Canterra Minerals Announces Staking of Highly Prospective Critical Metals Mineral Claims and Identifies New Zinc-Copper Massive Sulphide Targets in Newfoundland

- Canterra Minerals Corporation has expanded the land position of its Long Lake critical minerals project through staking, providing new exploration opportunities and potential for resource extension.

- None.

Insights

Analyzing...

Vancouver, British Columbia--(Newsfile Corp. - June 13, 2023) - Canterra Minerals Corporation (TSXV: CTM) (OTCQB: CTMCF) ("Canterra" or the "Company") has expanded the land position of its

Key Points:

- The new claims cover the strike extensions of the Long Lake massive-sulphide mineralization and encompasses drilling by past operators

- Results from the 2022 IP survey have revealed several high priority drill targets located outside of the current mineral resource

- Mineralization open for extension and expansion to the southwest and northeast along strike

- Previous drill highlights include:

- 7.5m of

14.07% zinc equivalent ("ZnEq") (1.4% Cu,2.9% Pb,6.7% Zn, 67.6g/t Ag, 0.56g/t Au); and, - 7.3m of

24.16% ZnEq (1.0% Cu,2.8% Pb,16.9% Zn, 85.3 g/t Ag, 0.68g/t Au)(1)

- 7.5m of

"Although Long Lake has an established mineral resource, Long Lake is very much an exploration opportunity in the heart of past critical minerals production camp in central Newfoundland. Recent IP results indicate there are significant chargeability anomalies that exist outside of the known resource that coincide with other gravity anomalies and favourable geology, which makes for compelling drill targets. In staking these new claims, we now own the most prospective exploration targets on this highly prospective critical minerals project," stated Chris Pennimpede, President & CEO of Canterra. "We look forward to the start of exploration on our resource-stage critical minerals projects In Newfoundland."

Long Lake Project

The Long Lake Project is located 50 kilometres ("km") southwest of the Duck Pond mine (90 km by road) and covers 40km2, located immediately to the north of Marathon Gold's Victory Deposit. The Long Lake Project is underlain by the volcanic Tulks Hill Group (Victoria Lake Supergroup) and contains the Long Lake "Main Zone" VMS deposit, which is hosted on the limb of an isoclinal syncline. The results of a 2012 Mineral Resource Estimate ("MRE") for the Main Zone are shown below (Table 1). Mineralization was extended by drilling in 2014 by previous operators (not included in the MRE).

Figure 1: New claims staked by Canterra expanding the Long Lake Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8054/169668_d58f8815e44608a7_001full.jpg

Table 1: 2012 NI 43-101 Compliant Long Lake Deposit Mineral Resource Estimate

| Deposit | Category | Tonnes | Au (g/t) | Ag (g/t) | Zn (%) | Pb (%) | Cu (%) | ZnEq (%) |

| Long Lake(1) | Indicated | 407,000 | 0.57 | 49.00 | 7.82 | 1.58 | 0.97 | 12.41 |

| Inferred | 78,000 | 0.48 | 34.00 | 5.77 | 1.24 | 0.70 | 9.15 |

(1) Based on a

2022 IP Survey Results

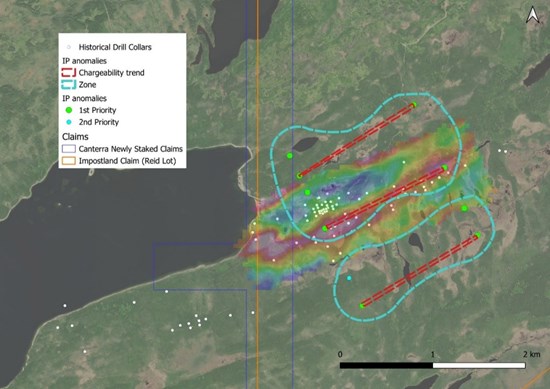

In summer 2022 Canterra engaged Simcoe Geoscience to perform high resolution Alpha-IP over the Long Lake Project to help identify new drill targets. Two IP lines (18E, 19E) were performed over the Long Lake Project and identified two anomalous zones and three first priority VMS targets with a southwest-northeast trend. One of these chargeability trends confirms known massive sulphide mineralization and reinforces the application of this method for the other targets, which are parallel to mineralization and along prospective geological horizons. No previous drilling has been conducted on the southern and northern targets.

The known mineralization is inferred to be on a limb of an isoclinal fold that correlates well with the newly interpreted IP data, and the new targets align well with the concept of further fold repetition and are future high priority exploration targets.

Figure 2: IP chargeability anomalies identifying the knowing massive-sulphide mineralization at long Lake and possible extensions of the known mineralization to the north and south. Historic gravity survey map shown with gravity highs in purple.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8054/169668_d58f8815e44608a7_002full.jpg

The scientific and technical information contained in this news release was reviewed and approved by Christopher Pennimpede, P.Geo., President & CEO of Canterra. Mr. Pennimpede is a Qualified Person as defined by NI 43-101.

Notes:

1. Price assumptions used were in USD

2. Metal recoveries used were

3. Zinc Equivalent % = Zn% + ((Pb% * 22.046 *Pb recovery*$Pb/lb) + (Cu% * 22.046 * Cu recovery * $Cu/lb) + (Ag g/t/31.10348 * Ag recovery * $Ag/oz) + (Au g/t/31.10348 * Au recovery * $Au/oz))/($Zn/lb * 22.046 *Zn recovery)

About Canterra Minerals

Canterra Minerals is a diversified minerals exploration company with a focus on critical minerals (zinc and copper) in central Newfoundland. Canterra's critical metals projects include four deposits which host compliant resources with considerable exploration potential. The deposits are located in close proximity to Teck Resources' past producing Duck Pond mine and the past producing Buchans Mine. The deposits host a combined complaint resource of 4.1 million tonnes of Indicated Resources and 1.2 million tonnes of Inferred Resources. See the NI 43-101 Technical Report "Lemarchant and South Tally Project, Technical Report and Updated Mineral Resource Estimate" effective September 20, 2018. In addition, Canterra holds exploration stage gold properties that cover 80 km of strike length of the regional gold bearing Rogerson Lake structural corridor which hosts Marathon Gold Corporation's feasibility stage Valentine Lake Gold Project. The gold projects have been subject to four drilling campaigns, demonstrating many gold occurrences and warranting further exploration. In Alberta, Canada, Canterra also holds a

ON BEHALF OF THE BOARD OF CANTERRA MINERALS CORPORATION

Chris Pennimpede

President & CEO

Additional information about the Company is available at www.canterraminerals.com

For further information, please contact: +1 (604) 687-6644

Email: info@canterraminerals.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include risks associated possible accidents and other risks associated with mineral exploration operations, the risk that the Company will encounter unanticipated geological factors, the possibility that the Company may not be able to secure permitting and other governmental clearances necessary to carry out the Company's exploration plans, the risk that the Company will not be able to raise sufficient funds to carry out its business plans, and the risk of political uncertainties and regulatory or legal changes that might interfere with the Company's business and prospects.; the business and operations of the Company; unprecedented market and economic risks associated with current unprecedented market and economic circumstances due to the COVID-19 pandemic, as well as those risks and uncertainties identified and reported in the Company's public filings under its respective SEDAR profile at www.sedar.com. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/169668