen (35%) und weniger ausgeben (35%). Dennoch erwarten 94% der Amerikaner Herausforderungen, wobei Inflation (47%), unerwartete Ausgaben (39%) und wirtschaftliche Bedingungen (38%) die Hauptanliegen sind.

Während 52% planen, 2025 ein Budget aufzustellen, hat nur 36% im Jahr 2024 ein Budget erstellt. Unter denjenigen, die 2024 ein Budget erstellt haben, hielten sich 22% daran und berichteten von Gefühlen der Erfüllung (46%) und der Vorbereitung (38%). Wenn man in die Zukunft schaut, sind die meisten Amerikaner vorsichtig optimistisch in Bezug auf ihre Finanzen, wobei 45% erwarten, dass ihre Situation stabil bleibt und 36% eine Verbesserung erwarten. Jüngere Generationen zeigen größere Optimismus, wobei 44% der Gen Z und 45% der Millennials eine bessere finanzielle Situation für 2025 erwarten.

- None.

- None.

According to a new national survey from Discover® Personal Loans,

Meanwhile, nearly all Americans (

“I encourage those planning financial resolutions to take actions now to position themselves to achieve their goals in the year ahead,” said Dan Nickele, vice president, Discover Personal Loans. “Think about, for example, creating a monthly budget that helps you save more or spend less; and setting up automatic transfers to a high-yield savings account to establish an emergency fund. Also, the interest rate outlook may give you the opportunity to refinance higher-rate debt. If you’re interested in exploring debt consolidation options, it’s a good idea to research and compare lenders that offer a great interest rate, with no origination fees or prepayment penalties.”

Conversely,

“It’s encouraging to see that so many Americans have a strong interest in improving their personal financial situations in 2025. Even if you’re not making a specific resolution, I would recommend taking any small step to get started on a path toward a brighter financial future – whether that’s saving for a specific goal or creating a game plan to manage your existing debt,” adds Nickele.

The survey also found that a majority of Americans have a cautious sense of optimism about their personal finances for the year ahead, with most saying they expect their situation to stay the same (

2024 Budgeting Actions vs. 2025 Budgeting Plans

Budgeting Actions |

2024 |

Budgeting Plans |

2025 |

Created a budget |

|

Plan to budget |

|

Did not create a budget |

|

Do not plan to make a budget |

|

2024 Budgeting Actions

Nearly one-quarter (

Fourteen percent of Americans created a budget but weren’t able to stick with it due to unexpected expenses (

Meanwhile, nearly two-thirds (

2025 Budgeting Plans

Just over half (

“I recommend consumers research common budgeting methods to help them choose an option they are most likely to stick with,” said Nickele. “For consumers who don’t plan to use a budget next year, I encourage them to financially prepare for the unexpected and to learn about options for managing any existing debt.”

Discover Personal Loans has many resources available to help consumers learn about managing debt, financing major expenses and reaching their financial goals. A personal loan calculator can help consumers find a loan term that works for their individual situation, and a debt consolidation calculator can help consumers see what they could potentially save if they were to consolidate higher-interest debt with a personal loan.

About the Survey

This poll was conducted by Morning Consult on behalf of Discover between November 8-10, 2024, among a weighted

About Discover

Discover Financial Services (NYSE: DFS) is a digital banking and payment services company with one of the most recognized brands in

View source version on businesswire.com: https://www.businesswire.com/news/home/20241211996767/en/

Matt Miller

Discover

mattmiller@discover.com

224-405-0653

@Discover_News

Source: Discover Financial Services